BCGと世界経済フォーラム(WEF)の共同レポート

The Cost of Inaction: A CEO Guide to Navigating Climate Risk

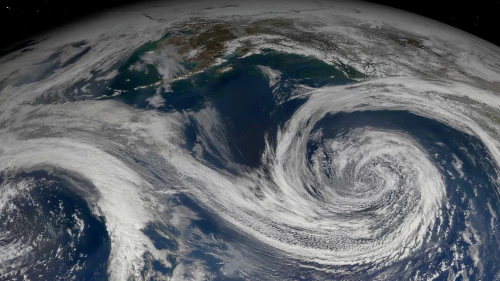

Climate change is already straining economies globally as it disrupts livelihoods, supply chains, and infrastructure. In the face of escalating operational costs and risks to business continuity, the need for immediate action has never been greater. Since 2000, climate-related disasters have caused over $3.6 trillion in economic damages, and without urgent action, global GDP could take a cumulative hit of 16% to 22% by the end of the century.

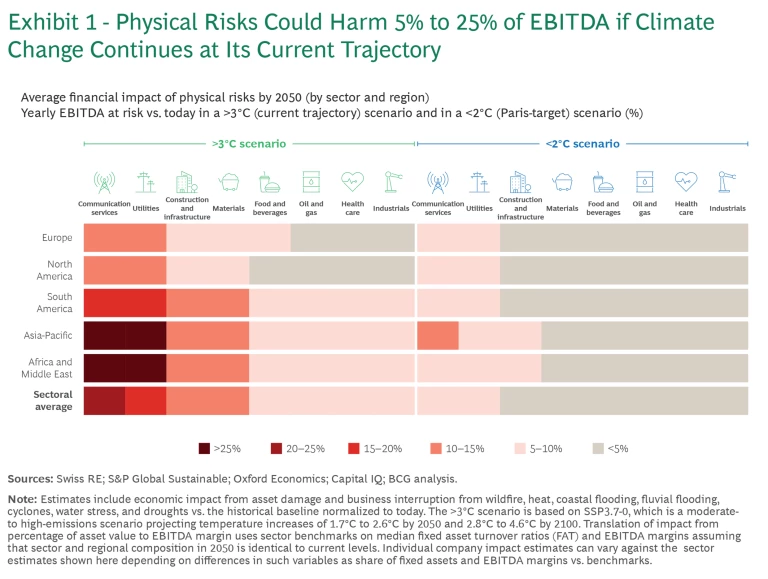

Climate change presents a dual threat to businesses: physical risks from extreme weather, and transition risks from the necessary global shift to a low-carbon economy:

- Physical Risks. Extreme weather events such as storms, floods, and wildfires damage assets, disrupt supply chains, and reduce productivity, especially in utilities, agriculture, and communications, and other sectors that that rely heavily on vulnerable physical infrastructure. Weather-related risks expose up to 25% of EBITDA to potential loss in these sectors. Addressing these challenges requires the adoption of robust resilience measures across operations and supply chains. (See Exhibit 1.)

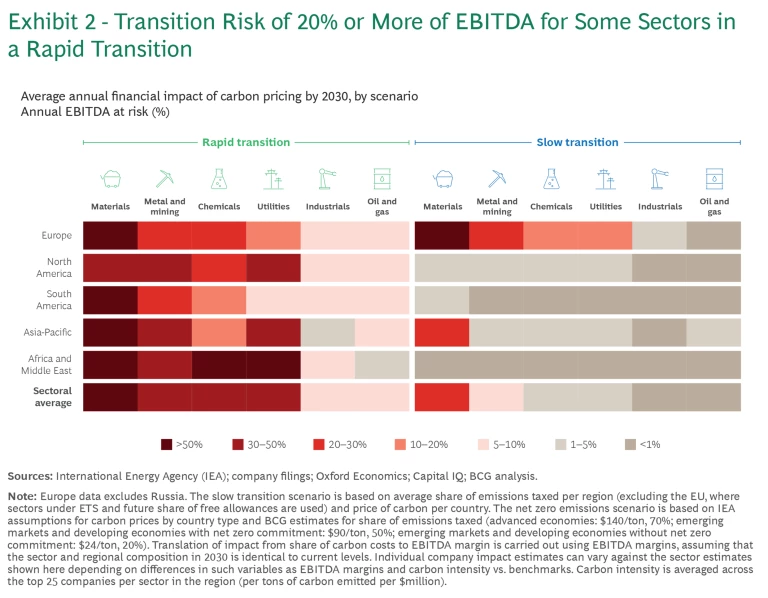

- Transition Risks. As governments ramp up carbon pricing and introduce stricter emissions regulations, companies that lag in decarbonization efforts put themselves in jeopardy not only of having to pay compliance costs but also of seeing their asset values diminish and their market position erode, especially in high-emission sectors. (See Exhibit 2.) Transition risks extend beyond compliance costs, as shifting investor and consumer expectations reshape demand.

Meeting these risks requires the formulation of proactive climate strategies to protect margins and market position:

- Businesses have a clear case for investing in adaptation: companies that comprehensively assess their risk exposure have reported to CDP that their current adaptation and resilience investments could yield returns of from $2 to $19 for every $1 invested.

- Transitioning to low-carbon operations can economically abate up to 60% of emissions in a fast-transition scenario, thereby reducing exposure to carbon pricing and regulatory costs, particularly in emission-intensive sectors.

Growing demand for climate-resilient infrastructure and supply chains is creating new opportunities for companies to expand adaptation solutions and services. For example, Schneider Electric partnered with AiDash to help utilities build climate-resilient electrical grids, using AI to forecast storm- and wildfire-related outages. Meanwhile, in construction, Vetrotech by Saint-Gobain has developed hurricane- and fire-resistant glass to enhance the resilience of buildings exposed to extreme weather conditions.

The green economy is projected to soar from $5 trillion in 2024 to over $14 trillion by 2030. Early movers in renewable energy, sustainable transport, and green consumer products stand to gain substantial competitive and regulatory advantages, positioning themselves as leaders in rapidly expanding markets.

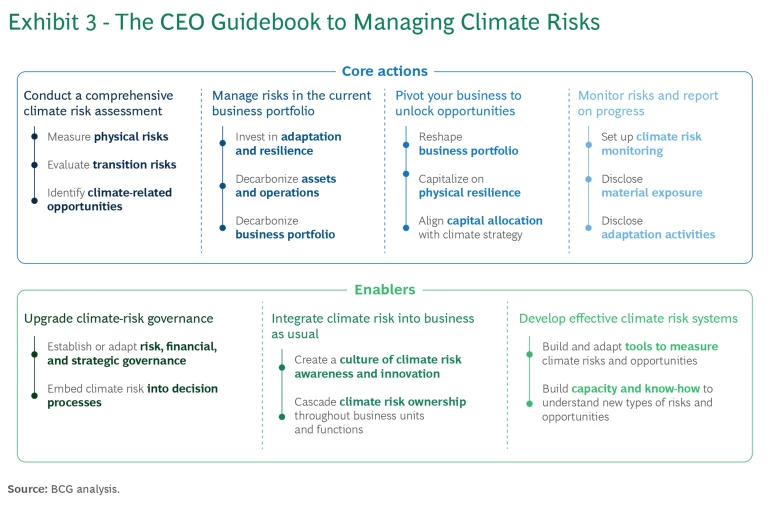

For CEOs, this report’s guidebook provides essential tools to address climate risks, secure long-term resilience, and capitalize on growth opportunities. (See Exhibit 3.) Drawing on insights and case studies from 20 CEOs and senior executives, it offers a structured approach to embedding climate strategy into corporate decision making and to transforming risk into lasting value.

Conduct a Comprehensive Climate Risk Assessment

Example: A detailed risk assessment can highlight vulnerabilities that are significantly greater than expected. The risk assessment of a European highway operator showed that annual physical damage costs, currently 5% of EBITDA, could double by 2050. Increased weather severity and wider spread of extreme weather events are expected to expose previously unaffected assets to harm, driving up future risks.

Manage Risks in the Current Business Portfolio

Example: A major utility strengthened its electrical grid to withstand severe storms, achieving $2 to $3 in net utility, customer, and community benefits for every $1 invested, while enhancing resilience and customer trust.

Pivot Your Business to Unlock Opportunities

Example: Repsol committed to shift 45% of its capital expenditure to renewable energy and biofuels over the next five years, balancing its net zero ambitions with attractive shareholder returns. This strategy boosted its market value by over $1 billion on the day it was announced.

Monitor Risks and Report on Progress

When reporting is integrated as a key driver of performance, it enables organizations to better tackle risks and seize opportunities. But if it is seen as a compliance checklist, reporting can become a burden. — Simon Henzell-Thomas

Bold Measures to Close the Climate Action Gap: A Call for Systemic Change by Governments and Corporations

Humanity’s biggest challenge remains far from being solved. The ambition agreed upon in Paris in 2015 may be slipping out of reach—less than ten years after its formulation. Decision makers must strengthen their resolve and immediately shift from incremental to systemic actions.

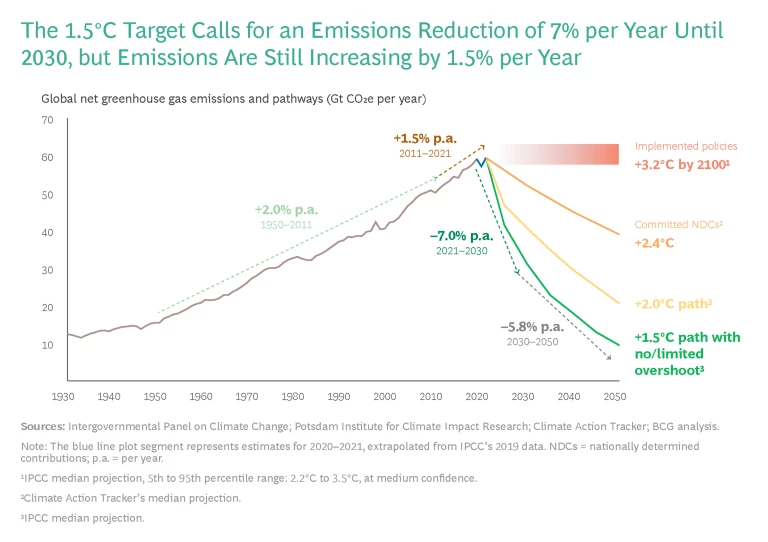

To retain any chance of limiting global warming below 1.5°C, global emissions must decrease by around 7% annually until 2030—but emissions are still increasing today by 1.5% per year. (See the exhibit.)

Despite recent progress in many dimensions, climate action remains largely ineffective:

- Only 35% of emissions are covered by national net-zero commitments by 2050, and only 7% are covered by countries that complement bold targets with ambitious policies.

- Fewer than 20% of the world’s top 1,000 companies have set 1.5°C science-based targets, and fewer than 10% also have comprehensive public transition plans. Almost 40% have no net-zero commitment at all.

- Technologies that are economically attractive now or will be in the near future can achieve only around half of the emissions reductions needed to reach 1.5°C.

- More than half of climate funding needs remain unmet, with especially critical gaps in early technologies and infrastructure and in lower-/middle-income economies.

The narrative may sound stale, but it is nonetheless true: the clock is ticking, and the time to avert disaster is running out. Focusing solely on our own agendas will not result in nearly enough progress. We must also become system players to support and accelerate change across industries and societies. This is not a moment for asking if we can do it—but finding out how we will.

We hope this report can both inspire and serve as a practical guide for decision makers in government offices and management floors alike. The first part offers an honest assessment of where we fall short, while the second part takes a deep dive into the practical actions that matter most in the shift from incremental to systemic impact.

Winning in Green Markets: Scaling Products for a Net-Zero World

To realize the ambitions set out in the Paris accord, a massive technology shift is needed across all economic sectors. Non-fossil solutions already exist to mitigate most global

In our new report, coauthored with the WEF Alliance of CEO Climate Leaders, we explore how other companies can take a similar path by identifying, creating, and scaling green businesses. Among the insights:

- The cost issue is particularly challenging in industrial sectors. Consider green technologies to decarbonize aviation. Air transport with 100% hydrotreated ester and fatty acid (HEFA) biofuels is expected to increase cost per ton-kilometer by roughly 8%, while reducing emissions by 50% to 90%. And a fully net-zero fuel such as power-to-kerosene, which is in the pre-industrial phase and not yet scaled, would increase fares by a factor of almost 2.

- The cost disadvantage is not set in stone. As green technologies scale, their cost disadvantage is likely to decline. In the US, for example, solar has reached cost parity with both coal and natural gas. Meanwhile, the total cost of ownership of both commercial battery and hydrogen electric vehicles is expected to drop below that of internal combustion engine vehicles within the first half of this century. And in Europe, green steel may reach cost parity with gray steel as early as next decade.

- There is an untapped market for green. A June 2022 BCG sustainability consumer survey found that while less than 10% of consumers purchase on sustainability just to “save the planet,” the number of consumers in any given category who would opt to make sustainable choices increases roughly twofold to fourfold (to 20% to 43% of consumers) when sustainability is linked to other benefits such as health, safety, and quality. And those percentages increase another twofold to fourfold (to roughly 80%) when barriers such as convenience, information, and cost are addressed. Companies that figure how to deliver additional benefits and reduce points of friction can gain access to a major untapped consumer market.

- Commitments to decarbonize will create further momentum in green markets. As of November 2022, 1,957 companies had set certified, science-based emissions reductions targets, and a further 2,103 had committed to set them—a significant increase in many sectors. As companies translate these commitments into action, “green premium” markets are beginning to emerge. Players in different sectors have begun introducing low-carbon materials and services to the market—and are capturing price premiums for them.

- Scarcity is likely to be an issue for some critical green inputs. There is a notable gap between the commitment of downstream players to decarbonize their upstream value chains and the commitment of upstream players to provide the low-carbon materials needed to meet these targets. This divergence in commitment level creates a major risk of scarcity for some green materials.

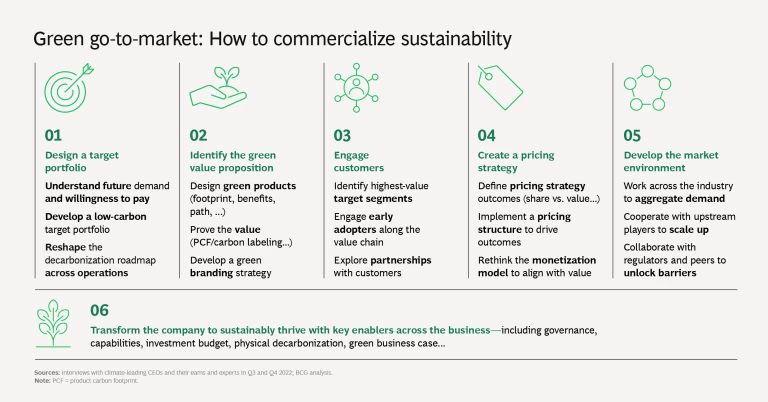

To create a compelling green offering and to secure the resources necessary to deliver it, both downstream and upstream companies need to rethink their go-to-market approach and take six critical actions:

A CEO Guide to Net Zero

Even as global climate action accelerates, many companies remain ill prepared. They underestimate the magnitude of the change ahead, and they act too conservatively, putting themselves at risk of ending up with stranded assets and obsolete business models.

Leading companies in an array of sectors—from automotive to food and from shipping to power—are starting to prove that the net-zero transition is a business opportunity that can bring sustainable competitive advantage. These leaders are not just creating more value; in many cases, they are changing the game in their industries by showing the way to a profitable, sustainable future.

Consider three facts about early movers on climate change:

- They gain competitive advantage. Climate leaders can attract and retain better talent, realize higher growth, save costs, avoid regulatory risk, access cheaper capital, and achieve higher shareholder returns. (See Exhibit 1.)

- They can achieve sizable emissions reductions at net-zero cost. By becoming more energy efficient and switching to lower-cost renewable power, for example, leaders can realize significant cost savings, which they can then use to fund costlier decarbonization levers. (See Exhibit 2.) Almost all companies can realize at least one-third of the emissions reductions they need to achieve at net-zero cost to their business. Companies in the food, consumer, and automotive sectors can reduce their Scope 1 and Scope 2 emissions by approximately 70% at net-zero cost.

- They raise the bar for their industry. Sustainability is now a competitive consideration. At the very least, companies do not want to be seen as lagging—so if one company moves, others feel pressure to follow. (See Exhibit 3.) As a result, the goalposts are shifting quickly. A single company with the courage to set ambitious targets can move its entire industry.

CEOs across all sectors must navigate an unprecedented global transformation. On the path to net zero, they must successfully transform their strategy, operations, business portfolio, and organization. There is no blueprint for what lies ahead, but we can identify challenges to look out for and moves to consider. To this end, BCG and the World Economic Forum have collaborated to produce the CEO Guide to Climate Advantage.

We encourage business leaders to read the full guide, but here are the four key building blocks for a net-zero transformation:

ネットゼロへの移行にあたり重要な4つの基本的要素

ネットゼロ経営戦略

気候変動対策のリーダー企業は、気候変動自体と、それに伴う対策の双方が自社のビジネスモデルに影響を与えることを認識しています。そして、製品や事業ポートフォリオを積極的に適応させれば、新たな成長機会が生まれることを理解しているのです。そうした企業は、ネットゼロのシナリオ下における現在の事業ポートフォリオの財務上のリスクを分析しています。加えて、ネットゼロをめざすうえでの自社のパーパス(社会に対する存在意義)は何なのか、ビジネスモデルをどのように適応させればよいかを定義しています。また、排出量削減についてはオフセットや二酸化炭素除去の位置づけも明確にして、野心的な削減目標を設定しています。この目標は、状況の変化や技術の進歩によって今後さらに高くなる可能性も見込んでいます。

ネットゼロ・オペレーション

効果的な排出量削減プログラムは、コスト削減プログラムとほぼ同様のやり方で実行されています。優れた企業はトップダウンで取り組み、拠点・施設ごとに最もコストの低い手段を特定し、よく考え抜かれた目標、インセンティブ、実行状況の追跡の仕組みを設定して進捗を管理しています。また、製品の設計を見直し、より少量の材料で済ませられないか、代替となる材料はないか、もしくは二次材料を使用できないかを検討します。調達の意思決定においても排出量を考慮し、サプライヤーと密接に連携して自社の製造ラインやサプライチェーンの排出量を削減しています。

ネットゼロ事業ポートフォリオ

ネットゼロ組織

収益性や売り上げのかじ取りと同様に、脱炭素のガバナンスモデルを構築することも求められます。マネジメントの新たなモデル、プロセス、KPI(重要業績評価指標)、システムなど、適切なインセンティブを設定し、将来的に有効な投資をしやすくします。

ネットゼロに向けたトランスフォーメーションには、新規事業や最新テクノロジーへの転換を支える新たなスキルを開発、あるいは獲得することが求められます。また、オペレーションの脱炭素化や新規事業の構築、レジリエンスの強化などにも多額の投資が必要になります。こういった場合には、グリーンファイナンスの活用、サステナビリティ連動債などの革新的な資金調達スキームを通じたパートナーとの協働といった選択肢があります。

企業は、サステナブルでない事業やビジネスプロセスの寿命を延ばそうとするのではなく、将来に向けたサステナビリティ向上の取り組みを進めるための支援を求めるべきです。今後、規制が強化されたときに、サステナビリティのリーダー企業は、先手を打った対策で競争優位性を築くことができる一方、競合企業は追いつこうと四苦八苦するでしょう。また、サプライヤーやパートナーとつくるエコシステム全体を巻き込んで全ステークホルダーの能力を高め、サステナビリティ向上の成果をさらに迅速に実現することもできるでしょう。

It’s time to commit, engage, and act. The world is embarking on the biggest transformation in history. This is a time like no other for bold, ambitious leadership. It’s time to move.

本プロジェクトのエキスパート