The following article originally appeared in M&A: Using Uncertainty to Your Advantage .

That article was based on a survey of the M&A plans of European

Given the acute pressures faced by biopharmaceutical companies that originate innovative drugs, this industry provides a good illustration of why skillfully executing the right kind of M&A can spell the difference between emerging from the current uncertainty in a weaker or a stronger competitive position. Below, we provide a brief overview of the industry’s challenges and M&A options, based on our strategic insights into the industry and our functional expertise in M&A, followed by specific recommendations for biopharmaceutical companies regarding M&A. Our analysis focuses on drug originators rather than on producers of generic or over-the-counter drugs, although some of the same challenges and solutions apply to them as well.

Facing pressure from all sides, the pharmaceutical industry is one of the likeliest to generate a high degree of M&A activity. A confluence of four major strategic challenges makes the prospects grim for large drug originators: the so-called patent cliff, rising pricing pressures, the faltering R&D-driven business model, and the growing importance of emerging markets.

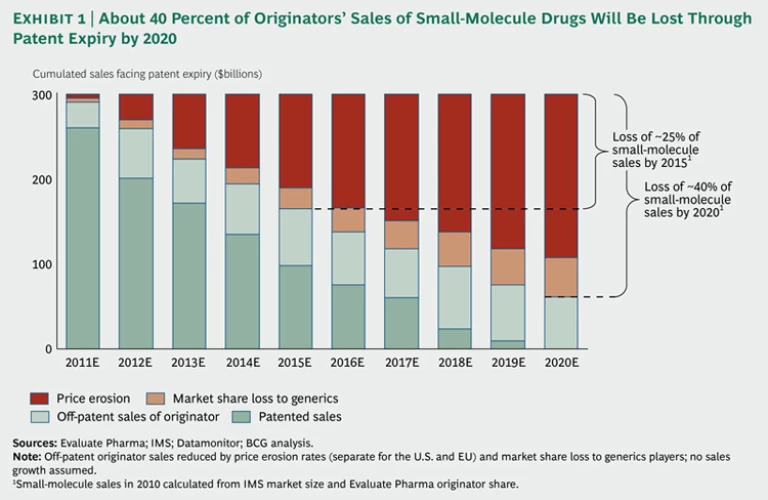

Falling Off the Patent Cliff. Over the next five to ten years, many of today's top-selling drugs will lose their patent protection, especially the small-molecule drugs that dominate the product portfolios of major originators. For many of these companies, revenues in the near future will fall steeply as prices plunge and cheaper generic versions grab market share. We estimate that originators’ sales from currently marketed small-molecule drugs will drop by about 40 percent by 2020 due to patent expirations, with almost two-thirds of this loss occurring in the next five years. (See Exhibit 1.) Not all originators will be hit equally. Pfizer, for example, with the expiration of just one patent—for the cholesterol-lowering drug Lipitor in November 2011—faces a potential loss of up to $11 billion in revenue, or 15 percent of its sales. As a result, the company is expected to lose its number-one market position in terms of sales to Sanofi. Because of the patent cliff, many pharmaceutical companies face enormous pressure to slash their large fixed costs or to refill their product pipelines.

Price Premium Pressures. Further revenue losses are being induced by pressure on price premiums for innovative drugs from governments and payers trying to rein in soaring health-care costs. Prices for new drugs are increasingly tied to clear evidence of incremental benefit over the next-best drug available. Other price-control mechanisms imposed by health care providers that depress the revenues and margins of both new and existing drugs include price caps, mandatory discounts, and reference price systems.

A Faltering Innovation Model. The basis of originators’ business model—creating innovative drugs—is also being fundamentally challenged. While global R&D costs have risen by an average of 9 percent annually since 1999, the payoff has not increased. The number of new-drug approvals per year has remained essentially flat for more than a decade. (See Exhibit 2.) The reason for this decline in R&D productivity is that achieving breakthrough innovation with chemically synthesized drugs, still the dominant technology among many originators, is becoming more difficult. Small-molecule drugs for many diseases already exist, and further advances tend to be incremental. In addition, regulators are tightening approval requirements, making it harder to bring new products to market. The search for breakthrough therapies that address important unmet needs, such as chronic and degenerative diseases like cancer and HIV, is frequently driven from the field of biologics, where many originators are not yet as strong as in small molecules.

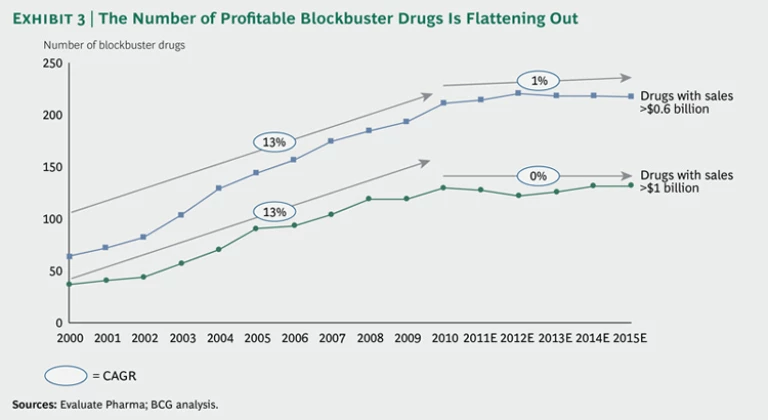

The problem becomes especially evident when we look at the number of hugely profitable blockbuster drugs in the market. (See Exhibit 3.) While this number rose by an average of 13 percent each year from 2000 through 2010, it is expected to remain flat over the next five years.

The Emerging-Market Imperative. Most originators are facing a mismatch between their geographic exposure and product portfolio, on the one hand, and their market opportunities, on the other. As a result of the patent cliff, price pressure, and a stuttering innovation engine, their core markets in the developed world are expected to stagnate in the years ahead. Growth will come from emerging markets with large and expanding populations, developing health-care systems, rising wealth, and a growing incidence of lifestyle diseases such as diabetes. Pharmaceutical sales are projected to grow by an average of 14 percent per year in key emerging markets through 2015. In contrast, 5 percent average annual growth is expected in Japan and virtually none in North America and Europe.

Yet Western originators still have a relatively limited presence in the “pharmerging” regions, and these drug markets remain small. As a result, emerging markets will not easily compensate for stagnating revenue in the West, at least in the short term. What’s more, the product portfolios of many originators are frequently not well suited to emerging economies, where demand is still focused on basic, low-cost generic and over-the-counter medications. Selling product portfolios that are heavily dominated by innovative drugs at high premiums, therefore, is a challenge. In addition, originators’ focus on innovation makes it difficult to establish the rock-bottom cost structures often necessary to succeed in emerging markets.

Biopharmaceutical companies can, of course, expand into the growing segments of biologics and generics. But these businesses can only partially compensate for losses in the short term. Margins in the generics industry, for example, are themselves under pressure from the clampdown in health care spending and from competition that is even stiffer than that for patented drugs. Finally, operating a low-cost business model in parallel with one driven by innovation is generally difficult for originators because of the differences in governance, corporate culture, and strategic focus.

Dissecting Pharmaceutical M&A Moves

The patent cliff. Price pressures. The faltering innovation model. Underexposure to growing market segments. Strategic challenges are hitting pharmaceutical companies from all sides, strangling growth prospects and margins. While organic changes are therefore a necessity for most biopharmaceutical companies, the extent of the challenges make M&A an increasingly necessary part of the strategic response as well.

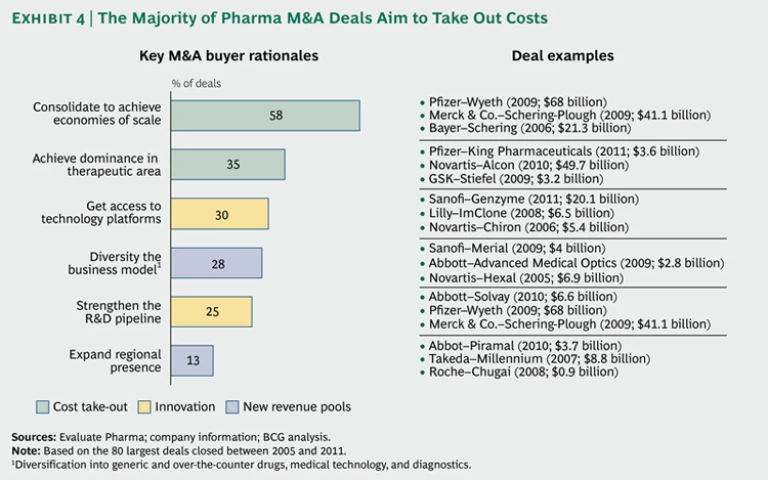

To understand the many ways in which pharmaceutical companies are using M&A to respond, we analyzed the 80 largest pharmaceutical M&A transactions since

Maintaining Margins. In most large deals (58 percent), the major objective was to slash costs through pure consolidation. By combining sales forces, manufacturing, and overhead with those of another company, originators strive to eliminate redundant costs—and to spread R&D investment and the associated risks over a larger revenue base. For example, Pfizer’s 2009 acquisition of Wyeth, which followed its 2003 takeover of Pharmacia, enabled it to build greater scale and secure its position as the world’s largest pharmaceutical company.

Around 35 percent of deals aimed at improving margins by building dominance in a specific therapeutic area. In so doing, companies increased their negotiating power with health care providers and regulators and leveraged their sales forces, R&D capability, and knowledge of patient needs in a given area. In the future, a dominant position in a therapeutic area will also allow companies to extend their business model beyond the provision of drugs to the offer of holistic treatment programs. Novartis’s $49.7 billion acquisition of Alcon in 2010 enabled it to strengthen its presence in the growing eye-care segment, for example.

Bolstering Innovation. It is not surprising that addressing the innovation challenge is the most urgent priority after maintaining margins, since R&D is integral to originators’ business model. Thirty percent of big M&A deals sought to bolster innovation by giving the company access to new technology platforms. Biotech companies are a major target of small-molecule-dominated originators seeking more sustainable growth. The biotech industry is growing much faster (8 percent per year over the next five years) than the small-molecule segment (2 percent) because it still offers greater potential for breakthrough innovations that can command high premiums. While biologics face their own patent cliff, it is often less steep because these especially complex drugs and their production processes are more difficult and costly to copy, which limits competition from generics. Revenues from biologics are therefore more sustainable.

Twenty-five percent of large deals—in addition to a large number of smaller deals—are aimed at strengthening the R&D pipeline with drugs in the early or late stage of development. There is considerable debate in the industry about whether acquisitions are the best way to expand the portfolio of new-drug candidates. One attraction of going to outside sources rather than relying on internal R&D is that the company can essentially turn fixed R&D costs into variable costs. Another is lower risk, since much of the cost of failure is shifted to the outside partners. Moreover, pharmaceutical companies cherish the entrepreneurial spirit that is often pronounced in start-ups. On the other hand, spotting and securing the most promising targets ahead of the competition is difficult, and the deal premiums paid for companies with successful R&D can be stiff. This can depress returns on external R&D investments.

New Revenue Pools. The intensifying search for new avenues of growth beyond established markets was reflected in many of the large pharma M&A deals that we studied. Diversifying into fields adjacent to classic prescription drugs was an objective in 28 percent of these deals. Diversification into over-the-counter drugs, diagnostics, or medical technology can help reduce risks by easing a company’s dependence on patented drugs and by helping it achieve a more balanced mix of businesses and cash flows. For example, Abbott’s acquisition of the surgical-device company Advanced Medical Optics for $2.8 billion in 2009 allowed it to diversify into the fast-growing eye-care device market.

In general, many companies in the diagnostic and medtech segments are still posting attractive growth because they address unmet patient needs, achieve relatively high levels of innovation, and face fewer regulatory challenges. By marketing drugs along with diagnostic and medtech products through product bundling or personalized medicine, originators can often add value and charge higher prices. In ophthalmology, for example, several players offer drugs, surgical instruments, and implantable lenses together. However, establishing a good governance model and go-to-market approach for such a combination of diverse businesses is not easy.

Thirteen percent of transactions were aimed at expanding the company’s presence in strategically important emerging markets. Such acquisitions are generally driven by the search for market access, distribution power, local market know-how, and a suitable portfolio of low-cost products. Abbott, for example, acquired the generic-drug business of India’s Piramal Healthcare for $3.7 billion in 2010. These deals are especially challenging because of the complexities of

Cross-Border E-Commerce Makes the World Flatter

Favorable Conditions, but Solid Execution Required

Despite current market volatility, pharmaceutical companies’ M&A activity should seek to address the challenges described above while also taking advantage of favorable external conditions. M&A activity in the sector has remained strong in recent years, so there is ongoing momentum. Major drug companies have substantial financial firepower: lots of excess cash, low debt levels, and cash flows from current blockbusters that are still strong. Debt financing is still available to high-quality strategic corporate buyers, including pharmaceutical companies. And there are many potential targets. The industry is still highly fragmented, with numerous start-ups and emerging biotech and medtech companies in need of new funding sources in the current environment. Antitrust issues are generally not serious.

The market prices of potential targets have dropped, especially since the recent stock-market correction. The current low valuation multiples of most pharmaceutical companies partly reflect the industry’s structural challenges, inducing many executives to regard potential targets as still too expensive. But others regard this as overly pessimistic. A UBS analysis of global pharmaceutical companies’ current market valuations concluded that they may actually be significantly undervalued relative to their fundamental cash flows. The analysis shows that current valuations assume a 12 percent yearly decline of free cash flow between 2013 and 2020—an outlook that even the most pessimistic industry managers do not share.

Complex Value Creation. Many pharmaceutical executives tell us that the pool of attractive assets is dwindling and that those remaining are of mixed quality. Competition for the remaining high-quality targets is intense, driving up prices and making value creation increasingly difficult.

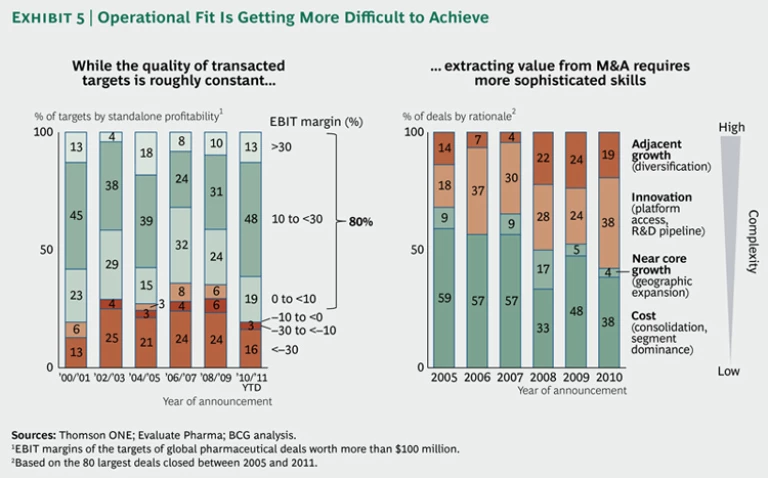

But the belief that asset quality—if measured by profitability—is deteriorating may be off-base. Our analysis of pharmaceutical acquisitions over the past decade does not indicate a downward trend in the profitability of acquired assets. (See the left-hand graph in Exhibit 5.) About 80 percent of acquired targets are profitable, a proportion that has remained roughly constant since 2001. It is true, however, that our analysis looked only at transacted assets, which could be of better quality than those generally available for sale.

Good assets are regularly becoming available as pharmaceutical companies divest well-performing businesses that are not an optimal fit with the parent portfolio and that could perform better under different ownership. For example, AstraZeneca sold Astra Tech, its dental technology, urology-device, and surgical-device business, to Dentsply for $1.8 billion in June 2011. Pfizer is exploring strategic options for its nutrition and animal-health businesses, which it believes have limited synergies with its core human-biopharmaceutical businesses.

Pharma executives are right, though, that fit and the creation of operational value from deals are increasingly difficult. As the focus of M&A shifts from simply consolidating and taking out costs to expanding R&D platforms and fostering adjacent growth, integration and synergies become much more difficult to achieve. (See the right-hand graph in Exhibit 5.)

Extracting revenues from innovation-oriented deals and achieving operational synergies across assets not directly related to the core business are tricky endeavors that often require building new competencies. Deals in which pharmaceutical companies aim to diversify into medtech illustrate how complicated value creation can be. On paper, synergies are often sought by leveraging sales forces or by developing and selling combination therapies. However, many hurdles must be overcome to make this work. Sales forces must learn to sell these combined products, very different R&D departments must cooperate closely, and executives of the combined drug and device business must learn to manage two very different operations. Indeed, Abbott recently announced that it will break up its pharmaceutical and medtech businesses into two independent companies, which it believes can perform better on their own.

Rigorous Execution Requirements. Given that M&A is increasingly necessary—though extracting value is more difficult than it was in the past—what should pharmaceutical companies do?

First, they must be more thorough than ever in searching for attractive targets, determining the optimal fit, and delivering on the promised synergies. To get all this right under the time pressure of completing a deal requires that companies develop clearly defined hypotheses that can be validated early on, instead of waiting until the due diligence process to look for opportunities to create value. Complex opportunities for value creation require that the value proposition, the integration model, and the governance model be clearly defined well ahead of the transaction.

Second, pharmaceutical companies must go beyond looking only for problem-free assets with products that fit perfectly into their existing operations. The key to successful M&A is finding assets that offer more value than is currently reflected in their price. Viewed this way, many complex assets—such as those with issues limited to one area or whose future is uncertain—might make attractive targets if the acquirer is skilled at turning around troubled assets and the deal is structured accordingly.

Sanofi’s $20 billion acquisition of Genzyme in February 2011 is a good illustration. When Sanofi was negotiating the deal, there was considerable disagreement about the value of Genzyme’s product pipeline and the company’s ability to resolve its severe manufacturing problems. To get past the disagreements, Sanofi made Genzyme shareholders a creative offer. In addition to the cash price offered for Genzyme shares, Sanofi offered a tradable option known as a contingent value right (CVR). The CVR could pay up to an additional 20 percent of the purchase price contingent on the achievement of milestones in resolving the manufacturing problems and developing Lemtrada, Genzyme’s experimental multiple-sclerosis drug. Although the uncertainties could not be resolved, this innovative option structure made the deal successful.

Third, deals involving innovation require special execution. While often necessary to complement the organic R&D pipeline, these deals are especially challenging from a governance perspective. Tightening the reins on an acquired R&D team can strangle innovation and prompt researchers to flee the new bureaucracy. Too little control, on the other hand, can result in R&D cost overruns. Finding the right balance is essential. Solving governance questions is also a key challenge in diversification deals. It can be successfully addressed through meticulous up-front planning and experience in integrating and organizing such business models. Still, diversification almost always requires company-specific solutions; there is no one-size-fits-all governance or go-to-market model.

In general, the degree to which a company relies on external innovation should depend on the competencies available. An originator needs to be strong either in building entrepreneurship internally and fostering organic innovation or in screening M&A deals and building an external pipeline. In any case, building one competence or the other is required.

Fourth, as pharmaceutical M&A continues to grow more complex, acquirers’ communications with investors and employees need to be very clear. The deal’s rationale should unambiguously address one or more of the industry’s core challenges that relate to value creation. Clear messages on synergies require a good understanding of the future relationship between the target and the acquirer—and they need to spell out exactly where the added value will come from.

The good old days of simply consolidating businesses and taking out costs are certainly over in the pharmaceutical industry. Yet in today’s environment, where M&A is one of the key ways to tackle strategic market challenges, the ability to do the right deals the right way will give companies an even clearer competitive edge.