BCGの事業売却支援のアプローチ

BCGには、あらゆる主要業界で事業売却を成功させてきた実績があり、クライアントからもBCGが関与することで実質的な価値を引き出せるという評価を得ています。私たちは潜在的なバイヤーを特定する方法や、指標のみに頼らずにビジネスを評価する方法を理解しています。これにより、売却先の企業に変化をもたらし、購入希望金額を最大化できるようになります。また、クライアントと密接に連携することで、クライアント自身は最も重要なこと、つまり自社の中核事業に集中できます。

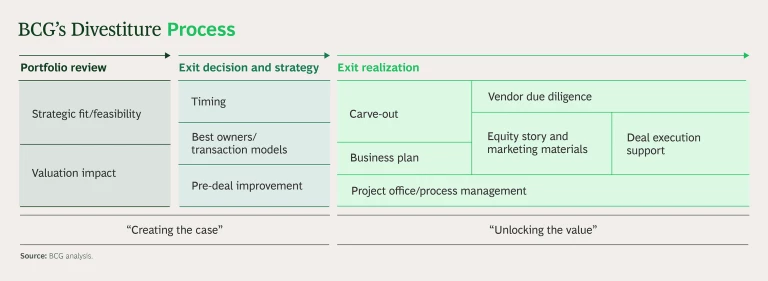

私たちのアプローチは、「事業売却チェックリスト」とは対極にある、クライアント企業に合わせて高度にカスタマイズされたアプローチです。私たちは「事業売却のためのケース策定」と「売却プロセスでの価値創出」という2つの大きなカテゴリーで事業売却のプロセスと案件の遂行をエンドツーエンドでサポートします。

事業売却のためのケース策定

事業売却プロセスのフェーズ1 では、売却に適した資産の選定を含むポートフォリオレビューから、売却資産の価値向上を目指すオペレーション改革を含むエグジット戦略の策定に至るまでが対象になります。

価値の実現

フェーズ2 には、事業売却の準備と実施が含まれます。事業売却は通常、 カーブアウト、つまり親会社から対象部門を切り離すプロセスから始まります。後回しにされがちですが、カーブアウトにおいては価値の流出を防ぐため、監視のもとに行うことが必要になります。

BCGはまた、このフェーズのカギとなる2つの要素、説得力のある投資の根拠を含むエクイティストーリーと、大きな価値を生むオペレーション改善を踏まえた詳細な事業計画を構築する支援を行います。

In the case of a trade sale, we conduct intensive vendor due diligence to deliver an independent assessment that can guide prospective bidders’ decisions. Our objective, highly reputable opinion of a unit’s value and prospects raises the confidence of would-be buyers—and often the price they’re willing to pay.

Finally, we support you throughout the divestiture agreement process and interaction with bidders to close the optimal deal.

M&A Activity by Year: The BCG M&A Report Collection

Our Insights on Divestitures

事業売却分野のエキスパート