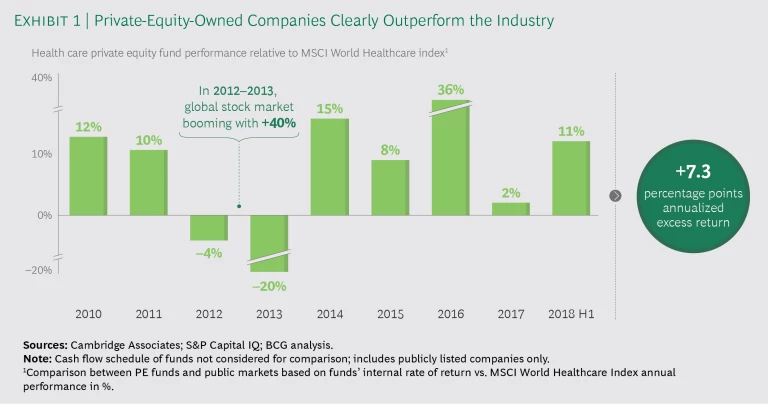

Medtech companies face a multitude of challenges in today’s health care environment: declining prices, decreasing R&D efficiency, a complex go-to-market environment, and increasing regulatory costs. Despite these challenges, one subset of medtech companies outperforms its peers: private-equity-owned firms. They have managed to generate 7.3 percentage points more in value per annum than their listed competitors. (See Exhibit 1.) And more than half of this value comes from operational improvements (rather than from multiple increase or financial leverage).

The most sophisticated PE companies take a much more rigorous approach to value creation.

So how are medtech companies owned by private equity (PE) firms outperforming their competition—what are they doing differently from an operational perspective? What we have observed in our work in the field is that the most sophisticated PE companies take a much more rigorous approach to value creation in their portfolio companies, often leveraging a “full-potential plan” to rapidly transform the acquired business.

In this article, we offer a brief overview of what a full-potential plan is, illustrate how it differs from the way typical corporations operate their businesses, and show how it can be used to drive significant improvements in value creation for all medtech companies. By defining and implementing a full-potential plan, traditional medtech companies have a unique opportunity to achieve a step-change improvement in growth and profitability, and outperform the competition—in particular in the currently transforming market environment.

New Challenges for Medtech

The global medtech market is experiencing slowed revenue growth and eroding EBIT margins, which dropped from 22% in 2010 to 19% in 2016. Also, market dynamics will continue to put pressure on growth and profitability in four key areas.

- Price Erosion. As medtech customers continue to consolidate and professionalize procurement, prices have declined. Between 2013 and 2016, medtech prices fell approximately 20% across a wide range of products.

- Decreasing R&D Efficiency. While medtech companies overall increased their R&D spending by roughly 85% over the past ten years, the number of US Food and Drug Administration approvals remained largely flat.

- Complex Go-to-Market. Clinicians are no longer the sole decision makers when it comes to medtech purchases. Sales teams must divide their time among various clinical, operational, and administrative stakeholders (all of whom have different purchasing criteria), and experiment with new forms of customer engagement by implementing key account management, building up tender management teams, and developing digital channels.

- Tightening Regulatory Environment. Regulatory agencies are setting a higher bar for new product approvals, and reclassifying devices to higher risk classes, which could drive up costs to bring products to market by 15% to 25%, particularly in the EU.

With the traditional medtech business model under pressure, companies will need to make significant operational improvements in order to continue historic top- and bottom-line growth rates. For the most successful PE-owned medtech companies, the full-potential plan has become an essential component of their winning strategy.

The Four Primary Elements of a Full-Potential Plan

A full-potential plan is very different from how typical corporations operate their businesses, in that it requires managers to think boldly and innovatively about the future of the company, and adapt their ways of working to drive meaningful change. Managers are provided with incentives so they have skin in the game, and leaders track progress based on real-world impact, not process metrics.

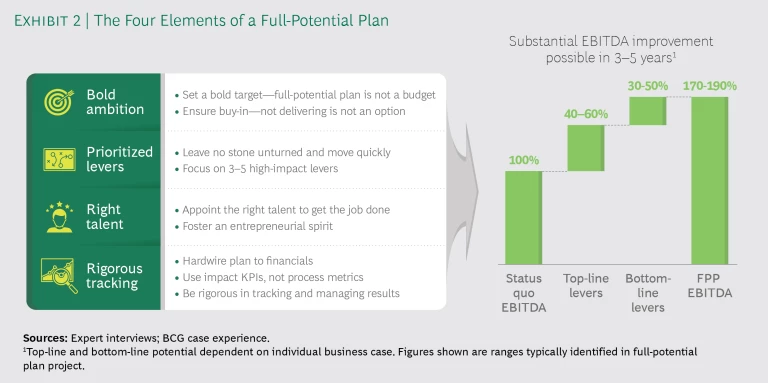

A successful full-potential plan is built upon four foundational elements: a bold ambition, a focus on high-impact levers, the right talent, and rigorous tracking. (See Exhibit 2.)

Set a bold ambition. When PE firms acquire a company, they set bold targets right away to signal that a major transformation is underway. The ambition may be moving up from the number three market position to number one; doubling CAGR to grow sales by 50% in four years; or lifting EBITDA margins by a third in four years. When discussing a $650 million company in his portfolio, the managing director of a PE fund told us, “We want to make this a billion-dollar company in the next three to five years. That’s the kind of target we aim for.”

We want to make this a billion-dollar company in the next three to five years. That’s the kind of target we aim for.

This bold ambition setting is very different from an annual budgeting exercise in a typical corporation, where business units may set an incremental goal to increase their previous year’s performance by 3% to 5%. Instead, employees are encouraged to think more boldly—and creatively. The question is not, “How much can you improve last year’s performance?” Instead, the question is, “If we want to reach $1 billion in revenue within four years, what needs to happen for us to achieve this ambition?”

Focus on three to five high-impact levers. Medtech companies are no strangers to change agendas and transformation road maps. In fact, many companies are drowning in them. They may have 30 or more initiatives underway all at once, but this rampant proliferation of initiatives ultimately dilutes their overall impact. The CEO of a PE-owned medtech company put it succinctly: “Don’t make the mistake of boiling the ocean. If resources are limited, focus on a few high-impact levers—and outperform on those.”

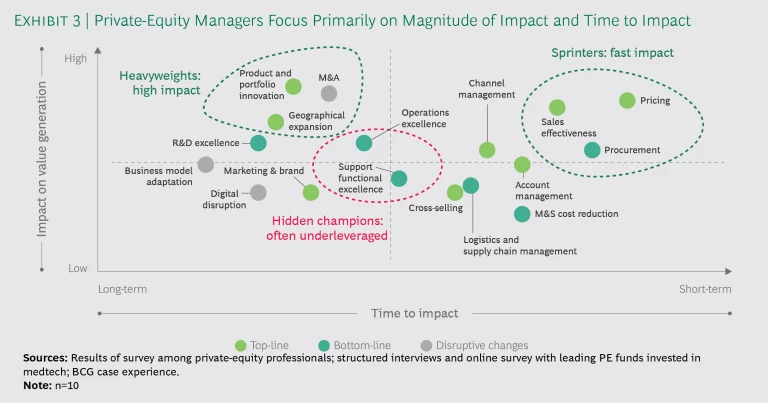

Start with a structured, comprehensive assessment of all aspects of the business, including strategic, operational, and financial issues. Review top- and bottom-line performance. Seek out disruptive opportunities. Leave no stone unturned. Once the analysis is complete, identify three to five big bets that will move the needle. Some bets will deliver high impact; others will deliver fast impact. Find the combination that best accommodates your unique business situation. (See Exhibit 3.)

For high impact, focus on the “heavyweights”—product and portfolio innovation, mergers and acquisitions, and geographical expansion. For fast impact, invest in the “sprinters”—pricing, sales effectiveness, and procurement. And don’t overlook the “hidden champions”—operational and functional excellence, which are often undervalued.

Appoint the right talent. After identifying three to five high-priority initiatives, it’s essential to assess whether the people managing those areas are up to the task. As part of a full-potential plan, PE firms systematically review management to ensure that their capabilities are aligned with the full-potential plan goals and that the highest-value initiatives are run by the best people. For example, if one of the high-priority initiatives focuses on manufacturing, a comprehensive assessment of the management team in manufacturing will reveal whether they are capable of delivering the desired results—and identify any major gaps. If the management team isn’t up to the task, PE firms will act quickly, either by developing or replacing existing management. Either way, they are single-minded about putting top performers in key positions.

When hiring new talent or upskilling employees, look for an entrepreneurial mindset.

When hiring new talent or upskilling employees, don’t just look for people with the right skills—look for an entrepreneurial mindset. To foster an entrepreneurial spirit, consider compensation models that encourage key employees to have skin in the game. For example, instead of offering a fixed salary with a built-in bonus, put in place a management participation plan so managers can invest their own money into the company. If they fail to deliver and the company falters, managers lose money on their investment. On the other hand, if they deliver strong results and the company thrives, the managers reap the rewards disproportionately to their investment. This type of investment scheme encourages managers to think more entrepreneurially and make bold strokes.

Track rigorously. Once the full-potential plan is underway, executives need to track whether the initiatives are delivering their targeted impact. Too often, companies track ineffective process metrics: Have we met key milestones? Are we on time? Are we under budget? With many metrics like these, it’s easy to report all green lights, but it’s nearly impossible to discern whether the initiatives are delivering any real impact.

What’s needed is a rigorous tracking system that clearly shows the impact of high-priority initiatives on real-world outcomes, in particular on the company’s bottom line. At BCG, we use a methodology called “rigorous program management,” based upon three primary principles: 1) create clear accountability by defining explicit roles and processes, and designate a single point of accountability for initiatives; 2) maintain transparency on the KPIs that matter most; and 3) establish an early warning system that allows managers to flag deviations from the plan and make the necessary adjustments and course corrections. This data, along with clear accountability for all members of the team, provides deep insights into the ongoing full-potential plan’s effectiveness.

How to Implement a Full-Potential Plan

To deliver swift and sustainable results, the full-potential plan is usually set up in three phases:

- Phase I—Define the ambition. In the first phase, a clear baseline is established to benchmark future changes in the company’s position relative to competitors and the overall market. Once the baseline has been established, we jointly define the bold ambition, set financial targets, develop a heat map of opportunities to drive value, and pinpoint three to five big bets. This phase typically lasts four to six weeks.

- Phase II—Create a detailed plan. Next, we conduct a deep-dive on the three to five biggest bets, driving each one forward with a specific implementation plan. If the goal is revenue growth, for example, the focus will be on implementing not only tried-and-true methods such as product and portfolio innovation and geographical expansion, but also more innovative techniques like big-data-based customer segmentation, next-generation sales, or personalized marketing. To improve the bottom line, companies can apply new data-driven approaches to achieve operational excellence and improve procurement, supply chain, and manufacturing. During this phase, companies also set up a project management office (PMO), which should be given the power to drive the strategic initiatives, track metrics, foster talent, and encourage a culture of change. This phase typically lasts eight to ten weeks.

- Phase III—Build quick wins. In phase III, it’s time to start implementing the full-potential plan. Teams launch three to five high-impact initiatives while the PMO tracks progress toward the high-level ambition (such as revenue growth or profit improvement). The implementation phase typically lasts 12 to 18 months. Go after quick wins. One of our clients reduced costs by 10% after optimizing their distribution networks and transportation routes, while another reduced costs by as much as 40% after deploying digital shared services. These early wins can be used to free up capital for mid- to long-term investments and build confidence throughout the organization in the ability to deliver significant value through a full-potential plan.

With full-potential plans, companies can quickly reassess where to play—and how to win.

The medtech sector has been flying high for many decades. In the first few years of the 2000s—the golden age for medtech—

Medtech Companies Need to Transform While Times Are Still Good

. But sales have leveled off considerably and the health care industry is undergoing a great deal of change. With full-potential plans, companies can quickly reassess where to play—and how to win. By embracing this methodology, traditional medtech companies (and PE firms that are not yet applying full-potential plans) have an opportunity to pursue new paths that will significantly step-change their growth and profitability.