Over the past two decades, pay TV providers have experienced massive disruptions to their business models because of changing consumer behaviors and the digital alternatives that have emerged to meet new consumer needs. As a result, incumbent players are encountering major threats from multiple insurgents, including streaming services such as Netflix, Hulu, Amazon, and Google’s YouTube TV. Even traditional studios like Disney and WarnerMedia are now launching their own competitive streaming platforms. Moreover, pay TV providers are competing not just with other types of television, but also with various providers of music, print, and digital content, including video games.

In this environment, most providers are facing the grim prospect of little or no growth and stagnant or even declining audiences. Consider these changes in viewing habits:

- Globally, consumers now spend 1.63 fewer hours per week watching live TV than they did in 2012, according to PQ Media.

- According to the same source, consumers spend 2.85 hours more per week streaming content than they did in 2012.

- The total number of global streaming-video subscribers is on track to increase by 44% between 2019 and 2024, according to projections from Ampere Analysis.

Despite these challenges, pay TV companies can achieve growth by finding underserved audiences and the market segments that they inhabit. BCG’s proprietary Demand Centric Growth (DCG) methodology points the way to these market segments through a combination of quantitative and qualitative research that allows companies to identify essential consumer wants and needs. By providing a deeper understanding of target audiences, DCG gives pay TV companies the market intelligence they need to develop new products or rebrand existing offerings—and to thereby capture market share and achieve their growth objectives.

DCG’s Record of Success

Traditionally, companies have tried to understand consumers by looking at basic sociodemographic characteristics. But BCG’s research has shown that the most important determinants of consumer choice are the occasions of use for a product or service and the consumer’s needs on those occasions. DCG focuses on occasions of use and related needs, thus providing deeper insights than traditional segmentation analyses can. By asking specific questions about recent consumption experiences, the methodology uncovers and isolates key demand drivers that those analyses may overlook. Companies can then use the insights that DCG generates to differentiate their brands and develop comprehensive commercial strategies.

By providing a deeper understanding of target audiences, DCG gives pay TV companies the market intelligence they need to develop new products or rebrand existing offerings.

Identifying the Sources of Demand to Fuel Growth in more than 200 projects across many sectors and industries. Boston Consulting Group first applied the methodology in the consumer products industry, then expanded it to clients in financial services, travel, telecom, and other industries. For instance, DCG helped snack food company Frito-Lay uncover nine unique demand spaces that led the company to rethink its growth investments across its brand portfolio. Frito-Lay used the insights afforded by DCG to grow faster than the market, achieving a material increase in market share after years of decline.

In the media industry, we have used DCG to help newspapers, magazine publishers, and free-to-air and pay TV providers. The methodology can likewise benefit music, gaming, and even telco providers.

Mapping Demand Spaces

DCG combines advanced analytics and large data sets to produce a detailed map of consumer demand spaces. Demand spaces may be thought of as a type of market segment. But unlike traditional market segmentations that look at narrow factors such as age or income level, demand spaces are defined by consumers’ emotional and functional needs. Mapping demand spaces requires the collection of both qualitative and quantitative data:

- In the qualitative phase, BCG uses its proprietary MindDiscovery approach, which encourages consumers to express themselves freely through pictures and symbolic language. The language used in MindDiscovery focus group sessions can provide crucial insights to guide marketing campaigns. For instance, young consumers are likely to say “streaming” rather than “watching” TV when they talk about viewing programs from streaming-video providers like Netflix and Amazon.

- In the quantitative phase, BCG conducts a large-scale online survey of up to 20,000 consumers, then uses an AI software tool with a proprietary algorithm to analyze the data and identify the factors (demographic, contextual, behavioral, and attitudinal) that play the biggest role in driving consumer choices among multiple options. For instance, viewers want to be entertained or inspired, but they also make decisions based on price, convenience, and ease of use. Content is still king, but our research has shown that there are vast disparities (up to a 90% drop-off rate) between the proportion of consumers who say that they favor a certain genre and those who are actually willing to pay for it.

A basic tenet of DCG is that people do not make decisions solely on the basis of demographic factors like age, gender, income, education, or marital status. Individuals have different needs, and they make different decisions depending on occasion, circumstances, and context. For instance, the same individual might have completely different viewing tendencies and preferences depending on whether she is unwinding after work by herself, enjoying a movie night with a partner at home, or planning the entertainment for a party of family and friends.

A basic tenet of DCG is that people do not make decisions solely on the basis of demographic factors.

The methodology taps into the emotional and functional needs that drive decision-making. By understanding these needs, BCG can help companies develop demand maps that provide an objective, comprehensive picture of the Identifying the Sources of Demand to Fuel Growth.

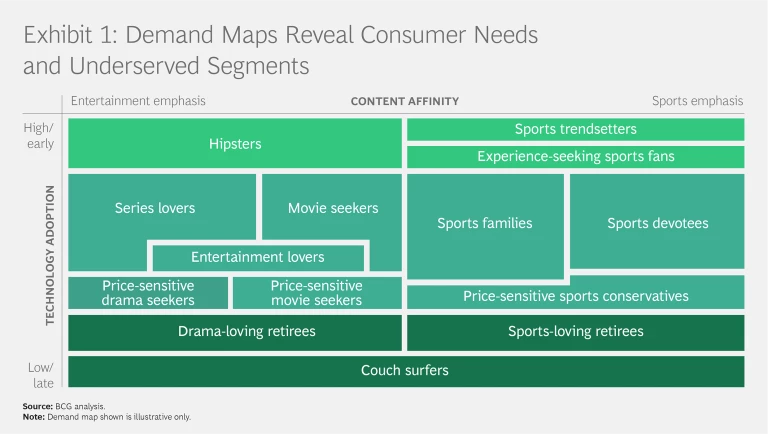

We recently used the DCG methodology to help a pay TV provider understand the key factors underpinning subscription and usage decisions. After testing the relative importance of approximately 60 variables, the team determined that two primary factors—content affinity and technology adoption—play the biggest roles in the subscription decisions. (See Exhibit 1.)

Exploring Demand Spaces

In many industries, the needs that drive a purchase (of a hamburger, say) and the needs that drive the use of the purchase (eating the hamburger soon afterwards) are similar, if not identical. In pay TV—and in media and entertainment in general, where subscription-based business models are likewise common—those two needs can differ. A consumer may subscribe to a streaming service in order to watch his favorite sports team but, after the season ends, maintain his subscription and start watching other content, whether to be part of discussions about a particular series or for some other reason.

To derive the greatest benefit from DCG, media companies need to analyze both types of consumer needs—those that drive initial subscription purchases and those that motivate the actual use of the service.

DCG groups consumers with similar emotional and functional needs when consuming entertainment or shopping for a pay TV subscription within specific demand spaces. For example, some viewers may be motivated primarily by the need to be in on the latest hit show or movie. Those in a different demand space may place more value on programs that provide a relaxing backdrop for gatherings of family and friends.

Once the emotional and functional needs that define the various demand spaces are understood, BCG describes each one across multiple dimensions. For example:

- Opportunity size is based on factors such as the number of households in the demand space, subscriptions per person, per capita spending, and market share already held by various providers.

- Content attitudes and preferences include consumers’ favorite genres and subgenres, hours spent watching on-screen content each week, and the importance of local versus national or international content.

- Typical media consumption experience might address whether consumers usually watch pay TV alone or with friends, live or on-demand, on a TV screen at home or on a mobile device while traveling by bus or train.

- Willingness to pay would assess consumers’ interest in paying for various types of content or certain technical features (such as HD or UHD picture quality), in entering into long-term contracts, or in purchasing specific content versus having access to a diverse content library.

- Brand perceptions cover both awareness of specific brands and how well those brands meet consumers’ emotional and functional needs.

- Demographic characteristics include gender, age, occupation, income, and household size. (It’s important to note that demographic traits such as gender can vary across demand spaces, but the gender ratio does not necessarily drive the purchase decision.)

Demand Maps Guide Strategy

Demand maps help companies answer three strategic questions that are key to achieving growth: Where should we play? How can we win? And do we have the ability to win?

Where to Play. Demand maps illustrate the biggest, most valuable demand spaces, or those with the largest growth potential. DCG research helps companies determine the extent to which their brands are already a good fit with the most important demand spaces or whether they need to rebrand in order to boost their appeal in those spaces.

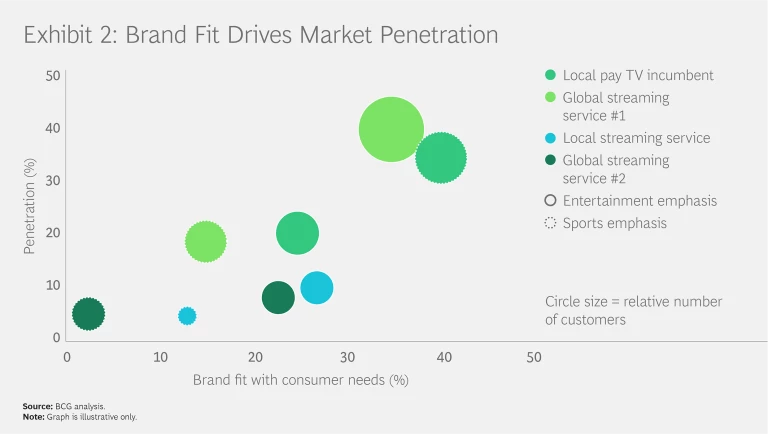

Brands that deliver on consumer needs within a certain demand space generally outperform other brands in penetrating that space and capturing market share. (See Exhibit 2.) Sometimes research reveals that a product meets the emotional and functional needs of a certain demand space, but consumers in that space still have a poor perception of the brand. In such cases, a company can probably improve its performance by shifting its marketing focus or even rebranding the product.

How to Win. Demand maps give companies a deep understanding of consumer priorities and values in terms of both content and technical features. Some consumers relish the thrill that comes with being early adopters of the latest technology, but our research shows that most people are still focused on ease of use rather than technical frills. For example, a majority of consumers are still open to having a physical set-top box with their pay TV subscription.

The consumer insights that DCG provides can give pay TV providers other clues as to how to win in important demand spaces. For instance, the data shows that many consumers compile their own bundles of pay TV and streaming services. Seeking to capitalize on the desire for convenience and own the relationship, providers such as Sky are striking deals with the competition in order to proactively offer their customers bundled access to content from streaming services like Netflix and DAZN, as well as streaming music from Spotify. Bundles like this are a smart move in an environment where pay TV providers must compete against multiple types of content providers for the time that consumers spend on entertainment.

Individuals have different needs and make different decisions depending on the occasion, circumstances, and context.

Ability to Win. Demand maps let companies assess the level of investment and the degree of difficulty involved in capturing the most promising growth opportunities in each high-priority demand space. Pay TV companies should ask themselves such questions as:

- Do we have the right content on hand to meet the needs and expectations of our target consumers?

- If not, should we develop new content ourselves or form partnerships with other providers?

- Do we have the technological capabilities to meet consumer needs and expectations for speed and picture quality? Do our servers have the capacity to handle high access rates when millions of viewers all try to view new episodes of their favorite show at the same time?

- Can we use digital marketing to reach consumers when and where they will be most receptive to our message?

DCG gives pay TV and other media companies insights that they can put to use in product development, marketing, and sales. When companies are ready to execute on their chosen growth strategy, BCG’s Customer Influence Pathways methodology provides marketing, sales, and digital teams with a unified way to manage the entire customer journey, from prepurchase to consumption.

DCG Is Helping Media Companies Find a Path to Growth

DCG has proven its value across media sectors, helping print, free-to-air, and pay TV companies to stimulate or accelerate growth. Some examples:

- DCG helped a large European news and lifestyle publisher break down internal silos, develop new products, and encourage collaboration after research showed that the traditional separation of print and digital did not accurately reflect consumer needs for entertainment and information.

- A European pay TV provider was seeking to attract more female viewers. DCG research showed that all demand spaces had a fairly even mix of female and male viewers. Instead of fruitlessly hunting for female-dominated segments that did not exist, the insights afforded by DCG allowed the provider to redesign its pricing and packaging and reposition its brand to tap into growth opportunities in demand spaces where it had low market share.

Demand Centric Growth provides the insights that incumbent pay TV and other media companies need to reset their strategy, adopt a challenger mentality, and establish a new growth trajectory. By combining a consumer-centric understanding with hard data on market opportunities and practical guidance on go-to-market execution, the methodology helps companies identify, quantify, and pursue their most promising growth opportunities.