Consumers have a seemingly insatiable thirst for mobile data. New devices—powered by better, faster software—and an ever-expanding selection of apps continue to enhance the user experience. Telecommunications companies with spare network capacity have done their part to boost demand with device subsidies, faster networks, and all-you-can-eat pricing plans. But coming capacity constraints in many markets complicate prospects for continued profitable growth. Smart companies will get ahead of the curve by shifting their strategies from promoting data use to maximizing the economic value they can extract from the massive demand already on the horizon. Managing capacity and value, rather than cost, will be the deciding challenge of the future.

Soaring Demand for Mobile Data

For years, telecom companies—especially mobile carriers—have pushed data services and have subsidized devices to offset revenue pressure on their legacy voice businesses. They have collectively pursued an “if you build it, they will come” approach, and now, with the stunning popularity of smartphones and tablets as well as the emergence of 4G networks, the users are indeed coming—en masse.

Mobile data traffic grew to almost 600 petabytes a month worldwide in 2011, according to networking-equipment giant Cisco—more than doubling for the fourth year in a row. On an annual basis, this is eight times more data than the entire Internet generated in 2000. Global mobile data traffic will exceed 10 exabytes per month (ten times the total amount of printed material in the world) in 2016. While usage patterns vary by geography, video now represents up to half of mobile data traffic in many markets, and this will increase to two-thirds by 2015. Data usage per smartphone is expected to grow by a factor of 16 by 2015, when market research company IDC projects almost a billion such devices will be shipped. Tablet sales nearly tripled in 2011, and Cisco projects tablet-generated mobile data in 2016 will match today’s total mobile data traffic. And traffic is still increasing on laptops—as it is everywhere—despite the proliferation of different types of devices.

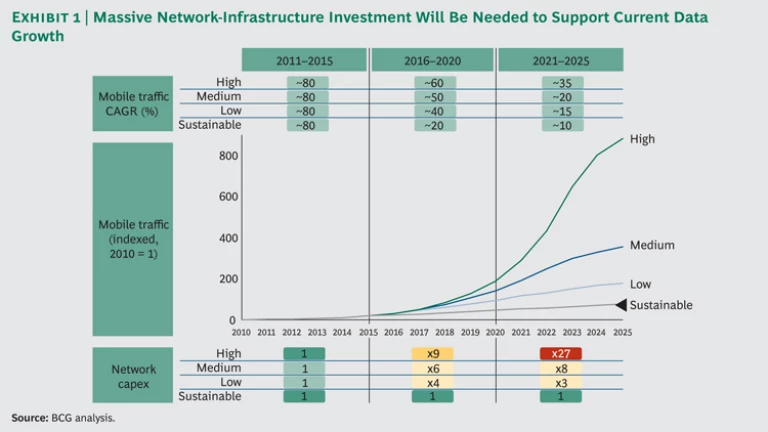

The days of carriers’ ability to transport this uncapped data growth are numbered. If the current growth continues, the level of capital expenditure in new network infrastructure will become unsustainable. (See Exhibit 1.) Moreover, particularly in some developed markets, the profitability of many carriers will be threatened as data revenue per gigabyte declines faster than network cost per gigabyte.

The urgency with which companies need to shift to managing capacity from promoting growth depends on when real constraints kick in—the moment when additional capacity becomes either prohibitively expensive for them or physically impractical to add (because of restrictions on new base stations, for example). The prospect of a capacity crunch that undermines quality of service and user experience is quite imminent in some markets and much less so in others. Whatever the timing, though, the transition from a world of abundance to one of scarcity in many places has profound implications:

- Usage once again will have a real cost associated with it, and pricing models will have to take such costs into account.

- Capacity availability and quality of service will supersede low cost structure as principal competitive advantages. This shift will be especially pronounced in densely populated cities and will also carry implications for network expansion decisions.

- If they play their cards right, telecom carriers could tip the playing field back toward network providers after years of favoring content developers and device makers. In some markets, perhaps, the “dumb pipe” might become the biggest value-creating link in the value chain.

Successfully navigating an increasingly complex competitive landscape will require greater sophistication in pricing and consumer segmentation, and more emphasis on innovation—especially in managing network tonnage and the costs of equipment, backhaul, and spectrum.

Increased Pricing Sophistication and Segmentation

Mobile data pricing has historically relied on fairly blunt instruments. Customers in most markets pay monthly fees for a specified amount of data usage; if they exceed that, they are charged overage fees and sometimes blocked or throttled until the next month starts. If they travel outside defined territories, they risk roaming charges. These models are inflexible and often lead to dissatisfied subscribers.

One response has been all-you-can-eat plans such as the one introduced earlier this year by Free Mobile, which shook the French—and broader European—markets with a simple offer of unlimited voice and data for €20 per month, about half the then-going rate. Behind the cut-price offer is a plan to offload much of the traffic onto the company’s extensive Wi-Fi network. The Free Mobile plan is notable because it includes no subsidies for device purchases, a departure from normal industry practices in most countries. The offer has generated a predictable surge in new customers, followed more recently by reports of significant churn. The ultimate extent of the plan’s success remains to be seen.

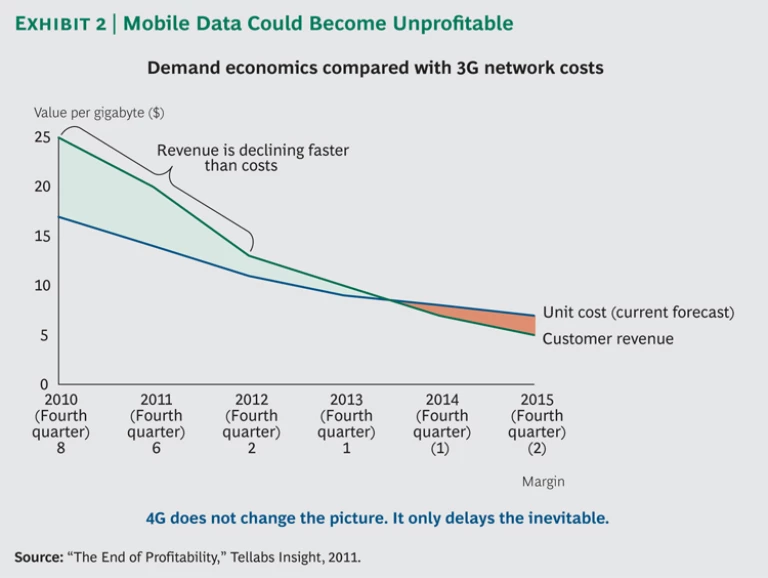

A big drawback of most pricing plans is that they fail to align data revenue with either network cost or value delivered—one major reason that revenue per gigabyte realized by carriers is declining faster than the cost to deliver the traffic. (See Exhibit 2.) Carriers actually have a wide array of pricing and usage levers at their disposal. The trick is pulling them in the combinations that meet consumer needs, promote desired behaviors, and align revenue with cost. There will be increasing pressure on unlimited plans—where they continue to exist—to incorporate caps, overage fees, and blocking or throttling that is consistent with the more widespread adoption of explicit consumption-based pricing, which is not only desirable but inevitable.

We expect companies will increasingly use some combination of the following pricing mechanisms in the future. For most, employing these tools will require more meticulous customer segmentation than they pursue today.

Transmission Speed and Throughput. Similar to the way many wireline companies operate today, we anticipate carriers will charge more for higher wireless speeds and offer “value-based,” lower-speed packages.

Quality and Traffic Prioritization. Some customer segments are willing to pay more for higher quality of service, and some carriers will look to capture incremental value by offering quality-of-service guarantees, thereby “prioritizing” premium traffic during times of potential network congestion.

Time-of-Day Pricing. Peak hours have long been the challenge for carriers. Just as voice plans often have different rules for peak and off-peak periods, we expect operators to “de-average” data pricing and charge varying rates depending on the time of day.

High- Versus Low-Density Geographies. Network congestion and spectrum scarcity are far from universal problems; they typically apply to a small portion of a carrier’s coverage area—and in many countries do not yet exist at all. We expect carriers either to set prices based on regional realities of data usage (relative to capacity) or to adopt yield-management practices to drive more usage in underutilized areas (mobile voice in Africa, for instance) in order to improve profitability.

Pricing by Data Type. Unlimited data plans make no concession to the widely differing densities of e-mail, Internet, and video traffic—one reason users, especially those consuming large quantities of video, love them. While differences in types of video usage (downloaded versus streaming) give carriers some flexibility, there is little question that growing demand for data-heavy video will be the biggest strain on most networks. This may lead to plans that price by type of data, for example—offering unlimited e-mail and Internet use but pricing video traffic based on some measure of quantity consumed.

Value-Added Features. Wireless carriers will follow trends in the wired world and look to generate added revenue by bundling complimentary features and services beyond basic connectivity, including multidevice plans, tethering (allowing one device to make use of the connectivity of another device), and deep packet inspection and other security services.

Managing High-Cost Customers. For some operators, only 5 percent of users generate up to 75 percent of traffic on their networks. Managing—or even actively churning—these high-traffic users can have a massive benefit for network cost as well as the quality of service and user experience for all the other customers.

Taking account of competitors’ capacity is a critical factor when implementing new pricing plans, as some carriers have painfully discovered. Moving to a usage-based pricing model might make sense in the abstract but not when competitors have excess capacity with which to steal market share by charging less while following suit. Such competitive dynamics will play a big role as telecom operators evolve their mobile data business models and coordinate multiple marketplace initiatives.

Managing Network Volume and Cost

Even with the expected increases in network efficiency that will result from such technology advancements as LTE, multimode base stations, and data compression—as well as the addition of more than 1 million new public Wi-Fi hot spots in the past year—the cost to carriers of delivering the data that consumers want to consume remains high. While carriers experiment with new ways to charge, they will also take more aggressive steps to develop and gain access to cost-effective capacity.

One strategy is offloading traffic. For years, wireless carriers have viewed Wi-Fi as both a competitive threat and too expensive to serve as an offloading solution. In today’s capacity and pricing environment, they are starting to embrace Wi-Fi—as well as microcells (small base stations typically designed for use in a home or small business)—as potential complements to their networks. These alternative means of data transport can serve as “relief valves” for overcrowded wireless networks (with the offloaded data, ironically, hitching the same sort of free ride on the wired infrastructure that much data currently receive on wireless networks).

Some U.S. carriers, Verizon and AT&T among them, already include use of Wi-Fi hot spots in their mobile data pricing, and they increasingly prompt consumers to select a Wi-Fi network on their mobile device if one is available. We expect this trend to accelerate along with the ongoing integration—and, from the user’s perspective, blurring—of mobile and Wi-Fi networks. AT&T provides “free” Wi-Fi access to millions of McDonald’s restaurant customers using service set identifier (SSID) technology. We predict there will be rapid growth in Wi-Fi deployment and the development of new business models as Wi-Fi providers seek revenues not only from end-users but also from carriers looking for less expensive networks.

Spectrum and network strategies will increase in importance. Wireless spectrum and new base stations are becoming scarce in many markets, and lack of access is a growing constraint. Some companies have sought to purchase more spectrum from governments and in private-sector transactions. Verizon’s plan to buy AWS spectrum from several U.S. cable companies; AT&T’s failed effort to acquire T-Mobile; and a three-way deal among Hutchinson 3G Austria, Orange, and Telekom Austria are recent examples of the latter. Various governments, including the U.S., Canada, the Netherlands, the U.K., Ireland, the Czech Republic, and Austria have facilitated, or are considering, the former.

While market leaders with access to the best assets may be well positioned, smaller competitors will need creativity to stay in the game, manage capital expenditures, and remain profitable. Tactics will likely include new partnerships for sharing spectrum holdings and subscale network assets, hybrid networks that embrace offloading and microcells, and closely orchestrating network and go-to-market rollouts (which to date have often operated independently).

Many of these activities are complex and difficult to execute. Simply aligning the short- and longer-term incentives of parties in sharing arrangements can be daunting. But the economic realities of increasingly constrained capacity will motivate carriers to take them on.

Other Revenue Sources

As over-the-top services from Facebook, Skype, and others capture a growing share of the value generated in the mobile data ecosystem, telecom companies face the challenge of finding ways to participate in them more fully. Some are experimenting with dedicated units for digital services, recognizing that the need to pursue speedy, collaborative, test-and-learn methods is a significant departure from the structured approaches that have characterized the industry.

London-based Telefónica Digital, for example, formed last fall, has a broad remit that includes cloud computing, mobile advertising, machine-to-machine communications, and e-health services. In Norway, Telenor created a digital-services unit, one major piece of which is ComoYo, the developer and aggregator of Internet services Telenor launched last year.

Apps, services, and mobile commerce are where new value is being created (in addition to devices, of course)—and carriers are largely losing out to players such as Apple, Google, Amazon, and a myriad of software developers and content providers. ISIS—the mobile payment joint venture involving AT&T, Verizon, and T-Mobile—is one example of carriers trying to reinsert themselves, and we expect there will be many more in the future.

The transformation in telecommunications from a world of abundance to a world of scarcity will affect carriers and consumers alike. Carriers must drive the evolution of new pricing schemes that enable them to align revenue with cost more efficiently and realize a profitable level of return on the massive investments required to satisfy exploding user demand. These moves, along with others implemented to address growing capacity constraints, will be made in an increasingly complex competitive environment, which makes the task facing telecoms more difficult. We believe those companies that can move with agility, innovate, and find the answers first will capture substantial value in this rapidly evolving market.