The Millennial generation is poised to leave its mark on the world—and its dollars in the cash registers of restaurants and stores around the U.S. Although the youngest members of this 16- to 34-year-old group are still financially dependent on their parents, the Millennials are forming strong brand and retail-format preferences, and they report an intentional influence on the behaviors and brand choices of their family and friends, and even complete strangers.

What’s more, Millennial attitudes toward and preferences for marketing and media are early indicators of trends that will eventually spread beyond this group to non-Millennial consumers. And unlike with past generations, the influence of Millennials is far from passive and narrow. Rather, members of this generation are active advocates and detractors, using social media to broadcast their preferences and influence the choices of others.

To better understand Millennials as consumers, The Boston Consulting Group joined forces with Barkley and Service Management Group to survey 4,000 Millennials (ages 16 to 34) and 1,000 non-Millennials (ages 35 to 74) in the U.S. A key focus of this research was to identify how behaviors and attitudes differ between the two groups and determine which of those differences are truly generational characteristics of Millennials—and not merely qualities associated with youth in general.

To this end, we looked not just at age but also at household income, employment details, marital status, and the presence of children in the household. We took into account any significant differences related to gender as well as ethnicity and race. For example, we looked in particular at Hispanic Millennials because of that group’s rapid growth in terms of population size and discretionary spending.

As noted in an earlier report on the Millennial consumer , the members of this generation are entering their peak earning and spending years. Our findings put to rest one stereotype: that Millennials aren’t particularly interested in spending money. Moreover, their needs and preferences are often quite different from those of non-Millennials as well as those of one another. In this article, we explore U.S. Millennials in terms of their dining and apparel-shopping habits: two categories that rank high with this generation in terms of enjoyment, knowledge, and overall spending.

Dining Out

Restaurant meals and drinks are high on the list of what Millennials like to spend their money on—ranking above consumer electronics, apparel, footwear, beauty and cosmetic products, and accessories. Our research showed that Millennials eat out more often than non-Millennials (3.4 versus 2.8 times per week), regardless of their income or household composition. And Millennials are more likely to get food to go than to dine at the restaurant—particularly at breakfast. This generation also spends slightly more on dining out than non-Millennials on average; indeed, a subgroup spends considerably more. Male and Hispanic Millennials eat out more often than other Millennials.

Millennials eat at restaurants during off-peak hours twice as often as non-Millennials, a behavior that appears to be generational, not just related to life stage. They also prefer fast, fast-casual, takeout, Asian, exotic, and organic foods more than non-Millennials, who prefer seafood and steak. Millennials are also much more likely to eat out with friends and coworkers (reported by 65 percent of Millennials compared with 43 percent of non-Millennials). Although Millennials told us they often go to casual-dining restaurants such as Olive Garden, Applebee’s, Chili’s, and The Cheesecake Factory, they tend to prefer fast-casual options such as Panera Bread, Chipotle Mexican Grill, and Pei Wei Asian Diner.

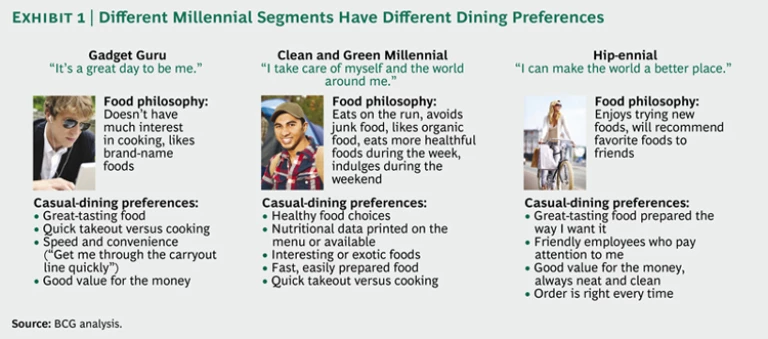

As noted in our earlier report, Millennials are far from a homogenous group, and different segments have different dining needs and preferences. (See Exhibit 1.) For instance, Gadget Gurus, typically male and the generation’s most frequent restaurant goers, want great-tasting food and convenience. But Clean and Green Millennials, who also tend to be male but younger, want healthy choices, nutritional information, food that’s fast and easy to prepare, and interesting or exotic food options. And Hip-ennials, the largest Millennial segment and primarily female, want customized and error-free orders, friendly and attentive service, good value, and an orderly, clean dining environment.

Different Millennial segments reported different emotional needs related to dining out and the casual-dining format in particular. As a group, they want to feel that they are “exploring something new.” They also get more social value out of casual dining than non-Millennials and want to feel that they can “easily catch up with friends” and “leave my responsibilities behind and relax.” Millennial men seek to “cheer on my team and celebrate,” “be recognized as a regular [customer],” and be “in the know” more than female Millennials and non-Millennials. Millennial women want to know that they are “getting their money’s worth,” while Hispanic Millennials want the dining experience to be a nice one for their entire family.

Generally speaking, Millennials care more about late-night dining, convenience, décor, menu and drink variety, entertainment, and Wi-Fi than non-Millennials. Given these varying preferences, the challenge for casual-dining brands is to build a loyal following of Millennial diners without turning off their non-Millennial customer base.

As Millennials become a growing presence on the casual-dining scene over the next ten years, restaurants can attract them by offering the things that matter most to this generation:

- Faster service, along with ready-to-eat and to-go options, or separate areas for taking out and dining in

- Fast-casual format(s) in the corporate portfolio

- Happy-hour, late-night, and bar experiences, events, and menus

- Ability to provide innovative services for large parties, such as reservation-sharing apps, check in from multiple mobile phones, small plates and plate-sharing options, separate checks, high-top tables that promote standing and mingling, and separate dining spaces for private parties

- New food and beverage combinations that incorporate unusual, exotic, organic, or local ingredients, and “crowd sourced” menu ideas

- Technology that enhances the dining experience, such as online reservations, mobile- and self-order placement, self-payment, Internet access, communal tablet usage, charging stations, and location-based promotions

- Digital-, mobile-, and social-media promotions in addition to advocacy marketing

Most restaurants already have access to a powerful tool: the Millennials on their own wait staff, who can be a valuable source of advocacy, insights, and new ideas.

Dining In

Our research also revealed consistent insights into Millennial behaviors related to food shopping that will likely stick as Millennials get older, such as a preference for farm-to-table and organic groceries (Millennials are twice as likely to care about organic food than non-Millennials); a taste for exotic and diverse foods and creative menu ideas; a move away from traditional grocery chains toward club, specialty, and convenience formats; more use of online ordering as well as delivery and in-store-pickup options; and enjoyment of the social aspects of food preparation and sharing. Interestingly, Millennials are more likely than non-Millennials to love cooking and to consider themselves experts in the kitchen (64 percent versus 52 percent).

In our survey, Millennials at all income levels were less aware than non-Millennials of traditional grocery chains such as Albertsons and Safeway and preferred club, specialty, and convenience food stores. Our research revealed differences between where the Millennials say they want to shop (SuperTarget, Whole Foods Market, Trader Joe’s, and Costco) and where they actually shop (32.7 percent shop at Walmart Supercenters). These differences are driven primarily by cost and convenience considerations. There is also a tendency to spend more, or “trade up,” for fresh produce and prepared or organic foods. Generally speaking, Millennials still prefer branded foods and report a noticeable quality difference with brands, but economic realities and having children tend to drive store-brand purchases.

Clotheshorses

Our research showed that U.S. Millennials—both men and women—are knowledgeable about clothing, like buying it, and have formed brand preferences. Among female Millennials, 47 percent reported shopping for clothing more than twice a month, compared with 36 percent of non-Millennials. The difference in shopping frequency was even more striking among men (38 percent for Millennial men versus 10 percent for non-Millennial men).

Interestingly, male Millennials also spend twice as much on apparel per year as the men of previous generations. This difference is consistent among all ethnic groups, incomes, and household types. Generally speaking, female Millennials buy more apparel per year than non-Millennial females, too, outspending them by a third regardless of income or race. Compare this with women’s footwear in the U.S., where affluent women and those 35 and older are the primary spenders. Not surprisingly, buying clothing for oneself drops in Millennial households with children.

Millennials tend to shop in groups and consider the opinions of others more than non-Millennials. Compared with female non-Millennials, for example, female Millennials shop almost twice as often with their spouses and shop twice as often with groups of friends and with relatives other than immediate family. Fashion magazine articles and editorials, retailer websites, apparel brand websites and social media, fashion blogs, and store associates are top sources of information on trends, products, brands, and retailers for male and female Millennial apparel shoppers.

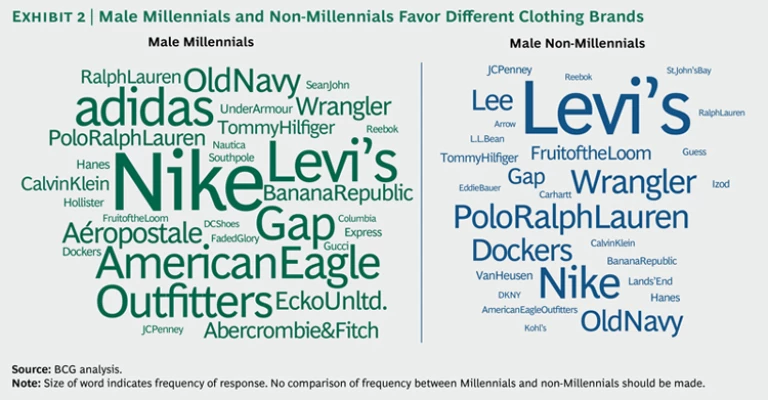

Perhaps not surprisingly, Millennials and non-Millennials told us they prefer different apparel brands. (See Exhibit 2.) In addition, the “dual gender,” or unisex, brands in our research tended to do better with either Millennial men or women but not equally well with both sexes, notable exceptions being Levi’s (liked by both genders of Millennials but even stronger with non-Millennials), Gap (though weakest with non-Millennial men), American Eagle Outfitters, and Abercrombie & Fitch. From our survey, Millennial men’s favorite unprompted brands also included Nike and adidas.

Millennial women’s unprompted apparel favorites were Old Navy, Forever 21, Target private brands, Express, Aéropostale, Hollister, and H&M. Generally speaking, Millennial men try fewer apparel brands and retail formats and have fewer favorite brands relative to Millennial women. When Millennial men do try a new brand, they are more likely than Millennial women to convert and stay loyal. They also tend to stay with brands over time and as they age more than their female counterparts, who report “outgrowing” brands earlier.

Our research also showed that the generations have different expectations for in-store service and the overall shopping experience. Millennials told us they prefer an experiential, lifestyle environment (such as that offered by Hollister and Abercrombie & Fitch), like to receive help and approval from fashion consultants rather than just basic sales assistance, and value store environmental factors more than their non-Millennial counterparts. For instance, female Millennials care about the music played, prefer neat and well-lit dressing rooms, and like roomier stores, with seating for friends to stay, lounge, and hang out. Female Millennials also want fashionable, knowledgeable sales associates who wear the store’s merchandise in unique and creative ways.

Male Millennials seek a more fun and energizing place to shop than do non-Millennial males (54 percent versus 39 percent) and also value the music played and store roominess more than their non-Millennial counterparts. Millennial men value sales associates who are trendy (45 percent versus 22 percent) and wear store merchandise (46 percent versus 33 percent). Perhaps not surprisingly, male Millennials value the store associate as fashion expert and advisor even more than their female counterparts.

Millennials and the Mall

Millennials are challenging America’s great shopping institution: the mall. To keep these shoppers coming, savvy owners of malls and mall stores will focus on six key principles:

Getting the store and restaurant mix right

Creating experiences, events, “pop up” stores, and social forums to drive incremental visits

Making shopping fast, fun, and easy

Serving groups of shoppers

Getting on board with mobile apps and social media

Integrating in-store and online channels

A winning mall experience for Millennials includes entertainment, movies, and restaurants; a convenient layout, such as stores targeting the same life stage in proximity to one another; an appealing look and feel; and stores with trendy associates, speedy checkout, and an energizing atmosphere and music. For all consumers, the mall has to have three or four appealing stores or restaurants to drive routine visits. For Millennials, fast-casual dining spots and specialty or lifestyle shops that offer apparel, footwear, or accessories are especially attractive.

For Millennials, retail stores are places where they can see, touch, and try on a potential purchase, but the new mall “purchase pathway” must combine this live research with the mobile, social, and online interactions that this generation craves. Millennials want integrated online and offline shopping experiences. They want to go online to research products, comparison-shop, check prices, discuss experiences, share recommendations, and arrange for easy or discounted delivery. But they also want the option of going to a store to pick up or return their online purchases, or to arrange at-home delivery.

A number of new technologies are shaping the Millennial shopping experience. These include Amazon’s Price Check, which allows shoppers to use their smartphones to compare prices; Shopkick, an app that offers customers rewards or points for entering stores and making a purchase; digital wallets, which let shoppers pay with their mobile devices; Monocle, an augmented-reality technology that combines the global-positioning-system and camera features on a user’s phone to help diners find the best eateries in the area according to Yelp reviews; and Google’s Project Glass, an emerging augmented-reality device that will let users project a variety of applications onto the world around them by wearing special, computerized glasses.

Looking Forward

To stay relevant to Millennials over the next three to eight years and retain their popularity with the succeeding generation that will begin to emerge in this time frame, stores and brands that target teens and young adults must reinvent themselves—especially given the growth of online and mobile shopping and the importance that Millennials place on the shopping experience, shopping in larger groups, interactions with sales associates, and specialty and off-price or discount retail formats.

For brands such as Wrangler, Polo Ralph Lauren, Dockers, and Lee that appealed more to non-Millennials than Millennials in our survey, as well as luxury and affordable-luxury brands and multibrand, multicategory formats like department stores, the challenge is fundamentally different: how to introduce their goods and brands to Millennials at the appropriate life stage. And, importantly, when to do so, given that Millennials are not their core customers today but will be in ten years. To succeed, all companies must use language, marketing messages, causes, and spokespersons that relate to members of this generation.

Generally speaking, Millennials are in a transitional, expansive, and exploratory life stage in which their attitudes, beliefs, preferences, and rituals are emerging and evolving. But the window of opportunity to truly connect with this generation is fleeting. Forward-looking companies that can reach and engage members of this generation now—and build their trust and loyalty—have an opportunity for an “epic win” as the Millennials enter their peak spending years.