Today many wealth managers are struggling to maintain their top-line margins despite strong growth globally in personal financial wealth and assets under management. They can help reverse this trend—and strengthen their competitive positions—by using advanced analytics to better address clients’ individual needs and by adopting smart revenue practices that help generate new pools of opportunity.

This is one of the key findings in BCG’s eighteenth annual analysis of the global wealth-management industry, a report that examines such topics as the evolution of personal financial wealth globally and regionally, the widening revenue gap and how institutions can narrow it, and the state of offshore business. The report also takes a comprehensive look at a critical initiative for staying competitive in the marketplace: unleashing the value of advanced analytics.

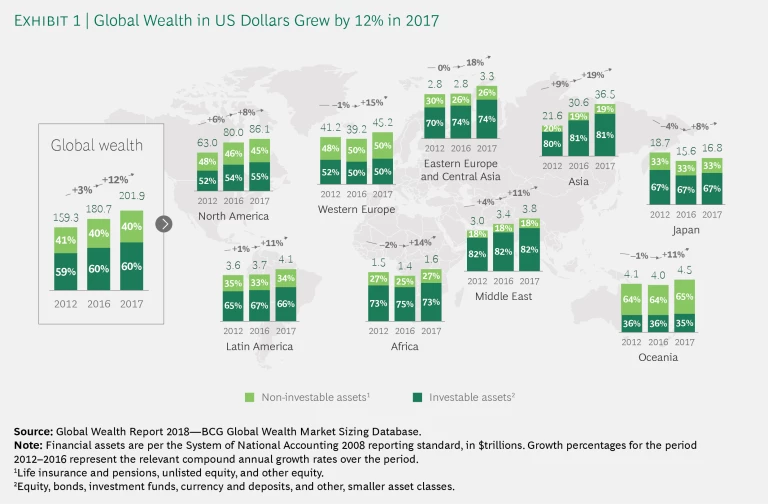

Global personal financial wealth grew by 12% in 2017 to $201.9 trillion in US dollar terms. This total, roughly 2.5 times as large as the world’s GDP for the year ($81 trillion), more than doubled the previous year’s rate, when global wealth rose by 4%. It also represented the strongest annual growth rate in the past five years in dollar terms. The main drivers were the bull market environment in all major economies—with wealth in equities and investment funds showing by far the strongest growth—and the significant strengthening of most major currencies against the dollar.

In terms of asset classes, $121.6 trillion (60%) of global wealth took the form of investable assets—mainly equities, investment funds, currency and deposits, and bonds—with the remaining $80.3 trillion (40%) held in non-investable or low-liquidity assets such as life insurance, pensions funds, and equity in unquoted companies.

Residents of North America held over 40% of global personal wealth, followed by residents of Western Europe, with 22%. The strongest region of growth was Asia, which posted a 19% increase. All wealth segments grew robustly, but high growth rates were especially prevalent in the uppermost wealth segments.

This year’s special discussion of advanced analytics and data addresses the challenges—and opportunities—involved in using the wide spectrum of tools now available to wealth managers to create personalized customer experiences that reflect the clients’ individual needs, preferences, contexts, and behaviors. Leveraging technical capabilities in these areas to the fullest has become vital to the success of any wealth management enterprise. In our view, wealth managers should embrace the opportunity to embark on the advanced analytics journey and to capture the considerable value it offers.

Our annual market-sizing exercise encompassed 97 countries that collectively account for over 98% of global GDP, and our annual benchmarking study stemmed from a survey of more than 150 wealth managers, involving more than 1,500 performance indicators. The study also scrutinized smart revenue and pricing practices and analyzed ways to enhance client satisfaction.

As always with our annual reports, our goal is to present a clear and complete portrait of the wealth-management industry and to offer thought-provoking analyses of issues that will affect all types of players as they pursue growth and profitability in the years to come. We take a holistic view of the industry ecosystem—emphasizing how the market, the institutions, and the clients interact—with the aim of identifying the best opportunities for wealth managers.