With a population twice that of the United States and GDP growth greater than 5 percent, Southeast Asia is a large and dynamic region. By 2015, the ASEAN Economic Community (AEC) free-trade pact will be in effect, further energizing the region. The increasing flow of resources, goods, and capital will be especially beneficial to countries along the Indochinese peninsula. These countries are connected by geography but, until recently, were separated by historical circumstances.

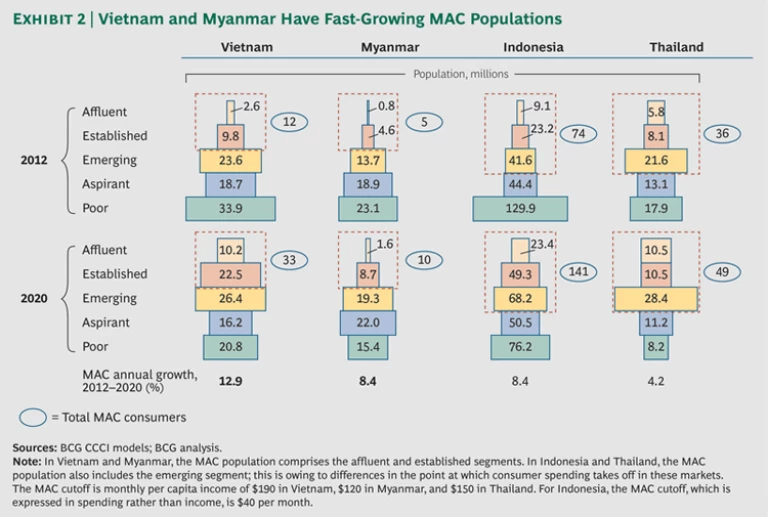

In particular, the economic spotlight is now on Vietnam and Myanmar. With a combined population of 150 million and economic expansion exceeding 6 percent annually, these nations are Southeast Asia’s new growth frontiers. Indeed, Vietnam has the fastest-growing middle and affluent class (MAC) in the region. Between 2012 and 2020, this population of consumers will rise from 12 million to 33 million.

Vietnam has been attracting foreign investment for several years. Samsung, for example, has won a license to invest $1.2 billion in production facilities in the country, while Nestlé recently opened a $240 million coffee-processing factory to serve Southeast Asia.

Interest in Myanmar is more recent. Unilever and Coca-Cola have both recently opened local manufacturing facilities and are committed to making further investments. A joint venture between the Myanmar and Thai governments is developing a deep-water port in Dawei, on Myanmar’s Tenasserim coast. A new road through mountains and jungles will eventually connect a surrounding industrial zone of more than 200 square kilometers with Bangkok, 350 kilometers away. The development will help knit Indochina together and provide easy water access to India at an eventual cost of up to $50 billion.

Both Vietnam and Myanmar have valuable natural resources—offshore oil in Vietnam and minerals, metals, gems, and timber in Myanmar.

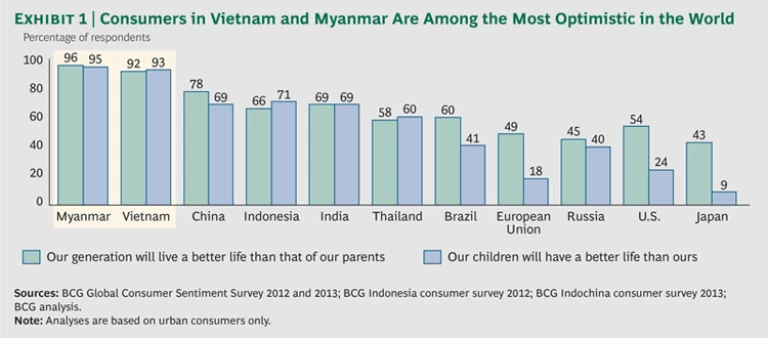

One of the little-known facts about these two nations is that their consumers are among the most optimistic in the world. The Boston Consulting Group’s consumer research shows that more than 90 percent of consumers in both countries expect to live better than their parents and expect their children to live better than themselves. (See Exhibit 1.) This level of optimism is among the highest recorded across 25 countries surveyed in the past year and is significantly higher than in China, India, and Indonesia.

Consumers in Vietnam and Myanmar are rapidly acquiring purchasing power that will make them attractive to companies. Indeed, the MAC segment is growing faster in both Vietnam and Myanmar than in any other Southeast Asian nation and is expected to double in size by 2020. (See Exhibit 2.)

BCG’s Center for Consumer and Customer Insight (CCCI) recently surveyed more than 3,000 urban consumers in Vietnam and Myanmar. The analysis provides a granular forecast of consumption, by product category, in both countries. (See “Consumer Power,” below.)

Consumer Power

In order to project the growth of consumers and their spending in Vietnam and Myanmar, the CCCI analyzed population and income trends in nearly 1,400 districts in Vietnam and nearly 75 provinces in Myanmar. The center also surveyed 2,000 urban consumers in Vietnam and 1,000 urban consumers in Myanmar about their purchases in 20 categories of consumer goods in order to understand channel preferences, attitudes, and behaviors. The CCCI generated consumption curves that showed the income levels at which purchasing takes off for individual products. (See the exhibit below.)

By combining consumer research with income forecasts, the CCCI study provides a perspective into where companies should target their efforts based on their product portfolio and how quickly those markets will develop. This analysis affords a more nuanced view of consumers and consumption than traditional consumer research. For example, many models set an arbitrary floor for the consuming segment that is adjusted by country based on cost of living or purchasing-power parity. The CCCI methodology, in contrast, sets the income floor on the basis of when actual spending starts to take off for a wide array of goods and services.

Companies that enter Vietnam and Myanmar now have an opportunity to build businesses, brands, and momentum early in the development of these formerly closed economies—but only if they have a solid understanding of these markets’ consumers and how to satisfy them. (See “Tidbits About Vietnam and Myanmar,” below.)

Tidbits About Vietnam and Myanmar

Vietnam and Myanmar are not well known globally. A few facts help shed light on these countries and their people.

- Consumers in Myanmar and Vietnam are the most optimistic in Asia, with 93 percent and 95 percent, respectively, saying that their children will have a better life than they do.

- Consumers in Vietnam are among the most family oriented in Asia, with 69 percent saying they never spend money on themselves before the family’s needs are met.

- Vietnam has higher Internet penetration (43 percent) than Thailand (41 percent) or Indonesia (29 percent).

- Myanmar was the world’s leading exporter of rice before the collapse of the economy following a military coup in 1962.

Vietnam and Myanmar should be on your radar screen. Vietnam is an attractive market today and will become more so. Now is the time to make smart investments and develop an expansion strategy. If Vietnam is a here-and-now opportunity, Myanmar is a more long-term play. The market is still developing, so there is time to learn and be focused in your strategy. Still, the history of all emerging markets shows that consumption takes off quickly as soon as the MAC class reaches critical mass. It is better to be early than sorry.