Watch the turtle. He only moves forward by sticking his neck out.

—Lou Gerstner

Does your company have a credible investment thesis —a focused set of priorities that will drive competitive success and create sustained shareholder value? Many leadership teams struggle to define such a thesis. Hoping to meet the expectations of investors, they outline a bold growth agenda supported by financial goals and a list of actions. But in many cases, the shareholders, analysts, and business press are skeptical—with good reason. The stated agenda does not match the company’s current context or its economic realities; it doesn’t match the company’s starting position.

Value Patterns

In this series, BCG Fellow Gerry Hansell explores how value patterns shape the strategic moves most likely to create value.

- The CEO as Investor

- Value Patterns: The Concept

- How Value Patterns Work

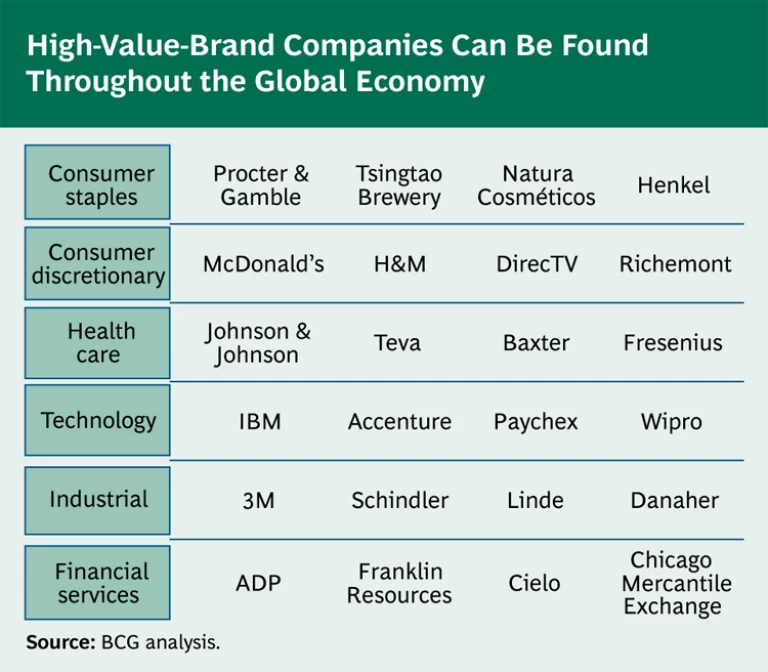

Although each company’s context is unique, there are recurring common patterns that show similar performance priorities, tradeoffs, and risks. The Boston Consulting Group has been exploring how to quantify these patterns. In-depth discussions with professional investors, detailed company vignettes, and a statistical clustering of 2,700 global companies have led us to identify ten different value patterns , or company starting points, that cut across industry boundaries and shape the range and types of strategic moves that are most likely to create value. To illustrate how these value patterns work, let’s look in detail at one of the larger groups: high-value brands.

Healthy, Stable, and Mature

High-value-brand companies (about one-fifth of our global sample) compete in many different product markets and regions. (See the exhibit below.) Yet they share a distinctive profile that shapes their investment thesis and strategic priorities. These companies are among the healthiest and strongest businesses in the market. They typically enjoy powerful competitive advantages in market segments that are not especially cyclical, and they have a limited concentration of earning power in any particular technology, patent, or product. They derive advantage from scale (for example, Perrigo in store-brand over-the-counter drugs and ADP in payroll processing), from brands ( Hermès in apparel and Danone in food), from capabilities ( Illinois Tool Works and Danaher in industrial goods), from strategic control of scarce resources ( McGraw-Hill in publishing and DirecTV in satellite broadcasting), and, in many cases, from a combination of these strengths.

As a result, high-value-brand companies occupy a starting position quite different from that of the average company—with powerful implications for their strategic agenda. Although they have long-term revenue-growth expectations similar to those of the average company, they enjoy more differentiated positions, with higher gross margins (at 47 percent, about ten points above the average). They also have higher returns on capital (at more than 20 percent, about twice that of the average company). They enjoy relatively low risk along multiple dimensions: market value volatility (reflecting lower-than-average risk of competitive or technology shocks to their earning power), debt leverage, performance dispersion, and rates of bankruptcy or being taken over. Finally, they are not particularly capital intensive, with about 50 cents of tangible capital for every dollar of sales.

As you might expect, this combination of high returns, high value added, and low risk earns these companies premium valuations compared with those of the average company. Their enterprise market-to-book multiples average 3.4x—double the market average of 1.7x. (Note that we measure valuation using a multiple of book capital in order to filter out noise from companies with depressed earnings and, therefore, inflated price-to-earnings ratios.)

And yet, despite so healthy a starting position, high-value-brand companies do notcreate more shareholder value, on average, than the market as a whole. In other words, position and trajectory are different issues: a good company today is not necessarily a good stock over time. In any given period, there are clear winners in the group that deliver top-quartile returns, and there are also clear losers that deteriorate and end up destroying value. And over a five-year holding period, approximately one-third of high-value-brand companies deteriorate in performance significantly enough to migrate down to other value patterns with lower margins, lower returns on capital, and lower average valuations.

Investment Thesis Priorities

A review of the historical patterns of the winners and losers reveals four clear priorities for high-value-brand companies.

Protect and grow the category. As category leaders, these companies often see significant strategic leverage from efforts to ensure the long-term health of the segments in which they participate. For example, Colgate-Palmolive , a global leader in oral-care products, invests considerable resources in encouraging the use of toothpaste, especially in developing markets. Colgate manages extensive oral-hygiene education programs in elementary schools and with dentists—not only to sell its products but also to promote good oral-care habits and thus stimulate overall demand.

Similarly, one of the critical risks that high-value-brand companies face is from broad long-term shifts that reshape their core markets permanently. The list of underperforming companies in this value pattern shows many once-dominant players that have been unsuccessful in developing an effective response to fundamental category declines (for example, in newspapers, department stores, office products, or bookstores).

Fight the pressures of commoditization. High-value-brand leaders are continually challenged to “revitalize the successful company.” Complacency often overtakes competitively successful, high-margin businesses. Ironically, the competitive strengths and consistency of performance that high-value-brand businesses typically deliver can become a trap: in the short term, unsustainable milking (pushing prices up while forcing advertising or R&D expenses down) can help meet quarterly earnings-per-share (EPS) targets. But driving current profits through unit price increases can also lead to franchise erosion, as a rising price umbrella invites competition. The winners keep a strong customer focus, reinvesting a meaningful portion of productivity and pricing gains to reinforce competitive differentiation.

Avoid complexity and low-quality growth. Growth can create significant value for high-value-brand companies. But the performance and valuation of these companies are quite sensitive to precisely how they are grown. The same noncapital barriers to entry that help generate and protect a high return on capital can also make it easy for these companies to add size in ways that destroy value.

Contrary to what many expect, the high valuations of these companies do not reflect investor expectations of high revenue growth. Rather, the valuations are primarily supported by high value added: high gross margins and high return on capital. Company-level event studies and empirical valuation regressions show that one point of sustained additional gross margin at these companies is worth three to four times more in market value than one point of additional forward revenue growth. A common mistake this group makes is to focus on revenue growth at the price of eroding margins—a move that can have a major negative impact on valuation.

High-value-brand leaders need to guide growth from a clear view of the sources of scale and competitive advantage in their portfolio. In what segments (customers, occasions, brands, and platforms) does the company earn a return premium? Historically, the top-quartile value creators in this value pattern have grown revenues through proprietary solutions that support or expand gross margins. At the same time, they have grown while reducing selling, general, and administrative expenses by not adding too much complexity to the business system. All EPS is not created equal: companies that grow within their sweet spot create value, and those that stretch beyond it simply create more size.

In 2002, for example, McDonald’s shifted from driving revenue growth through new store concepts and store openings toward improving the customer experience and margin structure of existing stores. As then-CEO Jim Cantalupo put it, “We are now targeting a lower earnings-growth rate. . . . We will shift our focus from ‘adding restaurants to customers’ to ‘adding customers to restaurants.’” Over the following nine years to 2011, the company delivered modest revenue growth of 6 percent but spectacular annual total shareholder return of 25 percent, driven by a full seven-point increase in gross margins and a doubling of return on capital.

Carefully allocate excess cash. The high-value-brand value pattern also puts a particularly strong emphasis on priorities for capital allocation simply because these companies generate far more cash than they can profitably reinvest. Their operating returns of 20 percent and higher can self-fund investment for business growth at rates in the high teens to the midtwenties—far in excess of demand growth. So these businesses show a substantial cash-flow surplus even after funding reinvestment for innovation, market share gains, and growth initiatives in emerging markets.

The resulting “excess” cash can contribute strong and sustained shareholder value—but only if that cash is harvested from the business and allocated intelligently at the corporate level. The investment thesis requires that each dollar of distributable cash be either reinvested in the portfolio at greater than a dollar in risk-adjusted present value or returned to owners as a yield-based contribution to TSR. Since 2003, for instance, IBM has increased its quarterly dividend by 400 percent, and 2011 was the eighth year in a row in which the company grew its dividend by more than 10 percent.

Know Your Value Pattern

For the one in five companies that enjoys a high-value-brand starting position, the “outside” view of investment thesis priorities is relatively clear: Protect and grow the category. Don’t let smooth EPS get in the way of the right innovation bets. Avoid complexity from margin-diluting growth outside your sweet spot. Discipline capital allocation to support high-quality growth with reliable cash-flow yield. The priorities for companies in other value patterns, however, will be different, reflecting their different tradeoffs, risks, and business economics.

If you are a leader of a high-value-brand business, you can pressure-test your value-creation agenda starting with the following five questions:

- How would we describe our investment thesis if we were meeting with an activist investor or a new board member?

- Do we know the level and sources of economic returns across our portfolio?

- Will our strategies drive proprietary and meaningful innovation—solutions that create value for customers and raise or support gross margins?

- What companies are the new “fringe” competitors that could signal long-term threats to the health of our category and to our position as a leader

Do we have an explicit capital-allocation framework that can assess the value created across competing uses of funds?

We will explore the priorities for companies in other value patterns in subsequent publications.