As soon as the COVID-19 pandemic hit, many grocery shoppers took to the safety of the web. Rather than risk catching the virus in physical stores, wary consumers let their fingers do the shopping on e-commerce sites in unprecedented numbers—and with that, the grocery landscape will never be the same. Nor will the future of the consumer packaged goods (CPG) sector, which makes its living from what happens in grocery retail.

In the wake of the coronavirus, CPG companies are facing a radically (and permanently) less familiar sales environment.

In the wake of the coronavirus, CPG companies are facing a radically (and permanently) less familiar sales environment. If they are to succeed in this transformed landscape, they must nurture nascent capabilities and adopt new strategies and partnerships. CPG companies that are unable to move fast and nimbly to change the way they view and respond will find themselves struggling to catch up.

The numbers reflecting the shift to e-commerce are dramatic: the use of online grocery services (across all fulfillment models) more than doubled from February to March 2020, from 13% to greater than 30% of US consumers, according to Brick Meets Click. And BCG analysis reveals that about 40% of these consumers are trying online grocery for the very first time. Perhaps the more important finding is that approximately 35% of US shoppers new to e-commerce in March plan to continue making grocery purchases online after COVID-19 restrictions are over. By 2022, e-commerce’s share of individual grocery categories is expected to be as much as three times higher than pre-COVID-19 levels and two times higher than forecasts before the pandemic.

A Pivotal Moment for CPG Companies

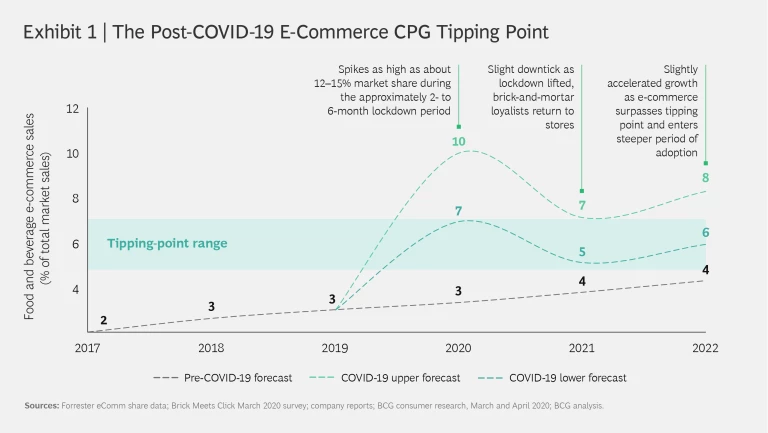

In the past, with grocery e-commerce capturing only a small share of the market, CPG companies could still succeed even without prioritizing online-shopping channels. Almost all their products were purchases off the physical shelf, not the digital one. In general, e-commerce accounted for about 3% of all food and beverages sales before COVID-19, a tiny portion of overall volume. (See Exhibit 1.) But with the surge in e-commerce activity during the pandemic, online food and beverage sales have spiked to as high as 15% of total retail sales according to a detailed BCG analysis. As the lockdown is lifted and consumer fears about in-person shopping abate somewhat, we expect that figure to settle at about 6% to 8% by 2022.

That’s an important level, because by our reckoning an e-commerce market share of 5% to 7% would be a tipping point for CPG companies—a threshold that indicates and foreshadows an acceleration in the growth of CPG online purchases as e-commerce acceptance and adoption balloon. That has in fact been the level at which e-commerce took off in many other large product segments, including toys, auto parts, and electronics. Once that threshold is reached, CPG companies cannot afford to be anything but aggressive and proactive with e-commerce strategies and creative about their online presence.

Three Urgent Priorities

According to our analysis, the hastening shift to e-commerce will drive more than 70% of sales growth across food and beverage categories through 2022. And these gains will be captured primarily by CPG companies that can develop the most sophisticated and effective omnichannel capabilities in order to both maintain their position in physical grocers and play a more active and innovative role in the digital sphere. As the COVID-19 crisis advances from pandemic to recovery, CPG manufacturers must immediately shift their focus to the future. To come out on top with a forward-looking plan for success in this evolving new environment, they should focus on three urgent priorities:

- Seize the short-term opportunity to win valuable new e-commerce shoppers during this COVID-19 demand surge.

- Create a detailed blueprint of what the grocery e-commerce new reality will be when the pandemic wanes and beyond.

- Build the needed capabilities to navigate and succeed in this new environment.

Priority 1: Seize the Opportunity During the COVID-19 Demand Surge

Now, more than six months into the COVID-19 crisis, nearly every CPG category has seen a surge in e-commerce demand. And because the demand initially far outpaced forecasts, unplanned stockouts left many shoppers up for grabs as availability trumped brand loyalty. That’s an especially serious problem for CPG companies in the online environment. It is not uncommon for customers who have been purchasing a certain brand for decades in stores—basically by rote—to change brands if the item is unavailable or hard to find on, say, Amazon, Fresh Direct, or Instacart. And the next time they go online, they may stay with the new product since it is convenient to simply reorder contents from their prior shopping cart.

To stem defections from formerly loyal customers and simultaneously take advantage of the surge in online shoppers, CPG companies must develop immediate visibility into changes in demand . They can do this by having sophisticated analytics teams develop scrappy, dynamic e-commerce dashboards that display for each online outlet real-time sales figures by SKU, current SKU inventory levels, and the latest demand forecasts. Armed with this information, if demand spikes again in response to a localized resurgence of COVID-19 infections, CPGs can easily track availability shortfalls, rapidly intervene to resolve inventory allocation issues, and adjust marketing investments accordingly. In addition, these analyses can draw out insights about new e-commerce shoppers—who they are, what they want to buy, and which calls to action most influence their purchases.

CPG companies should rethink their promotional programs to capitalize on the recent wave of new shoppers choosing their brands.

CPG companies should also rethink their promotional programs to capitalize on the recent wave of new shoppers choosing their brands. They might offer an incentive to surge shoppers—either existing loyal customers or potential new ones—to opt into subscription ordering plans, locking in a shopper’s long-term value. At the same time, they could shift marketing dollars to fund sponsored or prime placement on digital grocer sites for their most high margin or best-selling products. Companies might also consider reorienting trade budgets toward joint promotions with retailers, which may include hybrid physical-store and online campaigns.

Priority 2: Create a Blueprint of the E-Commerce New Reality

It is difficult to imagine that the growing popularity of online grocers is anything but permanent, precipitated by fundamental shifts in shopping and consumer attitudes. Many people are choosing e-commerce because they enjoy the convenience and accessibility of online groceries. But equally significant, consumers are adjusting their eating and food preparation habits during the virus outbreak: they’re eating more meals at home because they are working remotely and restaurants are closed, and families are cooking together more often. Coinciding with the rapid rise in grocery e-commerce, these new routines are increasingly driving consumers to purchase foods online that they previously bought primarily in stores, such as meats, fruits, and fresh vegetables.

Because of their innate appeal, these new habits and preferences will likely endure and escalate after the lockdown. And CPG companies must understand and map out what the future will look like with dominant digital channels (Amazon, Fresh Direct, Instacart, Target/Shipt, and the like), before manufacturers face the inevitable e-commerce tipping point. With that blueprint, CPG players can determine where they should place their strategic bets to take advantage of the online boom. Here are some questions to ask in order to sculpt a vision of the future:

- What will the new e-commerce consumer care most about in the future: convenience, price, expanded assortment, speed, or something else?

- Which grocers and e-commerce services will be most popular with consumers and which will fade away?

- Where will category e-commerce penetration level off after the lockdown? For instance, companies that make hair clippers can probably assume that the surge in e-commerce sales will not outlive the pandemic. But CPG providers that make products consumers buy routinely should determine which product categories will predominate and how strong the demand will be for those items.

- How will brand loyalty be a factor in online markets?

- How will customer business models and requirements from CPG partners change as the e-commerce tipping point is reached, and what do CPGs need to do in order to prepare for this shift?

Answers to these questions should give CPG companies a strong starting point for a new e-commerce model that allocates the appropriate amount of weight—in terms of staffing, financial support, expertise, innovation, and analytical tools—to online activities.

Priority 3: Build the Needed Capabilities to Win in the New E-Commerce Environment

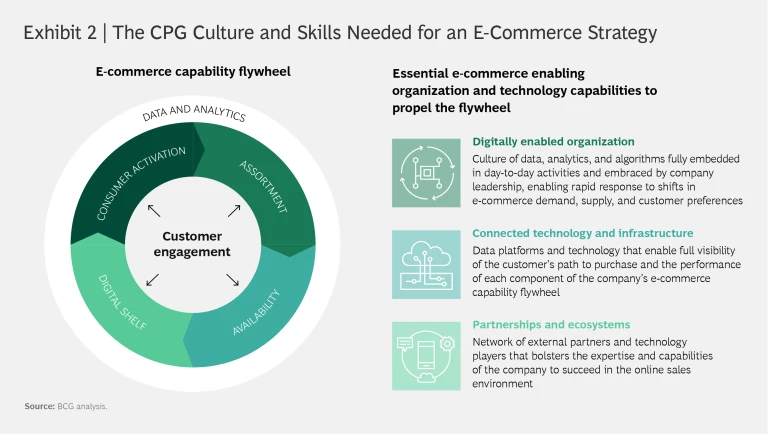

Every CPG manufacturer should develop a clear strategic roadmap to build an e-commerce presence over the coming years, linked to its view of what the new normal will look like and which capabilities will be required to win. (See Exhibit 2.) This roadmap should focus on building the capabilities—in particular, the enabling organization and the technology—to run the e-commerce flywheel.

Beginning with the e-commerce flywheel, a well-formulated e-commerce strategy depends on having a clear window into four primary contributing elements and ensuring that they work in concert. Asking some important questions about these elements can help companies develop that strategy:

- Assortment. What are the top-selling SKUs by priority e-retailer, and what is their price realization relative to offline channels? What percentage of e-commerce sales are in SKUs optimized specifically for the channel (for instance, with “ship in own container” packaging)? How does the ROI from trade dollars and promotions for products vary? Is there an assortment gap, currently populated by competitors, that can be filled?

- Availability. How accurate and effective are online-retailer and SKU-level forecasts and allocation decisions? To what degree are inventory levels and stockouts incorporated real-time into flywheel decisions, such as where marketing dollars are spent? How oriented is the distribution network toward e-commerce activities? Is the supply chain sufficiently flexible to manage changes in online retailers and consumer expectations on speed, assortment, and returns?

- Digital Shelf. How developed is product page content for top SKUs across priority e-commerce retailers? What is the optimal variation strategy to balance ownership of the digital shelf with conversion of lower-ranking products? How frequently are products displayed on first pages across priority e-commerce retailers? Do competitors have any weaknesses that could be exploited in the short term?

- Consumer Activation. What is the split between traditional and digital marketing dollars? What are the tactics for optimizing return on ad spending (ROAS) across e-commerce retailers and SKUs, using keywords, onsite and offsite display advertising, and consumer targeting? How advanced are personalization and performance marketing capabilities?

To put these four crucial elements of an e-commerce strategy in motion, CPG companies need a comprehensive data and analytics foundation to serve as a feedback loop between digital analysis teams and e-commerce business decision making. This data foundation is intended to eliminate e-commerce blind spots and provide a real-time view of the company’s online performance—as often as every day—while helping inform manufacturing, product development, brand growth, and marketing decision making.

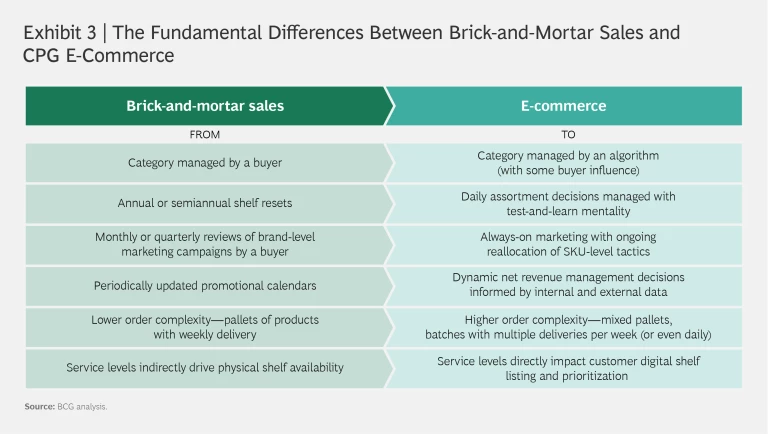

For the e-commerce flywheel to run smoothly, companies must create an organizational culture capable of managing a technically oriented workforce, adopting advanced technologies, and taking action in an agile, fast-paced environment. This type of digitally enabled organization requires strong leadership support in order to navigate the fundamental distinctions that separate brick-and-mortar sales from e-commerce—everything from categories managed by algorithms instead of buyers to greater complexity of orders and always-on marketing rather than monthly or quarterly reviews. (See Exhibit 3.)

Some CPG companies will have to develop new capabilities allowing them to be quick and responsive to shifts in customer preferences and in the way online retailers promote and prioritize products. Other CPG organizations—mostly larger, more established firms and smaller, digitally native brands—have already built strong online operations and have impressive digital expertise. As a result, they are in a somewhat more privileged position. But in either case, standing pat is not an option. CPG companies, no matter their technical skills, have to continually ask themselves, “What is going to be the next evolution of best-in-class in e-commerce and how do I go from good to great or great to even greater?” In many cases, CPG companies looking to bring these capabilities in-house will have to hire employees already experienced in digitally driven environments.

As CPG organizations become more digitally aggressive, they can enhance their connected technology and infrastructure—networks, data sources, and analytical tools that provide the underpinning for the data and analysis activities that drive the e-commerce flywheel.

In the process of implementing an e-commerce flywheel strategy, CPG companies will no doubt find that they need to join with partners and ecosystems to efficiently acquire the expertise and capabilities they need for an online sales environment. CPG organizations may come to rely on numerous types of businesses—for instance, firms that can provide tactical management of SKUs and make sure that the search terms for products are optimized and accurate so that they align with the ways that shoppers typically look for the items. Data and analytical-insight partners are critical as well, especially to provide ongoing real-time visibility into online performance, changes in consumer demographics and preferences, and competitors’ moves in the e-commerce realm. Content and omnichannel management firms may also be important, as might email, customer support, order management, logistics, warehousing, and technology platform specialists.

But these partnerships will fail to deliver their full potential benefits if CPG companies do not simultaneously improve their ties to e-commerce retailers. Before COVID-19, the need for this may have been minimal, but it’s not anymore. Consumer goods companies must nurture direct relationships with Amazon, Walmart.com, Target/Shipt, Instacart, and the like so that they enjoy the same degree of familiarity and cooperation with online companies as they do with brick-and-mortar grocers. Moreover, as the CPG e-commerce tipping point is reached, large regional grocers will increasingly set up their own web-based operations—both competing against, and working with, companies such as Instacart. As that occurs, CPG manufacturers will need to develop localized strategies covering demand planning, inventory management, and shipping to individual-grocer e-commerce hubs.

As the COVID-19 crisis evolves, it will continue to shape consumer behaviors in fundamental and long-lasting ways. Lockdowns drove a massive uptick in online grocery trials in the earliest days of the pandemic, and prolonged social distancing coupled with the many consumer benefits of e-commerce have ensured that online grocery shopping is here to stay. CPG companies that move into action quickly to change their e-commerce capabilities and meet consumers as they shift to this new environment will come out on top in the current surge and set themselves up to win when the e-commerce tipping point arrives.