In the global struggle to manage the cost of health care, practitioners and policymakers are increasingly focusing on value —delivering the best possible health outcomes at the lowest possible cost. The most advanced health systems around the world are documenting broad variations in health outcomes and differences in clinical practice and using these data to identify best practices and to steer resources toward those interventions that have the highest impact. Such efforts are facilitated by the proliferation of new systems and capabilities in health care informatics that make it possible to collect outcome data and share findings broadly with clinicians and the public. This new paradigm is known as value-based health care .

By uncovering the root causes of the wide variations in outcomes across patient populations and care delivery sites, value-based health care has significant potential both to improve the quality of care and to lower costs. But the approach also represents a major challenge to the pharmaceutical sector, which is already facing an increasingly difficult competitive environment. Pharma product-development costs are rising. Pressures on pricing and access are growing. The blockbuster era, if not exactly over, certainly appears to be waning. Now, value-based health care threatens to put pressure on the industry’s basic business model. One pharma CEO put it this way: “In ten years, the pharma industry will be paid on outcomes, and we have no idea how to get there.”

Although value-based health care represents a potential threat to the pharma sector, we believe it can also be an opportunity. In many respects, pharma companies are well-placed to take advantage of the trend. In their research, clinical development, regulatory, and medical-affairs functions, they possess strong disease-based clinical knowledge, which could provide the foundation of new approaches for improving health outcomes in key diseases. Their global reach positions them better than national or regional payers and providers to identify and disseminate excellent clinical practice. In recent years, pharma companies have developed considerable expertise in managing stakeholder relations with both public and private payers (and, in some cases, with providers), enabling them to play an orchestrator role among clinicians and suppliers. Last but not least, they have significant resources that they could use to refocus their innovation on improving outcomes and fund the exploration and exploitation of new value-based business models.

To take advantage of such opportunities, however, pharma companies must address two major challenges. The first is strategic: companies will have to decide what role they want to play in the treatment path for each condition, how to structure their product and service offering, and where to look for partners in what is becoming a far more complex market. The second is organizational: companies will have to rethink the pharma value chain, increase collaboration between the R&D and commercial sides of the business, and consider restructuring what has traditionally been their functionally based organization.

Why Value-Based Health Care Is a Threat

To understand why value-based health care is a potential threat to pharma, consider how the growing focus on outcomes is likely to affect the traditional sources of competitive advantage in the industry. For years, pharma companies have competed on the basis of the medical differentiation of their products and the sophistication of their marketing and sales activities. The former has put a premium on a strong R&D organization able to design new drugs that address unmet medical needs. The latter has increasingly focused on engaging with a broad range of influencers (for example, payers and patients) in addition to the individual subscriber in order to maximize pricing, market access, and reimbursement and to drive sales volume. Both these areas of strength are being challenged by value-based health care.

On the one hand, the number of criteria determining the success of a new drug is expanding; on the other, both long-term regulatory approval and commercial access are increasingly linked to the postregistration performance of the drug. Where regulatory approval traditionally focused on efficacy, safety, and whether the new drug addressed an unmet medical need (as demonstrated in randomized clinical trials versus a placebo), both public and private payers are creating health technology assessment (HTA) units that evaluate each new drug in terms of its comparative effectiveness and cost-effectiveness based on real-world evidence (that is, data from the use of the drug in an uncontrolled patient population). Failure to meet these new criteria can lead to lower levels of reimbursement, outright exclusion from a payer’s benefits package, or even the withdrawal of regulatory approval. Consider the following examples:

- In the U.K., the National Institute for Health and Clinical Excellence (NICE), an independent HTA organization within the U.K.’s National Health Service, evaluates drugs in terms of their clinical impact versus the total cost of treatment. Although, in theory, drugs can achieve access to the U.K. market without NICE approval, the agency’s recommendations have a major influence on prescribing behavior; failure to win approval can greatly limit a drug’s market penetration. Of the 36 drugs that received negative evaluations over the past five years, 26, or 73 percent, were in oncology and immunology—two high-growth therapeutic areas that most pharma companies have been targeting.

- In 2011, Sweden’s government passed a law mandating the Swedish Medical Products Agency’s continuous monitoring of the health outcomes associated with new drugs. The new assessment of a drug’s post-launch performance made possible by the law is likely to influence reimbursement and may even lead to the withdrawal of drugs because of less favorable efficacy, safety, or efficiency profiles in real-world settings than in clinical trials.

- The Italian Medicines Agency (AIFA), Italy’s national pricing and reimbursement agency, has developed a drug-monitoring program and outcome-tracking database. Originally designed for selected oncology drugs with a cost-benefit ratio that was not considered definitive at the time of launch, the system has now been expanded to include expensive ophthalmology drugs and additional drugs for “orphan” diseases.

- Although such trends are more developed in Europe than in the U.S., the 2010 Affordable Care Act in the U.S. also promotes pay-for-performance standards and continuous drug evaluation, and the growing international collaboration among HTA entities suggests that European standards could be duplicated in the U.S. and other countries.

Such trends will make regulatory approval more difficult, further constrain pricing and access, and clear the way for new pricing and reimbursement models designed to shift the risks of failure onto the drug maker. Take the example of alternative pricing agreements between payers and pharma companies that link payment to drug performance. Such agreements are becoming increasingly popular, especially in high-growth and high-cost therapeutic areas such as oncology and immunology, as discussed above. In the words of one pharma sales executive, “We need to move from ‘price per tablet’ to ‘price per outcome.’”

Value-based health care also has the potential to redraw the competitive landscape. As health systems increasingly focus on a comprehensive range of factors that affect health outcomes—drugs, medical technology, health information, care management, care delivery—the role of orchestrating and managing all these inputs will grow in importance. One might expect that leading payers or, perhaps, advanced providers would be the institutions most likely to play this orchestrator role. But it is also likely that several of the growing number of new players in value-based health care—health information companies, IT vendors, disease management organizations, and others—will try to do so. In some therapeutic areas, pharma may need to aspire to the orchestrator role or risk becoming marginalized.

At the moment, few pharma companies are up to the task. One recently discovered that it needed to coordinate seven different data flows across three information-management and service providers to execute what was a relatively simple value-based initiative. Few companies have much experience scaling this kind of capability to provide solutions on a global basis.

How Value-Based Health Care Can Become an Opportunity

Pharma companies can not only limit the threat represented by value-based health care but can also turn it into an opportunity. To do so, however, they need to redefine their strategy and realign their operating model. There is a lot that companies can do to get started.

In R&D, the major task is to make sure that late-stage products are prepared for success in a value-based world. That means rethinking the product portfolio. The ability to secure superior outcomes in the treated population of patients will determine competitive differentiation and sustainable advantage. Gaining this edge will require vastly improved patient segmentation and diagnostic criteria, as well as drugs and bundled service offerings that are better than the current standard of care. Companies should start by introducing true value-based metrics into their R&D process and investing disproportionately in health economics and other disciplines that will be critical in a value-based world.

One important approach in R&D is to leverage existing efforts in identifying biomarkers for personalized medicine by expanding that research into phenotypic characterizations of the patient population—research increasingly made possible by the existence of disease registries and other high-quality sources of real-world data. Although personalized-medicine initiatives have often met with limited success in the past, we believe that in the future they should significantly enhance patient segmentation and increase the odds of positive health outcomes. Some companies are already moving aggressively in this direction. Fully half of the products in Roche ’s late-stage pipeline, for example, have companion diagnostics to determine whether specific patients are genetically disposed to respond to the therapies.

There is also a compelling commercial agenda. Pharma companies should be experimenting with new pricing mechanisms and innovative supplemental offerings to improve outcomes. For example, Merck’s subsidiary in the U.K . recently acquired a general-practitioner-led company that has developed a facilitated program for the clinical management of diabetes. The program currently works with some 250 practices covering 1.5 million patients nationally on a fee-for-service basis. With better management of the care for patients with high-risk factors for diabetes, the program has reportedly contributed to a reduction in expensive outpatient appointments and hospital admissions.

In the longer term, however, companies will have to address the fundamental strategic question of where to play and what to offer in order to exploit the changes associated with value-based health care. In a sense, the pharma industry is confronting a situation that many other industries have already faced. The information associated with the development, use, and impact of medications is fast becoming a valuable asset. The organizations that have access to, develop, and, in some cases, control that information and use it to deliver new insights about effective care and new value-adding services are likely to capture much of the value.

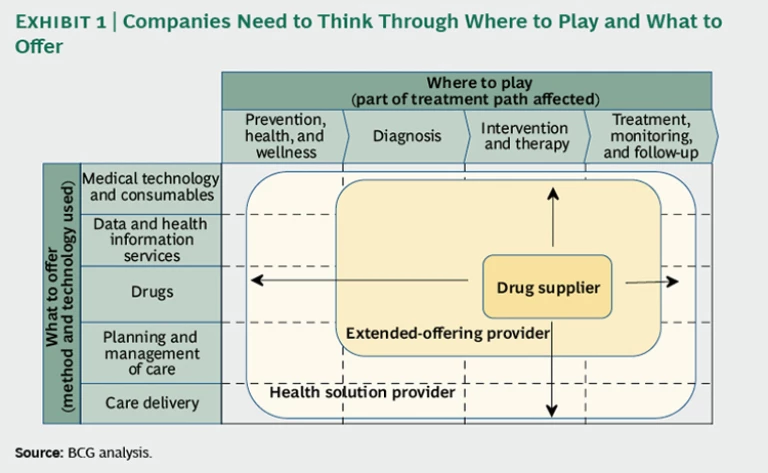

But how far should a drug company expand from its traditional focus on providing therapeutic interventions—whether going upstream into diagnosis and prevention and wellness activities, or downstream into treatment monitoring and follow-up? Should it consider offering data and health-information services in addition to drugs? What about care-management expertise or even care delivery? Where on the spectrum from drug supplier to complete health-solution provider should a company operate—and in what specific therapeutic or disease areas? (See the exhibit below.)

An essential element in answering such strategic questions will be the feasibility of partnerships with other health-care entities to create innovative new business models. Most pharma companies already have a range of existing partnerships and collaborations today. Increasingly, they will also need to consider their partnerships with value-based health care in mind. AstraZeneca , for example, has signed collaboration agreements with HealthCore (the health-outcomes-research subsidiary of WellPoint ) in the U.S. and health information and technology provider IMS Health in Europe. The partnerships, intended to advance the use of real-world evidence based on observational and retrospective studies, reflect an appreciation that having access to such information is critical in helping to determine where to focus R&D, how to target new products, and how to position existing products with payers and providers.

As pharma companies begin to define their strategy and explore new business models, however, they also need to keep in mind that value-based health care is likely to have profound organizational consequences as well. First, pharma companies will have to enhance their expertise in areas such as epidemiology, health economics, medical consultancy, and e-health. Second, they will have to greatly increase collaboration between the R&D and commercial sides of the business.

Most innovation in pharma has taken place at the very beginning of the value chain in drug discovery. In the future, innovation will have to be far more holistic, occurring across the entire pharma value chain. The commercial organization of a drug company in the future could consist of teams of highly trained medical consultants who work closely with payers, providers, and patients to improve adherence, target products to the populations most likely to benefit from them, understand the patterns of drug usage, document improvements in health outcomes over time—and feed all this information back to drug development to inform the next generation of products. We have already seen a few experiments in this direction and believe that value-based health care will drive a broad transition to this new commercial model.

Pharma’s traditional functional silos are ill-suited to succeed in the value-based environment. Companies will need to reconsider their traditional organization structure based on functions and divisions—a model that runs counter to the imperative of creating value on a disease-specific basis across markets. In the near term, the least-disruptive approach is probably to create a set of cross-functional value-based teams organized by disease. But in the longer term, companies may find that restructuring the entire organization around diseases or therapeutic areas is far more effective at facilitating the necessary connections and interactions among R&D, commercial divisions, health economics, access, public policy, and other key domains of expertise. Changes in key management processes will also be required. Who will be responsible for investing in programs to compete effectively in value-based health care? Who will fund those investments to build new capabilities for tomorrow’s market at a time when today’s margins are under pressure?

This combination of strategic and organizational choices represents a long and complex agenda. Although we encourage pharma companies to experiment and learn, we also believe that ultimately a major shift will be necessary to compete in a value-based environment. After all, the changes we have described are driven by the reasonable desire of payers and patients to get an attractive return on their investment from providers and the suppliers of pharmaceuticals and medical-technology products.

The transition to value-based health care may take a number of years, or even decades, to complete. But pharma executives can’t afford to maintain a reactive stance. Payers and other health-care players are accumulating information and setting new paradigms based on value; these trends are real and material. Pharma executives need to understand the implications for their business and develop a serious companywide response. Creating an explicit strategy to maximize pharma’s value in a world of value-based health care is a good place to start.