Read these posts

Spotlight: To Prevail, Automotive OEMs Must Prepare for a Marathon

OCTOBER 1, 2020

By Brian Collie, Michelle Andersen, Gang Xu, Rolf Kilian, Daniel Küpper, and Andreas Maue

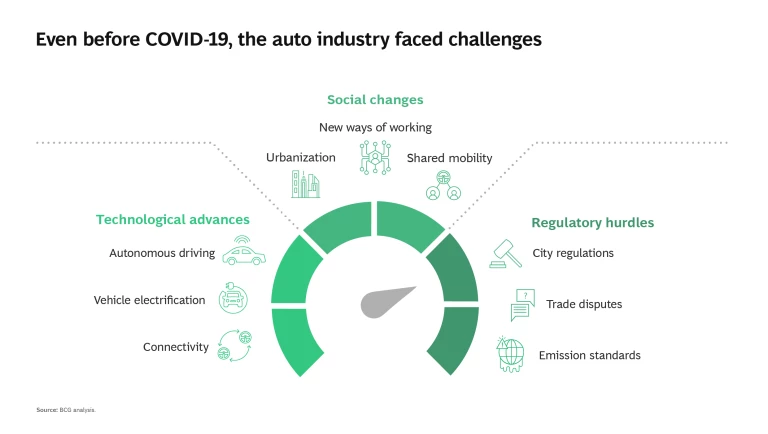

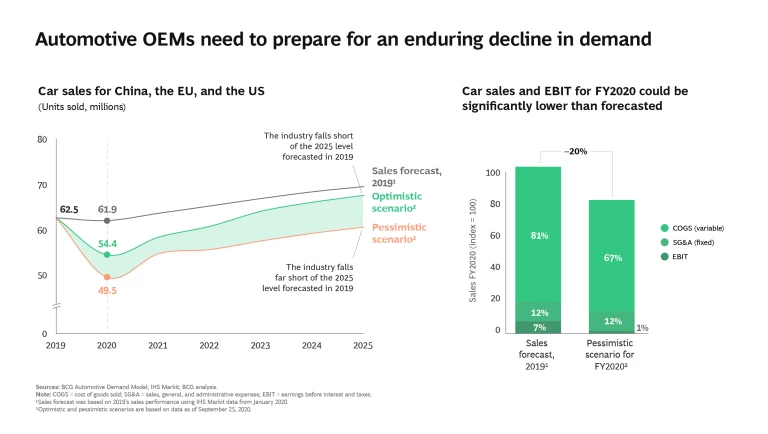

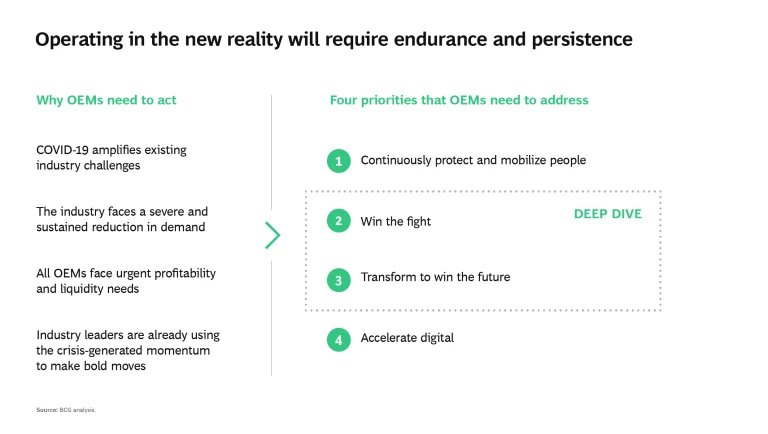

The coronavirus crisis arrived at a time when automotive OEMs were already facing the greatest disruption that their industry has ever seen. Several auto-industry trends—including autonomous driving, vehicle electrification, connectivity, and shared mobility—have converged to upend decades-old business models. The pandemic-induced recession has added to these challenges, with car sales decreasing significantly across the globe. In the US, for example, sales declined by 31% from December 2019 through May 2020. As a result, OEMs face even greater pressure to adjust their business models and make overdue structural changes.

If history is any guide, the actions that OEMs take today will determine which companies emerge as the winners in the postpandemic world. The auto OEMs that took rigorous actions and used the 2008 financial crisis as a transformative opportunity managed to recover quickly and gained a sustainable competitive advantage.

To date, the auto industry has reacted quickly and effectively to the coronavirus crisis. For example, OEMs in most regions around the globe successfully managed the restart of operations after lockdowns and implemented protective measures to ensure a safe return to work for their employees. Ensuring the continuity of these efforts and promoting constant improvement throughout the crisis are crucial to pave the way for future success. Going forward in the new reality, OEMs should not approach their response to the prolonged crisis as a single, rapid sprint, but rather as a marathon that demands endurance and persistence.

In this marathon, the health and safety of employees remains the top priority over all other issues and initiatives. OEMs’ primary areas of focus should be implementing advanced, digitally enabled solutions to protect people (such as virus monitoring systems), institutionalizing new ways of working (such as remote work), and leading with the head, heart, and hands. Moreover, by encouraging suppliers to also adopt these best practices and tools, OEMs will help to reduce supply chain volatility.

While maintaining a safe and healthy work environment, executives at OEMs must simultaneously manage two efforts on different time horizons. They must take immediate actions to win the fight as the pandemic persists (most likely for 12 to 24 months until an effective vaccine or treatment is developed and widely deployed). And they must initiate bold transformative actions to win the future.

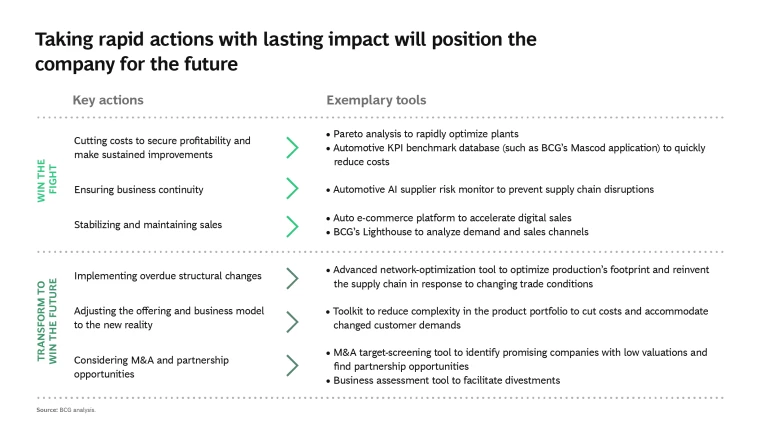

To win the fight, OEMs should prioritize three actions:

- Cutting Costs to Secure Profitability and Make Sustained Improvements. OEMs need to reduce costs across the company to secure profitability in the face of drastic declines in sales globally. Because the crisis will not be over quickly, OEMs must move beyond rapid, short-term cost reductions and consider more meaningful structural changes that will promote sustained cost improvements.

- Ensuring Business Continuity. OEMs must rigorously manage liquidity so that they can free up resources and give themselves room to maneuver. They also must actively stabilize the end-to-end value chain in order to reduce the volatility of operations and prevent future supply disruptions.

- Stabilizing and Maintaining Sales. OEMs need to accelerate their implementation of e-commerce solutions and enhance their online presence in order to offset lost sales from traditional brick-and-mortar channels (such as car dealer networks) that have been impeded by the pandemic. A recent BCG consumer sentiment survey finds that consumers are shifting their purchasing activities to online channels and changing their preferences in ways that affect how OEMs must meet demand. By implementing a data and analytics platform (such as BCG’s Lighthouse) that provides insights into sales and demand developments, OEMs can help to ensure production continuity.

Even though near-term issues are top of mind, executives should use the momentum generated by the crisis response to begin taking transformative actions to win the future. Three actions are the most valuable for promoting future success:

- Implementing Overdue Structural Changes. As OEMs grew in recent years, most accumulated structural problems in their operations, such as overcapacity and inefficient manufacturing footprints and dealer networks. The current crisis creates momentum for change that allows companies to address these problems and realign company structures to changing environments, both during and after the crisis.

- Adjusting the Offering and Business Model to the New Reality. OEMs need to manage the transition to electric mobility and make corresponding adjustments to their business models. Now is the time to act, because in some countries, government subsidies are accelerating the transition. The transition also presents an opportunity to streamline the product portfolio so that it is aligned with market needs and trends, thereby reducing the costs arising from complexity. Additionally, OEMs should reimagine their retail environments so that they can better meet emerging trends in customer demand, now and in the future.

- Considering M&A and Partnership Opportunities. Many automotive companies currently have a low valuation. Stronger players can make targeted M&A moves in order to further strengthen their competitive position, gain access to new markets and capabilities, and open up new revenue opportunities. OEMs should also consider new forms of partnerships (such as joint ventures and alliances) that will allow them to build scale and close capability gaps relating to new mobility business areas. Additionally, the crisis is an opportunity for OEMs to divest unprofitable businesses or those that don’t add value.

Digital technology is key to enabling each of these priority actions. For all automotive OEMs, accelerating the digital transformation of company processes is essential to promote sustainable success and drive growth in the midst of changing and challenging market environments.

Spotlight: How Additive Manufacturing Can Rebound from the Crisis

SEPTEMBER 3, 2020

By Daniel Küpper, Wilderich Heising, and Thomas Krüger

The COVID-19 pandemic has created severe headwinds for additive manufacturing (AM) players, interrupting what had been a positive growth trajectory. To reestablish the precrisis growth path, AM players must focus on developing a strong value proposition for their products and innovations.

Because AM technology does not require tools, such as molds, it offers greater flexibility to producers than traditional manufacturing provides. The only prerequisites are a printable design, a 3D printer, and the right material. Innovative producers have put this unique flexibility to use during the crisis—for example, by printing face shields and masks and even parts for ventilators with virtually no lead time.

However, notwithstanding such accomplishments, all players in the industry have been hurt by the pandemic, whether immediately or prospectively. For example, 3D Systems, one of the largest manufacturers of 3D printers, cited the impact of the crisis in announcing plans to reduce its workforce by 20%. In contrast, SLM Solutions, a German metals printer manufacturer, recently announced that revenue grew by 90% in the first half of 2020, compared with the first half of 2019. However, the strong growth reflects, in part, weak performance during the same period a year earlier, and the related sales occurred several months ago, before the outbreak of the pandemic. Indeed, looking ahead, the company is forecasting lower demand and revenue than previously anticipated.

The sharp decline in the demand for AM results from three interrelated challenges:

- End users are struggling. Major AM end users, such as aerospace and automotive companies, have been hit hard by the economic downturn. Business from the health care industry has also suffered. The postponement of many elective surgeries, for example, has led to lower demand for printed implants.

- Specific AM applications are seeing diminished demand. Across industries, cash-constrained companies have slashed R&D budgets. The reduction in R&D activity has a direct impact on the AM market because the technology is still predominantly used for prototyping. Demand for customization, another valuable AM application, has also diminished as consumers are less willing to pay for noncritical features.

- AM players are cutting their own costs. Cost-saving initiatives at AM players will likely hit their R&D budgets, slowing down technology development. Consequently, these companies will not develop new applications as quickly as anticipated. Moreover, a large share of technology development comes from startups that are at risk of reduced funding, which will amplify the effect.

The AM industry can potentially recover quickly from the first two types of headwinds—assuming that the industries it serves, particularly health care and consumer products, rebound fast. The third headwind could have a more enduring impact, as internal cost-cutting threatens to hurt the AM industry’s ability to promote the longer-term adoption of its technology.

On the positive side, however, the crisis may be a catalyst that accelerates the development of applications and technologies that would have otherwise reached the market further in the future. Applications and technologies that truly create value will survive the crisis. But in the coming months, projects with uncertain value propositions will likely fall by the wayside.

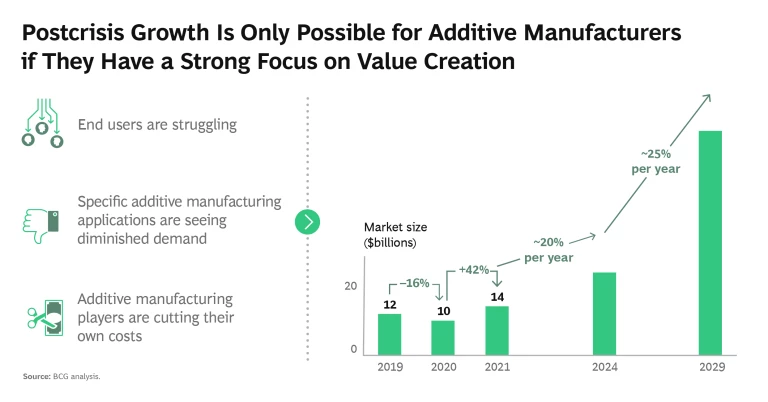

Before the onset of the pandemic, BCG’s proprietary Additive Manufacturing Market Model predicted that the AM market in 2020 would reach approximately $14 billion (including material, equipment, and services), up from $12 billion in 2019. But the impact of the coronavirus will cause the market to shrink this year to $10 billion. (See the exhibit.) This represents a 16% decline from 2019 and a 30% decline from the predicted size for 2020. It also marks the first decline since the financial crisis of 2008–2009.

Even so, there is hope. If industry participants are able to convincingly demonstrate the value that AM brings to users, the industry will return to, or even exceed, the 2019 market size in 2021. Thereafter, it will continue to grow strongly, at the rate of approximately 20% per year. This would bring the industry back to its precrisis trajectory in 2024, representing a V-shaped recovery scenario. From that point, annual growth of about 25% is possible through the end of the decade.

Growth will not return on its own, though. To drive this rebound, each player in the AM industry must revisit its strategy and fight for its share of market growth. AM companies need to intensify their focus on the value generated by the technology. Beyond creating value during the crisis, AM technology can support customers’ efforts to win in the postcrisis world. For example, customers can use AM applications to boost supply chain flexibility and reduce inventory requirements, thereby improving resilience.

It is essential for AM players to support their users in finding the most valuable applications and choosing the best technology and materials. This was a promising approach before the crisis and is now more important than ever. Users must see the clear value created by AM technology in order for the industry to return to its precrisis trajectory in the coming years.

Spotlight: Rapidly Rebalance the Technology Portfolio and Reduce Costs

SEPTEMBER 3, 2020

By Michael Grebe, Johan Stockmann, Juuso Soininen, and Marc Roman Franke

The COVID-19 crisis has forced companies to reconsider their priorities for technology investments. Digital channels and the virtual workplace have gained importance at the same time that companies are under pressure to cut costs in response to the pandemic-induced downturn. To adjust to the new reality, companies across industries must find ways to retain the most important technology capabilities and increase resilience even as they reduce overall spending.

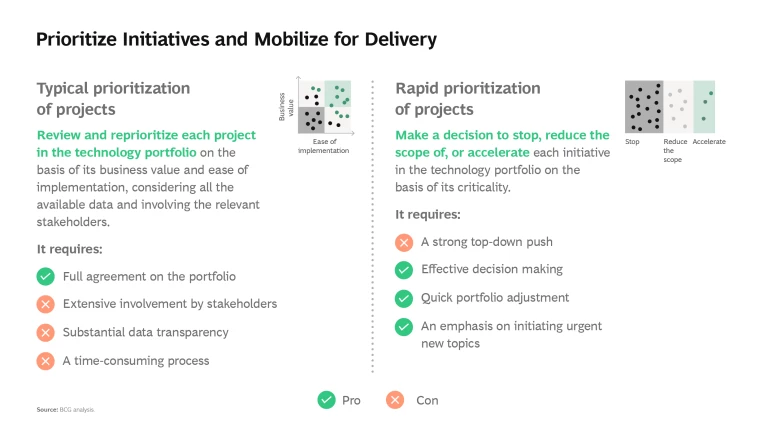

Leading companies are rapidly rebalancing their technology portfolio and reducing costs by requiring key stakeholders to make a decision about each initiative: should the company stop it, reduce the scope, or accelerate it. The approach entails two steps that a company can complete over the course of eight weeks.

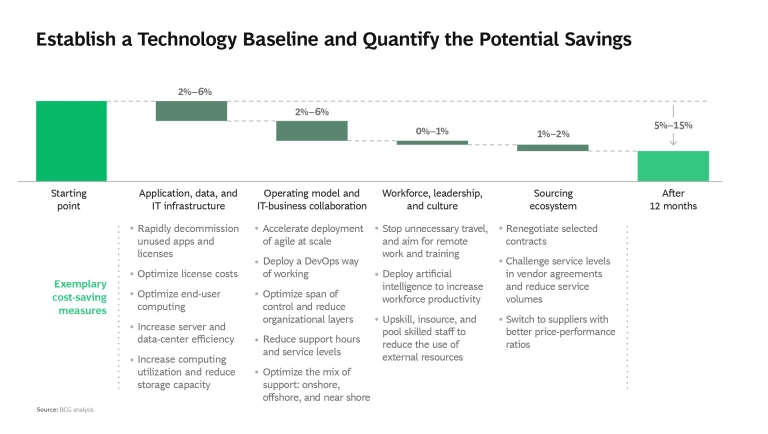

Establish a baseline and quantify the potential cost savings. A company needs to first establish a baseline of its current technology and IT costs and resources. Then, using this baseline, the company should assess the potential cost savings relating to four topics:

- The current IT landscape (applications, data, and IT infrastructure)

- The technology function’s operating model and governance, including how IT and the business units collaborate

- The available resources, including the workforce and leadership, and the company culture

- The opportunities for more effective sourcing by building and using an ecosystem of partners

This transparency will help the company define and select the relevant measures to leverage this cost-savings potential. BCG’s experience transforming IT into a world-class technology function can support these efforts.

Prioritize initiatives and mobilize for delivery. As the company prioritizes the identified measures and creates an actionable roadmap, it will need to make tradeoffs given the limited resources that are available for running current and new initiatives. A company should therefore accelerate only four types of critical projects:

- Projects that can promote significant business value in the short term (usually a small number)

- Projects to replace legacy systems with new IT platforms that are capable of supporting future applications and that are almost finished

- Projects that enable remote working and digital collaboration

- Projects that enable regulatory compliance or the achievement of key strategic objectives under the new business priorities

The company should also set up the governance function, which includes monitoring the program’s progress, and mobilize the necessary organizational capacity and capabilities. With these prerequisites in place, the company should initiate pilot projects. These pilots allow the company to begin to realize its savings goals and to determine if the previously calculated cost savings will be valid if scaled up. If so, the pilots should be implemented at scale to fully deliver the savings.

Depending on their starting point, companies have rapidly rebalanced their portfolio to reduce technology costs by 5% to 15% within 12 months, providing much-needed financial breathing space. Companies can apply the savings to fund capability building, to further accelerate their digital transformation, and to embark on more complex, investment-heavy measures that generate a longer-term return. We have seen cost reductions of up to 40% in a two- to three-year transformation. Importantly, companies can rebalance their portfolio effectively while retaining or even strengthening the technology function’s key capabilities.

Spotlight: Accelerate Digital Transformation

AUGUST 19, 2020

By Michael Grebe, Marc Roman Franke, Wendy Anderson, and Michael Leyh

The COVID-19 crisis is rapidly reshaping the digital transformation agenda, confronting many companies with the need to accelerate their digital programs. The focus on digital transformation is clearly warranted. Digitization is an important driver of sustainable competitive advantage and business resilience, according to BCG’s fourth annual Digital Acceleration Index (DAI), a global study of digital maturity that involved more than 2,300 companies in Asia, Europe, and the US.

The most digitally mature companies have superior financial performance in various dimensions. For example, their enterprise value grew twice as fast annually from 2016 through 2020 as that of peers with lower digital maturity. In addition, digitally mature companies typically have the ability to respond to a crisis, and they are becoming bionic companies—organizations that combine the capabilities of humans and machines.

Companies generally recognize the imperative to rapidly advance their digital maturity. In fact, more than 80% of companies surveyed see the need to accelerate digital transformation efforts, according to BCG’s recent Digital Strategy Roadmap study.

As companies seek to accelerate their digital journey, leaders frequently ask four key questions:

- How can we gain full transparency into our current digital capabilities and ensure that we reach our goal?

- How do we determine which digital initiatives to continue pursuing as part of the digital transformation?

- How should we ensure that we focus solely on high-value projects?

- How do we navigate through the crisis over the next 12 months and win in the future?

To answer these questions, companies should follow a four-step approach. (See the exhibit.)

- Determine the digital maturity level, and set the appropriate ambition. A company can establish the baseline of its digital maturity by using the DAI, a questionnaire-based evaluation that covers 39 dimensions. The process will help a company fully understand the strengths and weaknesses of its current digital capabilities so that it can set the appropriate ambition for its digital transformation. Competitor and cross-industry benchmarking and stakeholder interviews are essential to this process.

- Understand how to gain more value from digital. Digital can help companies improve their performance. Frequently, companies can apply digital technologies (such as artificial intelligence) to specific use cases (supplier negotiations, for instance) to decrease costs. Companies need to identify which use cases are relevant, and they need to leverage a solid fact base of digitally enabled use cases to assess to what extent each is currently implemented and operational. From this baseline, companies can determine the additional potential that can be gained if all use cases were fully digital and operational according to best practices.

- Reprioritize digital use cases. A company should reprioritize its digital initiatives in order to adjust to the resource constraints induced by the crisis. Senior leaders from the business, IT, and digital organizations need to rapidly review the portfolio of initiatives and decide whether to refine, continue, or stop each initiative. Then the company should conduct workshops for stakeholders of the selected focus areas in which they define the scope and ambition of the initiatives for the adjusted portfolio and validate their EBIT impact.

- Agree on lighthouse projects and the roadmap. To complete the portfolio reset, a company should select lighthouse projects and design a plan for mobilizing the organization. The plan should address where in the organization the company must build the required digital capabilities for each initiative. The plan should also cover how to continuously measure the outcomes of the initiatives to determine if the capabilities have been built or if the value of the initiatives needs to be reassessed.

Using this approach to accelerate a digital transformation has generated significant impact, enabling companies to:

- Focus on the right things. In most cases, more than 25% of digital initiatives are accelerated, adjusted, or stopped as companies seek to maximize value.

- Speed up digital delivery. Companies have implemented digital initiatives 1.5 to 4 times faster than in the past.

- Create value. The approach has boosted EBIT by 4 to 8 percentage points, as a result of reducing costs or increasing revenue across the value chain over one to two years.

Spotlight: Stabilize and Transform the Supply Chain

AUGUST 10, 2020

By Claudio Knizek, Daniel Weise, Daniel Küpper, Marcel Sieke, Rajesh Shetty, and Boris Sidopoulos

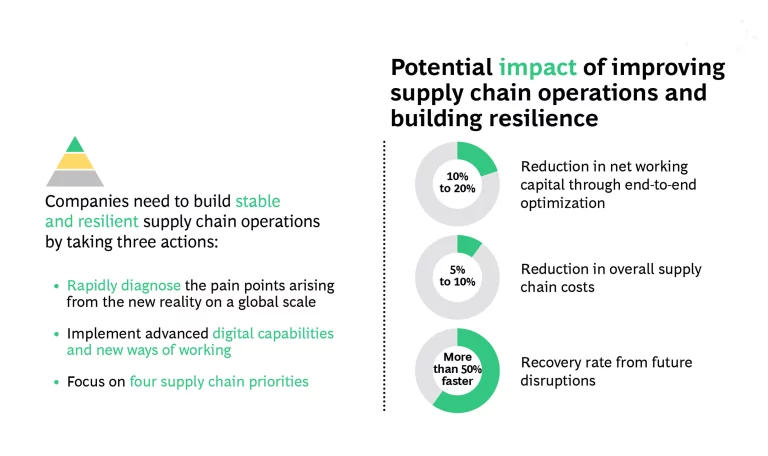

To win the fight against COVID-19, companies must act quickly to create stable and cost-efficient supply chain operations in the face of extraordinary volatility in demand and supply. To transform and win the future in the postpandemic world, companies need to take specific actions that will build supply chain resilience for the long term. Supply chains must be adaptable to withstand the impact of trends that have been accelerated by the pandemic, such as the emergence of new consumer needs and the reversal of globalization.

Using rapid-diagnostic tools is essential to understand how the crisis is affecting a company’s entire supply chain and to develop a suitable action plan. Companies can use quantitative and qualitative assessments as well as internal and external benchmarks to establish a baseline of performance and identify priority areas for improvement.

To implement changes in these priority areas, companies need advanced digital capabilities, such as a supply chain planning platform that uses artificial intelligence, integrates a control tower approach, and monitors supplier risk. Companies must also rethink their ways of working across the supply chain, including processes for sourcing.

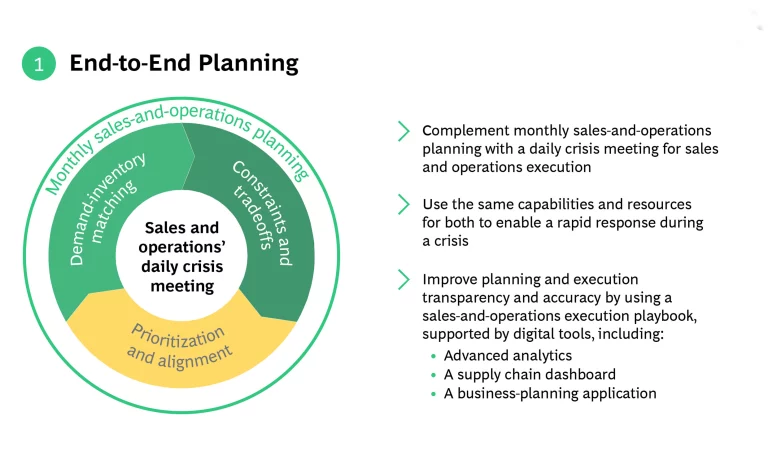

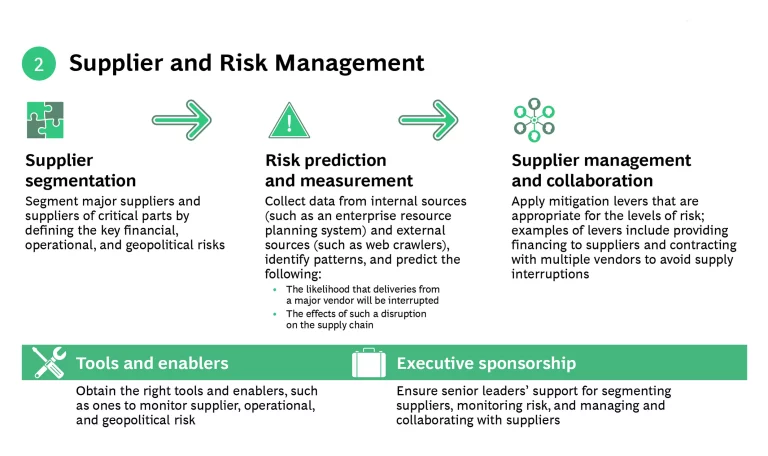

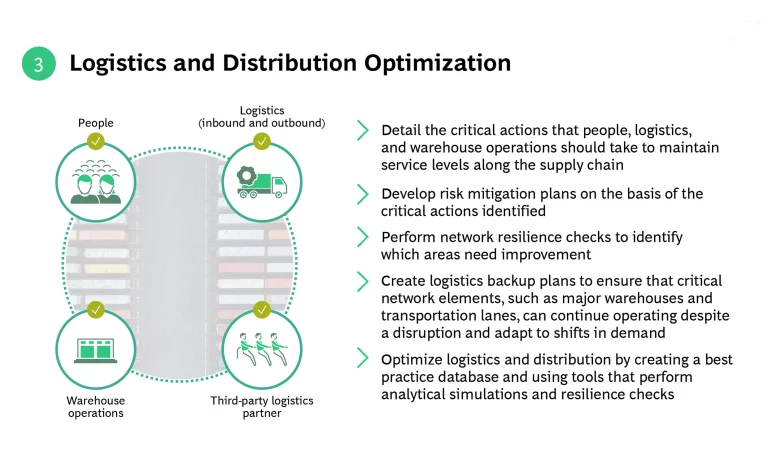

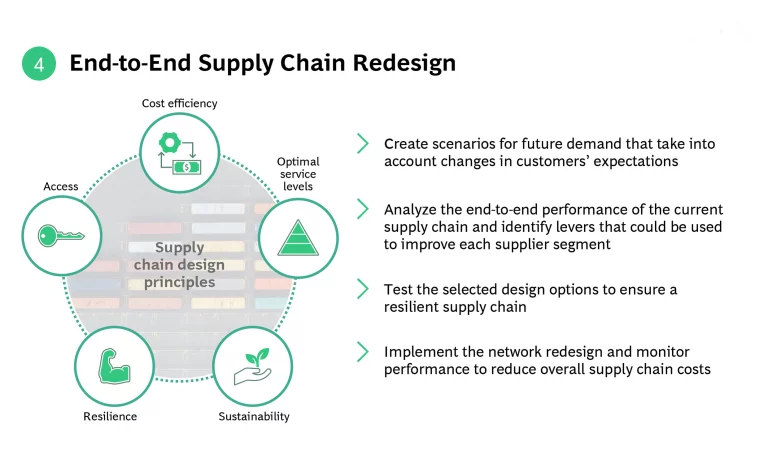

To accomplish their goals, companies should focus on four priorities: end-to-end planning, supplier and risk management, logistics and distribution optimization, and an end-to-end supply chain redesign. We delve into each of these topics in the slide show below.

Spotlight: The Soft Side of Operational Transformation

AUGUST 6, 2020

By Damon Bland and Justin Ahmad

The COVID-19 crisis has motivated many companies around the world to launch transformation programs. Indeed, BCG believes that companies must transform to thrive in the postpandemic world even as they seek to win the fight against the coronavirus in the near term. As companies launch these efforts, they must come to terms with a sobering fact: most operational transformations ultimately fail to capture their intended value.

There are many reasons why transformations fail. But one common problem is that leaders focus on implementing new technologies and processes without giving enough attention to understanding and changing people’s mindsets, behaviors, and practices—the “soft” issues—and supporting those changes with the right organizational structure and capabilities. Getting these soft issues right is essential for extracting the full value of an operational transformation over the longer term.

To achieve a meaningful shift in mindsets, behaviors, and practices, leaders in manufacturing companies need to act on several fronts concurrently:

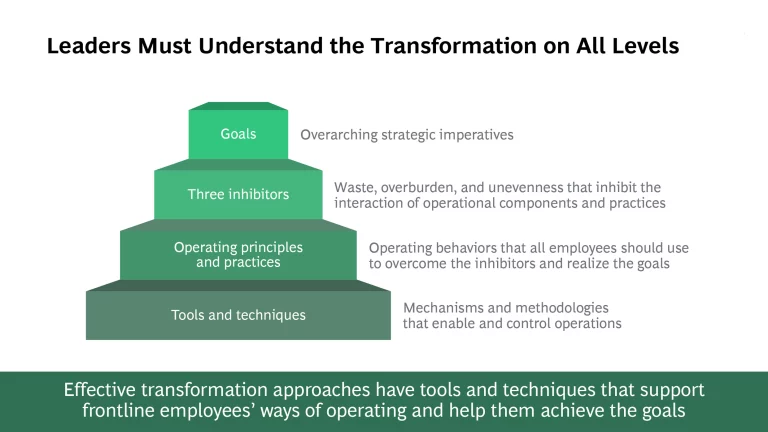

1. Understand what a transformation means on all levels. Leaders must understand the higher-level goals of the transformation and the main inhibitors to achieving them. (See the exhibit.) Moreover, they should be capable of articulating—in layman’s terms—these goals and problems accurately and consistently. It is not enough to expound the virtues of the many hundreds of improvement tools. A comprehensive understanding of the transformation is essential for bringing the entire organization along on the journey.

For example, in launching a change program as part of a three-year transformation, an automotive supplier defined initiatives across the organization to support the overall goal. The fact that all areas of the business were contributing fostered an organization-wide view that we’re all in this together. The company’s leaders complemented this approach with greater transparency into objectives and progress across the organization and much more communication than in the past. These efforts resulted in significantly higher levels of collaboration among functional silos, such as procurement and operations.

2. Set clear but discontinuous goals. Leaders need to explain why a transformation is required in a way that employees will regard as authentic. To gain employees’ support, it is not enough to merely communicate an abstract desire to become number one in the industry, for example, or set an incremental target to be 5% better than last year. There must be a higher purpose. This may take the form of a strategic imperative that is discontinuous (such as realizing a net-zero carbon production footprint) and not simply an extrapolation of prior improvement. Leaders need to set a transformative ambition with enough “stretch” that teams are not going to see obvious ways to achieve it. Even so, the ambition must be plausible and look beyond this quarter’s, or even this year’s, results.

In setting discontinuous goals, companies need to avoid the trap of overcommitting the organization to an abundance of initiatives, the vast majority of which will fall by the wayside. The automotive supplier prioritized a few critical initiatives. It focused resources on completing these and then moved on to the next set of prioritized initiatives. It also placed a premium on accountability, including requiring weekly status updates across the organization, from the plants to the C-level.

3. Define and drive the targeted behavioral change. People’s behaviors are notoriously difficult to change. Leaders must clearly communicate the purpose of behavioral changes so that each individual understands the importance of the changes he or she is being asked to make. Leaders must also consistently exemplify the behaviors that they are asking other people to adopt. Finally, leaders must provide people with capabilities and systems that enable the behavioral changes.

At the same time, senior leaders must verify that what they think is happening is actually happening at the frontline. This requires establishing a structured process in which C-suite executives visit the frontline and, importantly, take middle managers with them. Leaders should, for example, attend daily performance reviews to better understand the issues facing teams and ensure that teams are working on the right operational priorities. They should use the visits to interact with team members, ask questions, and participate in frontline continuous-improvement activities. They can then apply the insights to offer targeted support, such as by removing the sources of impediments, building capabilities, improving communications, or clarifying guidance.

4. Help senior leaders change their own behaviors. Although behavioral change starts with senior leaders, it is unlikely that they will be able to act differently on their own. To assist them, a company could use an external coach, such as a former senior executive of another company, to help talk leaders through what works and what does not. The coach should be capable of giving constructive feedback on the behaviors of the top team—when leaders do well and when they fail to model the right behaviors. The top leaders should, in turn, coach their direct reports and establish a process for cascading the coaching throughout the organization.

In seeking to change senior leaders’ behaviors, the automotive supplier focused on transitioning from a culture of command and control to greater empowerment at all organizational levels. To enable this, the company defined targeted actions and behaviors for the plant leadership, including those at the supervisor level. This included defining the standard work for plant leaders as well as setting specific improvement priorities for each leader.

5. Provide the supporting organization structure and capabilities. A company must develop the right organization structure and embed the capabilities needed to deliver the transformation. Operations leaders and plant managers who run a steady-state environment may not have the right capabilities to drive a transformation, such as the ability to prioritize initiatives and focus their teams on the right tasks. Importantly, these leaders also need the will and energy to disrupt the status quo and lead the change.

A successful operational transformation takes time, effort, and tenacity. The investment was often difficult to justify in the pre-pandemic world of short-term quarterly reviews and rising shareholder expectations. The current crisis may have lowered these expectations, thereby providing companies with some unexpected elbow room, at least once liquidity is assured, to experiment and take a longer-term view. Companies should seize the opportunity to give the soft side of operational transformation the attention it deserves.

Spotlight: Ramp Up and Optimize the Workforce

JULY 22, 2020

By Reinhard Messenböck, Niels Kammerer, and Michael Lutz

To win the fight against COVID-19, corporate leaders must address many complex issues, but none more critical than those involving their people. In previous articles, we set out people priorities for immediately responding to the crisis and managing the return to work. Now, as companies seek to operate efficiently during the ongoing pandemic, they must turn their attention to two key people-related issues: ensuring the effectiveness of remote work, often with a focus on productivity, and rightsizing the workforce and related costs for the new reality.

Ensuring the Effectiveness of Remote Work at Scale

Among the many aspects of managing the return to work, ensuring the effectiveness of remote work is a key priority. Seemingly overnight, the COVID-19 crisis has turned remote work from the exception into the rule for a substantial portion of the workforce. BCG’s recent Workplace of the Future survey reveals that most organizations believe their future workforce will be much more remote than ever before. Overall, companies expect approximately 40% of employees to use a remote work model in the future. Thirty-seven percent of companies expect that more than 25% of employees will use hybrid models that combine remote and onsite work. Leaders must develop a bold yet sustainable vision for how remote work will grow in the future. Even as they develop a long-term vision, leaders need to address numerous immediate challenges, which we group into three categories.

- Ensuring a Sustainable Pace and Workload. Companies must ensure that working from home does not become living at work. They must help employees avoid this trap by assisting them to set clear boundaries between work and personal time and providing guidance on how to self-organize a well-delineated workday. Without this support, some employees will work too many hours and risk burning out.

- Maintaining Team Performance. Being part of a team is especially challenging for remote workers. Companies should clearly define each team member’s goals and responsibilities upfront in order to avoid misunderstandings that cause delays. Keeping teams small facilitates remote interactions. To ensure that people work on the most valuable tasks, team leaders should maintain and prioritize a backlog of assignments. They should also conduct regular check-ins, preferably via video.

- Fostering a New Sense of Community. The socially distant nature of remote work diminishes interactions and loosens bonds among colleagues, causing some people to feel isolated. Companies can foster team spirit and a new sense of community by scheduling virtual social meetings and establishing informal communication channels. Additionally, proper communication about the common vision and how to work toward it is crucial, regardless of whether team members are at home or on site.

Rightsizing the Workforce and Costs

To ease the immediate financial pressure of the crisis, many companies responded with short-term measures, such as furloughs and hiring freezes, that in some cases were supported by government aid. However, despite gaining some breathing room, most companies still face entrenched issues relating to workforce size and costs. Indeed, at many companies, the crisis exposed issues that existed before the pandemic. These issues will become even more burdensome during what is expected to be a slow recovery, thus accelerating the need for transformative changes.

To thrive in the medium to long term, companies need to focus on cost efficiency in three categories:

- Workforce Size and Skills. Looking beyond the immediate crisis, companies must rightsize the workforce and equip employees with the appropriate skills. Typical steps to reduce full-time equivalent (FTE) levels include layoffs and terminations, not renewing fixed-term contracts, early retirements, eliminating or not immediately filling vacant positions, and attrition. Rightsizing the workforce also requires reskilling and upskilling employees so that the company can efficiently staff the jobs of the future.

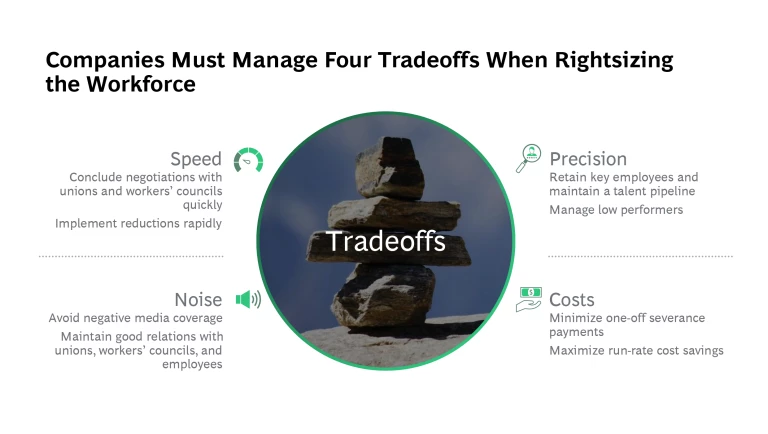

In deciding how to rightsize the workforce, companies need to manage tradeoffs in four dimensions. (See the exhibit.) Because it is not feasible for companies to achieve the best outcomes in all four dimensions, they need to thoroughly discuss the tradeoffs and prioritize the actions that will most effectively promote their company strategy.

- Personnel Costs. Typically, companies that reduce the head count also reduce the average costs per FTE. A company can lower these costs by reducing bonuses and overtime, for example, and putting a freeze on promotions. Additionally, it can review and adjust the pay grades throughout the organization, as well as replace contractors and other external staff with internal staff, who are generally less expensive.

- Nonpersonnel Costs. These costs include expenditures for buildings and equipment, facilities management, travel, and fleet management. Companies can often reduce nonpersonnel costs by renegotiating the terms and conditions of agreements with existing providers or bundling services with fewer providers.

Decisive action requires time-consuming efforts to align with employees, workers’ councils and unions, external stakeholders (such as investors and suppliers), and the media. So companies must act now to initiate these long-term adjustments—even as they devote attention and resources to ensuring the health and safety of people returning to work. Companies that put off taking action will limit their opportunities to set the agenda and will be forced to take less effective, reactive measures. They also risk damaging their credibility and reputation among the workforce and stakeholders.

Spotlight: The 4T-IQ Virus Monitoring System

JULY 22, 2020

By Kestas Sereiva

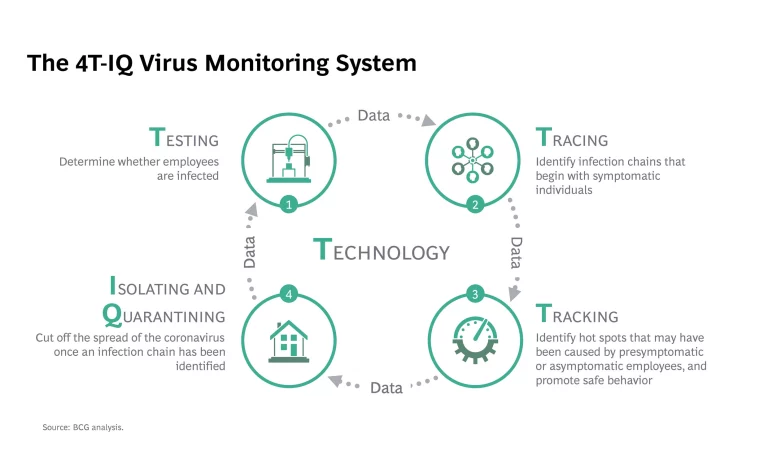

To safely resume operations during the ongoing COVID-19 pandemic, companies must take steps to monitor and prevent the spread of the coronavirus among their workers. An effective approach is what BCG calls the 4T-IQ virus monitoring system (VMS)—one that companies can adapt to their workplace and sustain.

The 4T-IQ VMS integrates testing, tracing, tracking, and technology (the 4T’s) as well as isolating and quarantining (IQ). (See the exhibit.)

- Testing. BCG does not expect scalable and cost-effective point-of-care testing services to be available for use in the workplace in the near term. In the meantime, each company needs to determine how it will screen employees for symptoms, such as by conducting temperature checks. Although such checks do not detect contagious individuals who have yet to develop symptoms or who will remain asymptomatic, it is a first line of defense.

- Tracing. Robust contact tracing (whether manual, automated, or a combination of both) helps to identify infection chains that begin with symptomatic individuals. However, infection chains started by presymptomatic or asymptomatic individuals cannot be traced back to their original source. Contact tracing is in many ways the most challenging element of the 4T-IQ VMS, given the complex privacy issues as well as technical challenges.

- Tracking. Real-time tracking of the health of a workforce at an aggregated level helps to identify hot spots that may have been caused by presymptomatic or asymptomatic employees. Pinpointing hot spots complements a company’s testing and tracing efforts. Furthermore, tracking provides insight into the effectiveness of a company’s safety measures, and the results can be used to encourage employees to continue practicing safe behaviors (such as staying at least six feet from other people in crowded areas).

- Technology. Technology provides the underpinning for a comprehensive, robust, and scalable 4T-IQ VMS. For example, health checks can be done using a standalone app or one that is used in combination with a specialized device, such as a thermal camera; testing results can be automatically reported by an app; and workflows for tracing and tracking can be automated, even if only partially.

However, technology by itself is not enough. For example, Bluetooth-based tracing apps suffer from technology limitations and cross-device compatibility issues, and the apps require hard-to-achieve adoption rates. Tracing apps will be useful to augment human tracers, but they will not replace them anytime soon.

- Isolating and Quarantining. Having guidelines that clarify when employees should isolate and quarantine themselves helps to cut off the spread of the coronavirus once an infection chain has been identified. To increase adherence to the guidelines, companies should provide employees with supplemental medical assistance and health insurance and, potentially, living arrangements suitable for self-isolation. Such support could also be extended to immediate family members who live together.

To build an effective and sustainable 4T-IQ VMS, companies should take several steps.

Make the system adaptable to a variety of operating environments. Most large companies have various types of work sites (such as offices, retail locations, field operations, or plants). They also have a diverse workforce with respect to age, health, and criticality to operations. And they operate in multiple regions that have different governmental responses to the pandemic, cultural attitudes, and laws.

These companies should consider the diversity of each of these dimensions when designing a 4T-IQ VMS. Ideally, all supporting technologies (such as a mobile app, management dashboard, and a set of tracing technologies) should be configurable to adjust to the required variations. This will enable these companies to use a single set of technologies across their environments, facilitating a consistent, company-wide level of response, support, and monitoring.

Design and implement the 4T-IQ VMS holistically. BCG has seen some companies design and implement each element of the 4T-IQ VMS separately, often using different teams. This approach is inefficient, and it will limit the system’s effectiveness when deployed.

Instead, companies should take a holistic approach by designating a single point of accountability for the VMS and a single team to implement it. Additionally, companies should establish the design principles and select the supporting technologies centrally. To ensure flexibility, however, regions and countries should be allowed to adapt the principles and technologies for their specific context.

Facilitate stakeholder agreement and rapid implementation. The need to select among design options for the elements of the 4T-IQ VMS can delay approvals and implementation. By making design choices early in the process, a company can avoid disagreements and accelerate implementation. To make upfront design choices, consider the following questions:

- What types of tests should we use and for what purpose? When should we implement them?

- Which aspects of tracing should we automate? Which privacy principles and frameworks are applicable?

- What data should we track and at what aggregation level? Which internal and external data flows do we need? Which types of role-based data access do we need to configure?

- Which technologies should we use for testing and symptom checking, tracing, and tracking? How will we integrate internal and external systems and data sources? How will we integrate our 4T-IQ VMS with business partners’ systems, and, potentially, public systems?

- What are the company’s policies and procedures for isolating and quarantining? What type of support will we provide to employees?

Additionally, executives who are leading the program should ensure consistent and timely communication to all stakeholders.

Once established, the 4T-IQ VMS needs to become permanently integrated into the company’s resilience toolkit. It is very likely that the VMS will need to stay in use until vaccines or effective treatments are available. Beyond this point, companies will need to keep the VMS on standby, so that it is ready for quick reactivation. The relative success of containing the coronavirus in many Asian countries illustrates the importance of being prepared for a contagious disease outbreak. In responding to COVID-19, these countries drew upon existing procedures and protocols, staff expertise, and institutional memory in the government and in society that were developed during previous epidemiological crises.

Spotlight: Design Future Operations

JULY 13, 2020

By Daniel Küpper, Claudio Knizek, and Andreas Maue

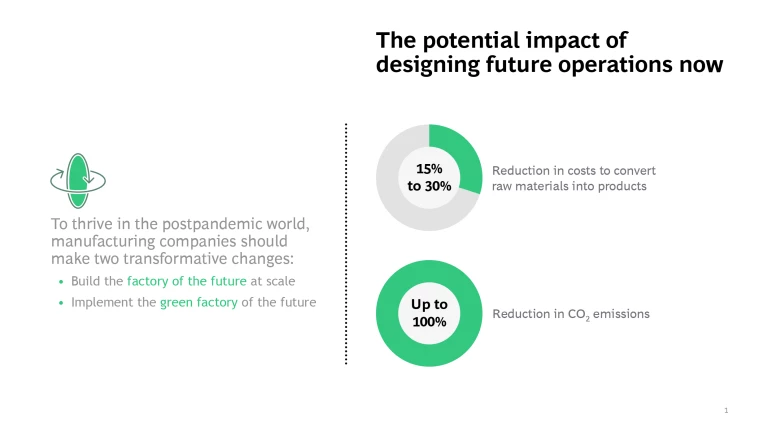

To thrive in the postpandemic world, manufacturing companies should use the COVID-19 crisis as an opportunity to design future operations. Key benefits will include enhanced agility, improved resilience, and lower costs.

To capture these and other benefits, companies should initiate two transformative changes:

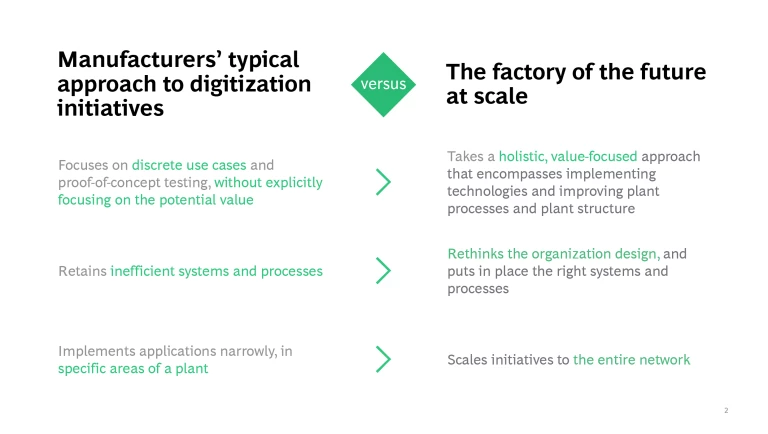

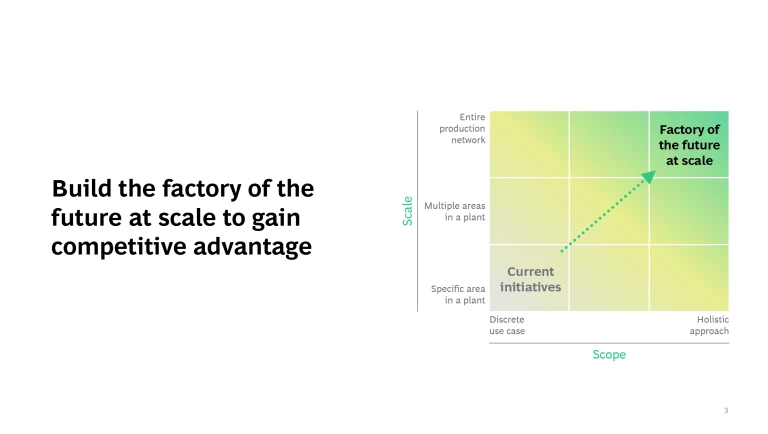

Building the Factory of the Future at Scale. In their efforts to digitize operations, many manufacturers have focused on narrow implementations of discrete use cases. To capture the full value of these digitization efforts, companies must take a holistic approach that encompasses not only implementing technologies but also improving plant processes and structure. And they must discontinue efforts that do not deliver the expected results and scale up those that do throughout the entire production network, not only in specific facilities. In other words, companies must build the factory of the future at scale.

In order to scale up and drive continuous improvement, a company needs to rethink its organization design and put in place the right systems and resources. Investments in digital operations can enable cost reductions of up to 30%—a crucial contribution to gaining a competitive advantage in the future.

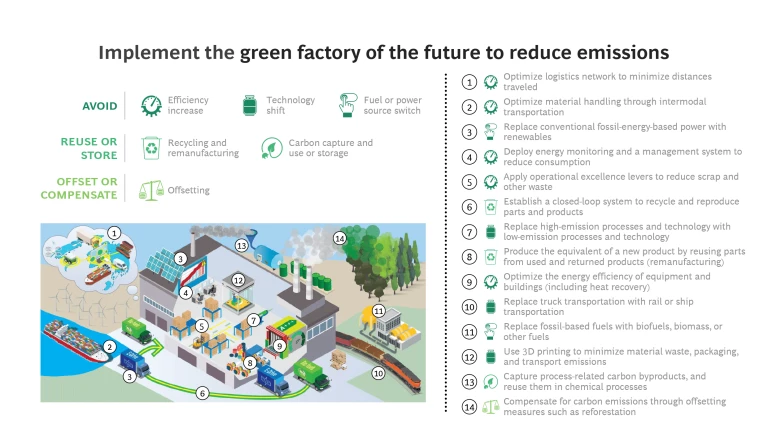

Implementing the Green Factory of the Future. Manufacturers should prioritize emissions reduction despite the pandemic. Indeed, companies may need to take climate protection measures in order to receive financial support from the government. Public pressure for this linkage will likely rise, as production processes account for approximately 30% of global carbon emissions. Moreover, because the decarbonization of manufacturing is among the most powerful levers that can be used to address climate change, a company’s environmental approach is increasingly influencing its market capitalization and social value.

As a result, a company needs to strongly focus on continuously reducing its carbon footprint, especially with respect to its production processes. By implementing a concept that we call the green factory of the future, a company can apply levers to avoid, reuse or store, and offset carbon emissions along the entire value chain.

Investing in these initiatives, even as the fight against the pandemic persists, is essential to ensure future-ready operations and long-term competitiveness.

Spotlight: Rapidly Optimize Sites

JUNE 24, 2020

By Daniel Küpper, Claudio Knizek, Bitan Datta, and Andreas Maue

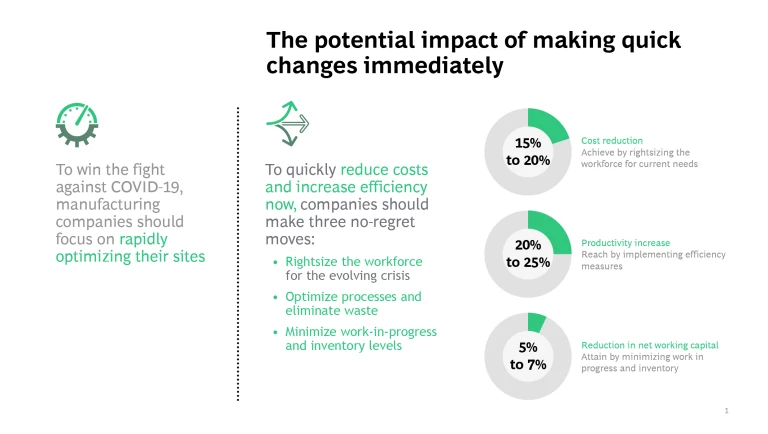

To win the fight against COVID-19, manufacturing companies should focus on rapidly optimizing their sites.

Companies can quickly reduce costs and increase efficiency in the immediate term by making three no-regret moves:

- Rightsize the workforce in response to the evolving crisis

- Optimize processes and eliminate waste

- Minimize work-in-progress and inventory levels

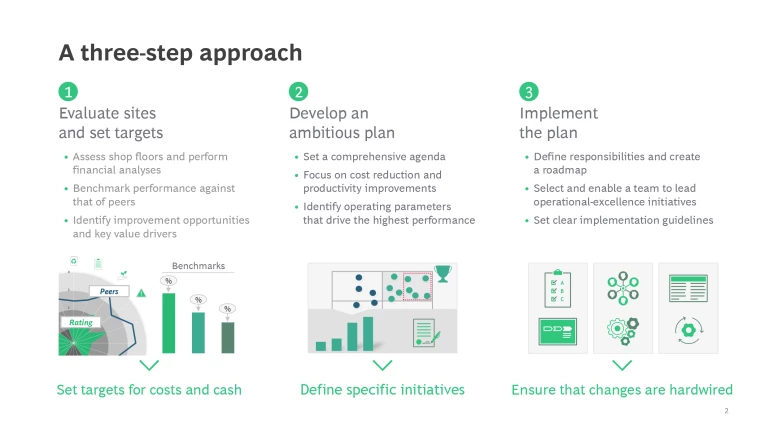

Companies can realize improvements in the short and medium terms by taking a three-step approach:

- Evaluate sites and set targets. Conduct thorough shop-floor assessments and perform financial analyses. Benchmark plant outcomes against those of peers. The evaluation will reveal improvement opportunities and key value drivers. Use the insights to set ambitious but realistic targets for costs and cash.

- Develop an ambitious plan to capture the potential opportunities. Set a thorough agenda with a strict focus on cost reduction and productivity improvements. Hold workshops with diverse teams to generate ideas for cross-functional improvement measures. Identify, and consistently replicate, the operating parameters that drive the highest performance levels. Take a broader perspective by considering industry best practices.

- Implement the plan. To hardwire the changes, define clear roles and responsibilities and create a comprehensive roadmap that includes all relevant milestones. Select a team to lead operational-excellence initiatives, support its development of the necessary capabilities, and set clear guidelines for implementing the plan.

Companies must also prepare sites for the postpandemic world by initiating transformative changes to their operations, including digital implementations that enable proactive identification of risks and rapid mitigation.

Five Priorities for COOs

JUNE 24, 2020

By Ravi Srivastava, Daniel Küpper, and Claudio Knizek

Most chief operating officers (COOs) of manufacturing companies have experience managing through crises, but they have never faced anything like the COVID-19 pandemic. Companies are now operating in a new reality, characterized by increased uncertainty and volatility, enhanced health standards, and, in some industries, a reversal of globalization trends. A defining feature of this new reality is that COOs must respond not only to a sharp decline in demand (as they did during the Great Recession, for example) but also to unprecedented supply-side disruptions.

Until a vaccine or highly effective treatment is widely available—12 to 24 months from now, according to the World Health Organization—COOs must lead their company’s efforts to win the fight by maintaining stable and cost-efficient operations as the pandemic persists. At the same time, they must initiate long-term actions that will position their company to win the future by gaining competitive advantage in the postpandemic world.

To navigate the challenges in the new reality, COOs should set five priorities now.

Ensure Business Continuity and Manage Liquidity

When countries lifted their COVID-19 lockdowns, COOs faced the challenge of safely restarting onsite operations. Many companies, with support from a rapid response team, have successfully managed the restart of operations and the return to work for thousands of employees. They must now turn their attention to the 12- to 24-month fight phase. During this marathon, business continuity and competitive position will constantly be at risk and require active management.

To win the fight, COOs must shift the rapid response team’s focus to tasks that are essential for stabilizing operations and ensuring business continuity. These tasks include adapting and optimizing production processes while complying with social-distancing rules, establishing a virus-monitoring system, and ensuring adequate supplies in the short term.

During the fight phase, it is also vital to rigorously manage liquidity. The effort should be led by a cash management office that is explicitly responsible for managing short-term liquidity, creating liquidity plans, launching cash preservation measures, and monitoring and forecasting cash and liquidity development. To further free up liquidity, COOs should optimize net working capital, especially inventory.

Rapidly Reduce Costs

For some companies, such as those in the pharmaceutical industry, revenues have been stable or even increased during the crisis. But most companies’ financials are under heavy strain. In a recent BCG survey of business leaders, almost half said that they expect their company’s profits to decline by more than 20%, and about 90% are planning company-wide cost-reduction programs.

To maintain competitiveness during the fight, COOs must act quickly. They should identify cost reduction measures and implement them across all operations, always with a strong bias toward quick wins. The measures should address all value pools in direct and indirect functions—there should not be any sacred cows that are exempt. In many industries, COOs need to reduce the operating costs of manufacturing plants by rightsizing the staff to meet the current needs. At a minimum, they should seek to maintain precrisis productivity levels despite the possibility of lower utilization. In many cases, an additional productivity increase of up to 15% can typically be gained quickly.

Implementing cost reduction measures is essential for securing a company’s survival—not only for the next few weeks but also for many months to come.

Build Supply Chain Resilience

The first weeks of the COVID-19 crisis revealed a weak spot for many companies: a global supply chain that operated efficiently in a steady-state environment but that was highly vulnerable to external shocks. In fact, supply disruptions caused some companies to stop or slow down production even before the virus outbreak reached their facilities.

To maintain business continuity during the fight phase, COOs need to increase the resilience of their supply chain. Digital tools, such as a supply chain control tower or a digital twin solution, can significantly improve transparency and stability. To unleash the full potential of digital tools, however, humans and digital tools must work together seamlessly in order to implement what we call the bionic supply chain.

Considering that increased volatility and uncertainty are expected to persist even as the immediate crisis subsides, building a resilient supply chain is a long-term imperative. Increasing its resilience will not conflict with efforts to reduce costs if done correctly.

Design Future Operations

In recent years, most manufacturing companies have gained significant experience with digital-operations use cases. But many companies have focused on narrow implementations of discrete use cases. To capture the full value of these digitization efforts, COOs must take a holistic approach that encompasses not only implementing technologies but also improving plant processes and structure. A focus on value also requires discontinuing efforts that do not deliver the expected results and scaling up those that do throughout the entire production network, not only in specific facilities. In other words, companies must build the factory of the future at scale.

In order to scale up and drive continuous improvement, a COO needs to rethink the organizational design and put in place the right systems and resources. Successful COOs recognize the future importance of continuing to invest in operations now, even as cost reduction takes center stage during the crisis. Indeed, investments in digital operations can enable cost reductions of up to 30%—a crucial contribution to winning the fight and gaining a competitive advantage in the future.

Address Environmental Sustainability

Because many manufacturing companies are still struggling with the immediate impact of the crisis, emissions reduction is not always a top priority. However, we expect this to change quickly. In many countries, companies may need to take climate protection measures in order to receive financial support from the government. Public pressure for this linkage will likely rise, as production processes account for approximately 30% of global carbon emissions.

Moreover, because the decarbonization of manufacturing is among the most powerful levers that can be used to address climate change, a company’s environmental approach is increasingly influencing its market capitalization and social value. This was the case before the pandemic, and it will remain true during the crisis and beyond.

As a result, COOs need to strongly focus on continuously improving their company’s carbon footprint, especially with respect to its production processes. By implementing a concept that we call the green factory of the future, COOs can apply levers to avoid, reuse and store, and offset carbon emissions along the entire value chain.

COOs must pursue these five priorities to support their company’s efforts to win the fight during the next 12 to 24 months and transform to win the future. The effort to maintain strong operations in the new reality will require agile decision making from COOs across the immediate-, medium-, and long-term time horizons. In short, COOs must take decisive actions today to ensure robust operations in the future.