The crisis created by the coronavirus pandemic hit the fashion industry especially hard. Online shopping surged, but not enough to erase the damage done by store closings and economic worries, which caused people to curtail spending on nonessential goods. Industry revenue this year could drop by more than one-third, the equivalent of up to $640 billion in lost sales.

Countries are now beginning to reopen their economies, and companies and people are gradually returning to work. But fashion won’t—and shouldn’t—return to what it was. The behaviors, preferences, and shifts in mindset that people have adopted during the pandemic will lead to permanent changes, including bifurcated spending, accelerated adoption of e-commerce, and increased demand for purpose-driven brands and sustainable fashion .

For brands, the trends and the dramatic drop in sales will contribute to substantial retail overcapacity. It will lead companies to adopt a new shape of P&L, accelerate the shift to digital and omnichannel distribution, embrace data analytics for decision making, and, for those with cash, pursue M&As when they have the opportunity. The sooner brands come to terms with this new reality, the sooner they can take the steps needed to rebound and succeed. It is time for a reset, not a restart.

More than four in ten US consumers say that they expect brands to offer discounts or other promotions once stores reopen.

Changing Consumer Behaviors and Preferences

The pandemic is reshaping the fashion industry. Consumer behaviors and sentiments in the US exemplify what’s happening. Shelter-in-place orders affected 300 million people and led to a sharp decline in use of public transportation and an increase in nesting. According to BCG and other research, 81% of US consumers believe that the pandemic will lead to a recession, and more than half worry about their personal finances and plan to spend less on fashion as a result. An increased focus on value is already evident—more than four in ten US consumers say that they expect brands to offer discounts or other promotions once stores reopen.

Around the world, more people are shopping online and ordering merchandise online to pick up in person—trends that are expected to continue. COVID-19 lockdowns also have led to an uptick in first-time e-commerce shoppers—14% of consumers in the US and 17% in China bought fashion online for the first time because of the pandemic. In that respect, it’s similar to what happened during the SARS epidemic, when e-commerce spending increased and remained at the new level after the outbreak subsided. The COVID-19 crisis has made people more conscious of sustainability and the environment, and it has piqued interest in spending on health and wellness and essentials such as casual apparel, skin care, and home products.

Shifting consumer sentiments and behaviors have major implications for fashion brands:

- Consumers will shop less, and be choosier when they do. Although overall spending will decline, interest will increase in casualwear, activewear, home categories, and beauty products, at the expense of such categories as handbags and formalwear. Instead of conspicuous consumption, think inconspicuous spending.

- Channel shifts will accelerate. Sales through digital and social media—especially mobile—will hit overdrive, with digital channels in key markets accounting for a larger portion of total sales. To grab customers’ attention, brands will need to strengthen their online presence through customization, community-building, and superior online-shopping interfaces and deliveries.

- With more people shopping online, retail stores’ role will change. Flagship locations will remain for brand image purposes, but the majority of physical locations are likely to be smaller, sell merchandise that’s customized for the area, and be set up to fulfill online orders. Some will also serve as hubs for community activities.

- Shifting preferences will squeeze midrange brands. In keeping with past economic contractions, more consumers worldwide will either trade down to lower-priced goods or trade up to premium brands they may perceive as providing more value than they did previously, leaving brands with midrange price points to feel the pinch.

- Demand will accelerate for sustainability and purposeful brands. More than ever, consumers will favor brands with a purpose, and sustainability will become a minimum requirement. Brands must ensure that they operate in ways that are environmentally and socially responsible.

- Consumers will expect more. People will want convenience, including an intuitive online shopping experience and fast deliveries. As consumers gravitate to social media and more individualized forms of communication over mass media, companies will need to provide shoppers with messaging that is more timely, relevant, and personalized.

Preparing for Fashion’s New Reality

Like companies everywhere, fashion brands initially reacted to the COVID-19 crisis by taking quick steps to ensure employee safety and preserve cash. Now, as economies begin to reopen and consumer sentiments reflect a new reality, brands must act on two fronts. (See Exhibit 1.)

Declutter

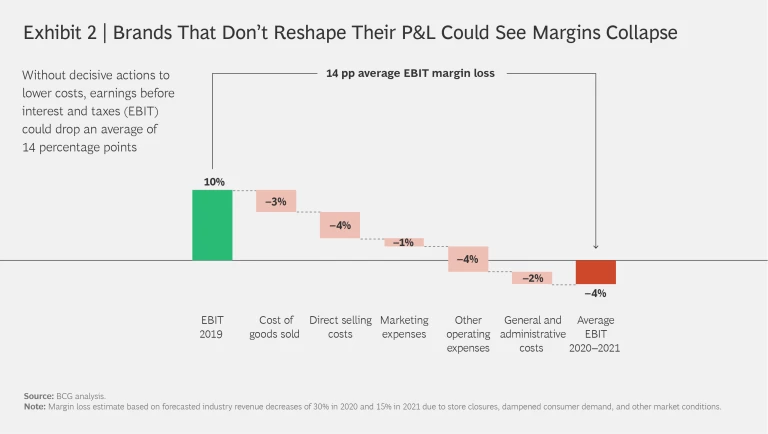

There’s no question that the shape of fashion P&L must change. In fact, we believe that if brands don’t act, margins will collapse. (See Exhibit 2.) Our forecasts show fashion industry sales dropping 30% this year (compared with 2019) and up to 15% in 2021. That could lead to a 14% decrease in earnings before interest and taxes (EBIT) over the same period if a company were to take no action to adapt its cost base to account for the lower sales.

Out of necessity, a company’s short-term actions should center on right-sizing operations, including rethinking sales channels and adopting a new P&L and associated costs to address shifting preferences and behaviors.

Reset the distribution footprint. Brands must rethink their overall distribution footprint to account for department stores and other wholesale channels that are consolidating or closing, the reduced foot traffic in company-owned stores even as economies start to reopen, and the increase in online shopping. For brands, it’s a chance to reset their wholesale and retail partnerships and streamline their sales organizations. If a brand’s reset includes a stronger push into direct-to-consumer channels, the company needs to update or expand its website—which could now cost more because every other brand will be doing the same thing, increasing competition for the optimum e-tail experience. Companies also need to solidify ties with multibrand platforms, such as Asos and Zalando, that continue to accelerate, along with such e-commerce giants as Amazon and Alibaba’s TMall, which have only gotten stronger during the pandemic.

Companies that own retail outlets need to conduct a thorough analysis of locations and close the low-performing ones. For remaining outlets, they may need to renegotiate rent and rethink layouts and staffing to improve profits from physical stores. That could include using more modular fixtures to make it easier to reconfigure merchandise displays and, if they haven’t already, set aside an area of the store to fulfill online orders.

Scrutinize all costs in light of the new P&L. To adjust to lower revenue and preserve operating profits, brands need to review and adjust costs across the board, including cost of goods sold, rent, personnel, marketing, and the like. For example, an overcapacity of unsold merchandise will lead to higher markdowns, which will squeeze margins if brands aren’t able to lower unit costs by renegotiating with suppliers. To preserve margins, brands also may need to consolidate materials sources and suppliers and be more vigilant about the timing and management of markdowns.

To adjust to lower revenue and preserve operating profits, brands need to review and adjust costs across the board.

As companies invest more effort into digital channels, the extra amount they spend on online marketing and brand purpose could be partially offset by near-term decreases in budgets for large-scale events and above-the-line costs. It makes adopting data-based marketing that much more important to increase reach with the same digital media budget.

Reduce supplier costs and increase flexibility. Brands with a strong supply chain will be in a better position to take advantage of the recovery once economies start to rebound. Because the near-term future could still be unstable, they need to forge close supplier partnerships in order to remain as flexible as possible, reduce costs, decrease the time it takes to get inventory to market, and increase risk sharing. Brands and suppliers need to come up with mutually beneficial solutions to minimize cancellations and other adjustments to orders. As part of solidifying their supply chain, brands need to adopt agile in-season inventory management .

Adopt zero-based organization redesign and AI-powered decision making. Undertaking a zero-based organization redesign is another way that brands can make their operating model leaner and more agile. In this process, a company determines the systems it would put in place if it were launching today, often using data analytics to forecast and augment decision making and identify areas of cost savings. A reorganization could lead a company to adopt a bionic operating model, one that seamlessly integrates the capabilities of people and technology. A bionic operating model also gives brands the opportunity to digitize their product development and supply chain to make both of them more agile and effective.

Invest

Companies must invest in areas that allow them to create advantage in adversity, building the organization, capabilities, and processes that they need for the future and that they can use to capitalize on opportunities to expand and gain market share.

Build a strong AI and technology backbone to digitize core processes. Adoption of advanced analytics and artificial intelligence (AI) will be among the fashion industry’s most significant changes in the coming decade, and one of its biggest challenges. Brands have been slow adopters for the most part, but laggards can take a page from companies that already use these technologies. Data will become an even more important competitive advantage: the brands with the most usable data will win. The biggest winners will be the brands that can codify data from all sales channels and consolidate it onto a single analytics platform to improve decision making on such core processes as planning, buying, promotions, markdowns, and in-season inventory management. Creating a market-leading e-commerce platform is another part of building out a more robust tech backbone.

Address elevated consumer demands. It’s more important than ever for brands to keep on top of customers’ needs and preferences in order to reorient and communicate their purpose. As part of the reorientation, brands must spend less on glossy, highly produced materials and more on content that’s real, personal, and made for social-media channels, whether it’s editorial, advertising, live video, or user-generated content. As consumer tastes shift toward casual and home-related categories, brands also need to rethink their product and merchandising mix and adjust price points, which may include tradeoffs between price and quality.

A silver lining of the crisis could be the accelerated pursuit of sustainability in fashion . After years of talk, it’s time for brands to get serious about sustainability , which has become table stakes for the industry . They need to understand what sustainability means for their business and invest in making progress. Any effort needs to start at the top, and it must be communicated to customers.

After years of talk, it’s time for brands to get serious about sustainability.

Build brand online and digitize pathways. Digital commerce could increase to 35% to 55% of total sales in key markets, so brands must boost their digital presence to keep up. Purchases of all kinds—whether online or offline—are being influenced by digital, including mobile and social selling. Winning at digital is winning overall. Online platforms will continue to gain market share through acquisitions and organic growth. But significant opportunities remain for brands that can build community and engagement around what they offer. They can also take advantage of increasing consumer interest in the resale and re-commerce markets.

A key growth area over the next decade will be personalization at scale, one-on-one engagement with customers across multiple channels, including in stores, on social media, and through digital. We call this clienteling 2.0. A number of brands and retailers are already testing this concept; some found success during pandemic-generated lockdowns, after turning store associates into digital stylists and having them engage with consumers and sell merchandise directly through WeChat and Instagram.

Retain and cultivate talent with analytics and digital skills. Finding data scientists, data analysts, and other people with the digital skills brands need to remake their business will be a challenge. Although the COVID-19 crisis has brought widespread layoffs, it may not have increased the available supply of people with the needed skills. If a brand’s efforts include expanding its tech backbone or e-commerce operations, the ramifications extend beyond new talent to the existing workforce as well. That could include deciding which people to bring back to work first, or how to Decoding Global Trends in Upskilling and Reskilling to take on new duties. Brands that are scaling down sales channels or other operations also need to consider the feasibility of reskilling people from those functions for completely new roles.

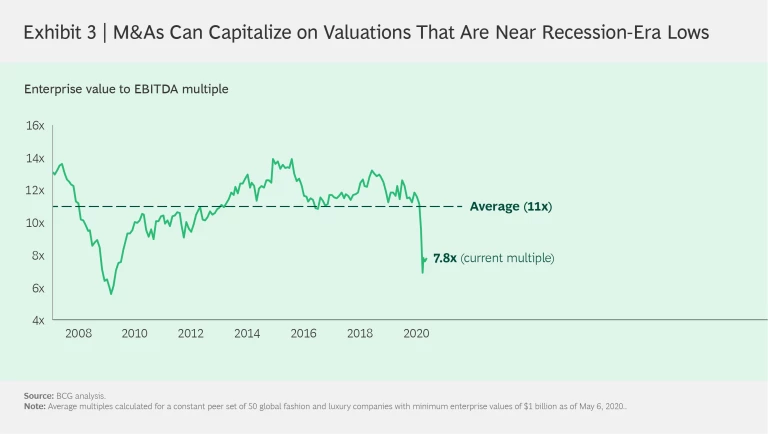

Look for M&A opportunities. Although most brands will lose revenue through 2022, we believe some could be in a position to benefit from industry consolidation and bankruptcies. Companies with cash to spend can take advantage of industry valuations that have dropped by an average 33% year-to-date, to a near-recession-era low of 7.8 times enterprise value over EBITDA. (See Exhibit 3.)

On the basis of our analysis, we believe that companies may discover opportunities to acquire both healthy brands and brands that need a partner to provide a needed influx of capital. Earlier BCG research showed that deals made in a weak economy create more value for buyers than those made in a strong economy; a year after an acquisition, relative shareholder return is nearly 7% higher, and after two years, the difference increases to more than 9%. Brands can pursue M&As to acquire direct competitors to expand horizontally and increase scale and market share; integrate across the supply chain into production or last-mile delivery; buy adjacent products or capabilities in order to diversify their product portfolios; or buy AI or digital startups, for example, to gain competencies to enhance their core business.

The next two to three years could be the most tumultuous that most people in the fashion industry will ever know. Agile, decisive brands that can free up capital to invest can set themselves up to create advantage in adversity. They can right-size operations and adopt new business practices while continuing to give customers what they want. Make no mistake, though, these actions will not be easy, and the window for taking them will be brief. But brands that act quickly can give themselves a better chance of not just surviving the chaos but becoming stronger because of it.