Even as upstream oil and gas companies contend with an extremely difficult near-term market environment , they confront a longer-term challenge: growing pressure from regulators, investors, and others to decarbonize their operations. Many upstream companies have already made meaningful strides toward decarbonization . But they will need to do much more going forward as stakeholder demands and expectations continue to rise.

BCG offers an effective approach to decarbonization. Along with shrinking the company’s carbon footprint, it can strengthen companies’ social license to operate, reveal new avenues for revenue growth, and, critically, limit the negative impact on the business. The approach emphasizes value- accretive decarbonization and an incremental strategy tailored to each company’s set of constraints and opportunities.

BCG’s approach emphasizes value-accretive decarbonization and an incremental strategy tailored to each company’s constraints and opportunities.

Three Goals

First and foremost, a value-accretive decarbonization strategy must meet regulatory requirements in the country where the company operates. These will vary in stringency, based on jurisdiction. At one end of the spectrum lies the EU, which has an established carbon-pricing scheme, net-zero-emissions targets, and restrictions on certain types of operations, including fracking. At the other end of the spectrum, most developing nations regulate carbon emissions in a limited way. The US lies in the middle, with considerable diversity from state to state. A company operating in California will face much different regulatory demands from one operating in Texas, for instance.

Local regulation also affects where a company concentrates its efforts. California’s Low Carbon Fuel Standard Program, for example, effectively steers a sizable portion of the decarbonization efforts of the state’s upstream players toward developing low-carbon-intensity transportation fuels. Other local regulation, such as fracking bans in New York State and water-disposal regulation in Pennsylvania, have similarly large effects on the day-to-day operations of companies operating within those states.

A value-accretive decarbonization strategy should ensure that the company retains its social license to operate.

Second, a value-accretive decarbonization strategy should ensure that the company retains its social license to operate. This demands effective engagement with a variety of stakeholders, including communities in which the company operates, which will be particularly focused on job creation and the local environmental effects of the business. Companies must have well-developed and articulated policies and targets for such community concerns, and they should communicate them clearly and proactively. Current and potential employees provide another critical cohort for ensuring social license: companies must present a cohesive and coherent discussion of their activities, particularly regarding sustainability, to these individuals if they hope to attract and retain top talent.

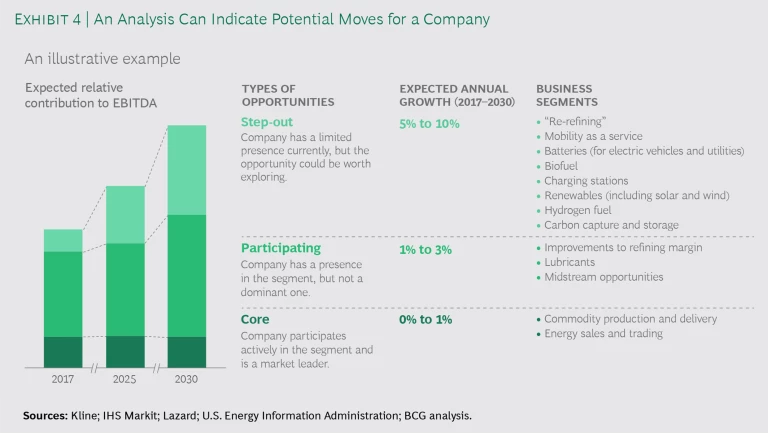

Third, a value-accretive decarbonization strategy should identify business opportunities for the company that have emerged or could emerge amid society’s accelerating march toward decarbonization. Chosen wisely, such opportunities could deliver new revenue streams, offsetting any negative effects of the company’s decarbonization efforts on its balance sheet, as well as portfolio diversification. Viable opportunities might include initiatives that leverage the company’s core business and capabilities, such as the monetization of project-management capabilities or the offer of technology as a service. They might also include positions in low-carbon technologies such as solar assets, hydrogen fuel, as well as carbon capture, utilization, and storage. Companies also could acquire conventional assets and manage them in a way that reduces the assets’ carbon intensity.

We recommend that companies focus on reducing the overall carbon intensity of their operations and activities.

BCG’s Approach

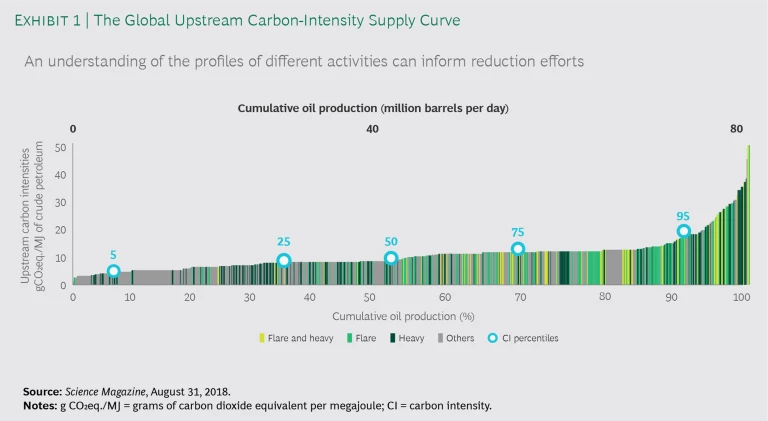

We take a highly company-specific approach to helping upstream players craft a decarbonization strategy, since each player’s operating environment, assets, regulatory constraints, and so forth are unique. We start with the design of a path for reducing the company’s carbon footprint. In general, we recommend that companies focus on reducing the overall carbon intensity of their operations and activities (for example, by reducing their production of high-carbon-intensity crudes), rather than on targets for the absolute emissions of individual hydrocarbon streams. Such an approach has proven the most efficient means for a company to reduce its net emissions. (See Exhibit 1.) We also think that an industrywide focus on achieving reductions in carbon intensity, were companies collectively to pursue it, could be more effective for meeting the broad goal of decarbonization and provide a much greater return on investment than a targets-based approach.

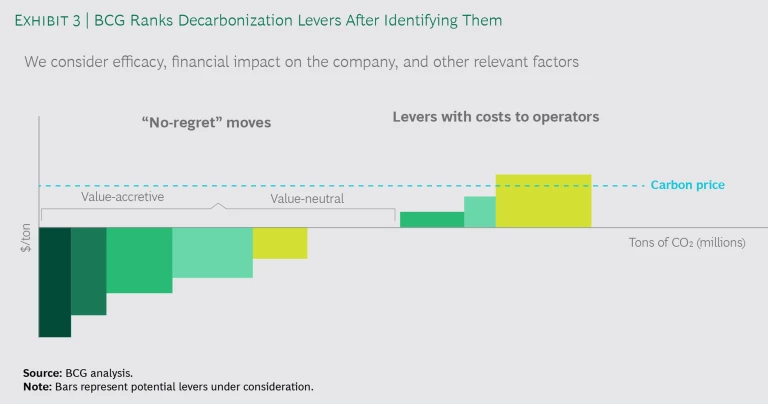

Based on our work with companies possessing different types of assets and operating under different regulatory regimes, most companies could reduce their carbon emissions 10% to 20% without having a negative impact on the company’s return on investment. Many companies could reduce their emissions an additional 30% to 40% while still maintaining a positive internal rate of return. The returns on such efforts, however, would be lower than those on most traditional upstream investments, which means the company would need to adjust its required cost of capital to make a strong business case for the investments. For most companies, reducing the remaining 30% to 40% of emissions (on the path to net-zero emissions) in a value-accretive manner will hinge on the company’s ability to identify and act on opportunities as they arise.

Once we have helped a company identify opportunities to reduce its carbon footprint, we identify and rank, in order of their potential relevance, all key external factors affecting decarbonization vis-à-vis the company and its operations. These include social factors, such as population and demographic shifts and societal concerns about climate change and the environment. Relevant external factors also include regulatory constraints, such as rules governing fracking; incentives to spur increased acceptance and usage of green technologies, including electric vehicles; and progress toward carbon pricing and related schemes. Market factors also play a role, such as local consumption of fossil-fuel-based energy sources and trends in non-fossil-fuel-based energy consumption.

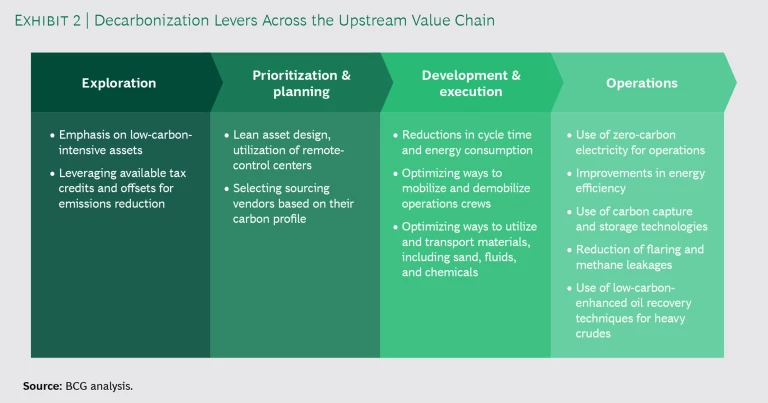

Next, we look at the company’s value chain end-to-end for decarbonization opportunities. (See Exhibit 2.) Different phases of the chain warrant different considerations. In the exploration phase, for example, the choice of opportunities should reflect the growing importance of low-carbon-intensity assets in a portfolio. By the mid-2020s, companies will face considerable pressure to show that new portfolio assets can operate carbon-neutrally—but companies should make decisions on that front now, given the long lead times for exploration and development. Companies should also consider how tax credits and offsets could influence the attractiveness of potential investments.

In the design and sourcing phase of the value chain, companies could realize de-carbonization goals by applying lean principles and tools to asset operations.

In the design and sourcing phase of the value chain, companies could realize de- carbonization goals by applying lean principles and tools to asset operations; electrifying operations where possible; and using remote-control centers. In sourcing, upstream players can create incentives for suppliers to reduce their emissions footprint. They can also employ carbon as a key metric in vendor selection and evaluation.

Companies could use a similar menu of decarbonization levers in the operations phase. These include optimizing operational cycle times, improving fleet performance and routing, using zero-carbon electricity, improving energy efficiency, reducing flaring and methane leakages, and installing carbon capture, utilization, and storage technologies.

Once we have identified all available measures and quantified their likely efficacy, we synthesize these and key social, regulatory, and market trends to produce a ranking of potential decarbonization actions the company could take, including “no regret” moves, whose implementation poses no economic downside to the company. (See Exhibit 3.) We also identify critical supports the company will need to institute or strengthen on the organization, governance, and technology and innovation fronts to support its decarbonization efforts. And we help the company gain a “seat at the table” with regulators and other key stakeholders in designing regulations that advance the general goal of decarbonization and accelerate the development of key technologies, such as carbon capture, utilization, and storage.

To ensure that the company maintains its social license to operate, we encourage quality communication with key stakeholders: it should be clear, regular, and tailored to the specific audience. The company should set transparent targets and establish a tracking mechanism (if not already in place) to monitor progress over time.

BCG also brings a strategic lens to help companies navigate the third goal of a value-accretive decarbonization plan: identifying potential new revenue sources. We typically identify a combination of opportunities in which the company has no, limited, or some presence currently and opportunities that leverage the company’s core suite of activities and capabilities. For many upstream players, this list certainly would include renewable-energy-related opportunities. It could also include activities in the mid- and downstream portions of the oil and gas value chain, such as the production and transportation of low-carbon fuels. Carbon capture, utilization, and storage can also provide new revenue sources through applications across industries beyond oil and gas. (See Exhibit 4.)

As an example of the sort of real-world results BCG’s approach can deliver when employed in full, consider our work with a US-based upstream operator. We helped the company craft a decarbonization strategy that was based on the acquisition of low-carbon assets, the adoption of energy- efficiency measures aimed at optimizing operations and reducing costs, the realization of new revenue streams based on regulatory incentives, and the launch of step-out businesses, far removed from the company’s current business. Once fully implemented, the strategy increased the company’s enterprise value by 30% and put the company on course for a roughly 90% reduction in its carbon emissions by 2040.

As societal pressure to address climate change continues to mount, oil and gas companies will face intensifying pressure from stakeholders—including investors, regulators, employees, and prospective employees—to decarbonize. Upstream players that act early, aggressively, and with an overriding focus on adding value to the business can reap substantial rewards. Foremost among these rewards are enhanced revenues, a stronger brand, a strengthened social license to operate, opportunities to shape the terms of the industry’s evolution—and, ultimately, confidence that the company will be around for the long haul.

BCG’s Center for Climate & Sustainability

We partner with clients across the public, private, and social sectors to align their strategy, operations, and stakeholder engagement with a low-carbon world. Our work is supported by BCG’s range of consulting experience across all industries and capabilities, as well as by our expanding reach of brands.