Emerging markets are more important than ever, and they make up a large share of many multinational companies’ revenues and growth. Yet even so, multinationals have not mastered these markets. That’s because they are not playing to win.

The BCG Globalization Readiness Survey, a recent poll of more than 150 top executives in multinational companies, revealed a large gap between the aspirations of these companies in emerging markets and their performance on key capabilities—especially when it comes to attracting and retaining local talent.

Among the key findings:

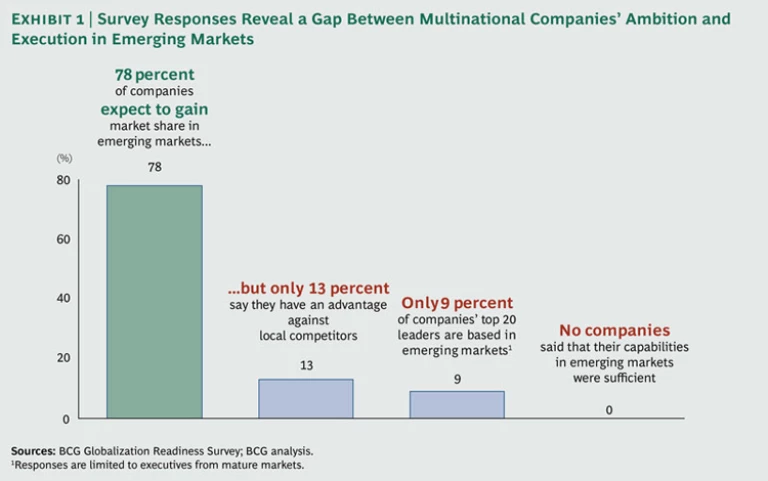

- Multinationals have large ambitions in emerging markets: more than three-quarters of the companies, or 78 percent, expect to gain share in these markets. Nevertheless, only 13 percent are confident that they can take on local competitors. (See Exhibit 1.)

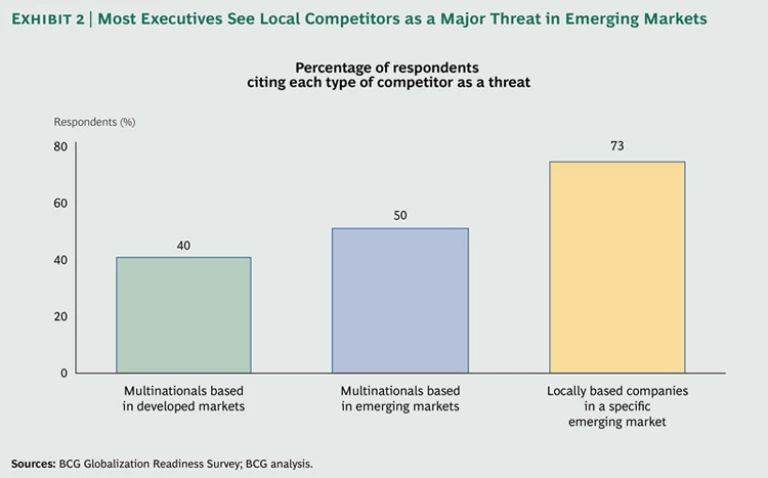

Nearly three-quarters, or 73 percent, of respondents said that local companies are a major competitive threat. (See Exhibit 2.)

- On average, multinationals told us that only 9 percent of their top 20 executives are based in emerging markets; the vast majority of them are still located in mature markets far away.

- Despite reports of slowing growth in China, 57 percent of respondents named the nation as the most important emerging market.

The survey suggests that multinational companies have the right priorities—emerging markets are the growth spots of the future—but have not fully put in place winning practices. (See “Who We Surveyed and What We Asked.”)

Who We Surveyed and What We Asked

The 156 executives who completed the BCG Globalization Readiness Survey work for a wide variety of multinational companies. Industrial goods companies employ more than one-third, or 37 percent, of the respondents. Other industries with strong representation in the survey are consumer goods (22 percent); technology, media, and telecommunications (10 percent); financial services (9 percent); and health care, professional services, and energy (each 6 percent). Of the respondents, 30 percent work for companies based in the U.S. and Canada, 49 percent for companies headquartered in Western Europe, 7 percent for companies based in Japan, 3 percent for companies headquartered in other developed Asia-Pacific markets, and 11 percent for companies based in emerging markets.

Nearly half of the executives, or 47 percent, work for companies with annual revenues exceeding $10 billion. One-third work for companies with $1 billion to $10 billion in sales. The remainder work for smaller companies.

We asked executives to answer a few general questions about their companies’ activities across all emerging markets. We also asked them to answer more detailed questions about performance, capabilities, and competition in a single emerging market that was critical to their company and that they felt they understood well. About half, or 52 percent, chose China. Other markets and regions that were heavily favored include Latin America (12 percent); Eastern Europe and Russia, India, and Southeast Asia (each 10 percent); and the Middle East and Africa (8 percent combined). Please note that because these figures have been rounded, they do not add up to 100.

We derived the performance gap by measuring the respondents’ ratings of importance of each of 13 capabilities on a scale of 1 (low) to 5 (high) and each respondent’s company’s performance on the same scale. The performance gap is the difference between their performance and importance scores.