Revenue growth can be a major value driver in transformations. In a survey of global business leaders whose companies underwent a transformation in the past five years, BCG found that 95% of transformations utilized one or more revenue growth

Growing revenue in a transformation is particularly important when the transformation is undertaken amid an economic downturn or industry-specific disruption. Our experience shows that companies with robust revenue streams are better positioned to respond to the risks associated with any transformation and to the urgency created by disruptive events. Using revenue levers can therefore greatly improve the odds that a transformation program will achieve its financial objectives and create both immediate and lasting impact.

The Why: Benefits of Rapid and Sustainable Revenue Growth

Rapid revenue growth in a transformation can have these near-term benefits:

- Funding the Journey. Transformations typically require significant investments. Revenue generated in the early stages of a transformation can be reinvested to fund multiyear transformation journeys without hurting a company’s bottom line.

- Generating Momentum. Organizational support across all levels of a business can have a positive impact on the trajectory of a transformation, one that is typically apparent within the first few months. Quick wins from a few well-executed revenue levers can help generate the momentum necessary for executing challenging, longer-term strategic efforts.

- Boosting Investor Confidence. Meeting or exceeding revenue targets early in a transformation can signal to investors that a company is on the right track toward its broader transformation objectives.

Furthermore, revenue growth that is sustained during and after a transformation can yield these long-term outcomes:

- Creating Sustainable Shareholder Return. Revenue growth during a transformation is a key contributor to increased total shareholder return. A BCG study shows that companies that succeed in transforming for growth generate significant value—11 percentage points more growth acceleration and 12 percentage points more TSR outperformance—than do companies in an average transformation.

- Establishing Competitive Advantage. Companies that achieve sustainable revenue growth through transformation are better able to weather and rebound from adverse events ; new sources of revenue growth often help establish lasting competitive advantage.

- Increasing Customer Satisfaction and Loyalty. Strategies to drive sustainable revenue growth can improve customer satisfaction and loyalty metrics, such as net promoter score and customer lifetime value, simultaneously.

We have worked with companies in several industries that have used revenue levers to improve their growth trajectories within the first year of a transformation—even during a crisis. The key to their success was knowing both what revenue levers to use and how to implement them for maximum impact. While our focus in this article is on organic revenue growth in B2B and B2C companies that provide “considered purchase” products or services, many of the revenue levers we describe can also be applied to companies that provide “impulse buy” products or services.

The What: Six Revenue Levers

Our approach to revenue growth in a transformation begins with the revenue levers themselves. We have two main criteria for deciding which revenue levers a company should prioritize: direct impact on P&L and rapid delivery of the impact.

There are several ways to create rapid P&L impact, most of which depend on utilizing a company’s existing products and sales force. This approach does not necessitate heavy investments, so most of the value created goes directly to the bottom line. At the outset of a transformation, therefore, we do not focus on revenue levers—such as launching new products or expanding into new markets—that typically require significant incremental costs and multiyear timeframes to achieve impact.

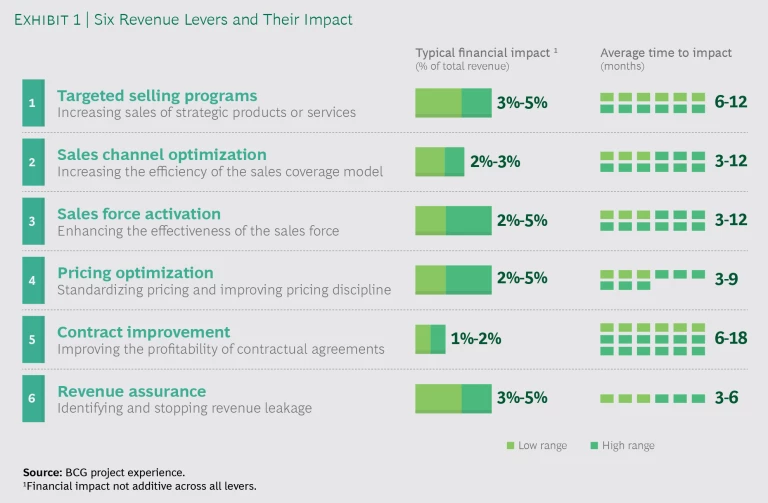

We have found that the following six revenue levers are most effective for driving rapid and sustainable P&L impact across a wide range of industries. Deploying these levers can help maximize both earned and realized revenue by, for example, expanding the number of sales leads, increasing the value of individual sales, increasing sales frequency, increasing recurring or subscription-based sales, improving sales win rate, improving pricing, accelerating the sales process, and preventing revenue leakage.

- Targeted Selling Programs. Sales of strategic products or services, or sales to specific customer segments, can be increased by, for example, bundling components of existing offerings to meet the needs of target customers, converting one-time sales to subscriptions, or improving the effectiveness of targeted promotions and loyalty programs.

- Sales Channel Optimization. The efficiency of the sales coverage model can be increased by, for example, expanding the size and capabilities of the inside sales function to better target underserved customer segments, clarifying direct sales roles (such as hunters versus farmers), or partnering with third parties to increase penetration in markets with limited sales presence.

- Sales Force Activation. The effectiveness of the sales force can be improved by, for example, increasing inbound marketing, improving account planning and sales funnel governance, or optimizing incentive structures for exceeding sales targets.

- Pricing Optimization. The sales process can be accelerated and more value captured through standardized pricing and rigorous pricing discipline—for example, by automating pricing rules in revenue management systems or enforcing contractual pricing changes.

- Contract Improvement. Contractual agreements can be standardized and profitability improved by, for example, introducing big data tools and process improvements to simplify and accelerate decision making in contract reviews and negotiations or aligning service agreements with delivery capabilities.

- Revenue Assurance. Revenue leakage—the failure to collect revenue earned from contracted services or products sold—can be identified and stopped by, for example, applying machine learning and automation tools to quickly find leaked revenue and fix systemic billing issues.

All of these revenue levers typically start generating impact approximately three to six months from launch. Exhibit 1 summarizes the typical impact and approximate time to impact for each of the revenue levers, based on our experience.

We also select revenue levers that can be scaled across multiple business segments or geographies and that require relatively small amounts of investment in order to maximize value capture. It is worth emphasizing that, by using the right revenue levers, companies can grow their base revenue while implementing cost reduction levers, with margins remaining consistent or even improving in the course of the transformation.

Growing revenue during a transformation can be quite challenging. For example, because the various stages in the revenue life cycle are all interconnected, applying a revenue lever at one point in the cycle will affect other points. In most transformations, however, companies focus on only a few discrete parts of the revenue life cycle. Taken together, the six revenue levers we focus on here address the interconnected stages of the cycle and allow companies to address the interdependencies among them.

The How: Implementing the Revenue Levers

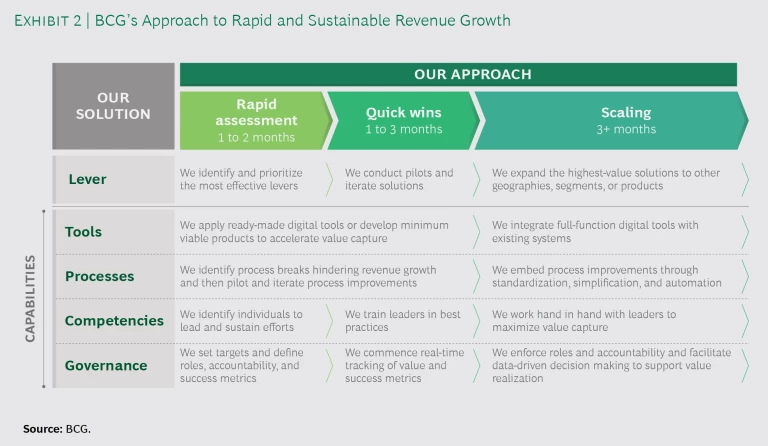

To ensure maximum P&L impact during—and after—a transformation, we follow a three-phase sequence:

- Phase 1, Rapid Assessment: Identifying, valuing, and prioritizing revenue levers according to which ones will yield the most value and can be implemented quickly

- Phase 2, Quick Wins: Designing and executing pilots to test the effectiveness of revenue levers—by demonstrating tangible P&L impact, evaluating lessons learned from pilots, and iterating solutions to maximize value capture

- Phase 3, Scaling: Applying the most effective revenue levers to new geographies, segments, or products

The key to successfully driving rapid and sustainable revenue growth through this approach is capability building. At BCG, we think of capabilities in terms of four components that we help clients implement:

- Tools. We introduce ready-made, customizable tools that use big data and predictive analytics to accelerate revenue realization. When ready-made tools are not available for critical use cases, we help clients build and test minimum viable products. For example, in sales force activation, we deploy digital tools that automate the identification of white space opportunities and “next best offer.” Salespeople who know what and when to sell can have more frequent and productive customer interactions, which drive sales

- Processes. We improve processes through simplification, standardization, and automation. These improvements help ensure a more frictionless sales experience for our clients and their customers. For example, in contract improvement, we implement a fast, data-driven review process based on best practices from across industries. This is supported by digital tools that use natural language processing and data analytics to evaluate the profitability of key contract terms. The information is then used by salespeople to negotiate optimal terms that maximize contract profitability.

- Competencies. Early on, we identify leaders within the various levels of the organization—including both P&L owners and frontline sales and account managers—who can lead and sustain change efforts. We work hand in hand with these leaders to identify and implement solutions. We also deploy next-generation technologies and sales approaches, as well as agile process improvements across the revenue life cycle, to quickly turn identified solutions into business as usual. For example, in revenue assurance, we create a functional center of excellence that continuously identifies new sources of revenue leakage using best-in-class robotic process automation and machine learning tools.

- Governance. We clarify roles, implement accountability measures, and align incentives and success metrics across the revenue life cycle. This ensures that everyone from sales to billing works toward unified financial and operational goals, including both revenue and margin growth. We also track financial and operational metrics through our digital performance management platform, Key by BCG, which provides transparency and real-time access to the information that business leaders need to make data-driven decisions.

We have found that embedding capabilities with all four of these components into our approach is critical to getting P&L impact that is both quick and sustainable. Exhibit 2 summarizes our entire approach to implementing revenue levers in a transformation.

Client Success Stories

BCG recently supported several companies in growing their revenue during a transformation and realizing many of the short- and long-term benefits described in this article:

- Technology. The services division of a technology company underwent a comprehensive transformation focused on all six revenue levers, helping turn a previously negative-growth business into the company’s fastest growing. The revenue levers alone contributed 4% year-over-year revenue growth and more than 10% year-over-year margin growth (a $140 million EBITDA increase) for the duration of the two-and-a-half-year transformation program—on top of additional cost reduction initiatives. These efforts also reduced customer churn and improved customer satisfaction, yielding a seven-point net promoter score improvement.

- Industrial Goods. An industrial supplies distributor faced stagnating growth and increasing competition from smaller players in a highly fragmented market. To reestablish a sustainable growth path, the company embarked on a transformation effort focused on targeted selling programs, sales channel optimization, sales force activation, and pricing optimization. The company’s revenue increased 5% annually in the five years posttransformation, and TSR has consistently outperformed the market and the company’s peer set.

- Consumer Products. A manufacturer and distributor of consumer products executed a transformation program to boost organic growth. Using levers that included targeted selling programs, sales channel optimization, sales force activation, and pricing optimization, as well as expansion into emerging markets, the company achieved 12% compounded annual growth and doubled its market capitalization over five years.

- Automotive. A vehicle fleet management company experienced three consecutive years of declining income and stock price. It implemented a transformation program employing targeted selling programs, pricing optimization, and revenue assurance. Application of these revenue levers contributed to a 13% operating income gain and almost 200% improvement in the company’s stock price over two years.

In all our work with clients to achieve revenue growth in transformations, we focus on creating direct P&L impact quickly, without the need for heavy investment. We tailor our approach to each client while drawing upon our extensive knowledge and experience, and we work shoulder to shoulder with clients to accelerate value creation. Helping to fix processes and align incentives so that the impact of our work extends across business functions, we also focus on enabling the right people. Finally, we help ensure not just quick revenue boosts but also sustainable future growth—so that top-line wins continue far beyond the transformation timeline.

BCG TURN

is a special unit of BCG that helps CEOs and business leaders deliver rapid, visible, and sustainable step-change improvement in business performance while strengthening their organizations and positioning them to win in the years ahead. BCG TURN helps organizations change their trajectories by turning their upside potential into radical performance gains. The BCG TURN team consists of transformation practitioners and battle-tested experts with a proven track record in large-scale transformation. BCG TURN is invested in the sustainable success of clients, with a focus on performance acceleration and a commitment to value delivered.