Acquisitions are an important strategic lever for many industries, and this certainly holds true in consumer goods. With organic growth slowed in developed markets, executives are looking to ramp up their business through purchases. Yet we’ve seen numerous examples of acquisitions failing to deliver much of a boost. Some failures are caused by inadequate discipline—weak strategic logic or overpaying—during the deal-making phase. But many more deals fail when pursuit of the underlying rationale gets lost in the ordinary complexities of the integration and the integration is run poorly.

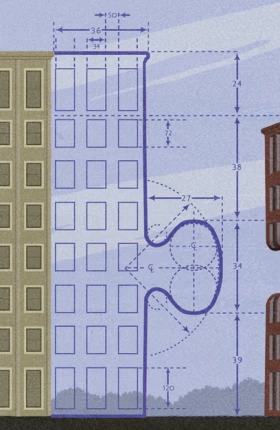

Some companies have certainly succeeded with integrations, as we can see in The Boston Consulting Group’s research into the “value creators.” These are the companies that created the most value for shareholders, in absolute dollars. Looking at consumer goods, the 30 greatest value creators made numerous acquisitions from 2002 through 2011. Nearly all the nondurable-goods companies, in fact, were serial acquirers, and many companies in durable goods acquired frequently as well. (For more on this research, see The 2011 Consumer Value Creators Report: Gaining a Value Creation Advantage in Volatile Times , BCG report, November 2011.)

What makes for a well-run integration? To find out, we undertook a lengthy research project examining 25 integrations of consumer goods companies. This report, the seventh in BCG’s series on PMI, examines the drivers of success that we observed in the project. We focus on the special challenges and opportunities that consumer goods companies face in tying acquisitions together. We look at durable-goods companies as well as nondurables, but not at service companies.