Our Approach to Semiconductor Consulting

We view the semiconductor industry through a holistic lens. That’s because it takes an end-to-end perspective and a range of capabilities to seize the full potential of an evolving, often volatile, global semiconductor market. Delivering innovative solutions and business models in the most effective and efficient way is key. This requires a long-term vision, growth enablers, and a trifecta of technical, business, and market insights. To guide the way, we’ve developed our semiconductor consulting around five building blocks:

- A Client Enablement Model. We help clients identify and seize opportunities. But just as importantly, we empower them: helping companies create—and continually improve—the enablers that accelerate growth, whether it’s agile ways of working or advanced analytics. The idea: to transfer our capabilities, so our semiconductor clients can run with their vision autonomously.

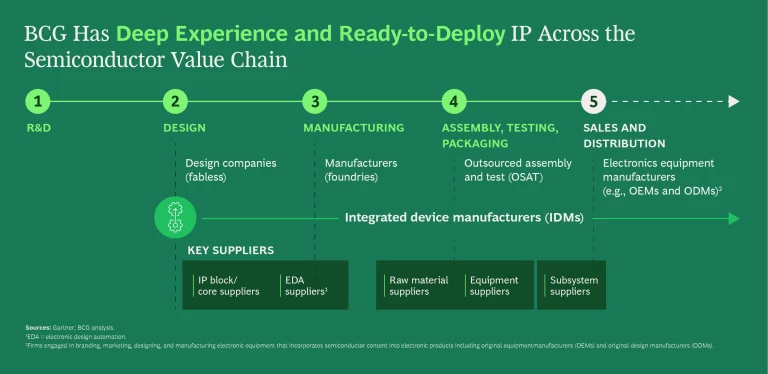

- Experience Across the Semiconductor Value Chain. We work with integrated device manufacturers, fabless companies, foundries, and other players along the semiconductor supply chain. We also partner with end-market clients, such as automotive manufacturers, consumer electronics companies, and telcos. This gives us deep insight into the interactions and interdependencies that drive—and sometimes challenge—the global semiconductor market. And it helps us optimize strategies and solutions.

- Cross-Functional Expertise. Our semiconductor industry experts work as part of team, one that includes thought leaders across an array of key functions: strategy, including go-to-market and pricing, cost excellence, people and organization, M&A integration, and much more. This deep bench of talent lets us tackle the various problems—and opportunities—in an integrated way. So, both the roadmap and its implementation are optimal.

- Tailored Solutions. There is no textbook business model or environment in the global semiconductor market. Different companies work at different stages of the semiconductor value chain; technologies, competitive dynamics, and even local policies will vary. That’s why we take a tailored approach, considering a company’s unique circumstances to develop unique solutions. But there are some common threads, like our emphasis on collaboration and data-driven insights.

- Proprietary Tools. Our people are our greatest asset, but our tool bag is formidable, too. On Day 1, we bring unique—and battle-tested—frameworks, analytics models, diagnostics, and datasets. Developed by cross-functional BCG teams, these tools enable our semiconductor industry experts to deliver deep insights into areas like fab and OSAT economics, semiconductor supply and demand, climate and sustainability, government policies, and supply chain activities.

Our Client Work in the Semiconductor Industry

We partner with a full spectrum of industry players from semiconductor design companies and end-product manufacturers to industry giants and high-growth startups. They all share a relentless drive to innovate—and get results. So do we. Here are some examples of our work.

Our Insights on Semiconductors

Meet Our Semiconductor Industry Experts