These are challenging times for supply chain management. Supply chain leaders must cope with the increasing complexity of their global networks and product portfolios, more intense regulatory scrutiny, and greater uncertainty surrounding global trade policy . They also face mounting pressure to make their supply chains a source of growth and competitive advantage. Companies that succeed in mastering these challenges can break away from the competition by increasing revenues, reducing costs, and optimizing working capital.

Recognizing the need for deeper insights about supply chain performance, companies across industries have invested in enterprise resource planning (ERP) tools and other IT systems to collect transactional and performance data. Even so, gaps remain in the visibility of the supply chain’s end-to-end performance. No system on its own seems to give supply chain managers enough information to take action and drive better performance. Furthermore, most companies lack the analytical capabilities required to fully integrate and analyze data from multiple systems across all levels—from the global end-to-end supply chain to local work centers in a plant. The result is a trove of data but a dearth of actionable insight.

By applying data and analytics, new technologies, and new ways of working, companies can realize the unfulfilled promise of their existing data and ERP systems and empower employees to make faster and better decisions that drive value every day. BCG has helped several companies develop advanced-analytics solutions that derive insights from supply chain and transactional data. These insights provide better visibility into performance, allowing companies to “control the flows” of material in the end-to-end supply chain and target their improvement initiatives to the highest-value opportunities.

How Visibility Creates Value

Controlling the flows is all about gaining improved visibility into the supply network and using that information to address inefficiencies. To obtain a granular view of the material flowing through the network, a company must create a platform that connects data from multiple systems. It can then feed the data into advanced algorithms that fuel descriptive, predictive, and prescriptive analytics. The output is a “control tower” that supply chain managers use to predict and respond to disruptions and inefficiencies in material flows.

The data and insights provided by the control tower must be tailored to deliver actionable information to each specific user in the supply chain, from end-to-end supply chain managers to employees on the shop floor. A company can use technologies such as wireless sensors and “data lake” architectures to efficiently expand the data set. This enables even deeper insights, better predictive outcomes, and additional improvement opportunities.

By controlling material flows, companies can create significant value in a variety of ways:

- Revenue. Product shortages resulting from poor forecasting or supply planning represent hundreds of billions of dollars in missed sales across industries. Improved visibility into the present and future status of material flows can help companies prevent shortages. They can also use analytic modeling to develop recovery scenarios when shortages occur. In our experience, enhanced supply chain visibility can increase the level of demand fulfilled by 4% to 6%.

- Cost. Lack of visibility into supply chain performance also results in higher costs related to volatility. To quickly react to unreliable material supply or unexpected demand changes, supply chain functions such as manufacturing, quality, and logistics must operate with spare capacity or use more costly methods (such as expedited transport). Enhanced visibility into supply chain performance enables these functions to reduce volatility by using methods such as lean, Six Sigma, and business process optimization. By reducing volatility, companies can optimize capacity levels and use cost-effective processes. In our work with supply chains across industries, we have seen companies achieve reductions of 7% to 20% in manufacturing, warehousing, and distribution costs by applying these techniques.

- Working Capital. To manage the variability of demand and supply, many companies add inventory buffers for procured materials, intermediates, and finished goods. Typically, they determine inventory requirements by applying rules of thumb unsupported by data and statistics. And because they lack real insight into demand and supply variability, companies are unwilling to reduce inventory levels, or they pursue only superficial reductions. Data on supply chain performance affords companies the analytical tools they need to calculate true inventory needs. In our experience, those that have a solid understanding of demand and supply fluctuations can make deep inventory reductions, amounting to 15% to 30% of working capital.

Building a New Analytics Solution: A Biopharma Example

Like many other industries, biopharma is characterized by highly complex supply chains. Drugs are produced in multiple steps, all of which utilize dedicated technologies and may occur in different locations around the world. In addition, some products require cold chain across a global distribution network. To address this complexity, biopharma companies have invested in IT systems for supply chain planning, materials management, and operations and quality management. However, these systems typically produce siloed repositories of data, with companies making only limited efforts to interpret the data as a whole and extract insights that could enhance supply chain performance.

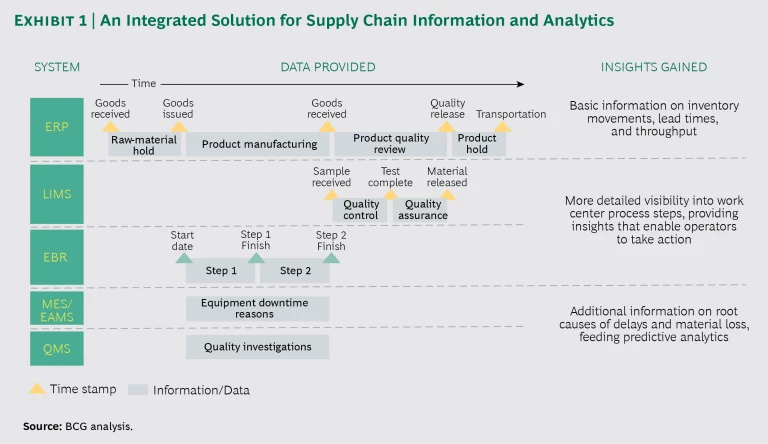

BCG has worked with leading biopharma companies to convert this trove of data into actionable insights. The core component of our supply chain analytics solution is an algorithm that uses ERP data to trace the movement of materials through the supply chain, from raw materials to the finished product. The algorithm links to and appends additional useful information from other previously siloed systems. The use of data besides ERP enhances the solution’s analytical power and provides valuable insights into the root causes of lost productivity and diminished velocity. (See Exhibit 1.) The additional data sources can include:

- Laboratory Information Management System (LIMS). This system provides, for example, detailed information about volume and lead times for quality control testing.

- Electronic Batch Record (EBR). Additional information about each batch—such as the identity of operators and supervisors on the shift—gives companies a more complete view of the potential root causes of problems.

- Manufacturing Equipment System (MES). This system specifies the equipment in which each batch was processed (for example, compression machine and packaging line). It also provides data on the status of equipment during and around the time of batch processing, which is used to measure planned and unplanned equipment downtime.

- Enterprise Asset Management System (EAMS). By providing more details on the maintenance record of the equipment involved in processing a batch, this system, paired with the MES, is a critical source of predictive maintenance algorithms.

- Quality Management System (QMS). From this system, companies can retrieve information on batch investigations, among other valuable data. Batch investigations are a critical source of insights into differences in lead times for quality assurance.

The algorithm’s output is a control tower that allows companies to analyze performance at the batch level for each work center in the supply chain. The algorithm also serves as the foundation for additional analytics that calculate critical supply chain performance metrics relating to lead time, throughput, quality, and material loss.

Creating Actionable Visibility

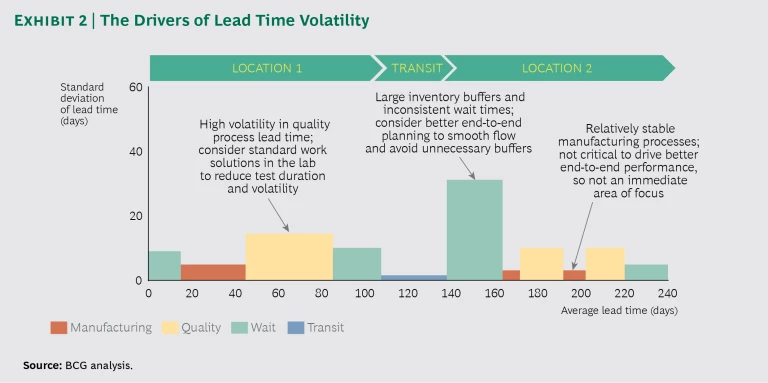

BCG’s analytics solution provides end-to-end supply chain visibility that companies can use to identify waste and inefficiency as well as revenue and growth opportunities. To help apply this visibility to efficient decision making, we have collaborated with supply chain managers at all organizational levels to develop performance metrics that are displayed on a supply chain “dashboard.” Exhibit 2 presents an illustrative dashboard display of one type of metric—lead time volatility. The dashboard metrics can be used in three ways:

- Disruption Response. Supply chain managers can use the metrics to obtain information that allows them to quickly assess the root cause of shortages or other unexpected supply chain disruptions and determine the most efficient recovery steps.

- Risk Mitigation and Intervention. The dashboard alerts managers when performance metrics hit certain thresholds or trend in an unfavorable direction. They can use the metrics to identify the causes, assess risks, and coordinate with other stakeholders—including plant managers, production planners, and distribution managers—to take appropriate action.

- Performance Assessment and Continuous Improvement. By analyzing performance trends over specific time periods, managers can identify points in the supply chain where volatility and inefficiency occur. They can use the insights gained in collaboration with continuous-improvement functions—such as operational excellence, lean, and Six Sigma groups—to target efficiency improvement initiatives where they will generate the highest value in terms of end-to-end performance.

Production planners, supply chain mangers, and shop floor employees require different types of metrics and visualizations, so it’s essential that the dashboard display the right metrics for each level of the organization. But since the various dashboard metrics are derived from the same underlying information, stakeholders across the supply chain have a single version of the truth and can quickly agree on current performance levels. This enables stakeholders to rapidly move from discussing the data to resolving problems and identifying improvement opportunities.

Capturing the Value of Visibility

Enhanced visibility and the insights it generates are just the starting point. The real value comes from driving new stakeholder behaviors. This can happen in a variety of ways:

- Applying Predictive Modeling. Integrating data from multiple systems opens the door to using machine-learning techniques to generate predictions and alerts. These allow supply chain managers to respond proactively to potential challenges and further understand the root causes of disruptions or poor performance. For example, we have worked with biopharma companies to feed information from the ERP, LIMS, MES, EAMS, and QMS into a machine-learning algorithm that uses thousands of decision trees (the “random forest” method) to predict the likelihood of quality-related delays at critical supply chain bottlenecks. The algorithm’s output tells supply chain managers and quality function employees whether a specific batch is likely to be delayed beyond the planned lead time. Stakeholders receive this information at least a week before the delay occurs. It can then be shared with production planners, quality managers, and customers, who can manage the batch release or develop mitigation strategies.

- Improving Shop Floor Performance. Companies can also use insights from the supply chain analytics solution to improve shop floor performance. We worked with managers and employees in a biopharma company’s manufacturing suites and quality labs to formulate a comprehensive set of performance metrics. These metrics inform daily decision making and analytics that support continuous improvement on the shop floor. Such improvements are fundamental to the success of a digitally enabled production system, which the company replicated across its complex manufacturing network.

- Getting Closer to the Customer. Additionally, companies can use the insights from improved supply chain visibility to become more closely connected with their customers and identify opportunities to generate revenues for the business. For example, a manufacturer can share information with customers about its supply status (such as material soon to be released for shipment), while customers can share information with the manufacturer about their inventory levels. Such visibility enables the parties to react faster and more accurately to changes in supply and demand. This agility promotes better customer service and hence valuable revenues for stakeholders across the supply chain.

Control towers that inform decision making and drive improvement opportunities are only one element of a broader digital transformation of the supply chain. Companies can also use digital technology and analytics to enhance demand forecasting and capacity modeling. This information supports sales and operations planning and integrated business-planning processes. In addition, advanced-analytics and optimization tools can provide insights into opportunities to restructure manufacturing, distribution, and logistics networks. Finally, companies should not ignore the enablers of the digital transformation, which include data architecture, organization design, talent, training, and agile capabilities.

Getting Started

The analytics solution described above will be valuable in any industry in which companies operate global supply chains in an increasingly complex competitive or regulatory landscape. These industries include consumer packaged goods, industrial goods, and energy, to name only a few. Regardless of industry, companies must take several steps to start using this approach.

Define the digital supply chain roadmap. Taking into account their starting point and an assessment of how digital can address key supply chain priorities, companies must define a multiyear roadmap that sets out how data and advanced analytics will be used to transform supply chain management over time. The roadmap should prioritize applications that deliver value and fund the transformation journey, while also encouraging experimentation and a “fail fast and pivot” mentality. In addition, companies need to select the right technology solution to support their objectives. (See the sidebar.)

Choosing the Right Technology Solution

The right technology solution depends on the particular company’s available data, existing systems and infrastructure, and business needs. Companies can typically choose between off-the-shelf and custom-made solutions.

Off-the-shelf products offer the benefits of rapid deployment, licenses priced for a mass market, and ongoing upgrades. However, if a company has several legacy systems or lacks the master data required to combine disparate, siloed data, its environment may be too complex for off-the-shelf software. The software will satisfy only some of the company’s needs, implementation costs will be high, and end users may resist adoption.

In such cases, the company can build its own custom algorithms. A custom-made solution can be used to both derive operational insights and detect and clean data anomalies. The company captures the benefits of more accurate advice and better decisions, as well as smoother end-user adoption.

BCG’s Gamma team has helped companies build custom-made solutions that support the specific requirements of their decision-making processes. Gamma’s data scientists achieve this, in part, by taking a technology-agnostic approach and working with a client’s preferred infrastructure and software, including modern data lakes. For instance, the Gamma team has built custom-made solutions adapted to a company’s existing infrastructure (Amazon Web Services or Microsoft Azure), core systems (SAP or Oracle), data management software (Alteryx and data historians), analytics and programing languages (Python and R), and visualization solutions (Tableau and JavaScript’s D3).

Address the cultural challenge. The cultural challenge is one of the largest roadblocks to success. To overcome it and accelerate adoption of advanced analytics, companies must combine deep industry knowledge with sophisticated data science capabilities. Success requires aligning stakeholders within the organization at the highest levels—including the CEO, the CIO, and the supply chain leader—on the role of advanced analytics. Companies also need to deploy agile ways of working to accelerate solution development and funding decisions.

Build internal capabilities and leverage external expertise. To achieve a long-term competitive advantage, companies must determine the best way to build advanced-analytics capabilities. Because the market for highly qualified data scientists is very competitive, the best approach is typically a combination of internal and external resources. If the CEO and CIO believe that analytics will be a source of competitive advantage, they should build an internal team and not rely exclusively on external vendors. Manufacturers are likely to attract managers with a good grasp of analytics rather than data scientists with deep analytical expertise. These managers can supervise external resources, whose level of expertise should be matched to the project’s sophistication and the value at stake.

Across industries, companies are just beginning to unlock the enormous potential of applying advanced analytics to supply chain management. Trends in computing power, machine learning, sensors, and the Internet of Things are continually expanding the opportunities for innovation in supply chain analytics. Companies whose analytical tools allow them to derive insights into supply chain performance will be empowered to truly control the flows by efficiently pursuing revenue and growth opportunities, reacting to changes in demand, recovering faster from supply disruptions, and achieving deep and sustainable reductions in operating costs and working capital. By mastering the challenges of data integration and advanced analytics, companies can realize the promised benefits of end-to-end supply chain coordination.