It is time for a closer look at Latin America. Today, the region offers some strong, resilient economies with solid opportunities for growth that set them apart from other markets and from the region’s volatile history. Within this new environment, a group of bold Latin American companies are expanding their operations internationally with impressive speed, ingenuity, and sophistication. The growth paths and approaches adopted by these thriving multilatinas may offer valuable lessons to others.

Latin America is a massive, diverse, and vibrant region. Its nominal GDP ($4.2 trillion in 2008) is equivalent to China’s, it has a very large population (562 million), and its market capitalization ($1.6 trillion as of June 2009) is greater than that of Eastern Europe and Russia combined.

While it is home to 20 countries, the region is more coherent culturally and linguistically than is Africa, Asia, or Europe. Barriers to regional trade are low and facilitated by regional frameworks. And economic activity is concentrated in a few large markets, with Brazil and Mexico—the two largest countries—accounting for 63 percent of regional nominal GDP.

Latin America is also a growth market. Although its GDP growth rate over the past five years did not match China’s spectacular growth rate, it consistently ranged between 3.9 and 4.8 percent per year.

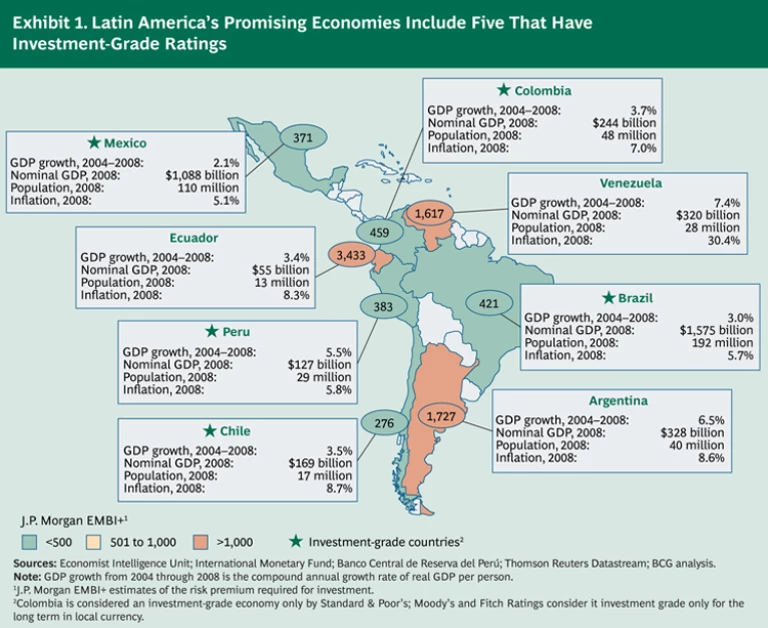

It is important to de-average these overall regional data points and take a deep look into the risks and opportunities in each market. The region has a volatile history, and some countries still have risky business and political environments. However, in recent years some major countries have reduced their debt levels, strengthened their currency reserves, and applied discipline to their fiscal deficits. The results have been unprecedented reductions in country risk and interest rates, creating unique opportunities for companies based both within and outside the region. In fact, for the first time, the region is now home to five investment-grade economies: Brazil, Chile, Colombia, Mexico, and Peru, which together are responsible for 75 percent of the region’s nominal GDP. (See Exhibit 1.)

A New Perspective on Latin America

The Impact of the Economic Crisis. The current global economic crisis—the worst since the Great Depression of the 1930s—has clearly made itself felt in Latin America, as elsewhere around the world. All countries in the region have been affected in a variety of ways, including falling prices, shrinking export volumes, erosion of consumer confidence, credit scarcity, limited liquidity, and capital flight. These effects, in turn, have had negative impacts on financial markets, currency values, economic-activity levels, consumer behavior patterns, company performance levels, and market valuations. Furthermore, several dozen companies, mostly in Brazil and Mexico, suffered severe losses in late 2008 as a result of exposure to exchange rate derivatives. The Bank for International Settlements estimated that Brazilian companies lost $25 billion in these transactions whereas Mexican companies lost $4 billion.

On the positive side, Latin America has been less affected by this crisis than by others in the past. In previous crises, such as the Latin American debt crisis in 1982 and the Tequila Effect during 1994 and 1995, the region was either at the epicenter or more severely affected than other regions. In contrast, with respect to the current crisis, the World Bank forecast of June 2009 estimates that in 2009, the GDP of countries in the Organisation for Economic Co-operation and Development will contract by more than 4 percent on aggregate, while Latin America’s GDP will shrink by only 2.2 percent.

Latin America’s relatively positive current position rests on two factors. First, the practices that triggered the crisis elsewhere are not present in the region; household debt is, on average, at manageable levels, and local banks are less leveraged and not directly exposed to toxic assets from overseas.

Second, the region is much better prepared to confront this crisis than it was to face others in the past. Many indicators are more favorable than they were at almost all other moments of crisis in recent decades, providing unprecedented strength and room for policy responses. For instance, on average, Latin American governments are far less indebted in terms of both net foreign debt as a percentage of GDP (down to 2 percent at the end of 2008 from a high of 30 percent during the 1982 Latin American debt crisis) and short-term debt as a percentage of international reserves (down to 22 percent in 2008 from a high of 227 percent in 1982). Inflation rates are lower and stable, averaging 8 percent per year across the region (versus 66 percent in 1982). Money market interest rates currently hover around 10 percent (versus 67 percent in 1982), and unemployment is a manageable 7 percent.

It should be noted, however, that the impact of the crisis varies significantly from country to country. Some, such as Venezuela, are particularly exposed to commodity prices and country risk. Others, such as Mexico, are affected because of their multiple connections to the U.S. economy. Still others, such as Argentina, are particularly vulnerable because of their fiscal and debt situations.

In contrast, major countries, including Brazil and most of the other investment-grade markets in the region, are expected to quickly resume their growth trajectories. Analysts expect GDP to recover in 2010 across the region, attaining GDP growth rates ranging from 1.1 to 4.7 percent, with especially strong performance in Brazil, Chile, and Peru.

The Region’s Prospects for Profitable Growth. The global crisis remains very serious. The world economy is likely to continue to suffer sluggish growth and uncertainty, possibly for some years. As the crisis is still unfolding, it is too early to foresee its ultimate implications for the region, particularly if the downturn is protracted.

Nonetheless, in our view, even in such an adverse global context, we expect Latin America to sustain above-average performance in the medium to long term. The region as a whole is better prepared to face this crisis than most, with the investment-grade countries—Brazil, Chile, Colombia, Mexico, and Peru—leading the pack and providing critical mass for growth in the region.

The resilience and growth potential of Latin America’s major economies are based on significant structural factors, which are especially striking in some countries, most notably Brazil (the region’s largest economy). These factors include structural reductions in the cost of capital (both equity and debt); relatively low levels of credit penetration; conservative banking practices and sound financial institutions; an increasingly diversified and modern economy; abundant natural resources; a young, growing, and increasingly educated population; improved access to information and global markets; crisis-seasoned institutions and leaders; and the emergence of local companies with international aspirations.

Structural Reductions in the Cost of Capital (Both Equity and Debt). This major achievement has been brought about by improved fundamentals. In Brazil, for example, country risk as measured by J.P. Morgan Emerging Markets Bond Index Plus (EMBI+) is at 280 basis points (June 2009 average) compared with 670 basis points five years ago (June 2004 average) and 1,000-plus basis points ten years ago (June 1999 average), while nominal benchmark interest rates are at unprecedented one-digit levels (9.25 percent in June 2009). Structural reductions in the cost of capital have spurred the development of capital markets and created opportunities in infrastructure, real estate, and other long-term investments.

Relatively Low Levels of Credit Penetration. This condition will give companies ample room to use debt to finance growth once liquidity in the markets returns to more normal levels. In Latin America in 2008, private-sector debt as a percentage of GDP was 29 percent—much lower than other countries’ or regions’ levels. For example, China’s 2008 private-sector debt represented 103 percent of its GDP. In Western Europe the percentage was 137, in the United States, 158 percent, and in Japan, 167 percent.

Conservative Banking Practices and Sound Financial Institutions. The region has a relatively low level of bank loans as a percentage of bank deposits (77 percent for Latin America in 2008, compared with 137 percent for Russia, 116 percent for Western Europe, 103 percent for the United States, 92 percent for China, and 86 percent for both South Korea and Eastern Europe). This, among other factors, allowed banks in Latin American countries to suffer less impact from the crisis than banks in other countries, such as the United States, and to be better positioned to support the recovery of their local economies.

An Increasingly Diversified and Modern Economy. With the growth of strong regional players over the past decade, Latin America’s economy has become increasingly diversified. These companies compete with multinational corporations (MNCs) based outside the region in various high-tech sectors, such as aerospace and defense, transportation, telecommunications, automotive, technology, and software design.

Abundant Natural Resources. This attribute of the Latin American region is exceptionally valuable in an increasingly commodity-constrained world. Latin America possesses 30 percent of the world’s fresh water, 48 percent of its copper, 19 percent of its iron ore, 13 percent of its petroleum, 23 percent of its natural forests, and more than 50 percent of its soybean production. Clearly, these resources provide a platform for growth and specifically for competitiveness in industries such as steel and paper.

A Young, Growing, and Increasingly Educated Population. Latin America’s population has grown at some 1.5 percent per year over the past 10 years, and 57 percent of the population is under 30 years old. Moreover, the literacy rate among people aged 15 years old and above increased from 91.8 percent to 93.5 percent over the past 10 years, while enrollment in universities almost doubled from 1.7 percent to 2.9 percent of the total population. This “demographic bonus” will fuel growing consumer spending as the young, increasingly educated sector of the population comes into its prime years for establishing households. It will also support the region’s need for highly qualified workers and managers as national economies continue to expand.

Improved Access to Information and Global Markets. The increasing penetration of new technologies, such as the Internet and cellular phones, is narrowing the information access gap and lowering transaction costs relative to other regions. For example, cellular phone penetration in the region increased from 25 percent in 2003 to some 80 percent in 2008.

Crisis-Seasoned Institutions and Leaders. The experience and know-how Latin American leaders bring to the present crisis has helped the region to be flexible and adapt to increased global volatility.

The Emergence of Local Companies with International Aspirations. Local companies are reshaping the regional competitive landscape as they expand outside their home countries, across the region, and beyond.

The Region’s Fast-Changing Corporate Landscape. The corporate landscape of Latin America is changing rapidly. Over the past two decades, privatization, trade agreements, deregulation, the development of capital markets, and increased pressure from international competitors have contributed to a market environment dominated by private companies—an increasing number of which are operating internationally.

Our analysis shows that the internationalization process is both deeper and more advanced than most observers might realize. For instance, we identified in our research 471 companies with 2007 regional revenues of more than $500 million. We categorized them in four groups, according to their international profiles:

- Local Companies. Each local company is based in one Latin American country and operates within its borders. Local companies represent 27 percent of the group of 471 but only 15 percent of its revenues. They tend to concentrate in specific industries—such as utilities, media, distribution, and infrastructure—in which foreign ownership is limited as a matter of government policy.

- Exporters. Each exporter is based in one Latin American country and earns at least 10 percent of its revenues from exports. Together, exporters represent 16 percent of the group in terms of number of companies and 13 percent of the group in terms of revenues. Many of these companies have supporting international commercial networks.

- MNCs. These companies are based outside the region and have operations in one or more Latin American countries. They represent 36 percent of the companies in the group and earn 38 percent of the revenues.

- The 2009 BCG Multilatinas. These 100 companies are a thriving breed of competitors that are headquartered in Latin America and controlled by shareholders based in the region. All 100 BCG multilatinas have significant operations and foreign direct investments outside their home-country markets. They represent only 21 percent of the companies in our study group but account for an impressive 34 percent of its revenues.

2