Hotter-than-ever competition. Overcapacity. Commoditized offerings. Fickle customers comparing prices and products with mere swipes of their mobile screens. These and other forces are squeezing many travel and tourism players, putting unprecedented pressure on prices in some sectors and geographies. But the same forces are also creating new opportunities—because companies that achieve a competitive edge in pricing will see a magnified impact on performance.

Under these conditions, A Renaissance for Revenue Management in Travel and Tourism? is more crucial than ever. With that in mind, some players have begun experimenting with innovative techniques like personalized pricing and dynamic online repricing. But even before these advances deliver their full impact, companies still have a major opportunity to get more from P&RM.

P&RM’s Potential for Travel and Tourism

The Boston Consulting Group’s recent survey of C-suite executives and P&RM leaders from multiple travel and tourism sectors suggests that P&RM counts among the most pressing topics on industry leaders’

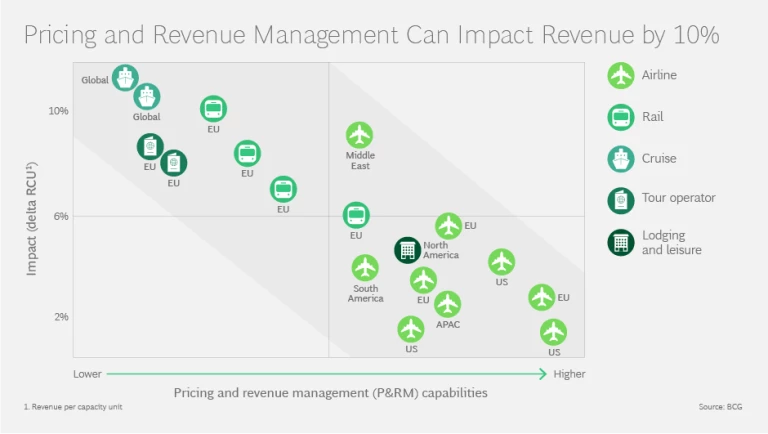

Indeed, BCG’s experience with clients confirms that the right approach to P&RM can exert a major impact on companies’ top line—as much as a 10% increase in revenue per capacity unit (RCU).

Sure, some sectors—most notably, commercial aviation—have long used practices like dynamic pricing. For companies in these sectors, additional benefits from improved P&RM may fall in the 2% to 6% range—still a valuable opportunity. But in sectors where use of sophisticated P&RM practices hasn’t yet become standard—such as railways, cruise lines, and tour operators—deploying such practices can deliver a considerably larger advantage.

Wanted: A Better Approach to P&RM

Yet mastering the complex art of P&RM isn’t easy. Success hinges on active involvement from stakeholders at all levels of the organization—from the CEO to IT system managers. As the company moves along the path to better P&RM, it can encounter a number of common pitfalls.

For instance, the P&RM team may not be attuned to the strategic direction defined by top management. Our survey findings suggest that many P&RM heads see less of an opportunity from improving P&RM than senior executives perceive. Companies in which the two groups are aligned on P&RM’s potential have a better chance of fully capitalizing on the opportunity.

Other companies fall into the “black-box” trap. In this trap, the P&RM team doesn’t have full visibility into how the P&RM systems they’re using operate. Consequently, those systems may not fully support the company’s objectives, its business model, or the competitive dynamics of the industry as these change over time.

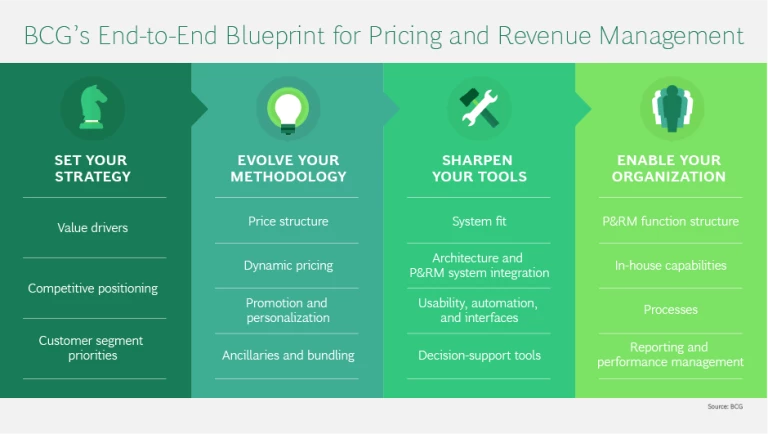

To overcome these challenges, craft the right P&RM strategies, and ensure that those strategies are successfully executed, companies need a holistic, end-to-end approach to P&RM.

A Closer look at BCG’s P&RM Blueprint

BCG’s P&RM blueprint—developed from the outcomes of 100-plus client projects across a range of travel and tourism sectors and geographies—is built on the understanding that to effectively manage their pricing and revenue, companies must address four crucial questions:

- Is our P&RM approach set up to deliver on our company’s strategic priorities?

- Is our P&RM methodology sophisticated enough to help us maximize our revenue—but not so sophisticated that we have difficulty using it?

- Do our dedicated systems and tools effectively support all key P&RM decisions made in our company?

- Is our P&RM team empowered to consistently apply best practices?

The BCG blueprint is designed to help companies answer these questions and identify changes needed to optimize revenue in their day-to-day operations.

SET YOUR STRATEGY

In developing P&RM strategies, travel and tourism companies must weigh a number of considerations, such as which value drivers to maximize; how to define their competitive positioning; and which customers should be prioritized.

-

Choose the right value drivers. As many as 70% of our survey respondents said they base their P&RM decisions on how best to maximize load factor, occupancy, or other equivalent measures of capacity utilization—even at the expense of average price. In our experience, strategies aimed at maximizing RCU, which combines load factor and average price, deliver greater value. What’s more, companies that focus on improving total revenues across tickets and ancillary products sold are better positioned to capture the full value on offer in specific markets and customer segments.

The way a company is organized can influence choices about which value drivers to focus on. For example, companies with a strong sales function—one that has veto power on pricing or even full ownership over pricing decisions—may tend to focus on maximizing volume rather than RCU. Such companies may thus set prices that don’t capture the full potential of individual customers’ willingness to pay (WTP).

To help senior leaders make the right strategic choices, P&RM teams should provide dedicated reports showing performance on the full set of relevant metrics.

-

De-average your competitive positioning. Our survey results suggest that in sectors with commoditized products and scant opportunity for differentiation, companies tend to use benchmarking to determine their price positioning. Indeed, 90% of the P&RM heads in our survey who work in commercial aviation rely on benchmarking to set prices. Sectors with opportunities to more sharply differentiate their offerings, such as cruises and tour operators, are more likely to use a strategic approach, by basing their pricing on WTP.

Some companies have an opportunity to develop price positioning strategies no longer at high-level but for individual markets—such as a rail route or a cruise itinerary—and by taking an analytical, structured approach to capturing each market’s full potential value. For instance, they must factor into their analyses elements such as intensity of competition, cross-price elasticity, WTP, and the product’s quality service index.

- Set customer segment priorities with market research and advanced analytics. Roughly 80% of our survey respondents said that their company seeks to address different needs in priority customer segments to fully capitalize on their WTP. But to accomplish this, companies need both a thorough understanding of customers’ unsatisfied needs and an analytical approach to measuring WTP. Few companies meet this dual imperative. Instead, many define customer segments based only on their own experiences with customers. They could craft smarter segmentation strategies by augmenting their experiences with additional data and insights gleaned from external consumer research. The result is a strong fact base to inform decisions about price structure as well as ancillaries and bundling strategies.

EVOLVE YOUR METHODOLOGY

To implement their P&RM strategies, companies need the right methodology—the set of algorithms and logical steps the organization uses to make decisions in areas such as price structure and dynamic pricing, promotions and personalization, and ancillaries and bundling. With the right methodology, all key P&RM activities are more likely to consistently deliver the intended impact on the final prices presented to customers.

- Challenge your price structure and dynamic pricing methodologies. Twenty percent of the P&RM heads represented in our survey said they’re not satisfied with the accuracy of price-elasticity estimates used in their algorithms. Even in sectors that have long used dynamic pricing (such as commercial aviation), operators can squeeze more value from this practice by embedding competitive pricing in their algorithms, including measuring cross-price elasticity of demand. Additionally, companies can unlock further value by adapting their P&RM methodology to markets and seasons in which customer booking behavior and price sensitivity change substantially.

- Measure the impact of promotions and personalization . Findings from our survey suggest that travel and tourism companies tend to use promotions as a tactical measure; for instance, to stimulate demand or to fill last-minute capacity. More than 85% of our respondents acknowledged using promotions in such ways. To get more strategic value from promotions, many companies could take a more analytical approach to assessing their impact; for instance, by measuring promotions’ return on investment—something that only one-third of our survey respondents do.

- Advance your ancillaries and bundling capabilities. Across travel and tourism sectors, the ancillaries and bundling offering has been increasingly important for driving up-selling and cross-selling. Yet less than 20% of our survey respondents said that their company has invested considerably in P&RM for ancillaries and bundling.

In our experience, companies can boost value significantly by improving their pricing methodology for ancillaries and bundling. For instance, they can conduct more scientific analyses of differences in WTP. A good first step to unlocking this opportunity can be to deploy business intelligence tools and systems to better support ancillary and bundling revenue management decisions.

SHARPEN YOUR TOOLS

To systematically apply their selected P&RM methodology, companies need support from P&RM systems and tools—which must process vast volumes of data to inform day-to-day pricing decisions. The right system fit, along with appropriate system architecture, interfaces, and decision-support tools, can help.

-

Manage your P&RM system fit to company’s objectives and capabilities. Companies rely heavily on IT systems to manage dynamic pricing. These systems comprise sophisticated algorithms aimed at helping a company to optimize prices based on demand estimates and supply constraints. In some companies, such systems are more sophisticated than they need to be to maximize prices and revenue—and may even become too sophisticated for P&RM teams to use, given their current capabilities.

Using custom-built systems or customizing vendor-provided systems seems to help companies surmount these challenges. In our survey, 85% of respondents from companies operating such systems said they were satisfied with their P&RM performance and consider their dynamic pricing “strong.” Only 60% of respondents using an off-the-shelf system expressed the same sentiments.

- Do not overlook P&RM team interactions with interfaces and decision-support tools. To get the most value from their P&RM system, companies must make numerous complex technical choices. These include how best to design user interfaces and which P&RM-related tasks will be automated versus performed by analysts in the P&RM team. By making smart choices in such areas, companies improve the odds that their P&RM system will deliver the data that analysts need to make effective pricing decisions.

ENABLE YOUR ORGANIZATION

To make sure that their chosen P&RM methodology will work as intended, companies must also activate organization enablers such as the following.

- Set your P&RM function structure to maximize ROI on costly P&RM systems. Our survey results show that companies offering a standardized product tend to centralize their P&RM function. Roughly 80% of our respondents in the commercial aviation sector said that responsibility for all crucial P&RM activities lies at the corporate level in their company. This perhaps isn’t surprising: Heavy investment in sophisticated P&RM systems creates a strong incentive to centralize the function so senior leaders can tighten their control over P&RM teams and build capabilities that their company needs. In sectors with higher product differentiation for diverse markets, companies may want to locate control over dynamic pricing and promotions that should be tailored to specific customer needs and market trends at the regional or country level instead of at the corporate level.

- Develop in-house P&RM capabilities. All of the P&RM heads in our survey agreed that developing their team’s capabilities is important. Yet only about 60% described their team’s skills as strong. The fact is, too many P&RM teams comprise members who lack the background and experience necessary for using sophisticated P&RM systems. Our work with clients suggests that teams should include experts in three major capability areas:

- Pricing analysis, such as combining detailed data on revenue performance with deep knowledge of the market, and developing strategic recommendations.

- Inventory analysis, including managing day-to-day tactical pricing decisions that require the use of large datasets, at times with limited information at hand.

- Data science; for example, applying advanced analytical approaches (such as linear optimization and AI) to develop P&RM models that drive optimal pricing decisions.

Experts who excel at pricing analysis or inventory analysis along with data science will bring the most value to P&RM teams in the future.

- Define the right P&RM decision processes. In many companies, P&RM analysts decide how to use their time and prioritize the product and service offerings they manage. Some devote more time to departures (for example, by train or airplane) scheduled for the next few days, driven by alerts or habit. But in that timeframe, analysts have only so much power to fill any residual capacity before it “spoils.” For example, when demand is weak, build volume last minute is very difficult. P&RM teams could exert a much bigger impact on profitability if they systematically prioritized their work according to the potential upside they can achieve. To help them do so, companies must design a consistent approach to prioritization, supported by decision-support tools.

- Motivate your P&RM team with performance management schemes. Several companies consider P&RM analyst work merely operative and technical. This viewpoint overlooks the substantial impact on a company’s revenues that analysts can achieve—if they consistently demonstrate exceptional performance in their role. The right incentive systems can help. Performance metrics that strike a balance between the accuracy of an analyst’s decisions and the top-line impact on his or her product portfolio can motivate team members to step up their performance. Equally important, this approach can help companies attract and retain the best P&RM talent.

Given the tough conditions reshaping the travel and tourism industry today, companies can’t afford to ignore the opportunity to strengthen their P&RM approach. BCG’s P&RM blueprint provides an end-to-end approach that can help. By applying this blueprint, companies improve their chances of breaking free from the forces currently squeezing travel and tourism players—and achieving revenue benefits of up to 10%.