Fashion and apparel retailers are facing a new round of challenges as the COVID-19 crisis accelerates e-commerce growth and drives demand volatility to new heights. Although many brands have invested substantially in digitalization to deepen customer relationships and streamline end-to-end operations, they continue to struggle, largely because of the way they address digital build-buy decisions. Preferring to purchase many of their technologies from third-party vendors to cut costs, retailers have become overly reliant on external sources for their digital capabilities and less able to innovate and adapt in the face of new business realities.

A select few retail brands are framing build-buy decisions differently, supplementing financial considerations with an important strategic dimension. Instead of asking whether they should own a particular technology, these companies are asking whether they should own the capability to build it. Those that answer in the affirmative are reducing their reliance on third-party vendors. They are becoming smart integrators, bringing key digital-technology building and integration capabilities in-house, while continuing to buy the balance of the technology that they need from third parties. These “digital hybrids” are already seeing the benefits: empowered employees, greater resilience in the face of volatility, and, ultimately, higher returns on technology investments.

Determining the Company’s Digital Aspirations

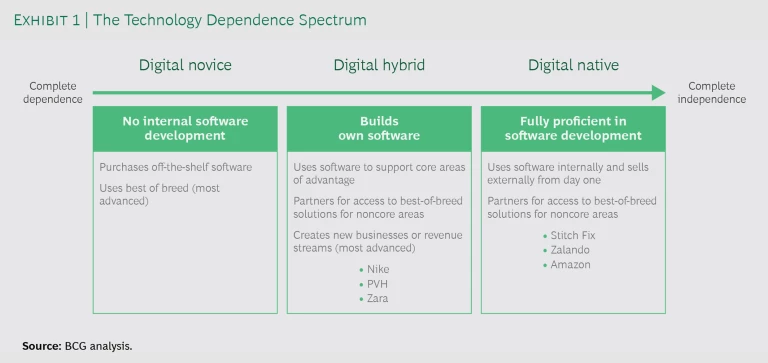

To address the question of whether they need to augment their technology-building capabilities, retailers should first decide where they wish to sit on what we call the technology dependence spectrum. At one end of this spectrum are digital novices, which have no internal technology-building capabilities. At the other are digital natives, with the ability to develop, use, and sell solutions. In between are the digital hybrids. (See Exhibit 1.)

Digital Novices

These companies are 100% technology dependent. They lack the skills to build technology solutions internally and therefore buy them from third-party vendors. Digital novices often purchase a platform solution—a bundle of solutions provided by a single vendor, such as SAP. As a result, they have no need to find or train people in the skills required to develop solutions.

Partnering with vendors allows digital novices to improve their performance, but they are wholly dependent on those vendors for their digital capabilities. This dependence prevents them from building a sustainable advantage because they must rely on the same best-of-breed solutions to which other companies likewise have access. The only competitive advantages available to them are selecting better vendors and integrating solutions more quickly.

But such advantages are hard to sustain. Technology dependence can even create a sustained disadvantage, because it forces companies to adopt processes to fit the software instead of the other way around. As a result, they are unable to design the solutions that would best suit their customers.

Digital Natives

These companies are 100% technology independent, having decided to develop all their software in-house because they require a level of performance beyond what off-the-shelf solutions can offer.

Take, for example, Zalando, a Berlin-based e-commerce platform that sells shoes, fashion, sportswear, accessories, and cosmetics. In 2010, the company replaced its open-source shopping platform with an internally designed version that enabled greater personalization and user engagement. Shoppers across Zalando’s 17 markets have more than 500,000 articles and 2,500 brands to choose from. Among the many features offered is the My Zalando recommendation engine, which provides style advice by leveraging data from recently purchased products; customers can also give My Zalando information about their tastes by “liking” items that they see on the website. The company has grown rapidly, with revenue of €6.84 billion in 2019, a year-on-year increase of 20.3%.

Digital Hybrids

Digital hybrids are traditional companies that acquire the capabilities that digital natives start out with. At first they are digital novices, purchasing off-the-shelf solutions. Over time, they begin working with vendors to develop their own core technologies, while continuing to purchase the rest of the solutions that they need. Eventually, they bring the development process in-house.

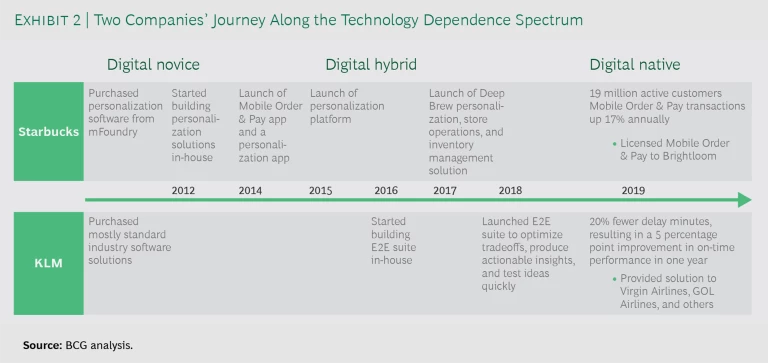

The most advanced digital hybrids today are outside the fashion and apparel sector. They are companies like Starbucks and KLM, which have gone on to sell their proprietary software to other companies, creating new businesses and revenue streams. (See Exhibit 2.)

Companies that build and improve their own technology solutions may gain a less obvious advantage as well. They can rapidly increase the rate at which they learn what works and what doesn’t work. In other words, in the process of developing technologies in-house, such organizations can become more agile.

Two Digital-Hybrid Retail Brands

The success of companies with their own technology-building capabilities has led brands like PVH and Nike to rethink their own approach to technology investments. They are asking whether they need not only a particular technology but also the ability to develop and improve it. That is, they are using technology-purchasing decisions as an opportunity to become better technology builders and innovators.

Retailers have become overly reliant on external sources for their digital capabilities and less able to innovate and adapt in the face of new business realities.

A few years ago, PVH (which owns Calvin Klein, Tommy Hilfiger, and other fashion brands) started building its own digital technologies. In 2019, it launched the award-winning PVH Digital Assistant mobile app to help retail associates answer customers’ questions, look up inventory, and provide product information. Staff can also use the app to share real-time customer feedback and best practices on how to sell specific products.

Nike took a different approach to boosting its internal capabilities. In 2019 it acquired Celect, a retail predictive analytics and demand-sensing platform developed by two MIT professors. This acquisition provided Nike with both technology and talent. Celect’s data scientists and engineers, who are now an integral part of the brand’s operations, are using the platform to predict when and where consumers are likely to buy certain styles. Nike uses these insights to ensure optimal inventory management across its many retail channels.

Becoming a Digital Hybrid

Retailers must decide where they want to be on the technology dependence spectrum on the basis of their long-term strategic goals. But the multifaceted advantages that the digital-hybrid route provides makes it the best option for companies aspiring to be industry leaders. Becoming a digital hybrid requires considerable technology investments, however, and these will take time to pay off. Therefore, small players that lack the required resources should probably remain digital novices.

Identifying the Company’s Core Digital Capabilities

Companies that decide to become digital hybrids must first identify the digital capabilities that are key to their competitive advantage. These capabilities, along with their underlying technologies, are the ones that the organization will want to develop in-house so that it can improve them over time.

For noncore capabilities, partnerships with software providers will be sufficient. This includes vendors of backbone solutions (such as SAP’s S/4HANA ERP for large enterprises), emerging technologies (augmented- and virtual-reality apps), and commodity solutions (financial solutions). Even the most digitally advanced companies make use of such vendors.

Fast-fashion retailer Zara is a good example of a digital hybrid that has identified its core digital capabilities and taken steps to build them. Known for its supply chain prowess, the company has developed proprietary demand-planning software that helps optimize inventory allocations across thousands of stores globally. The company has also developed its own logistics software to streamline distribution.

Smart integrators bring key digital-technology building and integration capabilities in-house, while continuing to buy the balance of the technology that they need from third parties.

At the same time, Zara works with various third-party vendors to develop noncore digital capabilities. It has collaborated with Jetlore, whose AI-powered platform helps Zara predict consumer behavior, and El Arte de Medir, whose big-data analytics help measure performance. Zara has also partnered with French technology company Holooh and digital-science research institute Inria to create a mobile augmented-reality app to improve customer engagement and sales. Customers point their phones at mannequins wearing the newest collection and click through to make purchases.

Implementing the Company’s Core Capabilities

The following measures are essential to in-house development of the company’s core digital capabilities:

- Decide which technologies to build. Select the technologies that will enable the company’s core digital capabilities; then develop them quickly and independently, continuing to purchase the rest.

- Focus on people, processes, and platforms. Adopt agile ways of working and develop teams with the needed technical skill sets. Also build the analytical and data platforms required for scaling the solutions that the company develops.

- Become a smart integrator. Determine how the company will use partnerships to support a faster rate of learning. Simply acquiring a technology from a partner may slow down learning over the long haul. But establishing technology partnerships that complement core internal capabilities can accelerate progress and build a sustainable advantage. This is particularly true when the company can leverage the partnership both for the technology solution itself and for guidance on how to build new ones.

- Create a strong continuous-improvement and innovation engine. This requires establishing the value logic of each technology solution as well as clear performance indicators. In the case of a forecasting tool, for example, it’s important to have a standard way of measuring forecast accuracy and quantifying its value. Also adopt product management practices that will allow the teams that build the technology solutions to work closely with potential customers and get their feedback in real time. This input should inform not only the technology but also the business processes in which it is embedded.

The onus of these decisions falls mainly on retailers, but they cannot make the journey alone. Vendors will need to become more flexible in how they support the more advanced players that are not looking for a full platform solution.

In all likelihood, the core challenges that retailers face will only continue to intensify. For companies weighing their long-term options, the journey to become a digital hybrid is not an easy one. But, as leading retailers have found, it can be well worth the effort.