Academic research has repeatedly confirmed that about two-thirds of all mergers and acquisitions among public companies destroy value for the acquirer, at least in the short term. Even when acquirers justify deals by pointing out the ample synergy opportunities that they offer, capital markets remain skeptical. Yet a significant minority of acquisitions do manage to create value for the owners of both the acquirer and the target, demonstrating that despite the doubters in the capital markets, the overriding M&A rationale—value creation—remains valid.

Of course, the specific path to value creation varies widely by company, depending on the economics of its business, its valuation in the marketplace, and the terms of any given M&A transaction. But whether by buying out-of-favor targets near their cyclical lows, realizing cost efficiencies, or boosting the top line through organic growth, acquirers and M&A partners can create value—provided the transaction is accurately priced and specific value-creation strategies are executed effectively.

Most acquirers seek to create value by capturing cost synergies. But there is more to value creation than simply identifying synergies and executing strategies to realize those synergies. The Boston Consulting Group teamed up with the Technische Universität München (TUM) to compile new research demonstrating that in successful deals, buyers and sellers share the synergies. Acquirers cannot expect to capture 100 percent of those synergies for themselves; sellers will anticipate the buyers’ synergies and demand takeover premiums, reasoning that the target is worth more in the hands of the acquirers than in their own. Our research suggests that sellers collect, on average, 31 percent of the average capitalized value of expected synergies. However, in practice, the seller’s share varies widely.

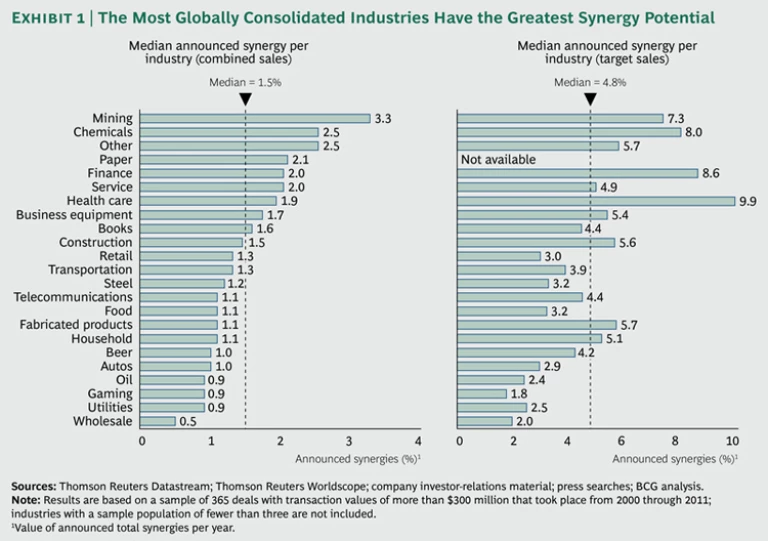

Potential synergies may include closing redundant plants or production lines, realizing economies of scale in purchasing, centralizing administrative functions, reducing headcount, or pushing forward other forms of streamlining. Not every acquisition has synergistic potential, however. In regulated industries such as transportation, utilities, and telecommunications, for example, there are sometimes few synergies available—even though they often operate as part of “natural monopolies” that, in theory, have high potential for synergies. Companies in such industries tend to be influenced and constrained by national regulators that generally bar them from realizing all available synergies for the benefit of the end consumer, and thus the net value of any synergies disclosed at the time of a merger announcement is relatively low.

Industries with a high ongoing level of international consolidation, on the other hand, can generate significant synergies, ranging from 2 to 10 percent of the target company’s latest annual sales (a median of 4.8 percent), or 1 to 3 percent of the combined sales of target and acquirer (a median of 1.5 percent). (See Exhibit 1.) Among the industries with ample opportunities for realizing synergies are mining and chemicals, which have experienced a wave of global consolidation in recent years, and health care, especially early-stage pharmaceutical companies that can dramatically increase value by joining forces with large organizations that have the manufacturing and distribution clout needed to overcome the lofty barriers to international market entry.

Acquirers Can Use Synergies to Set Takeover Premiums

BCG and TUM have developed a sophisticated method, based on the empirical experiences of our clients, of analyzing the relationship between synergies and the effect of M&A announcements on capital markets. This approach allows companies to quantify the value of synergies in terms of transaction price, thereby revealing whether the acquirer will retain adequate space to create value for shareholders in the combined entity. The acquisition price premium is expressed in relation to the discounted value of potential synergies and rests upon three interlocking assumptions:

- The value of a company to the seller is the sum of the company’s standalone future cash flows. The seller may anticipate that an industry buyer will be able to capture synergies and—because those specific synergies are unique to that company—might demand a share of them in the form of a takeover price higher than the asset’s standalone valuation.

- The value of a company to a buyer is the target’s standalone cash flows plus the value of the synergies that the acquirer can capture. But if the acquirer pays the full value of those synergies to the seller (in the form of a takeover premium), then the deal offers no headroom for value creation. Thus the acquirer seeks a price somewhere between the standalone net present value of the future cash flows and the full value of the synergies plus the standalone value.

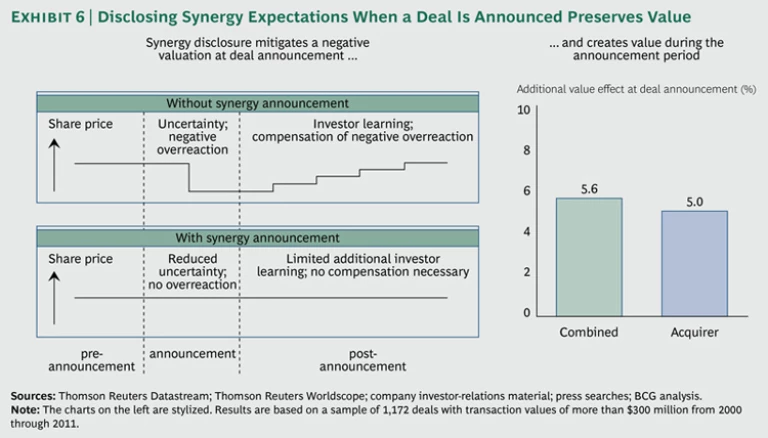

1 1 Because synergies tend to mount over time and become fully effective after roughly two years (assuming skillful management by the acquirer), the value of synergies can be stated as the present value of ongoing synergies after two years. - By sharing the value of synergies with the seller, the acquirer can pay a price that induces the seller to conduct the transaction while still enabling both acquirer and seller to create value for their shareholders. Further, by disclosing the value of potential synergies at the time of an acquisition, the acquirer can shore up its market valuation during the period following the merger announcement, offsetting the erosion in market value that frequently occurs as investors react to the uncertainty engendered by such announcements.

Synergy Potential Varies Widely by Industry and Company

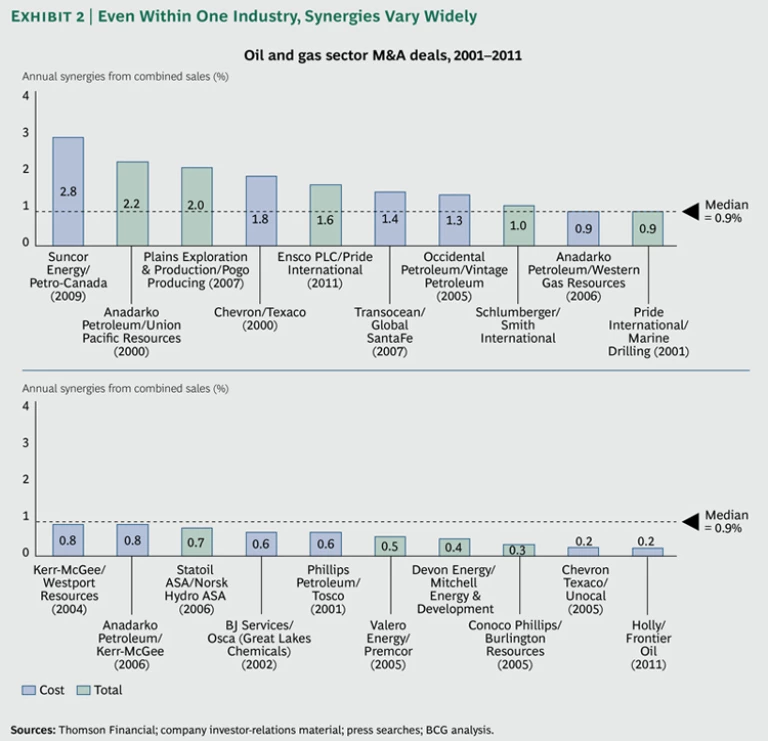

Identifying synergy-rich deals and expressing the value of those synergies with precision are complex tasks. Synergy value fluctuates widely even among M&A deals within a single industry. (See Exhibit 2.) When Suncor Energy announced its acquisition of Petro-Canada in 2009, for example, it promised shareholders synergies equal to 2.8 percent of the combined company’s annual sales. Statoil’s 2006 acquisition of Norsk Hydro, by contrast, offered synergies equal to 0.7 percent of combined sales—roughly in line with the industry median. (Statoil shareholders nonetheless supported the deal because of its sound strategic logic and modest takeover premium.)

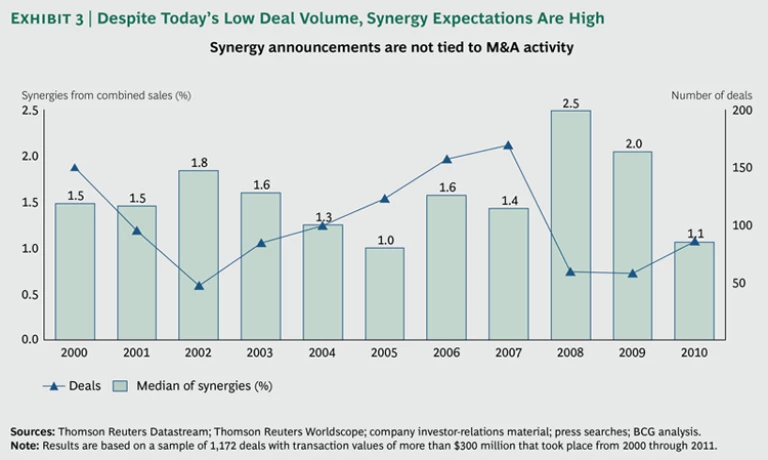

Moreover, synergy expectations are no longer tethered to M&A activity cycles. In the past, synergy expectations were high during periods of intense M&A activity and low during slumps. Today, expectations are high even though merger activity is depressed, as financing remains tight and acquirers have become picky. (See Exhibit 3.)

Although synergies can play a key role in price negotiations and in supporting the acquirer’s stock valuation following the deal announcement, companies generally focus only on cost-saving synergies when communicating such values to shareholders, omitting any mention of potential synergies on the revenue side. Indeed, 94 percent of merger announcements that disclose the value of synergies mention only cost synergies or don’t mention the specific nature of the synergies at all. By contrast, only 5 percent of announcements that disclose synergies mention revenue synergies.

Companies leave revenue synergies out of the conversation for two main reasons. One is that cost synergies are simply easier to talk about. Whether they’re derived from shared sourcing, rationalized manufacturing operations, elimination of overlapping functions, shared services, or other activities, cost synergies are relatively easy to quantify with some precision. And though realizing those synergies can hardly be called easy, acquirers can reliably realize them through their own efforts—provided they have developed a detailed plan for postmerger integration (PMI) that they execute successfully.

Revenue synergies, on the other hand, are more difficult both to realize and to quantify, depending as they do on the behavior of third parties such as customers. Although concepts such as cross-selling, up-selling, and concentrating on the highest-margin products and segments are conceptually easy to grasp, realizing them calls for exceptional management and execution. As a result, analysts and investors tend to view revenue synergies with great skepticism, preferring to believe in them only after they have come to fruition. Acquirers, by the same token, tend to downplay talk of revenue synergies during deal negotiations to avoid the risk that the seller will demand a share of synergies that ultimately may not materialize.

The rewards for realizing revenue synergies can be considerable, however—though those rewards often arrive some time after the transaction is finalized. Mittal Steel’s 2006 acquisition of another leading global steelmaker, Arcelor, is an instructive case in point. (See “Mittal’s Winning Synergy Strategy.”) BCG, with its finance and industry expertise, is able to assist acquirers by looking beyond costs to other sources of synergies, capturing their value, and, at the appropriate time, communicating that value to investors.

Mittal’s Winning Synergy Strategy

When Mittal Steel launched a hostile takeover bid for rival steelmaker Arcelor in 2006, the odds that Mittal would succeed initially appeared slim. Arcelor summarily rejected the bid, arguing that there was little strategic value in combining the two companies and that Mittal’s shares, the currency for the deal, were overvalued and subject to dilution. (Mittal’s free float was only 12 percent of outstanding shares at the time.) European governments, alarmed at the prospect of the takeover of a leading Continental industrial company, leaped to Arcelor’s defense.

Despite such objections, Mittal had a strong rationale for the deal. The steel industry, plagued by overcapacity and fragmentation, was in the midst of a consolidation wave. By acquiring Arcelor, Mittal stood to consolidate its position as a leading global steel producer while generating cost savings of $1.6 billion in two years. That amount was equal to 1.9 percent of Arcelor’s sales, a relatively small percentage considering that manufacturing-industry acquisitions as a whole generated savings equal to 4.3 percent of the target industry’s sales. The savings came from consolidation of marketing and trading operations ($530 million), purchasing ($570 million), optimization of manufacturing and processes ($400 million), and savings on selling, general, and administrative expenses ($100 million).

Mittal’s announcement of its hostile bid, which included disclosure of the $1.6 billion in synergies, appeared to tip the balance in Mittal’s favor. In the seven trading days around the announcement, the financial markets signaled the credibility of the bid by adding 15 percent to Mittal’s share price. Arcelor’s valuation, meanwhile, rose 29 percent. In the end, Arcelor shareholders claimed 40 percent of the estimated value of the synergies (compared with 44 percent for the median manufacturing-industry target).

Mittal shareholders, for their part, made out well on the deal, as their shares posted a 6.6 percent total shareholder return in the 12 months following the deal announcement. That return was driven by a better-than-anticipated realization of synergies—the combined entity, ArcelorMittal, regularly updated shareholders on the progress of synergy realization—and by the higher-than-expected absolute value of synergies. Not only did ArcelorMittal realize the savings it had forecast, it generated additional revenue synergies through cross-selling and accelerating sales in developing regions. In other words, ArcelorMittal fulfilled its implicit promise to shareholders and also delivered them a kicker in the form of revenue synergies—and was accordingly rewarded with a higher valuation.

Part of our assistance involves uncovering potential synergies from sources other than operating costs and revenues. A new owner can create synergies by its mere presence, either because it can offer advantageous financing, optimize the target company’s tax situation, or provide other crucial advantages. And identifying and capturing alternative synergy sources can provide potential acquirers with a decided advantage over rival suitors, because it allows acquirers to offer the target a higher price while retaining adequate headroom for future value creation.

It Pays to Share Synergies with Sellers

In M&A as in life, you can’t have your cake and eat it, too. To arrive at a transaction price acceptable to the seller, in most cases, the acquirer must agree to share expected synergies. The key word in that sentence is “share”—the deal price will fall in the range between the standalone value of the target and that value plus the maximum value of potential synergies. The amount of the seller’s share does not correlate with M&A cycles—that is, it doesn’t rise during M&A-intensive periods and decline during lulls in the cycle. It varies instead according to factors such as the relative negotiating strengths of the buyer and seller and the amount of competition to acquire the target.

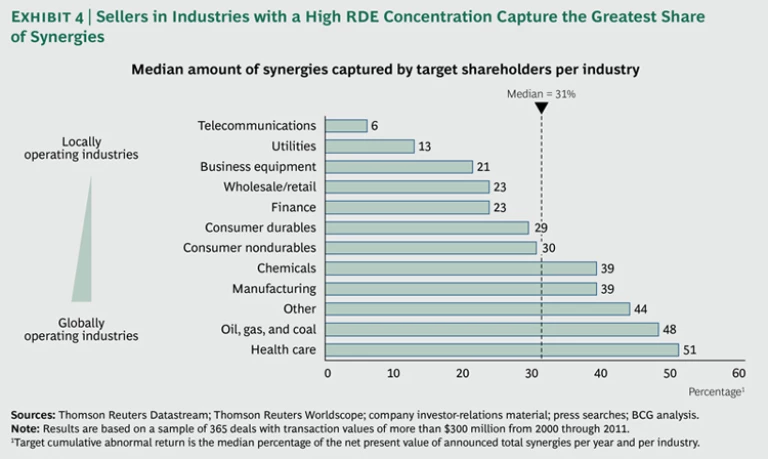

Nonetheless, the seller’s share has been trending upward during the past several years—to a current median of 31 percent—indicating that sellers have grown more sophisticated in assessing the synergy potential of their assets. Sellers in markets outside Europe and the U.S. have tended to collect the largest share, most likely because acquirers have been willing to accept a lower share in return for access to those markets. For example, in deals announced from 2000 through 2011, sellers in manufacturing industries, many based in rapidly developing economies (RDEs), captured 39 percent of the net present value of announced synergies, well above the median for all industries. (See Exhibit 4.) During the same time frame, sellers in the oil, gas, and coal industry—which is also concentrated in RDEs—captured 48 percent of the net present value of announced synergies.

Sellers in industries with a high level of expected synergies generally stand to collect a larger cut, in part because investors have learned through experience that sellers in such industries typically command higher takeover premiums than sellers in industries known for their low synergy potential. For example, sellers of telecommunications companies, whose synergy potential is generally low because of regulatory constraints, captured only 6 percent of the net present value of announced synergies in deals executed from 2000 through 2011, compared with a 51 percent share for health care companies over the same time frame.

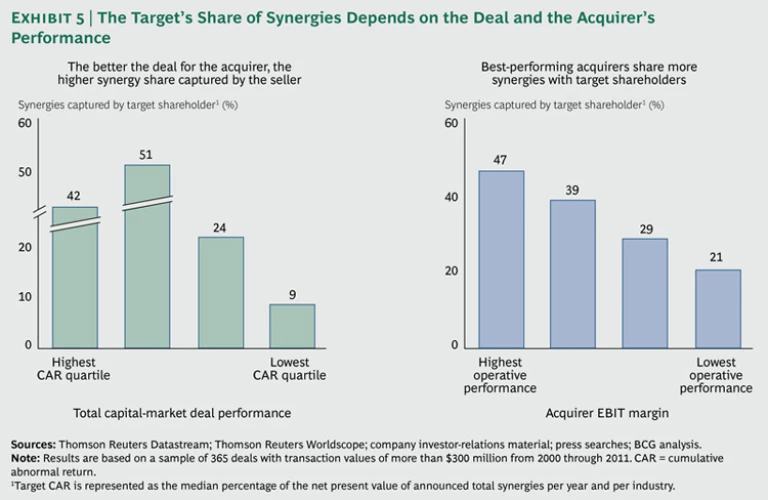

It’s impossible to say in advance how much the seller will demand in any given deal. As a general rule, however, the acquirer will reap twice as much of the synergies’ value as the seller, because the acquirer is assuming the risk of realizing the synergies, whereas the seller collects its share at closing and thus assumes no risk. Like synergies themselves, the seller’s share depends on the target company’s industry and the specific terms of the transaction. The seller’s share does not appear to correlate with its size or profitability, although it does seem linked positively to the profitability of the acquirer and negatively to the return on the acquirer’s shares during the period of the deal announcement. (See Exhibit 5.)

Ultimately, the parties to the deal negotiation determine the seller’s share of synergies, and both have an interest in arriving at a percentage that shareholders of both acquirer and target regard as fair and reasonable. Consider the merger of The Stanley Works and Black & Decker, a stock swap valued at $3.5 billion that gave Stanley shareholders a 50.5 percent stake in the combined enterprise. When the deal was announced in November 2009 (it closed in March 2010), top management of both companies justified the transaction by arguing that the combination of two companies roughly equal in size and with overlapping product lines would generate cost savings and produce an industry leader in the engineering and power tools business.

Both sides made a point of mentioning cost synergy potential in their merger announcements. Their conservative initial estimates called for cost savings of $350 million in three years. That figure translated to 7.3 percent of Black & Decker’s annual sales, well above industry median cost savings. That initial estimate was subsequently revised twice, first to $450 million and finally to $500 million, with the bulk of the savings coming from reduced selling, general, and administrative expenses, as well as streamlined manufacturing and purchasing. Following deal closing, management of the combined company regularly reported its progress toward realizing those savings, enhancing the credibility of its estimates.

Both companies reaped the rewards of their careful attention to and communication of expected synergies. The Stanley Works, the acquirer, posted returns 8 percent higher than the industry median in the seven trading days following the deal announcement, while Black & Decker posted returns 29 percent higher than the industry median seller’s return. It’s worth noting that Black & Decker posted those returns despite its having collected only 38 percent of the deal’s expected synergies, compared with the industry median of 44 percent. This was most likely because, as minority holders of the combined company, Black & Decker shareholders would continue to share in the expected savings.

There’s a final lesson in the story of this merger. Management of Stanley Black & Decker, the combined company, knew that the initial market reaction to the deal announcement would destroy value because of uncertainty that the deal would be completed and because of the inevitable disruption to operations that the merger would cause. (The market has generally come to expect mergers to destroy value.) To counteract this downward pressure, management stressed the importance of PMI and concentrated much of its energy and attention on realizing the savings promised when the deal was announced. Other acquirers should consider plotting a similar postmerger course, as they, too, will be operating in an environment in which the market assumes the deal will destroy value. An aggressive PMI agenda is the surest means to counteract diminished market expectations and restore the value lost as a result.

The Value of Communication

PMI actually begins the moment the deal is announced, when management communicates the rationale for the transaction and quantifies the synergies that shareholders can expect. Recent M&A history conclusively demonstrates that shareholders welcome details about the logic underlying a transaction and reward communicative acquirers with higher-than-expected valuations during the period after merger announcements. The valuations of acquirers that quantify synergies as part of merger announcements are roughly 5 percent higher, on average, than those of acquirers that make no such disclosure, while the valuation of the combined companies is approximately 6 percent higher than it is for comparable companies that don’t disclose synergies. (See Exhibit 6.) The value-creating potential of such announcements is especially high in transparent markets that are well-covered by equity analysts. In such cases, sellers and their shareholders tend to have a clear idea of the potential synergies they are relinquishing by selling.

All the communication in the world, however, cannot preserve the value of a combined company that fails to deliver against the synergy expectations it creates. BCG has identified a set of best practices for setting synergy expectations at the time the deal is announced and for tracking progress against synergy targets. These best practices include the following:

- Provide a context for the current deal by referring back to earlier transactions that demonstrate that each new deal is premised on sound, consistent strategic logic.

- Explain in detail the rationale for the current deal in the form of a narrative that takes into account macroeconomic conditions, industry fundamentals, and the competitive positions and differentiating strengths of both acquirer and target.

- Disclose the value of anticipated synergies and their sources and provide—and regularly update—a timetable for realizing that value.

As varied as these practices are, they are rooted in a single imperative: be straightforward, candid, and as accurate as possible. Setting expectations too low risks making the seller’s investors feel sandbagged when the company overdelivers against them, but setting them unrealistically high risks harming the company’s long-term credibility in the marketplace. Investors will welcome and reward over¬delivery against credible expectations, of course, but the long-term cost of unrealistic promises far outweighs whatever short-term gains those promises may produce. Using BCG’s unique synergies-based approach to M&A pricing, companies can realistically assess the synergy potential of particular industries, companies, and business models, and they can develop PMI plans that ensure that acquirers capture the full value of the synergies they identify.