Revenue assurance is the systematic application of tools, processes, and people to stop revenue leakage—the problem of unrealized revenue from products sold or services performed. In our experience, revenue assurance can contribute as much as 10% to a company’s total revenue without the need to sell additional products or services. Revenue assurance programs can be implemented and scaled quickly, typically generating financial returns within the first one to three months. A mature revenue assurance function, supported by machine learning tools, automated processes, and dedicated full-time employees, can identify and stop revenue leakage on an ongoing basis, thereby maximizing realized revenue for companies that choose to invest in these areas.

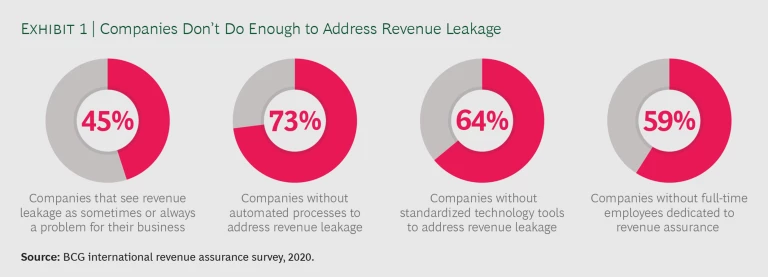

Notwithstanding the potential payoff, most companies do not provide their revenue assurance functions with the necessary resources—even when they know it is an issue. In an international survey of more than 2,000 business leaders by Boston Consulting Group, 45% said revenue leakage is a systemic problem facing their companies. Their practices show why. Almost three-quarters of companies do not have automated revenue assurance processes. Another 64% do not have standardized revenue assurance tools as part of their enterprise data systems, and 59% do not devote any full-time staff (or full-time equivalents) to revenue assurance. (See Exhibit 1.)

Companies That Are Vulnerable

Some companies are at greater risk of revenue leakage owing to the nature of their business. Our experience indicates that the magnitude of potential revenue leakage tends to be greatest among:

- Companies that have a contractual relationship between the buyer and seller (as opposed to those that use a “cash and carry” model, with payment collected immediately).

- Companies that use manual processes to create or audit invoices.

- Companies that have a high proportion of service-based revenue.

- Companies that allow invoicing discretion in client-facing roles, such as sales or account management.

- Companies whose invoiced prices and quantities are dependent on categorization of the type of product or service offered; this is often the case in companies that must invoice for noncontracted or out-of-scope services.

The following are some examples of revenue leakage that we have observed across industries:

- Technology. At a technology services company, billing analysts did not invoice for all the hardware units being serviced because of a lack of visibility into frequently changing contract terms and hardware counts. Additionally, out-of-scope services were often charged incorrectly because billing analysts struggled to manage the variations in scope across thousands of service agreements.

- Industrial Goods. A chemical services company propagated outdated prices in its invoices because contracts were not digitized. In addition, frontline employees had significant freedom to manually change prices and specify the grade or volume of chemicals used. There were no validation processes to catch errors in these manual inputs.

- Automotive. At a fleet management company, revenue leakage was driven by gaps in processes, systems, and data. Sources of revenue leakage included service fees that were not applied to customer invoices, contracted add-on and penalty fees that were not enforced (such as for reissuing lost service cards and for early lease terminations), and state sales tax refunds that were not collected for vehicles purchased on behalf of customers.

- Logistics. A postal service provider erroneously provided discounted rates to customers that had not met contract terms. Processes and systems to compare actual to contracted work were inadequate and audit capabilities were insufficient.

- Health Care. A health insurance provider collected lower-than-contracted premiums owing to gaps in data systems and quality checks.

- Travel. An airline’s data systems could not distinguish duplicates when customers double-booked flights from the same destination on the same day using different third-party vendors. Additionally, the airline’s agents had significant discretion to double-book passengers. This was not tracked in the data systems, and corrective measures, such as training or policy enforcement, were not in place to resolve the double-bookings. When passengers inevitably failed to board both flights, the redundant bookings led to lost revenue from unsold seats.

BCG’s Revenue Assurance Solution

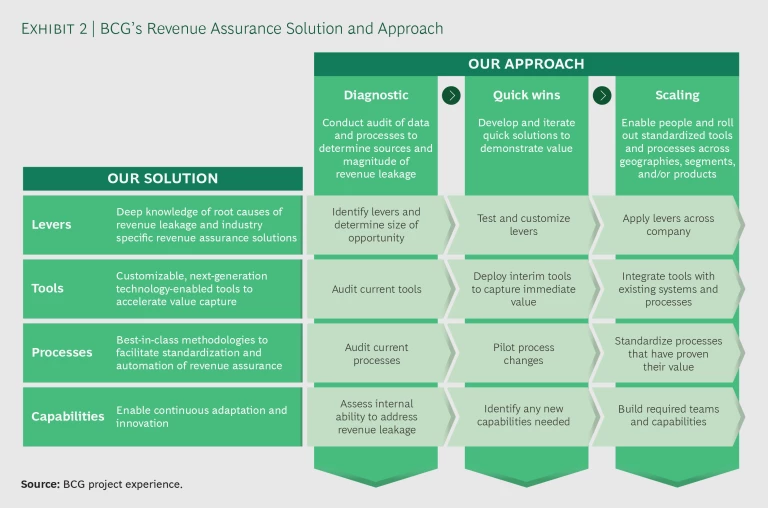

With our revenue assurance solution, we efficiently identify sources of revenue leakage and potential ways to implement quick wins, scale solutions, and build capabilities—giving our clients the know-how to sustainably capture value. We use best-in-class digital tools enabled by robotic process automation, machine learning, natural language processing, predictive modeling, and other next-generation technology to help clients excel at revenue assurance.

- Levers. We assess systems and processes to identify common root causes of revenue leakage. Some of these root causes are consistent across industries, such as charging the wrong price for a specific quantity or quality of service. Sources of revenue leakage can also be specific to an industry, as in the examples above. Our firsthand experience in various industries enables us to efficiently identify and prioritize the most effective levers for revenue recovery.

- Tools. We apply customizable digital tools that can plug into standard enterprise systems for billing, pricing, contracting, and account management. These tools help diagnose potential sources of leakage and accelerate value capture. Once we confirm opportunities to capture value, we scale the solution by integrating these tools into existing enterprise systems so that they become business as usual. We have also developed a proprietary cloud-based solution for rapid data processing that allows for efficient knowledge transfer and integration into standard enterprise systems.

- Processes. We conduct an audit of the end-to-end quote to cash process to identify manual or nonstandardized processes that are likely to be contributing to revenue leakage. We then work with our clients to simplify and automate processes. In doing so, we take into account best-in-class industry examples, as well as the client’s specific business requirements.

- Capabilities. A key differentiator of our solution is our focus on organizational capability building. To that end, we work with clients to develop solutions that are tailored to their business and people. We conduct training, implement performance tracking and incentives to maximize productivity, and introduce mechanisms for continuous improvement so that revenue leakage can be continuously monitored and mitigated.

A Three-Step Approach to Revenue Assurance

Our three-step approach diagnoses sources of leakage, implements small-scale solutions to quickly capture value, and then scales up those solutions. (See Exhibit 2.) In the scaling-up phase, we also lay the foundation for clients to develop the capabilities needed to sustain their revenue assurance programs for the long term.

Step 1: Diagnostic. We work with our clients to diagnose sources of leakage and prioritize revenue assurance levers for quick wins. This data-driven process evaluates multiple factors, such as the magnitude of revenue leakage, the feasibility of implementing specific levers, and the organization’s current capabilities and appetite for change. We also consider extrinsic factors, such as industry trends, economic headwinds, and customer behaviors that can impact our clients’ ability to recover leaked revenue.

For instance, our diagnostic work at one client—a European postal service company—made it clear that the majority of the client’s customers (77%) were not meeting contracted terms. Based on the findings from the diagnostic, we helped the client develop a robotic process automation tool that was then integrated with its customer relationship management system to automatically alert sales representatives to leaked revenue and provide a fact base for the reversal of unearned discounts.

Step 2: Quick Wins. We implement small-scale solutions to quickly identify and recover leaked revenue within the first one to three months of a revenue assurance program. This starts with the conception and testing of changes to existing tools and processes. For instance, at one chemical services company with revenue leakage from inconsistent pricing, we piloted initial process changes on the largest accounts. The economic value of the changes became apparent in the first month, generating the momentum needed within the company to roll out these changes more broadly.

Step 3: Scaling. Following testing and improvements to tools and processes in the quick-wins phase, we scale solutions and enable client capabilities for sustainable revenue capture. At the scaling phase, revenue assurance works its way into the DNA of the company, typically within the first six months of a program. We ensure that the new tools, processes, and capabilities continue to have a material payoff long after our involvement has ended.

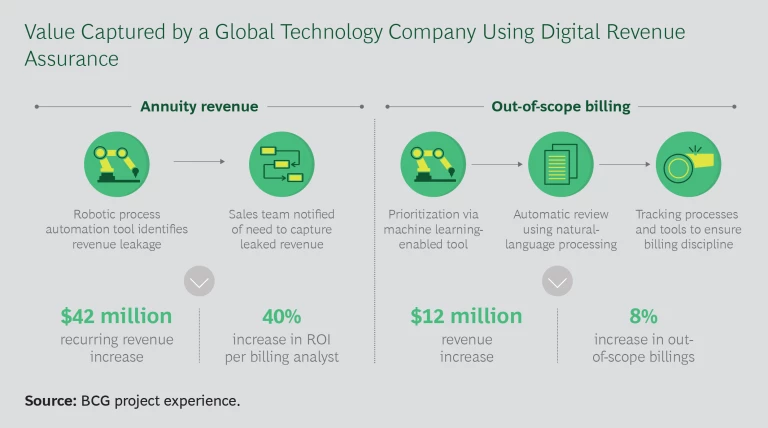

For instance, a global technology company incorporated robotic process automation and machine learning tools and processes to identify revenue leakage. The tools allowed the company to increase its annuity revenues and out-of-scope billings by $54 million annually. (See “How One Company Dramatically Upped Its Revenue Assurance Game.”)

How One Company Dramatically Upped Its Revenue Assurance Game

How One Company Dramatically Upped Its Revenue Assurance Game

While the company employed a sizable team of billing analysts, the team’s processes were largely manual. The billing processes were inconsistent, varying by region, business segment, and, in some cases, account.

We first looked at potential unrealized annuity revenues. Annuity revenues for this company derive from service contracts. To bill accurately, the company needed to know how many units of equipment each customer had, which was complicated because of nonstandard contracts and rapidly changing equipment counts and model types. We helped the company replace manual review processes with robotic process automation tools, which accelerated the time to review each customer contract by a factor of 16.

Another potential source of unrealized revenue was inaccurate recording of service work. Field technicians often did not categorize their work accurately, resulting in situations where they were doing noncontracted work but not invoicing for it. Again, it fell to billing analysts to identify the categories of work that should be billed as out-of-scope. With BCG’s help, the company implemented a machine learning-enabled natural language processor that identified the categories of work to be billed at the out-of-scope service rate. The billing analysts increased the volume of work classified as out-of-scope by 8%.

Having seen the value of the robotic process automation and machine learning tools on a limited number of accounts, the company expanded their use and trained its billing departments all over the world—and across different lines of business—to use them. In addition, the company created a functional center of excellence to continuously manage and improve revenue assurance tools, processes, and capabilities. More than 100 full-time employees currently work in the center, identifying, recovering, and preventing revenue leakage.

Today, the company is seeing $54 million in recurring annual value as a result of these initiatives: $42 million from the capture of previously lost annuity revenues and another $12 million from revenues associated with out-of-scope services. (See the exhibit below.) Ninety-five percent of that revenue flows directly to the bottom line. Furthermore, the improvements in invoicing processes have reduced customer billing disputes and increased customer satisfaction, as reflected in a 7-point improvement in the company’s net promoter score.

When to Start a Revenue Assurance Program

There are three ways in which a revenue assurance program makes sense. The first is as a standalone effort to unlock incremental revenue. With no additional selling cost, the newly realized revenue is largely profit. In these cases, we generally see companies’ revenues increase 3% to 5%.

A second type of revenue assurance program is connected to a broader initiative around pricing. In these engagements, the new discipline surrounding revenue assurance ensures that companies capture all the benefits of the pricing transformation initiative. This type of program can substantially increase the impact from pricing, driving incremental revenue of 1% to 10% in our experience, including the capture of revenue leakage.

A revenue assurance program might also make sense—even for companies with minimal revenue leakage and well-established revenue assurance capabilities—as part of a new product or service launch. Revenue leakage is common with new products and services (especially in adjacent industries) because of the need to link together new systems and the use of limited-time promotional discounts. Companies that strengthen their revenue assurance practices in advance of product launches can prevent revenue leakage in these situations.

Revenue assurance solutions can drive significant value for companies—up to 10% of revenue. And the impact of efficient revenue assurance goes well beyond revenue capture. With more efficient audit processes, employees can focus on creating value for their companies in other ways. Additionally, more accurate invoicing can reduce customer pain points and dissatisfaction, thereby creating positive momentum.

Integrated tools and processes can help your company develop its own capabilities in this important area. Once you have built these capabilities, the returns from revenue assurance become cumulative. Revenue assurance can be a significant driver of value for your company, which we can help you achieve.

The authors wish to thank Adam Gordon, Aljoscha Zahner, Jake Simon, and Rolf Erik Tveten for their contributions to this article.