Over the coming decade, the dynamics of payments markets in rapidly developing economies (RDEs) will shift dramatically toward the financial inclusion of the unbanked, the replacement of cash and checks, and the reduction of cash-based, underground economic activity. At the same time, innovation in mobile payments, prepaid cards, and new payments technologies will provide great opportunities for the most nimble players, as well as pave the way for new market entrants.

But the landscape is a highly variegated one. There are substantial differences not only between developed and developing payments markets but among RDE payments markets themselves. Brazil and India, two of the largest RDE payments markets, provide a useful lens for examining these differences, although other large markets, such as China and Russia, have their own distinct characteristics and evolutionary trends as well.

For example, card penetration per capita in Brazil has reached 3.5 cards, compared with 0.25 cards in India (and 1.0 to 1.5 cards in China). Moreover, an overwhelming 94 percent of cards in India are used solely to withdraw money at ATMs. Many cardholders in India either do not know that they can use the card to make purchases at the point of sale (POS), or they perceive such transactions as risky. Also, Internet penetration is still relatively low in India (about 10 percent, compared with 40 percent in Brazil). Internet penetration differs widely among RDEs in general, and the use of electronic payments varies accordingly.

The differences among RDE payments markets can be largely explained in terms of three factors:

- Access to banking services—that is, financial inclusion—is highly variable among RDEs. Currently, it is at about 65 percent in Brazil and 50 percent in India. Although banks have grown rapidly and profitably serving the mass-affluent and “aspirer” consumer segments

1 1 Aspirers are those in the rising middle class with incomes of more than roughly $1,500 per year; we expect this segment to reach mass-affluent status within the next ten years. , the cost structure of their branch-based distribution models is not suited to serving those with lower incomes. - There are sizable differences in the number of merchants that accept cards—roughly 170 credit-card POS terminals for every 10,000 inhabitants in Brazil compared with just 5 in India. These variations are driven by such factors as merchants’ perceptions of the cost of electronic transactions, taxation issues, and the organization of retail businesses.

- Banking clients have very different outlooks on the value that payment systems bring to their business models. In Brazil, for example, there is a comprehensive, sophisticated electronic-payment network that the country developed in response to the high inflation it experienced in the 1980s and 1990s. This network has facilitated banking clients’ appreciation of the value of electronic and card payments, which in turn has helped banks maintain healthy margins. By contrast, this infrastructure does not exist in India, prompting banks to lower margins for payments products in an attempt to attract new customers and bring them into the banking system.

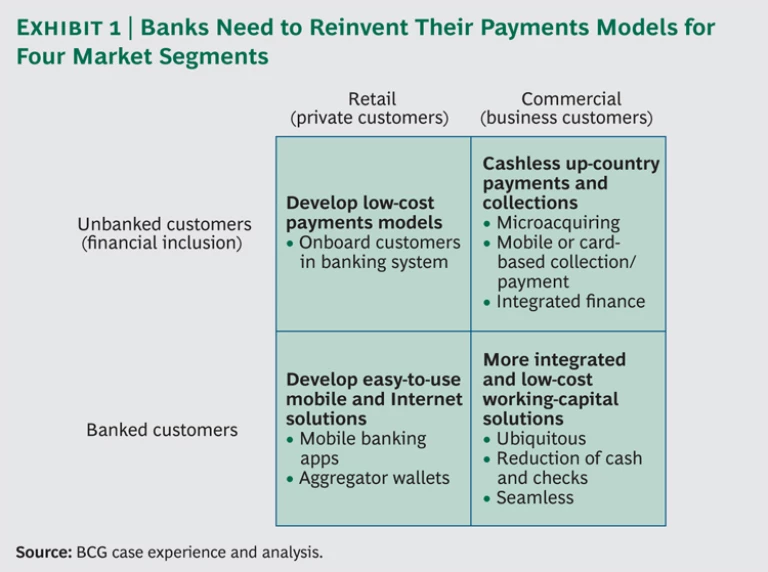

Ultimately, banks and other participants in the payments value chain in RDEs need to reinvent their payments models for four market segments: retail (private-individual) banked and unbanked customers, and commercial (business) banked and unbanked customers. (See Exhibit 1.) Below, we focus primarily on payments models for unbanked customers in Brazil and India.

Competitive Dynamics for Serving the Unbanked Are Evolving Rapidly

In general, banks in RDEs are showing renewed interest in payments models for the unbanked for several reasons. First, the pace of change in these markets—with respect to new technology, innovative payment schemes, the regulation of payments value chains, and financial inclusion—is highly accelerated compared with developed markets. Obviously, the impact of change will vary for different types of RDE markets, such as large versus small and retail versus commercial.

Second, through technological innovation, large swaths of currently unbanked customers can be served profitably and with strategic value. Examples include remittances processed through mobile phones; “rural POS,” in which a mobile phone functions as the acquiring terminal and is equipped with either card-swipe hardware or the capacity to acquire a transaction via a real-time mobile interface; direct subsidies from governments to unbanked households using prepaid cards or mobile wallets; and mobile payments that are integrated with supply chain processes, helping businesses optimize their working-capital efficiency and cash-pooling needs.

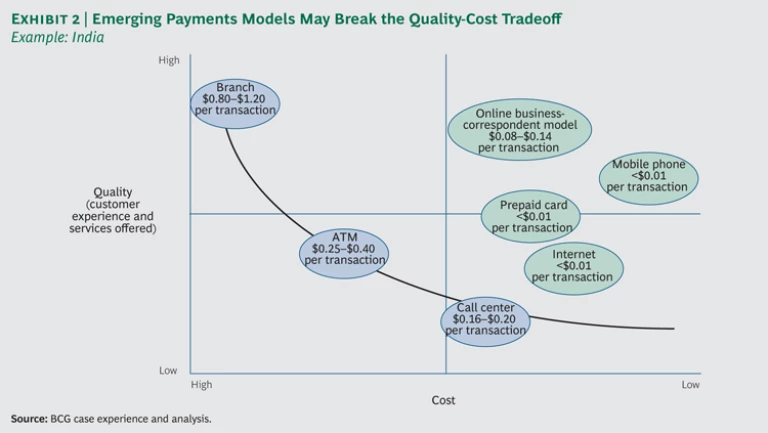

Third, several competing low-cost models are emerging. These include business correspondents (individuals or merchants who facilitate banking transactions in areas where such services are not readily available); branchless banking, such as the viral mobile distribution of First National Bank in South Africa; prepaid-card models like that used by the Brazilian government to disburse Bolsa Familia funds; and mobile wallets with low-cost distribution networks such as M-Pesa in Kenya, MTN in Uganda, and, more recently, Easy Pay in Pakistan and Airtel Money in India. Overall, it is possible that emerging payments models in RDEs may eventually break the traditional quality-cost tradeoff—meaning that low-cost solutions will deliver high-quality services. (See Exhibit 2.)

Our interviews with unbanked consumers confirm that they have a broad set of financial-services needs—including remittances, secured and unsecured credit, insurance products, and bill payment for medical and utility expenses—that are not being met because the cost to serve these consumers is too high for financial institutions or because they simply cannot be reached efficiently or effectively. But banks that can create targeted value propositions capable of bringing unbanked consumers into the fold will be in a position to profit handsomely.

Of course, substantial growth will not happen overnight. Serving unbanked customers in RDEs is likely to be only moderately profitable over the next three to five years—a revenue pool on the order of tens of millions of dollars—as different value propositions compete for scale and market share of at least 10 percent. Within this time frame, the use of low-cost payment solutions will depend on operational solutions from both issuers and acquirers. But once critical scale on both the issuing and acquiring sides is reached, revenue pools may grow exponentially.

Clearly, there is real strategic value in serving unbanked RDE customers, not just in terms of short-term numbers—in India, for example, mobile phone penetration is between 70 and 80 percent, while banking penetration (financial inclusion) is only about 50 percent—but in terms of building long-term relationships and cross-selling platforms.

Five Key Elements of the RDE Payments Opportunity

Although the payments landscape in RDEs is clearly still evolving, we have observed five factors that market participants should keep in mind as they target this opportunity.

The best solution for each RDE will be unique. Winning value propositions do not come easily. For example, while around 120 mobile wallets have been launched worldwide, only a handful have succeeded. Moreover, we have not observed any truly successful imports of payments models from one country to another. For instance, while M-Pesa in Kenya is mobile money’s biggest success story, with 14 million subscribers, its rollout in Tanzania and South Africa has been, at best, a partial success.

The key lesson is that given the high level of diversity among RDEs—including their overall economic evolution, the influence of regulation, the sophistication of the payments market, as well as demographic and cultural factors—there is no silver-bullet payments strategy that will be optimal for all RDEs. The best solution for each will be unique. Brazil and India are good illustrations.

In Brazil, multiple solutions will coexist, including traditional cards, prepaid cards, and mobile-based offers. In recent years, banks have tapped the opportunity to develop prepaid-card propositions to attract unbanked customers. They have then leveraged the existing cards infrastructure and the status that consumers associate with more-sophisticated products to steer qualified new customers toward standard cards and savings accounts.

In India, there is great opportunity in mobile wallets for both individuals and businesses. For example, recent regulatory momentum is allowing telcos to operate semiclosed wallets (which enable payments, but not cash withdrawals, using mobile phones). In addition, since card penetration is so low, mobile payments are not perceived as necessarily less convenient or more risky than the use of cards. One example of a new mobile scheme is Airtel Money, which has already reached 1 million users with a targeted value proposition aimed at helping urban unbanked consumers carry out bill payments and person-to-person transactions. In addition, the growth of mobile payments in India may enable banks to forgo further heavy investment in card infrastructure.

Going forward, retail acceptance of mobile wallets in RDEs will be driven by both unbanked and underbanked consumers—which is likely to have a ripple effect, prompting more banked clients to experiment with mobile solutions. Commercial acceptance will depend on mobile value propositions that enable businesses to improve the efficiency of their collection and payment interactions with unbanked small and medium-size enterprises—thereby optimizing their supply chain.

The key message is that the endgame in payments in RDEs will likely differ by market, depending on the starting position and aspirations of each one.

New collaboration models must be created. Reaching profitable scale quickly will require strong distribution, processing, and risk-management capabilities. Yet many banks and telcos, wary of sharing too much proprietary knowledge, still try to develop new models in-house. In our view, there is an opportunity to create competitive advantage by collaborating more closely to leverage the specific capabilities of different institutions. Banks, for example, cannot create the distribution reach required for rural households. Therefore, they will have to think boldly in order to forge meaningful links with other players, such as telcos and business correspondents (which bring extensive consumer reach and experience), and with payments processors (which bring operational excellence).

Leverage opportunities in domestic schemes. Emerging domestic payments schemes, such as ELO and Hipercard in Brazil, RuPay in India, and China UnionPay, are examples of domestic schemes that can have a major impact in their home countries and help drive the development of RDE payments markets. Banks can leverage such networks by using domestic brands as potentially lower-cost alternatives to cross-border schemes for low-value customers such as the previously unbanked and the urban lower middle class. For instance, in India, RuPay promises a 40 percent lower operational cost per transaction for banks, making it a viable solution for servicing new tiers of (first time) customers.

Banks with large local franchises will have an advantage. With many success factors being country specific—involving local knowledge, products, customer relationships, and regulatory savvy—domestic banks may well enjoy an advantage in tapping the growing payments market in RDEs. This does not mean that multinational banks and other global payments players cannot be successful, but these institutions will need to leverage all their capacities and depth of experience to the fullest in order to compete. They may need to focus on niches where they can create local scale or collaborate with local banks or telcos.

Choices by governments and regulators are likely to heavily influence the success of payments models. The volume and value of social-benefit payments and subsidies to unbanked consumers can create the necessary scale for some payment instruments. In Brazil, for example, there are roughly 12 million Bolsa Familia prepaid cards that carry social benefits. Worldwide, government-to-person payments in the form of subsidies to financially excluded people are estimated to reach $1 trillion by 2015. If even a fraction of such a substantive sum were to go through the domestic payments infrastructure, the economics of the network would measurably improve.

In India, the government is aiming to shift the payout of about $60 billion in subsidies for employment guarantees and other types of support to electronic benefit-transfer mechanisms. In addition, subsidies for fuel, fertilizer, and other commodities (amounting to another $40 billion) are being examined for payout through electronic methods. Historically, many of these subsidies have been plagued by leakages and inefficiencies. The new developments offer a potential win-win solution for all concerned.

Clearly, regulators have to perform a balancing act between sticking to tried and tested methods and embracing innovation. But they often have more confidence in familiar mechanisms that can be held up to tighter scrutiny. At the same time, they are innovating in tranches, observing the results, and then going further—always taking care not to create high systemic risk. Regulators will continue to face dilemmas about how much payments activity to shift to new ways of working, and how quickly. The decisions they make will strongly influence the domestic-payments endgame.

Looking Ahead

Ultimately, the direction that payments markets take in each RDE will depend on multiple factors. Among them are the ability of banks and others to develop low-cost payments models and to forge practical value propositions for both unbanked and banked consumers, the ability of banks and telcos to work together to create innovative mobile solutions, and the willingness of governments to create a favorable regulatory climate for growth.

Clearly, different markets will evolve in different ways and at varying speeds, depending on their starting position. In the near term, different payment propositions are expected to coexist as each builds scale in niche markets such as university campuses, rural areas, and low-income metropolitan areas. In the longer term, convergence is inevitable because consumers and merchants require network solutions—of sufficient scale and interoperability—in order to interact with each other.

But one thing is certain: the growth opportunities are significant. Only those banks and other payments players that are willing to take action, to make tough decisions on tradeoffs, and to think innovatively will capture a sizable share of this growth.

Acknowledgments

The authors would like to thank the following BCG colleagues for their ideas and insights that helped lead to the preparation of this article: Saurabh Tripathi, Bharat Poddar, Prateek Roongta, and Akshay Sehgal in India and Flávio Magalhães, Miguel Pita, and Masao Ukon in Brazil.