Within weeks of taking office in December 2019, the members of the new European Commission unveiled a bold set of initiatives to fight climate change and protect the environment. Dubbed the European Green Deal, the proposed measures aim to slash the greenhouse gas emissions of countries in the European Union (EU) by 50% over the next decade—compared with the current target of 40%—and make Europe the world’s first climate-neutral continent.

The roadmap for achieving these laudable goals, however, includes a provision that will likely have considerable repercussions for EU trade partners. The EU is considering imposing a carbon border adjustment mechanism, more commonly referred to as a carbon border tax. The tax would reflect the amount of carbon emissions attributed to goods imported into the 27-nation region. Producers in countries with carbon-pricing mechanisms that the EU agrees are compatible with its own may be exempt.

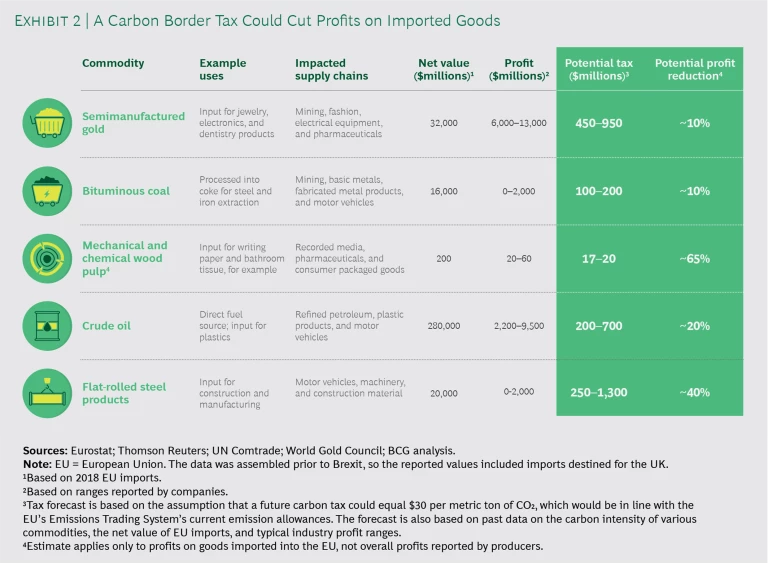

Although the policy has important proponents in Europe, it would create serious near-term challenges for companies with a large greenhouse gas footprint—and a new source of disruption to a global trading system already roiled by tariff wars, renegotiated treaties, and rising protectionism. We estimate, for example, that a levy on EU imports of $30 per metric ton of CO2 emissions—one potential scenario—could reduce the profit pool for foreign producers by about 20% if the price for crude oil remains in the range of $30 to $40 per barrel. The levy could reduce profits on imported flat-rolled steel, in particular, by roughly 40%, on average. The impact of the added costs would be felt far downstream.

In some sectors, the carbon border tax could rewrite the terms of competitive advantage. European manufacturers may find that the cost of Chinese or Ukrainian steel that is produced in blast furnaces now compares less favorably with the cost of the same type of steel from countries that require more carbon-efficient methods, for example. Similarly, European chemical producers may cut their reliance on Russian crude oil and import more from Saudi Arabia, where extraction leaves a smaller carbon footprint. If few cleaner supply sources are available, EU companies could face a choice of either absorbing the added cost of the tax or passing it along to downstream consumers.

Although the exact mechanics and timing of a carbon border tax must still be determined and approved by legislators, CEOs should begin preparing now. The requirement to measure, report, and factor in the costs of a product’s carbon footprint is already in place in the EU, and it could soon become a requisite for companies that export to Europe as well, contributing to the mounting global pressure to prepare strategies that reduce emissions.

Why a Carbon Border Tax Appears to Be Gaining Momentum

The concept of taxing carbon emissions as a means of providing businesses with a financial incentive to reduce greenhouse gas emissions has been proposed by numerous experts for decades—and not just in Europe. In fact, more than 3,000 US economists and all living former chairs of the Federal Reserve have endorsed a carbon tax.

Thus far, however, a carbon border tax has rarely been implemented. Nor is it clear how the policy would work in practice. The European Commission currently is exploring several options, each of which has benefits and challenges. (See the sidebar “Four Ways That the EU Could Tax the Carbon Footprint of Imports.”) The EU could exempt certain countries that already have similar carbon-pricing schemes in place. It could do so by negotiating new preferential trade agreements or updating existing ones, such as those with Australia, Canada, or Japan.

FOUR WAYS THAT THE EU COULD TAX THE CARBON FOOTPRINT OF IMPORTS

FOUR WAYS THAT THE EU COULD TAX THE CARBON FOOTPRINT OF IMPORTS

As part of its stated goal of cutting greenhouse gas emissions by 50% over the next decade, the European Commission has proposed taxing carbon emissions related to imported products. The commission has said that its carbon-pricing mechanism should simultaneously level the playing field for European and foreign producers in carbon-intensive sectors and respect the EU’s commitments under international trade law. The final form of the mechanism has yet to be defined.

Considering the guidelines provided so far, there are at least two possible approaches: fixing the price of CO2 emissions through a carbon tax or fixing total CO2 emissions through the EU’s current cap-and-trade system, known as the Emissions Trading System (ETS). The proposed mechanisms for implementing either of these approaches have their proponents and detractors and present different sets of challenges that would have to be addressed, such as the potential to trigger trade disputes or adversely affect domestic consumers and producers.

If the EU opts for a carbon tax on imports, most experts assume that ETS benchmarks would be used to calculate the tax. In terms of compliance with World Trade Organization (WTO) commitments, two key principles apply: the most-favored-nation principle, under which different trade partners are to be treated alike, and the national treatment principle, which means that the goods of foreign and domestic producers should be treated alike.

The European Commission could consider two basic mechanisms for taxing imports:

- Carbon Border Tax. A levy on imported products of carbon-intensive sectors would seek to adjust for differences in nations’ climate policies. In the state of California, for example, a border carbon adjustment is applied to electricity imports from neighboring US states. This currently is the most prominent application of such a mechanism.

A tax on imported goods would present several challenges. Depending on how it is designed, the carbon tax could run afoul of international trade law if it treats the imports of some producers differently on the basis of their country of origin, thus violating the WTO’s most-favored-nation principle. Attempting to tax goods differently on the basis of criteria such as production methods, carbon content, and the climate policies of home countries could be legally murky as well. But, in fact, the WTO’s General Agreement on Tariffs and Trade (Article XX, “General Exceptions”) allows member states to impose measures “necessary to protect human, animal or plant life or health.” This could certainly be invoked by the EU in this case. Whatever the legal basis for the measure, verifying compliance with environmental criteria by so many companies in so many nations would require extensive administration. To overcome these challenges, some experts propose that the tax vary only by sector. Foreign producers could have their carbon tax reduced if they can prove superior environmental performance. - EU-Wide Carbon Tax. There are proposals to transform the EU’s current ETS into a carbon tax that is imposed on both domestic producers and importers. Such a mechanism has never been implemented. Although an EU-wide tax would seem to comply with international trade law, the domestic response in Europe has been mixed. Some EU producers that rely on imported inputs oppose it because their costs would rise. Having brought their operations into compliance with the ETS, EU companies would now have to adapt to another new system for pricing carbon in parts of their operations. And many European manufacturers would have to forfeit special emission allowances that are granted to certain industries that are carbon intensive, such as steel. Finally, some EU member states may object to the proposal, simply because they have historically been against EU-wide taxes.

An alternative to using carbon tax mechanisms is to impose a cap-and-trade system on imported products under the ETS to cover imported products. This could be done in one of two ways:

- Extend the ETS to European importers. Under this scenario, the EU cap-and-trade system would be applied to domestic companies that import goods into the EU. These importers would also have to surrender current emissions allowances. Carbon caps would be allocated for the products. Importers that exceed their emission caps would pay a fine; importers that do not use their full caps would be able to sell permits on the open market. Although this scenario has never been implemented in practice, two French informal policy drafts had proposed this mechanism for the EU in 2009 and 2016, respectively. Both attempts were met with significant opposition owing to legal uncertainties.

- Extend the ETS to foreign producers. The current ETS could also be extended to foreign producers that export to Europe. In 2009, the EU proposed including foreign air travel providers in the carbon cap-and-trade system. This proposal was questioned on the grounds that it violated WTO rules regarding quantitative restrictions on imports and would therefore be incompatible with international trade law. It also provoked a strong reaction from the US, which saw it as an extraterritorial application of EU law.

Companies should be prepared for each of these potential EU policy approaches. But both exporters and importers should begin incorporating carbon pricing into their planning scenarios and developing potential response strategies.

The carbon border tax has wide appeal in Europe. It is supported by the new president of the European Commission, Ursula von der Leyen, and member countries such as France, Germany, Poland, and Spain. The new European Commission, whose term extends through 2024, has declared environmental protection its highest priority. Indeed, in a recent media interview, von der Leyen said that the European Green Deal will be at the heart of the EU’s economic strategy to “bounce forward” from the COVID-19 crisis. By the end of 2018, the EU already had reduced greenhouse gas emissions by 23% since 1990. In fact, the EU is ahead of its official benchmarks for achieving its current emissions-reduction target of 40% by 2030, a goal that is enshrined in EU law. But environmental experts contend that emissions must be cut much further to fight climate change, so the new European Commission intends to raise the target to 50%.

Placing a carbon tax on imports could go a long way toward meeting this goal. Imports represent approximately one-quarter of the emissions of all goods consumed or processed in the EU. Such a tax is also popular among European manufacturers. Many have already been paying for carbon emissions since 2005 through the EU’s Emissions Trading System. The ETS places caps on emissions for most companies and then allows them to buy emission permits from other companies if they exceed their limits. European manufacturers, particularly those that produce carbon-intensive goods, such as steel and chemicals, have complained that plans to raise ETS carbon costs would put them at a disadvantage against imports from foreign manufacturers that are in countries with low environmental standards and that are not subject to such regulations, thus lowering manufacturing costs. From the perspective of European manufacturers, a carbon border tax could help level the playing field.

A carbon tax could go a long way toward meeting the EU’s new goal of cutting emissions by 50% by 2030.

Depending on how the policy is designed, foreign trade partners could, of course, challenge a carbon border tax through the World Trade Organization or take retaliatory action in response. The concept also remains somewhat controversial within Europe: some critics view the tax simply as another trade barrier, while others view it as impractical or not worth the cost. Our view, however, is that the roadblocks are solvable and that the EU has the resources required to devise creative, workable policies to achieve its goal.

Sectors That Would Be Hit the Hardest

A European carbon border tax would impact, either directly or indirectly, all industrial sectors that rely on imports into the EU and would influence sourcing decisions throughout entire value chains. In addition to EU importers that pay the tax, for example, it would also affect EU-based manufacturers that rely on imported inputs.

The degree of impact on industrial sectors would be largely influenced by two factors: carbon intensity and trade intensity. Carbon intensity figures convey the relative propensity of various sectors to contribute to the so-called greenhouse gas effect, a leading cause of global warming and other adverse environmental changes.

On the basis of these two factors, among the sectors most directly hit by the carbon border tax would be coke and refined petroleum products, as well as mining and quarrying. (See Exhibit 1.) The carbon and trade intensities of each sector are high. Indeed, of the 44 sectors that the EU regards as high priorities for new carbon measures, 85% are related to materials, energy, and other sectors that provide raw ingredients for industrial processes. Sectors such as chemical products, basic metals, paper products, and nonmetallic mineral products, while less dependent on trade, would also be directly affected because of their high carbon intensity.

For companies that export to the EU and that are in carbon-intensive industries, the direct impact of the carbon border tax would alter the competitive landscape. If these companies cannot adapt quickly by reducing their carbon footprints, they risk losing market share either to EU-based competitors or to those in other nations that are more carbon efficient.

Other industrial sectors would feel an indirect—but still significant—impact from the EU carbon border tax because they are high consumers of carbon-intensive inputs. Of these sectors, textiles and apparel, as well as pharmaceutical products, would experience the most direct impact. The tax would have less of a direct impact on many products further down the value chain because carbon-intensive materials account for a lower proportion of a product’s value. It must also be noted that even in sectors that would be directly impacted, the EU carbon border tax would account for a very small portion of their overall cost base. Although it could translate into a 50% cost increase for producers of ethylene, for example, the tax would add only about 1% to the retail price of a soda sold in a plastic bottle.

Exporters of goods to Europe that are indirectly hit by the carbon border tax could pursue several basic options in order to retain their competitiveness. To the degree possible, they could shift to input suppliers that produce within the EU, input suppliers with a lower carbon intensity, or a country with an equivalent mechanism for pricing carbon. If low-carbon alternatives are limited, they could be forced to absorb the additional cost or try to pass it through the rest of the value chain.

Gauging the Financial Impact

To assess the potential impact of the carbon border tax, we analyzed a selection of carbon-intensive industrial sectors—semimanufactured gold, bituminous coal, mechanical and chemical wood pulp, crude oil, and flat-rolled steel products. Although we do not yet know how the tax would be calculated, for the purpose of this analysis, we assumed it would be $30 per metric ton of CO2, which is generally in line with current EU emission allowances that are used in the ETS. We regard this level as quite conservative. The actual tax per metric ton of CO2 would fluctuate on the basis of market dynamics, and some analysts project it could be dramatically higher on some products within a few years. We then forecast the total value of the tax for each sector on the basis of its carbon intensity.

To get an idea of the tax’s financial impact on each sector, we compared it with an estimate for the total profit pool for that sector, based on profit margins that are typically reported by companies. Because profits vary widely among best performers and worst performers—and estimates can vary—we provided a profit range. In each sector that we examined, the tax’s impact would be significant. (See Exhibit 2.)

Semimanufactured Gold. In 2018, the EU imported $32 billion of semimanufactured gold, which is used primarily in jewelry, electronics, and dentistry products. We estimated that this trade generated profits from $6 billion to $13 billion for mining companies. Given the carbon intensity of gold mining and processing, we calculated that an EU carbon tax of $30 per metric ton of CO2 would amount to about $450 million to $950 million. This would translate into a profit reduction of 10% on those shipments for mining companies or additional costs that would be passed on to their customers, or a combination of both.

Bituminous Coal. Foreign mining and quarrying companies exported $16 billion of bituminous coal to the EU in 2018, generating as much as $2 billion in profits. Bituminous coal is typically processed into coke that is used for forging steel and other basic metals, which in turn are used to make fabricated metal products and such finished goods as motor vehicles. We estimated that the carbon border tax on US bituminous coal would amount to $100 million to $200 million, an economic cost of 10% that mining companies would absorb or pass on through higher prices.

Mechanical and Chemical Wood Pulp. EU-based paper product manufacturers imported roughly $200 million in wood pulp that was produced by either mechanical or chemical processes in 2018, yielding a profit pool of $20 million to $60 million. We estimated that the carbon border tax would cost this sector $17 million to $20 million, slashing profits by an average of 65%. In addition to EU manufacturers of writing paper, bathroom tissue, and other paper products, the impact would be felt indirectly by producers of goods such as recorded media, pharmaceuticals, and consumer packaged goods that use paper products.

The carbon border tax could slash profits of the wood pulp sector by an average of 65%.

Crude Oil. The EU imported $280 billion of petroleum in 2018 for use as fuel and as an input for such sectors as chemicals and plastics. We estimated the profit pool from EU petroleum imports at $2.2 billion to $9.5 billion if oil prices range from $30 to $40 per barrel. The estimated carbon tax of $200 million to $700 million would reduce the profitability of these petroleum shipments by an average of approximately 10% if market prices for crude oil rebound to about $60 per barrel and by 20% if they range from $30 to $40 per barrel.

Flat-Rolled Steel Products. EU automakers, machinery and equipment manufacturers, construction companies, and other firms consumed $20 billion of imported flat-rolled steel in 2018, generating profits of as much as $2 billion for its producers. We estimated that the carbon tax would range from $250 million to $1.3 billion in this sector, reducing the profit pool by roughly 40%, on average. It may be particularly difficult for the most carbon-inefficient producers to pass these costs on to customers or through the supply chain. Many flat-rolled steel products are commodities, and the industry currently is facing a surplus, effectively creating a buyer’s market.

How a Carbon Tax Would Alter Competitiveness

The EU carbon border tax would transform the competitive landscape of several industries by putting producers with highly carbon-intensive processes at a strong disadvantage, compared with EU companies or foreign competitors that have a smaller carbon footprint. We explored these dynamics in the steel and petroleum industries.

The greenhouse gas emission footprint of commodity steel producers varies dramatically. Steel makers that use electric arc furnaces to produce steel from a high percentage of scrap metal are responsible for emissions whose CO2 equivalents amount to far less than those from steel makers using blast furnaces or basic oxygen furnaces, for example. Other factors, such as how the coal is mined and processed and the age of a mill, also influence a manufacturer’s carbon footprint. The ratio of carbon-efficient mills to older, dirtier ones varies by country.

The carbon intensity of commodity steel makers in China and the Ukraine that primarily use blast furnaces and basic oxygen furnaces is at the high end, emitting about 2 metric tons of CO2 equivalents for every metric ton of steel produced. The Canadian and South Korean steel industries are generally more carbon efficient owing to the higher contribution of electric arc furnace minimills to total steel output. Such minimills emit 1.5 metric tons of CO2 equivalents per metric ton of steel produced. Emissions in Turkey and the US—both of which also rely highly on minimills—average roughly 1 metric ton of CO2 equivalents per metric ton of steel output, or half the emissions of China and the Ukraine. (See Exhibit 3.) Some countries, including Russia, have a mix: there are mills using blast and basic oxygen furnaces that would be disadvantaged by the tax and minimills that would be advantaged.

It should be noted that many higher-grade products, such as flat-rolled steel that is used in autos, can still only be produced with blast furnaces. EU steel producers could therefore gain an advantage with the carbon border tax because they have already lowered their carbon footprints over the years by investing heavily in environmentally friendly and energy-efficient technology. Many blast-furnace mills in other nations have not yet made these investments; EU steel makers maintain that this partially explains their current cost advantage.

The carbon tax could therefore significantly alter the global steel trade, particularly in commodity products that can be produced with blast and electric arc furnaces. Because the steel industries of some countries, including India and Turkey, are generally more carbon efficient due to their higher share of minimills, they would pay significantly less tax. They would also be in a stronger position to build partnerships with European customers and take crude steel share from China, Russia, and the Ukraine. The US, which could emerge as the most carbon-friendly producer, could also become more competitive in the EU. Automakers in the EU could also buy more flat-rolled steel domestically from carbon-efficient blast furnace mills. Carbon-inefficient mills in other nations, by contrast, would have to absorb the cost of the tax, find alternative markets to the EU, or convert to cleaner technology.

The competitive dynamics of the global petroleum trade could also change. Russia, due to its proximity, is the biggest oil supplier to the EU, accounting for more than one-quarter of its imports. (See Exhibit 4.) But Russian petroleum has nearly twice the carbon footprint of petroleum from Saudi Arabia, a comparatively smaller supplier to the EU. This largely is due to the fact that oil reserves in Russia are deeper in the ground than those in Saudi Arabia, and, therefore, more difficult to recover. Technology differences are other factors. In some nations, for example, petroleum is extracted with dated processes that result in significant “off-gassing”—the release of natural gas that is trapped with crude oil. On average, Canadian oil is among the world’s most carbon-intensive petroleum, accounting for nearly 20 metric tons of emissions for every 1 million joules—four times more than Saudi Arabia—because much of it is extracted from oil sands. What’s more, the steep decline in global demand for crude oil since the onset of the COVID-19 crisis has pushed spot-market and futures contract prices so low that they already are well below the cost of recovery in many countries.

The new policy could prompt EU importers to switch more of their sourcing to Saudi Arabia, whose producers would pay 30% to 50% less in carbon border tax than most competitors. It could also prompt other producers to invest in improved extraction processes or risk being effectively excluded from the EU market. Canadian petroleum would be at a significant disadvantage until the country builds out its capacity in lower-carbon production.

The Implications for CEOs

The EU carbon border tax would have implications for companies in every sector, whether they would be paying the tax directly or indirectly and whether they are European or non-European. For some companies, the carbon border tax would present difficult, and urgent, strategic challenges. For others, it could present important opportunities to seize competitive advantage.

Companies that rely on the EU as an important export market would likely see a dramatic change in terms of competition. Some European companies could be stronger competitors in their home markets because they have already borne the high capital cost of adopting more eco-friendly production technology and have more than a decade of experience in understanding and managing their carbon footprints. Technologies, processes, and strategies aimed at minimizing greenhouse gas emissions that may have seemed like burdens previously may become strategic advantages. Non-European companies that had been under little regulatory pressure to map, report, and control their emissions would have to build these capabilities quickly and scramble to catch up in order to remain competitive in Europe. This may be particularly important for companies in emerging markets that have based their competitiveness primarily on a combination of low labor and environmental-compliance costs. The former advantage would effectively be neutralized by the carbon tax.

Non-European companies that had been under little regulatory pressure would have to build capabilities quickly to remain competitive.

For many EU-based companies at the forefront of emission management, the carbon border tax could be an opportunity to seize advantage against more carbon-inefficient foreign competitors within the EU. If a company’s carbon footprint comprises primarily materials and components imported from abroad, however, it may face urgent pressure to decarbonize its supply chain. Such companies may need to find more carbon-efficient suppliers. Relatively sophisticated EU companies may also have an opportunity to help their suppliers decarbonize. In so doing, they could also build competitive advantage in anticipation of future increases in carbon prices.

Although the price mechanisms and timing are uncertain, CEOs should accept that a European carbon border tax in some shape and form is on the way—and begin preparing now. Recent statements by EU leaders underscore their commitment to keeping the environment at the top of the economic agenda even as the region recovers from the COVID-19 crisis. We suggest that CEOs be proactive and consider the following four steps. (See Exhibit 5.)

- Measure exposure. The first step is to gain a clear understanding of the company’s carbon footprint and build a reporting capability that is at least on par with that of European competitors. Companies based in countries with limited carbon reporting mandates may have to build these capabilities rapidly.

- Adopt internal carbon pricing. If not already required by regulatory authorities, implement a parallel accounting method that tracks carbon pricing and its impact on product and other relevant costs, and include the information in management’s cost accounting reports. This will help the organization develop the reflex to consider the cost of carbon in sourcing and operational decisions.

- Build a playbook. Understanding the position of the company from a carbon-pricing perspective gives management the visibility it needs to develop a set of options and trigger points as the EU scheme approaches implementation. This will enable management to build flexibility into supply chains, understand the abatement curve within the company, and know when to engage specific measures. This will likely include developing joint plans with key suppliers that may be causing downstream exposure and cost to the company.

- Navigate and shape policy. Although it is almost certain that an EU carbon tax of some form will be applied to imports, there is still time to shape its timing and operational modalities. Armed with the analysis and planning described above, proactively engage in the policymaking process to help shape the final version of a carbon-pricing mechanism in a manner that will protect the company and secure its competitive advantage.

Whatever policy is adopted, the size and strategic importance of the EU market means its action could transform the fundamentals of global advantage. Companies around the world will be compelled to manage their carbon footprints with greater urgency. The best performers in each sector will not only enjoy a competitive edge in Europe but also have a head start against less adaptable rivals in other markets as more nations embrace financial incentives to push companies to accelerate the fight against climate change.