The COVID-19 pandemic—along with the new reality taking shape because of it—has created a clear mandate for insurers: deal with the rigors of the present and the near future while starting to prepare for challenges and opportunities over the longer term.

The pandemic has created many stresses for insurers—stresses that will evolve as companies prepare to move from the Flatten phase of the pandemic (tackling immediate priorities) to the Fight phase (preparing for the rebound) and begin looking ahead to the Future (pursuing structural enhancements).

Today, on the front end, traditional in-person sales and distribution channels have largely dried up. On the back end, employees are working remotely and will probably continue to do so to a greater extent than before, and new employees will need to be onboarded remotely. Meanwhile, many customers are—or will be—struggling to pay premiums, insurers in some lines of business may experience large increases in claims, and attempted fraud is likely to rise.

To cope with these immediate challenges, we see insurers focusing on five key areas that require digital responses—distribution, customer service, operations, organization, and claims handling—and specific objectives in each. (See Exhibit 1.)

In each of these areas, insurers are availing themselves of specific levers to help them overcome current challenges, prepare for the near future—and make improvements they will also need to succeed in the new reality.

LEVERS THAT INSURERS ARE USING

To understand how insurers are have begun addressing the challenges they face across the business, we consider examples in each of the five areas identified above.

Distribution. Adapting distribution to the requirements of the pandemic is all about equipping agents and brokers with digital and bionic tools to communicate and transact with clients during and after social distancing. Faced with an increase in traffic to pure online aggregators—which have proved that even complex products can be sold online—top insurers are reevaluating their online distribution, which did not pick up as expected while their offline distribution was down.

Insurers are employing many levers to enhance their distribution functions during the COVID-19 pandemic. Among of the most commonly used levers are these three:

- Direct distribution of more complex products

- Digital agency management, including training, activity management, and various office and meeting tools

- Social (as opposed to digital) marketing

In China, social marketing is now in widespread use. For instance, one major insurance company there connects agencies with supports including social media platforms that allow agents to become network celebrities. This new way of marketing calls for new tools—short videos of highly personalized commercials, for example, or video streaming of live chats—and a lot of creativity, as well as products that can be explained online and delivered via straight-through processing. It also involves agents working collaboratively, with other agents or with the firm, as opposed to conducting the end-to-end sale process by themselves.

Customer Service. Insurers are applying several levers to enhance the digital experience and improve convenience for customers who increasingly use digital channels in their daily lives. They are using these levers to strengthen digital interaction and reduce volume—especially in dealing with simple customer requests—at their call centers, aiming to introduce 80% to 90% solutions within days or weeks. Key examples include the following:

- Virtual, smart interactive voice response (IVR), including traffic segmentation

- Digital self-service tools, including tools for increased scope of services

- Simple optimization of cross-channel client journeys

Consider this example from outside the insurance industry. Finding that its customers’ adoption of digital self-service had plateaued, while its call center continued to handle simple contacts, a major US service provider replaced traditional IVR with an omnichannel virtual assistant accessible via mobile and tablet apps. Under the new process, the customer receives an SMS with a link to the app, clicks on the link, and is transferred to the app, with IVR confirming access. The customer then proceeds with the transaction on an AI-powered platform that should permit resolution of 70% to 80% of cases by AI alone. The company has seen a 40% opt-in rate for the virtual assistant, a 75% journey completion rate, and a 20% reduction in call volume. The new system is bionic in the sense that the virtual assistant can function in parallel with the call center.

Operations. During the pandemic, insurers are using AI, big data, and other technology advancements to increase operational excellence and efficiency. They are employing digital operations levers to achieve quick wins in process optimization, to introduce state-of-the-art digital services across channels, and to gather and deploy data about clients. Among the key levers in this area are the following:

- Robotic process automation (including bot farms)

- Predictive models for managing payments (including collections and retention of profitable customers)

- Underwriting process automation (including straight-through processing)

A major insurance company in Germany has found that, due to the economic impact of the pandemic, many of its customers have been looking for options to delay premium payments and/or cancel policies. Within 17 days, this insurer developed a minimum viable product ( MVP) consisting of a digital solution for both its tied agents and its call center. This solution supports agents in advising customers on how to manage their insurance policies at a time of strained liquidity. The company plans to expand the MVP’s capabilities, link it to the company’s financial and segmentation models, and implement a predictive model both to identify customers who are likely to have liquidity issues and to suggest appropriate actions.

Organization. To maintain cost efficiency and a focus on people, insurers are creating smart organizations designed to accelerate the shift toward remote working and digital solutions, optimize resource allocations to top-priority tasks, and review outsourcing strategy. The levers they are using for these purposes include the following:

- Identifying and reducing skills gaps

- Implementing digital employee recruitment, onboarding, and enabling

- Optimizing resource and vendor management

Many major companies across industries are using digital tools to move key parts of the recruitment process—including collecting information on candidates, interviewing, scoring, and status tracking—online. They are also using advanced analytical tools to support recruitment decisions, and they are employing e-learning and video meetings during onboarding. One global technology giant now uses active sourcing of candidates via LinkedIn as part of its day-to-day recruiting operations. (Social network sourcing has become its second-biggest recruiting channel, after employee referrals.)

Claims Handling. To speed up the claims-handling process in a way that reduces costs and increases customer satisfaction—and to do so at a time of social distancing as well as in the face of a potentially significant uptick in fraud—insurers are using several levers:

- AI-based, continuously improving fraud detection models

- Digital claims process improvements

- Smart, AI-based claims approval

An insurer working with an external vendor has used AI and advanced analytics to build a fraud detection model that is faster than its previous models and able to work with much bigger data sets. The key to the new model’s success has been to integrate the model into the claims-handling process to identify relevant predictors early on. The new model has improved the company’s loss ratio by 1 percentage point, permitting the fast tracking of more claims and yielding a higher net promoter score.

GETTING STARTED—AND LOOKING AHEAD

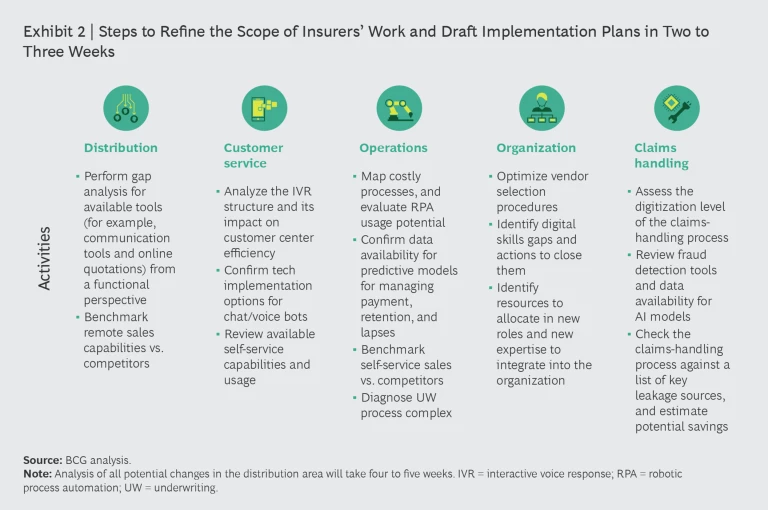

Presented with an imperative to act now in response to the COVID-19 crisis, insurers must begin by thoroughly assessing their strengths and challenges vis-à-vis the five key areas we have been discussing. In each area, companies can take clearly defined steps now to establish the scope of their Flatten and Fight efforts and to draft an implementation plan within a matter of weeks. (See Exhibit 2.)

Yet while insurers must currently focus the bulk of their attention on coping with the here and now (Flatten) as well as on preparing for the more or less foreseeable middle-term future (Fight), they also have the opportunity—especially given clients’ dramatic turn to digital channels in all aspects of their lives during social distancing—to accelerate the transformation necessary in order for them to be ready for the new reality (Future). By developing solutions in a modular way and with the customer’s perspective in mind, insurers can begin positioning themselves now to thrive in the new reality, whatever that may prove to be.