To mark The Boston Consulting Group’s fiftieth anniversary, BCG’s Strategy Institute is taking a fresh look at some of BCG’s classic thinking on strategy to explore its relevance to today’s business environment. This second in a planned series of articles examines the experience curve, an idea developed by BCG in the mid-1960s about the relationship between production experience and cost.

The experience curve is one of BCG’s signature concepts and arguably one of its best known. The theory, which had its genesis in a cost analysis that BCG performed for a major semiconductor manufacturer in 1966, held that a company’s unit production costs would fall by a predictable amount—typically 20 to 30 percent in real terms—for each doubling of “experience,” or accumulated production volume. The implications of this relationship for business, argued BCG’s founder, Bruce Henderson, were significant.

The experience curve theory proved a valuable descriptor and predictor of competitive dynamics across much of the business landscape through the 1970s, providing a sound guide for investment and pricing decisions and an invaluable tool for strategists. Is the idea applicable to today’s environment? Yes, but in some industries it is no longer sufficient by itself as a blueprint for competitive advantage. In contrast to the 1960s and 1970s, when the general business environment was relatively stable and new-product introduction relatively infrequent, today’s business climate is characterized by higher volatility, less stable industry structures, and frequent product launches in response to rapidly changing technologies and tastes.

Experience of the type addressed by the experience curve is still necessary—often critically so, depending on the industry. But we argue that most companies today need an additional kind of experience if they hope to create and sustain competitive advantage.

Two Types of Experience

The type of experience that the classic experience curve refers to—the ability to produce existing products more cheaply and deliver them to an ever-wider audience—can be considered experience in fulfilling demand. This type of experience remains very important in many industries, especially those that are relatively stable, cost-sensitive, competitive, and production-intensive.

Hard-disk drives, for example, showed a cost decline of about 50 percent for each doubling of accumulated production from 1980 through 2002, bringing the average cost per gigabyte from $80,000 in 1984 to $6 in 2001. Laser diodes showed a similarly steep cost decline of 40–45 percent with each doubling of volume, with prices decreasing from the roughly $30,000 of fiber amplifiers in the early 1980s to $1.30 for 0.8-micrometer CD lasers (unpackaged) in 1999. But to win in today’s environment, many companies also need experience in shaping demand, or creating demand for new products and services.

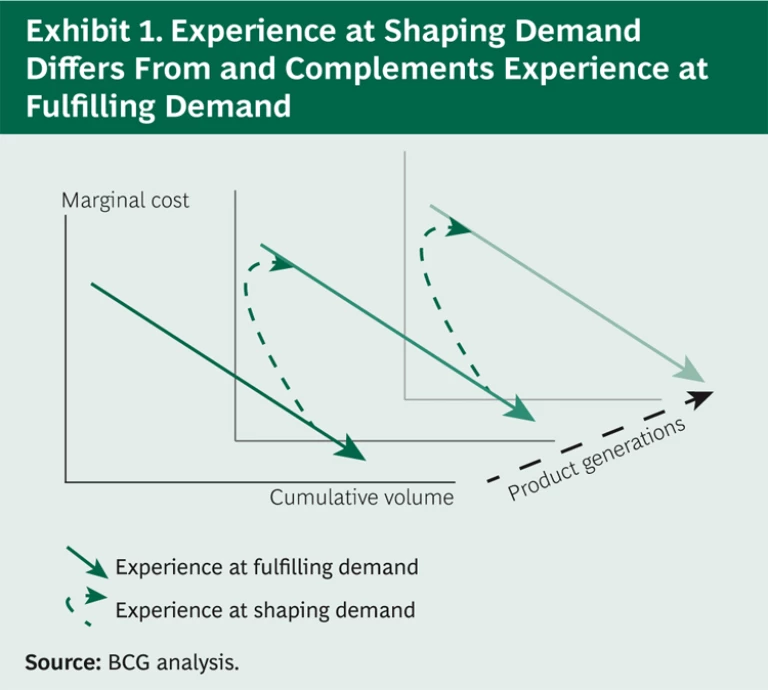

Exhibit 1 is a visual representation of the two types. Experience in fulfilling demand is represented as the classic experience curve: it shows a reduction in costs as a function of cumulative volume (which is a straight line in a log-log scale). Experience in shaping demand is represented as repeated “jumps” across successive experience curves, representing a company’s ability to move from product generation to product generation repeatedly and successfully. The relationship between the two types of experience might also be visualized as an endless version of the popular board game Snakes and Ladders. To maintain competitive advantage, companies have to both “slide down snakes” (that is, fulfill demand) and “climb ladders” (that is, shape demand). The relative emphasis on each depends on a company’s particular circumstances.

The two types of experience are inherently different, as is the way they are accumulated and the benefits they confer. Experience at fulfilling demand is acquired through a logical deductive process: capture your cost data, analyze them, determine opportunities for improvement, implement changes, iterate. The main features of the learning process are repetition and incremental improvement, both explicit and implicit. Experience at shaping demand, in contrast, is acquired through an inductive process: sample consumer behaviors, formulate a hypothesis on unmet needs or imagine the possibilities permitted by new technologies, test the hypothesis with a new offering, shut down the test or expand it based on empirical results, formulate new hypotheses based on the latest empirical results, repeat.

It should be noted that neither experience type, by itself, has ever been sufficient for long-term competitive advantage. Both have always been necessary. What has changed recently is that the required speed of cycling between the two has increased dramatically. We refer to this ability to develop and leverage both existing and new product knowledge concurrently, or to switch between them effectively over time, as ambidexterity.

Experience in Shaping Demand in Practice

Experience in shaping demand—which can be gauged by a company’s product-introduction “clock speed” or by the percentage of sales derived from new products or services—can be a powerful competitive weapon, particularly when paired effectively with experience in fulfilling demand. It can be seen as a second-order type of experience, one that comes from sharing experience across different areas and learning how to learn new things. It includes the ability to “forget” lessons from the past when such information has become obsolete and is no longer relevant to the latest product generation. This type of experience can be disruptive not only because it involves innovation but also because being at a disadvantage on an earlier product generation can quickly be overturned by shaping demand to get a head start on the next experience curve.

We can illustrate the power of demand-shaping experience, and how the past and present of the experience curve interweave, by taking a contemporary look at the industry that gave birth to the experience curve.

ARM Holdings is a leading semiconductor player, with particular strength in the design of low-power microprocessors. The company itself is not a manufacturer; rather, it designs the underlying technologies and leaves manufacture to its partners. By focusing on shaping demand through its innovative designs and leveraging its partners’ expertise in fulfilling demand, thus avoiding the need to develop such experience itself, ARM has created a compelling recipe for success. Devices based on ARM’s technology now account for 95 percent of the fast-growing smartphone market. ARM also boasted an impressive annualized total shareholder return (TSR) of 28 percent for the seven years through 2011. ARM’s partners, too, have benefited from this approach, as evidenced by their strong product shipments and TSR: Qualcomm’s annualized TSR for the same period was 5 percent, for example, also above the industry median of –6 percent for the same period.

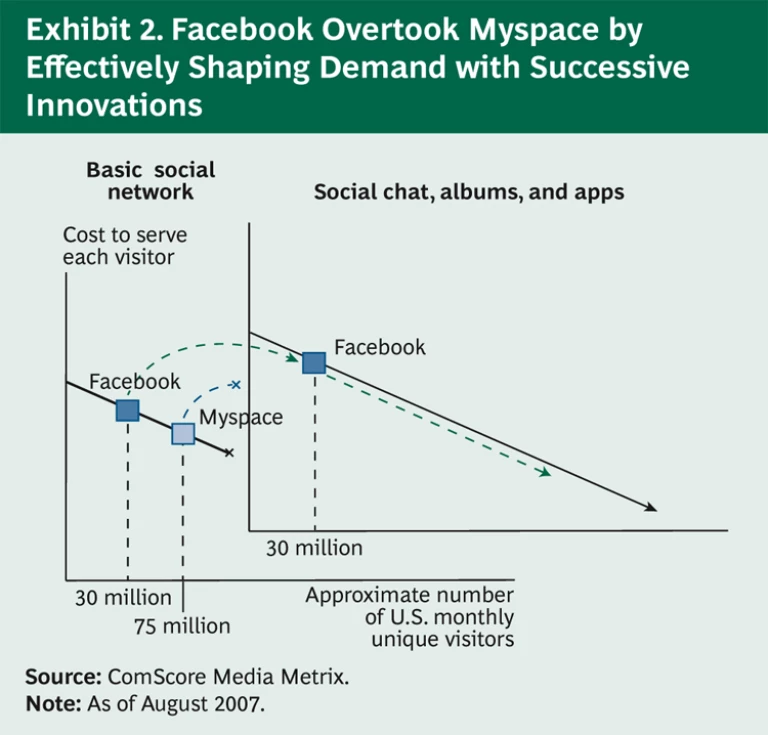

Facebook successfully shaped demand for its services by continually improving users’ experience and doing so faster than rival Myspace. (See Exhibit 2.) To build demand-shaping experience, Facebook released new software weekly and experimented with new technologies and features such as live chat, photo albums, and a third-party app-developer interface. These efforts allowed Facebook to gain a more thorough understanding of users’ needs and desires and respond to them with accelerated new-product generation, translating into a swelling userbase and eventually also an improved cost position.

Netflix twice radically shaped demand by improving the convenience of a service. Its promise of convenient and inexpensive DVDs by mail (with no late fees or hassles with pickup and drop-off) successfully shaped the demand for home video. Netflix succeeded again when it introduced streaming (which added the benefits of assured and instant availability), even though the offering was obviously going to cannibalize the company’s DVD-by-mail business. Netflix realized that the DVD-by-mail offering was vulnerable to streaming technology, regardless of which company launched the service first. The company’s early move to shape demand forced its major competitors to react to the initial consumer expectations that Netflix had set, giving Netflix a substantial advantage.

These companies’ focus on excellence in both shaping and fulfilling demand allowed them to thrive, often overtaking their established competitors. This is a phenomenon that the traditional experience curve cannot explain.

Sustaining Competitive Advantage Both Within and Across Product Generations

Solidifying your long-term competitive advantage in today’s environment requires asking yourself a series of questions about excellence in both shaping and fulfilling demand.

What balance of experience in fulfilling and shaping demand is required in our industry? In some industries, experience in fulfilling demand remains critical.

Do we have the right disciplines and capabilities to develop and leverage experience in fulfilling demand? Build scale and defend the market share of your established products. Learn through repetition and incremental improvement, both explicit and implicit, to further reduce costs.

Do we have the right disciplines and capabilities to develop and leverage experience in shaping demand? Unlink the development of new products and services from the production and management of existing ones. Empower individuals to experiment. Foster an appetite for risk with incentives that reward success; punish failure only if it arises from irresponsibility. Accelerate the product life cycle and plan the retirement of products as well as their launch. Create advantage by better understanding and shaping demand.

Do we have the right metrics in place for both types of experience? Ensure that you can gauge your prowess in building and leveraging both types of experience. Compare the results with those of your direct and indirect competitors. Examine your relative cost positions and demand-shaping clock speed and use them as your firm’s composite measure of success.

Do we have the right approach to balancing and combining experience types? Shaping demand and fulfilling demand are different in nature, and experience is acquired and leveraged through different, sometimes conflicting, means. In our above-referenced BCG Perspectives publication on ambidexterity, we presented four different approaches to striking an optimal balance: separation, switching, self-organizing, and external ecosystem. The right approach for your company will be determined by the dynamism and diversity of your specific industry environment.

As consumer tastes and product generations change ever more rapidly, experience in fulfilling demand alone is no longer sufficient to sustain a competitively advantaged position. An additional type of experience—experience in shaping demand—becomes necessary as well. This experience must be acquired through new and different means that can sometimes be in direct conflict with the current means your organization employs to acquire experience. But failure to do so can exact a significant toll, ranging from the loss of a leadership position to outright business failure.

The ability to skillfully build and leverage both types of experiences concurrently—ambidexterity—is the present-day hallmark of truly exceptional management. It is a rare attribute but a highly valuable one, one that can be developed if a company follows the right approach.

Acknowledgments

The authors thank Bruce Henderson and the many other BCG employees for their original work on, and subsequent development of, the experience curve; our clients, who worked with us to advance the theory and continue to do so; and BCG’s Strategy Institute team and its collaborators, especially Carine Assouad, James Hollingsworth, Jussi Lehtinen, and Carolyn Young, for their help in pushing BCG’s current thinking forward. Valuable input was provided by all BCG employees who submitted essays on this topic and by those who helped in its early, exploratory stage—in particular, Aakash Arora, Hannah Chang, and Max Otto.