There has never been a better time for an entrepreneur to create and scale a startup. InsurTechs are a great example: digital challengers and enablers in the insurance space received a boost in 2019 to do just that, receiving $6.1 billion cumulatively.

BCG’s FinTech Control Tower (FCT) annual “State of InsurTech” report provides a data-driven view of InsurTech globally using three lenses—products, investments, and geographies—to explore emerging trends, innovative business models, and the most disruptive technologies.

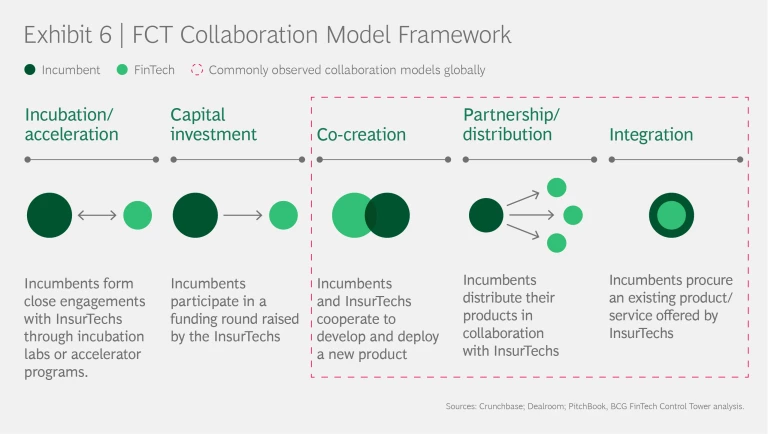

Incumbent insurers are also actively partnering with InsurTechs, and the report explores five common collaboration models: Incubation/Acceleration, Investments, Co-creation, Partnerships, and Integration, making the report an operational playbook for carriers, enriched by qualitative insights directly from market participants.

The report outlines five key findings:

- Funding volumes are at an all-time high

- Short-term growth is maintaining momentum

- InsurTech is maturing

- Global carriers are intensifying investment activity

- Collaborations can be a means of disruption

Funding volumes at all-time high

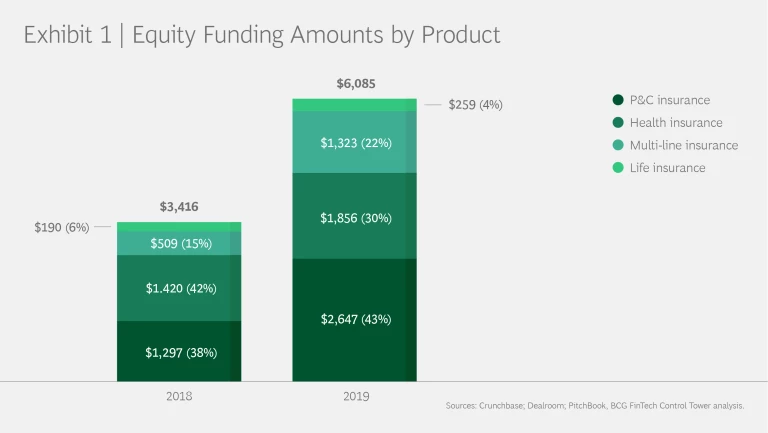

Globally, 2019 was a record-breaking year for the industry, with equity funding at $6.1 billion, up around 80% compared with 2018. (See Exhibit 1.)

Of the 2019 total, approximately:

- $2.6 billion (43%) was raised by companies in P&C insurance in 129 rounds, of which six were mega-rounds

1 1 Root, Lemonade, Next Insurance, Friday and Duck Creek. - $1.8 billion (33%) was raised by health insurance companies in 37 rounds, of which three were mega-rounds

2 2 Bright Health, Clover Health, and Collective Health. - $1.3 billion (22%) was raised by firms in Multi-line insurance in 65 rounds, of which five were mega-rounds

33 3 Policybazaar (x2), Waterdrop, Wefox (x2). -

4 4 Policybazaar (x2), Waterdrop, Wefox (x2). $0.25 billion (4%) was raised by life InsurTechs in 14 rounds, with no mega-rounds

Short-term growth maintains momentum

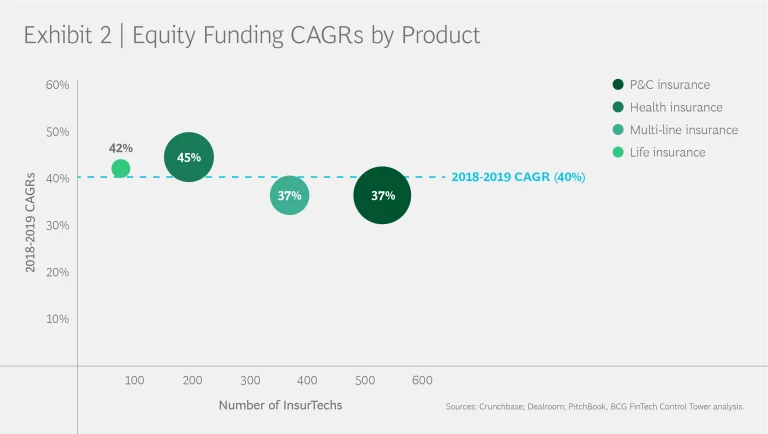

In the past two years (2018 and 2019), funding growth was strong across all four product verticals. Health and Life were at the fore, with CAGRs of around 45% and 42% respectively, followed closely by P&C and Multi-line, each of which had CAGR of approximately 37%. (See Exhibit 2.)

Within each vertical, we identified key areas of growth.

Life insurance was driven by InsurTechs in Group Life (CAGR of about 219%)—targeting members of large organizations—and Term Life (CAGR near 43%), offering term life, critical illness, and cancer plans at cheaper prices by leveraging fully digital application processes and real-time underwriting.

Full stack digital insurer Singapore Life has adopted one of the most interesting business models in this space with its centerpiece Singlife Account—an insurance savings plan that allows top-ups and withdrawals at any time and provides life insurance coverage for death, up to 105% of the account value. It also comes with an optional Singlife Visa Debit Card that enables customers to spend overseas without the additional foreign exchange charges.

Health insurance also was driven by two different groups of companies: Care Planning and Delivery (CAGR 56%), leveraging technology to improve patients’ experience and reduce carriers’ losses; and General Healthcare (CAGR 43%), offering original Medicare and Medicare Advantage Plans.

Within the commercial P&C space, cybersecurity stands out as the fastest growing sub-segment (CAGR around 108%), as new risks for global SMEs, such as cyber threats, data breaches, and ransomware arise; leveraging the latest technologies and big data, InsurTechs have developed strong capabilities to effectively detect virtual threats and counteract them.

For instance, Arceo.ai stands out by leveraging its proprietary methodology called Cyber Meteorology, that not only takes into account the micro technical view of global SMEs, but also the macro level context in which they operate, helping them prioritize their security efforts.

The commercial P&C space as a whole is expanding and attracting growing interest from worldwide investors, as shown by the first mega-round in the space closed by Next Insurance ($250 million Series C), a full stack digital insurer offering smart small business insurance solutions.

InsurTech is maturing

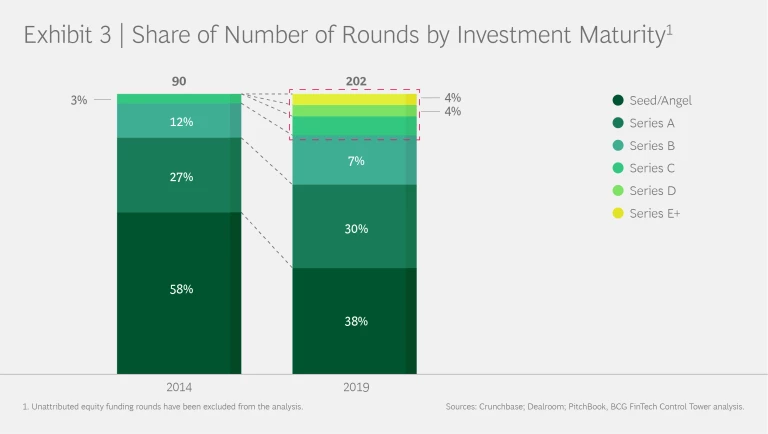

In 2019, the volume of seed rounds (number of rounds) dropped below the 50% mark for the first time in the past six years, clear evidence that InsurTechs are maturing globally. (See Exhibit 3.) The gap was filled by early VC rounds

In terms of equity funding amounts, Series C+ totalled about $3.4 billion (or 65%), boosted by 10 out of the 15 mega-rounds of the year. Similarly, Series B funding rose amid the two mega-rounds closed by Wefox Group of $125 million and $110 million. Seed and Series A remained stable, in line with the past three years.

As a consequence of large rounds, average investment sizes have been rising and diverging from their median counterparts across all maturities, specifically for late VC.

Global carriers intensify investment activity

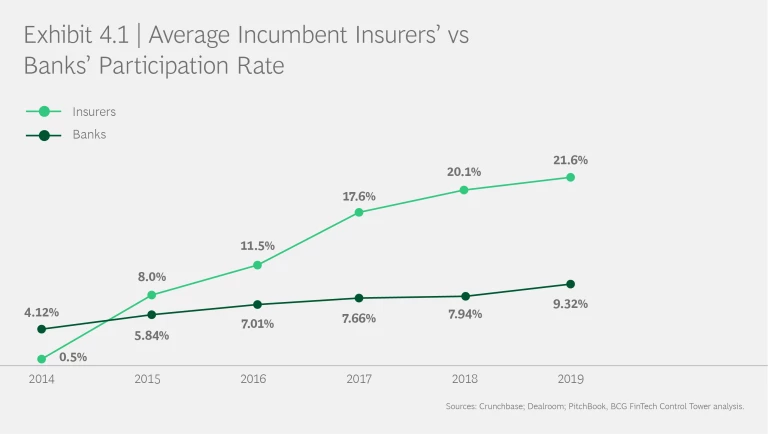

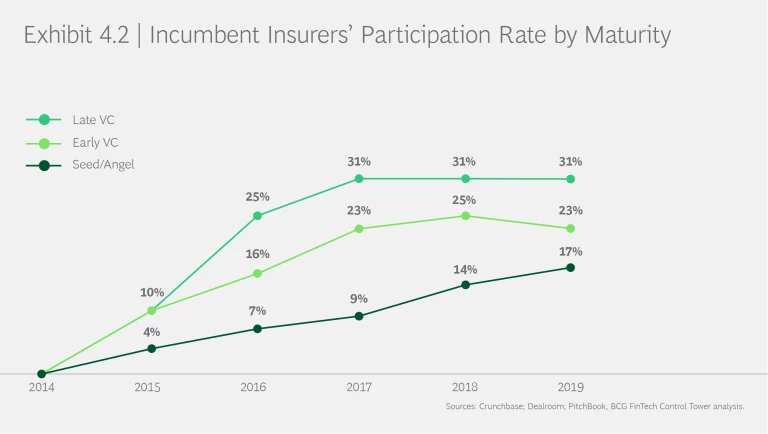

Venture capital firms have been the most active investors in the space, hoping to benefit from high IRRs, whereas incumbent insurers ranked third, after angels, joining the InsurTech race not only for financial, but also for strategic returns. Their average participation rate

The FCT database also shows that carriers have been consistently targeting later stage rounds, preferring companies with established product-market fit and/or existing success to fresh start-ups, as financially less risky and strategically more sound. (See Exhibit 4.2.)

Investors are “moving east”

Among the three macro-regions, the US keeps leading the way with $4 billion (66%) of equity funding raised in 2019, bringing the cumulative amount to approximately $13.7 billion.

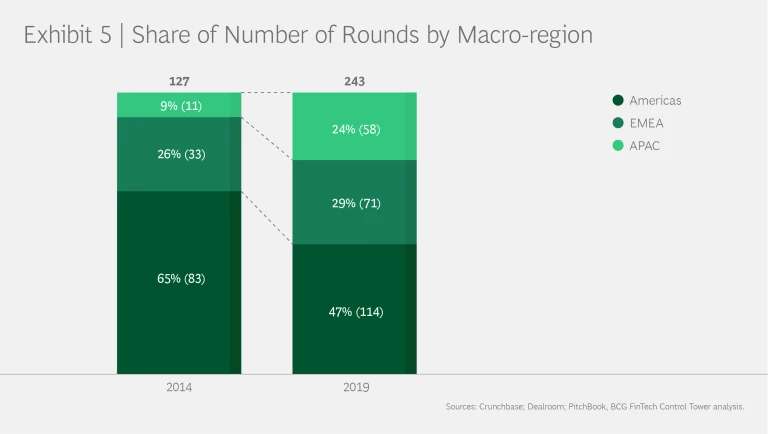

InsurTechs in EMEA (Europe, the Middle East, Africa) and APAC (Asia Pacific) combined, surpassed the $2 billion funding threshold for the first time since 2014. During the same period, the share of volume (number of rounds) in the Americas gradually dropped, falling below around 50% from 2017 onward. This shift shows that investors are focusing on new opportunities in untapped markets, such as APAC and EMEA. (See Exhibit 5.)

East Asia and Southeast Asia are driving the growth in APAC, with 2018-2019 funding round CAGRs of approximately 36% and 31% respectively; the former being by Multi-line companies in China, and the latter by health and life insurance firms in Singapore.

In EMEA, Western and Northern Europe have attracted the largest share of funding amount to date, driven by P&C and Multi-line InsurTechs in Germany (CAGR around 19%) and P&C and life InsurTechs in the UK (CAGR around 23%) respectively. The rest of Europe and the Middle East and Africa are slowly catching up, as local ecosystems such as Italy and Israel are expanding—especially for P&C and Multi-line insurance.

Collaborations as a means of disruption

Although InsurTechs and incumbents adopt different strategic and operational frameworks on average, they welcome collaborations with each other, aiming to offset their challengers and generate synergies from their core capabilities and key assets. (See Exhibit 6.)

Co-creation, Partnerships, and Integration resulted in the most adopted models globally, with the choice among them dependant on the purpose of the agreement.

Relationships between InsurTechs and incumbents might be undermined by some of their intrinsic traits, such as technology barriers for carriers and little knowledge of the insurance market for InsurTechs.

Successful collaborations are based on a set of core principles—people, technology, and business—to guarantee long-term success, including, but not limited to, alignment of vision and values, knowledge sharing and continuous learning, mutual adoption of new technologies, and set up of customer-centric operational frameworks.

To learn more about the global InsurTech ecosystem, including regional deep-dives and detailed profiles of emerging players, please reach out to your FCT InsurTech team.

About the FinTech Control Tower

The BCG FinTech Control Tower is an internal startup within BCG with a focus on the FinTech and InsurTech ecosystems. The FCT platform now tracks more than 22,000 FinTechs globally that are leveraged to run regular research aimed at providing insights into the landscape for our clients. Clients include top global FIs, asset managers, regulators, investors, and tech giants, that chose us for our expertise to drive informed decisions around innovation management, ecosystem engagement, IT investments, and M&A activities.