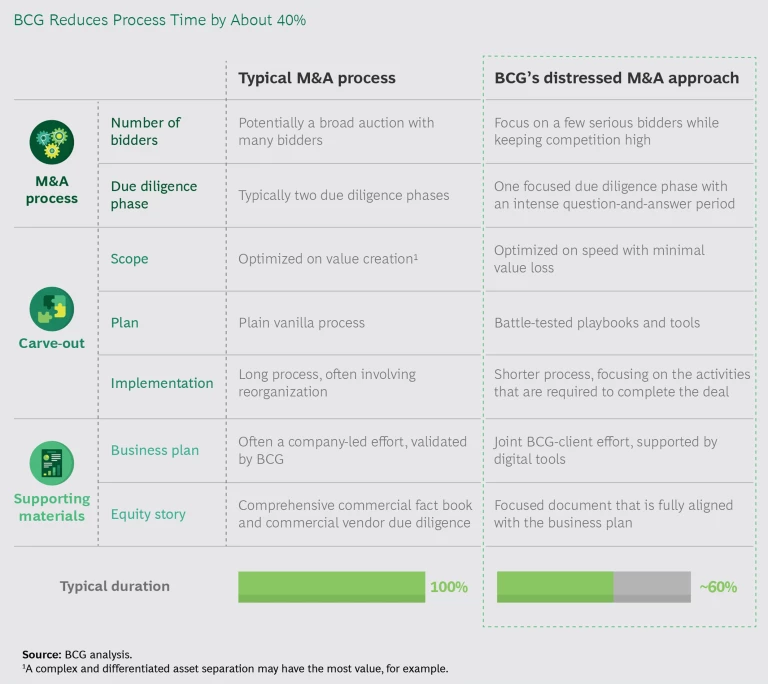

By taking three actions, companies can shave off about 40% of the time it takes to close a deal while maximizing value creation.

The COVID-19 crisis has caused economies to slow and societies to nearly shut down, disrupting companies’ operations and putting millions of people out of work. In fact, many national economies have entered a recession.

History shows that distressed M&A activity rises significantly in the wake of recessions. Data from the past two global recessions shows that distressed M&A activity reached its apex within one to three years after the recessions peaked.

During the global recession in 2001, the number of distressed M&A deals was 710, according to Refinitive. Distressed M&A activity rose the subsequent year, and the number of deals reached 890.

The difference was even more dramatic for the Great Recession. The number of distressed M&A deals in 2007 was only 200, but distressed M&A activity rose during each of the next three years until it peaked in 2010, when the number reached 920 deals.

BCG expects this pattern to repeat itself this time as well. If the global economy reaches its recessionary floor in 2020, we anticipate that distressed M&A activity will rise steeply in 2021. After experiencing significant declines in revenue owing to the COVID-19 crisis, many companies have drawn down their credit lines. With limited access to new financing, a number of these distressed companies will need to use M&A to dispose of certain assets in order to bring in cash and reassure lenders that they are taking decisive actions to shore up their balance sheet.

However, distressed companies face an inescapable dilemma when they pursue M&A. On one hand, they want the process to proceed as quickly as possible in order to retain customers and employees, avoid business disruptions, and conserve cash. On the other hand, companies want to maximize value creation by preparing an equity story and broadening the pool of potential buyers. Companies also want to assure possible bidders of the deal’s value by letting them conduct a thorough due diligence. But all that takes a fair amount of time—typically from 9 to 15 months—and distressed companies may not have enough cash on hand.

Companies can cut this Gordian knot by carving out the healthy part or parts of their business that will generate the most cash in an accelerated time frame.

A Proven Approach to Distressed Carve-Outs

BCG’s proven approach has helped numerous companies navigate distressed M&A deals, including complex carve-outs, by taking three actions.

Radically Reducing Process Time. There are hundreds of topics to consider when undertaking a carve-out. To accelerate the process, BCG applies its deep industry expertise to identify the topics that represent the biggest risks for buyers and that have the most impact on the value of the deal. Then BCG uses its proprietary playbooks, which detail how to handle the standard components of a distressed M&A carve-out, to help companies address those key topics. Meanwhile, companies can focus on removing potential stumbling blocks to the deal or packaging it in a way that will attract the most interest. In addition, BCG uses a comprehensive suite of digital tools (such as KEY by BCG ) to make it quicker to design the carve-out deal and easier to track its progress.

BCG also leverages its longstanding relationships with distressed M&A advisors, insolvency administrators, and other experts to foster collaboration, facilitate agreement, and enable the client to make rapid decisions in distressed M&A situations.

Providing a Due Diligence-Ready Concept. BCG provides a carve-out concept that makes it easier for bidders to perform due diligence. This broadens the bidder universe, improving a company’s chances of executing a distressed M&A deal and lowering the risk of valuation discounts. The concept includes three components:

- A Detailed Carve-Out Plan. BCG creates a carve-out plan that covers the assets, functions, and processes to be separated from the parent organization. The plan also includes a blueprint that executives can use to implement the carve-out. BCG helps optimize the perimeter of the carve-out—which portions of the business are being carved out and how they transition to a potential new owner—to minimize complexity and accelerate the process.

- An Investor-Ready Business Plan. This includes a full profit-and-loss statement as well as information on working capital, indirect cash flow, and a balance sheet for day one.

- A Focused Equity Story. A balanced equity story conveys the strengths of the business being carved out, while acknowledging areas where turnaround measures might be needed. By focusing on the key drivers for value creation and by combining industry knowledge with M&A expertise, BCG can significantly shorten the time it takes to prepare this document. The equity story then becomes a key input into other important carve-out transaction materials, such as the information memorandum or the management presentation.

Making the Carve-Out Operational and Ensuring Business Continuity. Distressed M&A usually involves a high level of uncertainty. Making the carve-out operational reduces or removes this uncertainty. Bidders understand exactly what they will get, and they know that the carved-out entity can hit the ground running. Here are some steps that sellers can take to make the carved-out portion of the business operational on day one:

- Broaden the scope of the carve-out to minimize dependency on the parent company and reduce carve-out complexity. A carve-out concept that includes necessary support functions—such as payroll, HR, and IT—can operate fairly independently after an acquisition. This broad scope may negatively affect the sales price by making the buyer responsible for restructuring the carved-out business. Nevertheless, broadening the scope of a carve-out greatly increases the likelihood of closing a deal and accelerates its execution.

- Lift and shift entire entities in share deals to minimize complexity. Buyers are likely to be wary of any deal that would require them to renegotiate contracts with suppliers or customers. Sellers can transfer assets using a hive-down approach to avoid triggering such change-of-control clauses.

- Develop comprehensive documentation of the as-is situation, transaction scope, and transition procedures for all relevant carve-out assets, functions, and processes. In lift-and-shift situations, this documentation can also include a high-level restructuring plan to give bidders ideas on possible changes they may need to make after day one.

- Back up the carve-out concept with comprehensive operational and financial data packs so that bidders and their advisors can easily perform due diligence on the deal.

- Use an activist project management office (PMO) to ensure that transition groups coordinate closely with each other. The PMO can also facilitate coordination with the buyer on key topics (for example, employees, contracts, and IT) to the extent that antitrust rules allow.

- Track and report stringently on the carve-out implementation on the path to day one. Escalate any significant issues that do arise to the steering committee for a rapid resolution.

Overcoming Headwinds to Close a Deal: A Case Example

Facing severe market conditions, a major European wind energy company filed for insolvency in 2019. The company had both manufacturing and service components, but it could not find any bidders for the whole business. The onshore service business attracted several substantial bids, but after the lead bidder nearly dropped out, the company engaged BCG to keep this distressed carve-out deal on track.

Using its deep knowledge of the wind energy industry and working closely with the client, BCG delivered a comprehensive carve-out concept within three weeks. The concept featured a carve-out perimeter designed to minimize both process duration and complexity. For instance, it included full IT functionality to ensure business continuity on day one after the completion of the deal, and to avoid any of the delays involved in disentangling networked systems.

The deal also provided full overhead in terms of finance, human resources, legal, and R&D functionality so that the buyer could continue running the business as a standalone entity without committing to any particular integration path. To make it easy for the bidder to perform due diligence, the carve-out concept included comprehensive data packs on employees, facilities, contracts, and other key assets. The concept also contained a restructuring plan that provided the bidder with guidance and suggestions on how to restructure and run the carve-out business after day one.

BCG helped with the successful execution of the deal by creating an activist project management office to support a variety of transition groups on topics such as employee staffing, organizational design, financial reporting, the transfer of physical assets, the functionality of critical processes (especially order-to-cash and procure-to-pay processes), the availability of critical IT systems, and the transfer of all critical supply chain contracts and materials.

Following a tremendous effort by the client’s organization and project team, and with BCG’s support, the client successfully closed the deal at a favorable valuation and faster than usual. The deal also benefited the client’s creditors and ensured a safe landing place for more than half of its employees.

Five Keys to Success

Companies can boost their chances of successfully carving out a part of their business and closing a deal by following these guidelines:

- Start early. Carve-outs can take more than a year to complete. Although BCG’s fast-track approach for distressed carve-outs can shorten the process time by about 40%, getting started early ensures that companies have as much time as possible to develop the carve-out plan, create a compelling equity story, attract a broad universe of bidders, and make them comfortable by allowing them to perform sufficient due diligence.

- Keep it simple. By carefully tailoring the scope of the carve-out and structuring the transaction, companies can simplify and accelerate the carve-out process. The simplest approach typically combines lift-and-shift with share deals.

- Stay nimble. Implement short feedback loops and empower the carve-out project organization to deal with any unexpected issues that pop up.

- Involve the other side. Make the buyer part of the carve-out process to the fullest extent that antitrust rules allow in order to ensure joint responsibility for a favorable and fast outcome.

- Keep the rest of the business running smoothly. With BCG handling much of the heavy lifting involved in defining, packaging, preparing, and executing the carve-out, clients can focus on keeping operations stable throughout the organization—both in the part of the business to be carved out and the part that will remain. This stability helps companies retain the valuable employees, customers, and other stakeholders that they need to succeed over the long term.