One of the fastest-growing worldwide consumer phenomena in memory, e-scooters are also one of the most controversial. And while some cities are putting the brakes on their proliferation, industry leaders are maintaining valuations in the billions, so the funding continues to flow unabated.

E-scooter sharing is big, hot, and (with apologies to Winston Churchill) a paradox wrapped in a conundrum. Some observers dismiss it as yet another overhyped industry rife with funding and, sooner or later, big losses. But the reality is that e-scooters’ unit economics have improved significantly, and companies are innovating aggressively to overcome operational constraints.

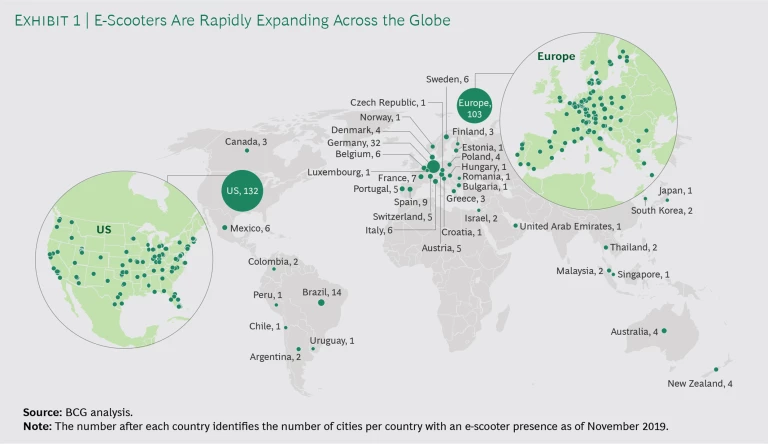

Companies are also engaging with regulators far more proactively than in the past. It is clearer than ever that micromobility solutions are not a fad; in an increasingly congested and polluted urban landscape, cities urgently need them, as their presence in some 350 cities worldwide attests. (See Exhibit 1.) Further expansion will follow.

It’s hard to unravel the dynamics of this fast-paced, still-developing market. It has now grown past its infancy, but what are the prospects for the e-scooter–sharing industry at this critical juncture? What does the industry’s long-term economic picture look like? Where are operators most likely to succeed in gaining traction? How will the market unfold—and what must operators do to survive and thrive? Most important, how can e-scooter companies and city leaders continue to work together to make e-scooters a viable micromobility solution? The current experience in the US and Europe, the two most developed regions, sheds light on these questions.

The Economics Are Looking Much Brighter

E-scooters started out at a disadvantage. First-generation e-scooters, which debuted in cities in the fall of 2017, were retail models and had a lifespan for fleet use of only two to three months, which made achieving profitability a challenge if not an impossibility. As fleet operators and venture capitalists hoped, however, second-generation scooters—jointly designed with manufacturers to boost sturdiness and lifespan—are far more durable, lasting 12 to 24 months in fleet use. In addition to being more rugged, the new scooters are more powerful and have a greater array of smart elements, such as sensors. Swappable batteries are gaining ground, too, especially in Europe; Berlin-based Tier Mobility, for instance, plans to replace its entire fleet with swappable-battery-powered scooters by mid-2020. As a result, a handful of industry leaders have managed to achieve positive variable margins at both city and regional levels of operation. More—and more substantial—improvements are in the works, including a self-parking capability and autonomous relocation (the latter obviates the need for workers to move scooters around town in vans). These improvements also go a long way toward fulfilling the e-scooter’s promise of environmental sustainability. (See “What's Driving the New Unit Economics?” )

What’s Driving the New Unit Economics?

What’s Driving the New Unit Economics?

Much can change in the course of a year. A comparison of 2018 and 2019 data from Santa Monica–based Bird shows how rapidly the unit economics have been improving. (See the exhibit below.)

A Price Hike. Initially, as in most newly emerging markets, most operators of e-scooter services offered low prices to attract users and to gain market share quickly. Soon, the high costs and complexity of operations became apparent, and price increases inevitably followed. A combination of general per-minute price increases and price increases in high-adoption locations boosted unit revenue more than 20%. Such a move might seem risky early in the adoption life cycle, but it demonstrates the urgency of improving unit economics. Fortunately for providers, consumers in many markets proved to be willing to pay a bit more for the convenience and fun of the service.

Greater Durability and Operational Efficiency. The company’s push to improve hardware, durability, and operational efficiency has yielded dramatic benefits. In particular, increases in battery size and quality have reduced the frequency of recharging and thus have allowed more rides per charge. The company leveraged a production-line-style operation to lower repair costs, even as it hired more-expensive in-house labor. In early 2019, it began hiring its own mechanics, who work out of regional service centers, rather than relying on gig workers to handle maintenance and repairs.

A Hefty Increase in Margin. The combined effects of price increases, greater durability, and improvements in operational efficiency yielded an increase in variable margin from roughly 20% to more than 50%. However, that increase excludes depreciation and corporate overhead costs for R&D, staff salaries, and other general and administrative expenses. Unlike other mobility businesses, such as ride hailing, the e-scooter business is capital intensive, so depreciation (not shown in the exhibit) is very important. The introduction of more-durable scooters significantly reduced depreciation.

Hardware improvements are not the only factor in e-scooters’ brighter economics. Providers have also been tackling operational obstacles, zeroing in on the key operational cost drivers in individual markets. Because they eliminate the need to retrieve, charge, and redeploy each scooter, swappable batteries are proving to be a game changer, reducing labor and logistics costs, downtime, and the scooter’s environmental footprint. The next level of innovation with regard to swappable batteries will be decentralized charging stations, where users can swap batteries in return for ride credit, similar to what is already being done with refueling in car sharing.

Perhaps the biggest factor underlying the improvement in operational unit economics is the professionalization and optimization of providers’ operations. Scale effects, along with early lessons learned, have enabled providers to lower the costs per ride significantly. Labor costs—which depend on one of three basic models for managing logistics, charging, and repair—are driven by the provider’s business model and by the specific operating region. In-house labor is more expensive, but companies can train their own employees and retain full control over operations. Third-party contractors are less expensive but less stable; and gig workers, although a cheaper option, give companies less control and are the least reliable at ensuring the completion of all necessary tasks. Business models don’t drive the choice entirely, however. In cities such as Paris, bidders seeking permits must meet certain social standards as well as environmental goals. France encourages employment with benefits and frowns on gig work. For this reason, some operators are abandoning the gig model altogether in certain cities.

Professionalization and optimization of providers’ operations have been the key to improved operational unit economics.

With a high volume of product in the field, it’s not surprising that data (along with the analytics and science around it) is crucial for informing decisions related to boosting fleet utilization. Tracking uptime (the proportion of live and available scooters in the fleet) and optimizing supply-and-demand matching enable operators to increase the utilization of active machines in circulation. For example, identifying the locations where consumer demand is highest enables operators to pick more strategic drop-off locations and to relocate stock to high-demand areas.

Finally, price increases have tipped the economics in a more favorable direction. In 2019, Bird and other providers raised their per-minute prices in most US cities from 15 cents per minute to as much as 39 cents per minute (in Los Angeles, for instance). In Europe, depending on the city, providers now charge the equivalent of €0.15 to €0.25 (representing a slight increase since service began). Companies almost always charge these per-minute rates on top of an unlock fee of $1 or the equivalent. For core target users—a young and affluent group—cost increases amounting to cents per minute are inconsequential and represent far less of an issue than availability. That’s a good thing for providers, since regulatory fees (permits and ridership fees), fines, and other costs are exerting pressure on unit economics.

Together, a more durable product, improvements in operational efficiency, and higher prices have made e-scooter operations more economical, at least for the top echelon of leaders in the more mature markets and in some individual cities. But to reach sustainable profits and justify their current valuations, companies need a model that reflects a broader pool of cities and micromobility modes. They need to operate on a scale big enough to amortize their corporate overhead costs.

To reach sustainable profits, companies need to operate on a suitably big scale.

Using City Archetypes to Extrapolate Future Growth

How bright are the industry’s prospects for growth? Certainly, variations in disposable income, even across Europe, make some cities better candidates than others for scooter growth. To arrive at a sound estimate, we first categorized cities on the basis of four key dimensions, using decision-tree analysis:

- Population Density. Daytime population density offers a good benchmark for understanding potential local demand for micromobility modes such as e-scooters. Cars are more expensive and inconvenient to drive and park, public transportation is often overloaded and uncomfortable, and heavy vehicular traffic makes alternatives such as taxis and ride sharing less appealing and less reliable. High-density areas are more condensed, so trips are shorter, which bodes well for scooters and micromobility vehicles in general.

- Bicycle Friendliness. An infrastructure that supports bicycling (with special traffic lanes and accommodations for parking, for example) serves as an important proxy for e-scooter potential.

- Weather. E-scooters are not well suited to inclement weather, so even cities that are otherwise hospitable to scooters are not prime markets if they have extreme levels or extended periods of precipitation or cold temperatures.

- A Large Population of Young People. Because young people are the largest user group for e-scooters, we looked at metropolitan areas in which students constitute a relatively large percentage of the population.

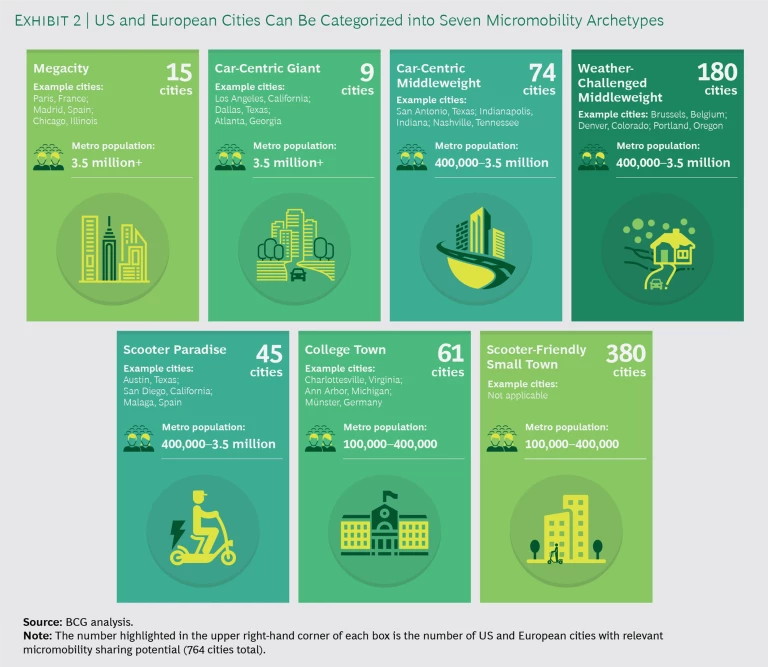

We used these dimensions to identify seven micromobility archetypes derived from varieties of US and European cities. (See Exhibit 2.) The archetypes are as follows:

- Megacity. A major global city with a metropolitan-wide population of at least 3.5 million—such as Paris, Madrid, or Chicago—that is dense enough to be bicycle friendly.

- Car-Centric Giant. A major US city—such as Los Angeles, Dallas, or Atlanta—whose layout is more horizontal than vertical and whose predominant mode of transportation is the car.

- Car-Centric Middleweight. A midsize US city—such as San Antonio, Indianapolis, or Nashville—where cars predominate.

- Weather-Challenged Middleweight. A midsize city—such as Brussels, Denver, or Portland, Oregon—that has long winters or inclement weather.

- Scooter Paradise. A midsize, non-car-centric city—such as Austin, Lisbon, Nice, or San Diego—with mild weather.

- College Town. A small city—such as Charlottesville, Virginia; Ann Arbor, Michigan; or Münster, Germany—that owes much of its population to the college or university located there.

- Scooter-Friendly Small Town. A smaller municipality that holds potential for e-scooter growth.

Our analysis indicates that approximately 750 cities could support widespread micromobility in the US and Europe. This figure is more than double the number of active markets today, suggesting huge growth potential. To better understand the long-term market size, however, we also need to estimate the number of scooters per market.

From existing data on scooter prevalence and use in cities within our archetypes, we developed an estimate of scooter penetration—the number of people per scooter in a given area. For example, there are about 16,000 e-scooters in Austin, Texas, which has a population of 1 million within its city limits, so we used this ratio (62.5 people to 1 scooter) to represent the saturation point for Scooter Paradise cities. We then applied that ratio to similar cities to calculate the total number of scooters that each market could bear at its current population.

Advancing Toward Long-Term Growth

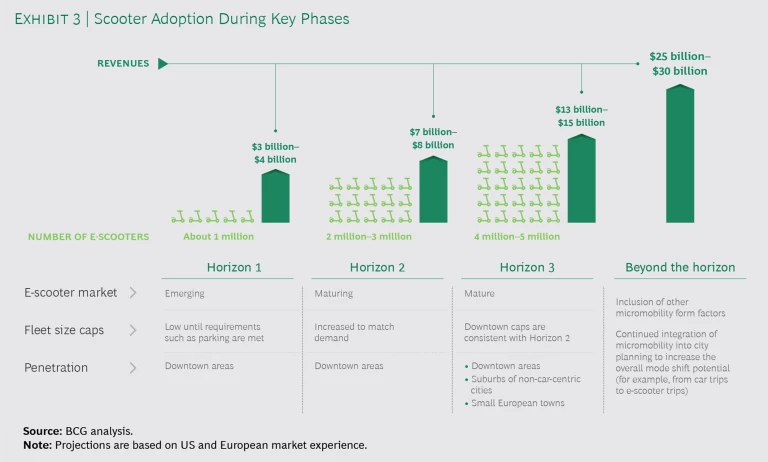

Given how quickly the e-scooter marketing is evolving, we also looked at how e-scooter penetration throughout the US and Europe would progress over time, focusing on three phases, or horizons. (See Exhibit 3.) The three horizons are as follows:

- Horizon 1—the immediate future, marked by continued expansion in existing core urban areas (in both the US and Europe) and an emerging e-scooter market in new cities. Widespread regulatory restrictions will cap the allowable number of e-scooters. We expect that, by the end of Horizon 1, the US- and European-based fleet of e-scooters will amount to roughly 1 million machines and will generate $3 billion to $4 billion in total revenue.

- Horizon 2—the phase when e-scooters have become endemic to city street life but for the most part remain located in downtown areas. During this period, the market will mature and economics will stabilize to create market equilibriums. Continued improvement in operations and ongoing growth in scooter use will help address city concerns, resulting in caps being lifted or adjusted to match market demand. By the end of Horizon 2, we expect, the total US- and European-based fleet will number roughly 2 million to 3 million scooters and will yield $7 billion to $8 billion in total revenue.

- Horizon 3—the longer term, with a mature e-scooter market and more broadly reorganized and integrated mobility systems. We estimate that 15 Megacities will generate more than one-third of overall industry revenue. In this phase, scooters will extend their range beyond core urban areas and into the less dense outlying areas and suburbs of Megacities, Weather-Challenged Middleweights, and Scooter Paradises. E-scooters will have reached most smaller towns with semiurban cores in Europe and elsewhere. At Horizon 3, when suburbs and small towns have fully adopted e-scooters, we envision a fleet of some 4 million to 5 million scooters, generating revenues of between $12 billion and $15 billion in the US and Europe alone; of the two, Europe will have the larger market.

The long-term scenario will see continued integration of micromobility in urban planning in order to achieve cities’ goals of shifting away from cars and toward more varied, lower-impact forms of transit, not just scooters. European and US market revenue will likely reach $25 billion to $30 billion.

What the Numbers Mean for Competition

In the short time since e-scooter sharing debuted, the barriers to entry have risen considerably. Scale is a major driver of this development: despite improvements in hardware, operations remain labor intensive and expensive. As fleets have grown from hundreds to thousands of scooters per market, leading entities have secured the advantage of economies of scale, allowing them to reinvest and further improve their operations capabilities on a global scale. Data is another major advantage: companies that deploy tens of thousands of e-scooters across different market archetypes can learn a great deal about rider behavior under different circumstances—and can use that information to tailor the customer experience and optimize operations accordingly. Finally, regulatory limits on deployment are an impediment to small entrants, but larger players that already have a market foothold can meet the costs of compliance. Over time, these barriers to entry will continue to grow.

Despite improvements in hardware, operations remain labor intensive and expensive.

The underlying unit economics, the barriers to entry, and the fact that few mobility modes today have more than a handful of players will likely result in three to four significant players competing in any given market. Our projection of the future economics suggests that companies with less than 25% market share will struggle to do better than break even on a fully loaded basis. This would mark a significant departure from today’s landscape, in which up to ten players participate in some markets.

Consolidation is inevitable; we expect the first wave to happen as early as 2020. Becoming the dominant player in a region demands a market-by-market or even city-by-city approach. Without a hefty investment, late entrants will not be able to capture a leading position.

The winners will most likely consist of a mix of global and local providers. Global champions will compete on the basis of cost and ubiquity, while local champions will capitalize on their inside knowledge and local relationships to offer a more customized user experience. Naturally, this evolution will be dynamic; leading in 2020 does not mean that you are destined to win in 2025. The introduction of new product forms or major regulatory changes could easily reshuffle the winners’ roster and introduce cracks for disruptors to exploit.

Global champions will compete on the basis of cost and ubiquity; local champions, on inside knowledge and local relationships.

Beyond the Horizon

Reaching a global market in the double-digit billions of dollars (or euros) will take more than just time. E-scooter providers must cooperate closely with cities while continuing to refine and innovate their core business models. As fleet operators and city leaders gain a clearer understanding of the optimal balance of supply and demand, they will be better equipped to compromise on operational and regulatory guardrails addressing rules of the road, public safety, parking and no-scooter zones, and other concerns. Already, some cities are managing this balance smartly: the city of Santa Monica, California, has adopted an adjustment process to regulate the e-scooter fleet size of each operator on the basis of consumer demand (rides per day). When the operator proves that its average ridership per scooter exceeds four rides per day, it can apply for permission to increase its fleet size.

With their longstanding bicycle culture and infrastructure, many European cities, such as Copenhagen and Berlin, are naturally conducive to e-scooter growth. Further scooter penetration will depend on advances in urban planning, as cities increasingly turn their attention from the automobile and toward other public transit and micromobility solutions. Fleet operators could pursue new business models, such as partnering with public transit agencies to serve as a more attractive first- and last-mile option, particularly beyond urban centers.

Safety improvements would encourage greater uptake, as well. At present, more than 80% of fatal accidents involving bicycles or e-scooters are instances in which cars or trucks strike riders. The rise in specially designated lanes bodes well for e-scooter riders as well as for bicyclists, by providing a safer travel zone. Reallocating parking spaces that are now dedicated to automobiles would be another way to encourage greater use of micromobility modes and reduce clutter on sidewalks. In the short term, such a move by cities might encounter opposition; but as congestion grows, concerns about emissions increase, and car ownership continues to decline worldwide, the longer-term odds favor modest reallocations.

Making Scooters Work in Urban Mobility

Clearly, e-scooters will continue to be part of the public debate on urban mobility for years to come. While providers focus on growth and consolidation, city leaders must find ways to integrate scooters and other micromobility modes into their urban mobility strategy.

E-scooter operators must achieve sustainable profits if they are to remain viable businesses. And their viability is important if cities are to realize their goal of creating environmentally sensitive micromobility solutions that serve growing urban populations. The two sides have work to do, both separately and together.

The Challenges for Operators. Operators must continue to improve their economics, especially as the market consolidates. Design and engineering improvements can have an enormous impact on profitability, considering the high cost of maintaining a large e-scooter fleet. Increasing vehicle longevity through product innovation and maintenance , along with further optimizing operations, will improve economics. So will pursuing various measures to boost e-scooter use, such as package offers (including those that offer other transportation modes) and new pricing strategies.

Obviously, the price elasticity of demand will vary from one market to another. Frequency of use among riders is another important consideration: occasional users and tourists tend to be rather indifferent to price. To achieve critical mass as a bona fide transportation alternative, e-scooters need to be more attractive as an everyday choice for commuters, rather than as an occasional choice. Commuters arguably represent the most important segment for future growth, and providers should consider addressing the needs of this segment with special package rates designed to boost the overall number of rides. Offering such discounts to a high-volume segment also creates a desirable lock-in effect, albeit at the cost of eroding the gains in per-ride unit economics.

To achieve critical mass, e-scooters need to be more attractive as an everyday choice for commuters.

The industry as a whole needs to pay special attention to issues of environmental sustainability. Beyond not generating emissions during operation, e-scooters must achieve a light end-to-end environmental footprint—from manufacturing and shipping to charging and disposal. The improvements in hardware durability and battery capability are an important first step.

The Challenges for Cities and Policymakers. For their part, cities need to regulate thoughtfully, drawing on the lessons of peer cities and their own pilot programs, as well as on data and analytics that operators have gathered. A good place to start is with permits and data requirements. Cities and policymakers also need to define rules of the road, public safety requirements, parking and no-scooter zones, and liability considerations. Well-planned investment in infrastructure, including bicycle lanes and designated parking, will advance safety and encourage greater and more responsible e-scooter use.

Above all, providers and city leaders need to work closely together to successfully integrate e-scooters into the mobility mix of the future. Their cooperation should encompass not only transportation strategies, but also broader efforts to promote solutions that serve the public good, such as programs for lower-income users. E-scooters are here to stay, and the progress made thus far is a good indication that they (and micromobility forms in general) will be an important staple of urban mobility in the future.