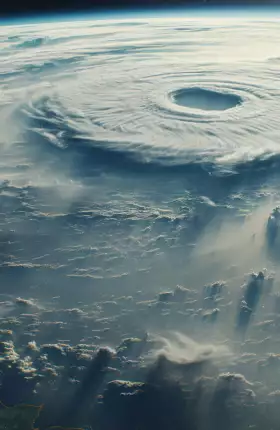

COP28は地球にとって重要な瞬間となるでしょう。BCGの気候関連エキスパートは、気候変動という差し迫った課題に対する革新的なソリューションに向けた連携と取り組みを強化するために、世界各地のリーダーと協働します。

Insights from COP29 and Beyond

At BCG, we remain committed to partnering with the most impactful institutions around the globe to drive impact on the issues that will be front and center at COP29. Our expertise includes:

Climate Finance — BCG is committed to helping organizations unlock climate financing and innovation by mobilizing funding across the investment and venture ecosystem.

Climate Finance — BCG is committed to helping organizations unlock climate financing and innovation by mobilizing funding across the investment and venture ecosystem.

Article

2025年3月12日

The investments necessary to mitigate and adapt to climate change are far less than the cost of inaction—11% to 27% of global GDP by 2100.

Our white paper—a collaboration with Howden and the conference’s High-Level Champions—illustrates the industry’s role through real-world examples in financial risk reduction, capital mobilization, operational performance optimization, and policy implementation.

Article

2024年11月12日

Companies need a holistic strategy to coordinate requirements, clearly define responsibilities, and effectively use advanced technologies.

Article

2024年10月7日

Optimizing networks requires balancing five key objectives that address traditional issues of cost, service, and growth as well as a new focus on sustainability and resilience.

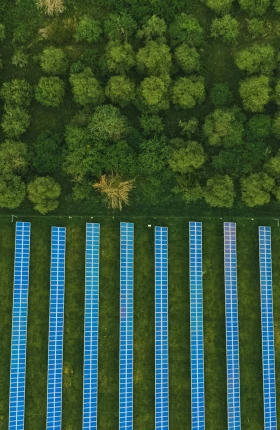

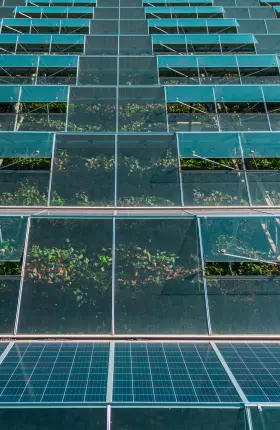

Sustainable Transformation and Green Growth — We help leaders build more sustainable organizations and deliver greener impact. Our experts help legacy companies drive innovation at the core, ensuring that they are able to deliver financial returns and positive societal impact. We also work closely with emerging businesses to scale innovation and achieve lasting competitive advantage.

Article

2024年11月11日

There’s a major value-creation opportunity in building green businesses, but many complexities stand in the way. Here’s how CEOs can seize the opportunity.

Video

2024年6月20日

BCG’s Green Growth Accelerator partners with clients across industries and sectors—including energy, textiles, fast-moving consumer goods, transportation, and more—to drive climate innovation, unlock opportunities for growth, generate new revenue streams, and create lasting competitive advantage.

Report

2024年10月23日

This year’s report reflects data from over 6,000 PE-backed companies, offering new insights on how sustainability in the private markets has evolved over the last year.

The Sustainable Advantage: Insights on Creating Competitive Advantage Through Sustainability

Decarbonization and the Energy Transition — BCG combines a deep expertise in energy, climate, and

social impact to bring innovative and inclusive solutions to the energy transition. We work closely with clients to lower their emissions footprint, ensuring that they are ready to build—and operate in—a more sustainable world.

Article

2024年11月13日

A clear framework outlines mechanisms and pathways that unlock more capital to ensure the climate transition is not only green but also equitable.

Article

2024年11月4日

Companies that abate their methane emissions early can gain a significant competitive advantage. We’ve identified six steps that can ensure the abatement journey is a success.

Article

2024年9月30日

These aren’t traditional capital projects—so, to succeed, companies need to deploy new collaborative approaches, capabilities, and tools.

Article

2024年9月19日

Four major barriers stand between emerging climate technologies and adoption at scale. Here’s how earlier pioneering technologies—wind, CCGT, renewables, LNG, and solar—overcame them.

AI, Technology, and Climate Impact — While

emerging technologies offer corporations and governments a much-needed edge in the fight against climate change, because of their energy intensity, they must be deployed thoughtfully. Our experts help organizations harness

AI, climatech, and other powerful capabilities efficiently and sustainably, without exacerbating the issues they are trying to solve. Used strategically, these tools will help our most important institutions reduce emissions, speed the energy transition, and unlock value.

Article

2024年9月9日

To make AI and other transformative technologies broadly accessible and avoid missteps, the private sector must double down on collaboration.

Slideshow

2024年9月17日

Our fourth annual survey on carbon emissions found that the overall pace of decarbonization has slowed—but that leaders are realizing significant financial value.

Using an integrated approach and granular understanding of customer needs, companies can harness deep tech and radical innovation to reinvent products that overcome barriers to sustainable choices.

Article

2024年11月8日

AI development is fueling a surge in energy demand, threatening net zero commitments. By working together, CEOs across industries can keep both transformations on track.

Our Latest Thinking from BCG Climate Experts

Highlights from UNGA & NY Climate Week 2024

Video

2024年9月27日

A Deep Dive on the Costs of Decarbonization

Ultimately, decarbonized products won’t cost consumers a big premium. But getting there won’t be cheap or easy, explains BCG’s Rich Lesser.

Video

2024年9月27日

What Will Enable Companies to Move Faster on Climate?

Dow’s Jim Fitterling discusses the role of new markets, collaboration, and innovation in driving technological advances and speeding up climate action.

Video

2024年9月26日

Profits with Purpose

Alex Amouyel discusses how Newman's Own Foundation directs all profits to support children’s programs, donating to initiatives that nourish and uplift kids facing adversity.

Video

2024年11月4日

Partnering with the Private Sector to Meet Humanitarian Needs

The private sector’s scale and reach make it a valued partner in disaster response and other humanitarian efforts, says BCG’s David Young.

BCGのCOP28代表団