Our Approach to Strategic Credit Risk Management

BCG’s credit risk consultants and data scientists draw upon our proprietary digitization tools and case experience, culled from more than 250 completed projects in the past five years, to improve and transform clients’ overall credit risk operating models. Our work includes credit risk strategy and regulations, risk governance and policies, credit risk models and processes, and data and IT systems.

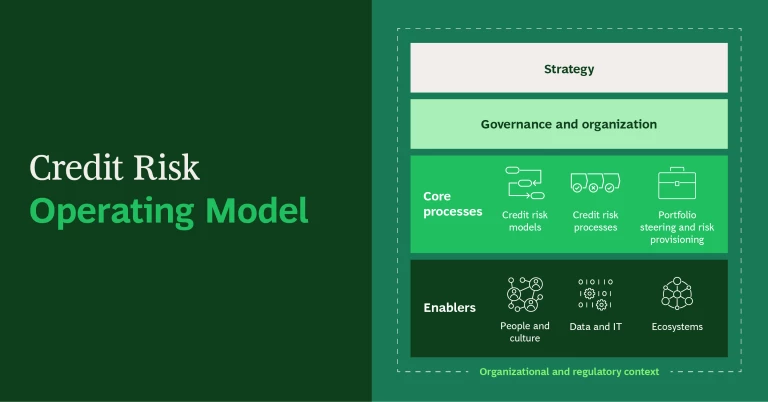

Our credit risk consultants work hand-in-hand with clients across the full spectrum of the credit risk management operating model, including:

- Credit Risk Strategy and Regulations. We help clients understand upcoming regulatory requirements, including environmental, social, and governance (ESG) and climate risks. We define a company-wide credit risk management framework that integrates risk strategy and risk appetite.

- Risk Governance and Policies. We help clients set up effective credit risk governance and policies, including our three lines of defense framework.

- Credit Risk Models and Model Validation. We help clients optimize and upgrade their credit risk model landscape, taking into account capital requirements, model performance, model maintenance costs, and emerging trends.

- Optimizing Credit Risk Processes. We review the credit risk processes (such as, loan origination and monitoring) from end-to-end to improve cost efficiency, risk-return profile, and customer experience. We also enable client to align their business and credit risk portfolios to climate targets.

- Stress-Testing Credit Portfolios and Risk Provisioning. Our thorough scenario-based review is designed to assess balance sheet and credit portfolio resilience under macro-economic and climate scenarios. We help optimize risk provisioning, especially with regard to IFRS 9.

- Data and IT Systems. We help clients redefine credit data models and IT infrastructure to support an end-to-end credit journey and enable advanced credit analytics.

Our Client Success in Credit Risk Management

BCG’s Strategic Credit Risk Management Tool Portfolio

- Advanced Analytics for Credit Process Digitization. Our set of advanced analytics tools apply big data to enhance processes and credit risk management. The toolkit includes credit decisioning, automated risk monitoring, automated collections, early warning indicators, and fraud detection.

- Regulatory Lifecycle Management. A set of relevant credit risk regulations, with guidance for how they should be read, interpreted, and implemented.

- Digital Policy Repository. A database of easy-to-implement digital policy and procedures documents that facilitate audit trail history, approval status, and links between policies.

- Supply Chain Risk Assessment. This tool identifies risk prone areas and weak links in supply chain and suggests mitigation strategies accordingly.

- Change and Enablement Toolkit. A menu of proven communication and change formats, including employee surveys, a leadership toolkit, communication apps, and change management support.

- Proprietary Benchmarking Tools. Expand, a BCG research company, works with 26 of the world’s top 30 financial services industry players to deliver unique decision-support services such as benchmark comparisons and industry diagnostics.

- FinTech Control Tower by BCG. BCG’s global fintech platform draws on proprietary data tools, the latest market intelligence, and deep in-house expertise to help clients uncover opportunities and execute on their fintech agendas.

Our Insights on Credit Risk Management and Credit Risk Strategy

Meet Our Credit Risk Consultants