The framework of a two-speed economy is becoming antiquated in a world of accelerating change and increasing complexity. But to speak of a “multispeed economy” is not especially helpful either. Instead, it is better to think of a mosaic, with hotspots of opportunity and black spots of no growth or slow growth. This commentary is part of our From Emerging to Diverging Markets series, which tracks these hotspots and the changes under way in the world's rapidly developing economies.

The recent volatility in the Turkish economy can mainly be attributed to concerns about the U.S. Federal Reserve's phasing out of quantitative easing. Even though Turkey’s current-account deficit has been declining, it is still relatively large at 5.7 percent of GDP as of 2012. Turkey finances most of this deficit with foreign-capital inflows in the form of portfolio investments and short-term loans, so talk about Fed policy changes resulted in worries about Turkey's ability to continue financing its deficit.

Turkey's main challenge, therefore, is to further reduce its current-account deficit without compromising economic growth. Because around 60 percent of this deficit is generated by net energy imports, improving energy efficiency must be a priority. Turkey should also improve its efforts to attract foreign direct investment, which is a much more stable and value-adding source of financing than inflows of short-term external capital.

In the long term, Turkey has strong fundamentals that should continue to power economic growth well after the current volatility has abated. These advantages include the following:

- Well-Managed Public Finances. Turkey has a budget deficit of only around 2 percent of GDP, and public debt accounts for around 36 percent of GDP. That makes Turkey one of the few countries in Europe that meets the Maastricht criteria.

- A Very Healthy and Advanced Banking System. Turkey’s banking system has a capital-adequacy ratio of around 17 percent and a nonperforming loan ratio of less than 3 percent.

- Favorable Demographics. Turkey has the largest working-age population in Europe, and it is still growing. The average age is 29. Moreover, 6 million Turkish households are projected to enter the middle class over the next five years.

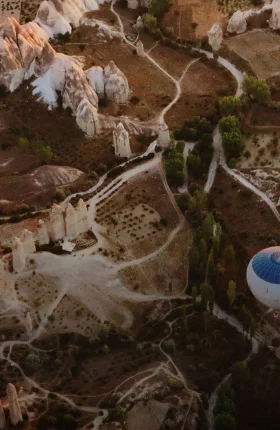

- A Unique Geopolitical Position. Turkey is located between Europe and Asia, which means that it is a bridge between rapidly developing economies and the developed world. Turkey offers access to 1 billion people living within four hours’ flying distance.

Turkey still needs to make several structural improvements in order to fully leverage these advantages and facilitate growth. The following should be top priorities for the government:

- Increase the value added of what it produces. Currently, Turkey's manufacturing exports are overly reliant on products assembled from imported components. As Turkish wages rise, it will be difficult to remain competitive. Moving up the value-added ladder will require greater investment in research and development. Currently, public and private R&D spending equals only around 1 percent of Turkish GDP. The government's ambitious goal is to increase that to 3 percent of GDP by 2023.

- Boost domestic savings. Currently, savings in Turkey amount to less than 15 percent of GDP. That is low for a developing economy. The government has taken some steps to make private pension plans more attractive. For example, for every Turkish lira that workers contribute to their own private retirement account, the government contributes an additional 25 percent—up to a limit.

- Continue to improve the investment climate. Industry has reacted well to new government incentives for investment in industries in which Turkey's trade deficit is particularly high. The climate could be further improved with a more transparent and predictable regulatory environment and a more efficient legal system.