Working in collaboration with the Grocery Manufacturers of America (GMA) and its membership, The Boston Consulting Group (BCG) conducted extensive benchmarking on topics related to effective supply-chain management. The resulting report, GMA Supply-Chain Benchmarking 2012: Unlocking the Hidden Value of Complexity Management and Collaboration, is based on a survey of 51 CPG manufacturers in the U.S., supplemented by interviews with 65 supply-chain executives. It also incorporates data that BCG gathered by polling 116 attendees at the February 2013 Supply Chain Conference, jointly hosted by the GMA and the FMI, including retailer views. Furthermore, it draws on BCG’s experience working with many of the leading CPG manufacturers and retailers in the U.S.

Collaboration with trading partners is, like Managing Complexity for Superior Value , a rich source of untapped value, which BCG estimates to be worth between $7 billion and $21 billion of incremental profit for the industry as whole, with both manufacturers and retailers winning relatively equally.

Nearly all participating companies have embarked on the collaboration journey, but only a few have moved into the advanced stages of partnership and none has achieved full end-to-end integration. Fostering greater trust, with the support of senior leadership, is the key to success.

Collaboration is not a new concept in the CPG industry. Since the 1980s, manufacturers and retailers have been working together, initially with vendor-managed inventory (VMI) and later through initiatives such as collaborative planning, forecasting, and replenishment. However, recent pressures shared by manufacturers and retailers—including the economic downturn and the looming transportation-infrastructure crisis in the U.S.—have made it increasingly important for manufacturers and retailers to work together to find mutually beneficial solutions. Technological advances have accelerated this potential for partnership.

Opportunities to Cut Inefficiencies and Fuel Profitable Growth

The need for greater collaboration to reduce supply chain inefficiencies is clear. Currently, out-of-stocks are still at 4 to 8 percent across the industry. Furthermore, product waste erodes sales by 2 percent, equivalent to nearly a $17 billion annual loss for the industry. In addition, approximately 5 to 10 percent of all private freight miles are “running empty.”

Collaboration is not simply about cutting costs; it can also boost sales and margins for both parties. Overall, BCG estimates that greater collaboration could improve manufacturers and retailers’ sales by 0.5 to 1.5 percent and margins by a similar amount.

Several manufacturers are already reaping substantial benefits from closer collaboration. For example, Kraft Foods Group and Safeway boosted sales of one product by 160 percent by eliminating out-of-stocks. A special collaboration team identified the location of one specific SKU on mixed pallets as a barrier to restocking the item from the back room. With this knowledge, the team undertook a simple, smart pallet redesign that resolved the problem. In another example, PepsiCo teamed up with retailers to use store-level distribution-and-inventory analysis, as well as POS data sharing, to ensure that one of its products was continually replenished, increasing service levels by 3 percent, sales by as much as 1.5 percent, and forecasting accuracy by 20 percent.

Basic Collaboration—but with Pockets of Innovation

It is encouraging that nearly all manufacturers recognize the strategic importance of collaboration. Of the executives we interviewed, 95 percent reported that collaboration is a strategic focus for their business, and nearly all of them claimed to have initiated related projects or established dedicated collaboration teams. In addition, two-thirds of companies indicated that their level of collaboration had increased since 2010. “We’ve had more collaboration in the past 18 months than the last ten years—it didn’t used to be such a deep focus,” said one executive. It is understandable that larger manufacturers (those with more than $10 billion in revenues) are more than twice as likely as their smaller peers to have increased their collaboration because of their greater resources and strategic significance to retailers.

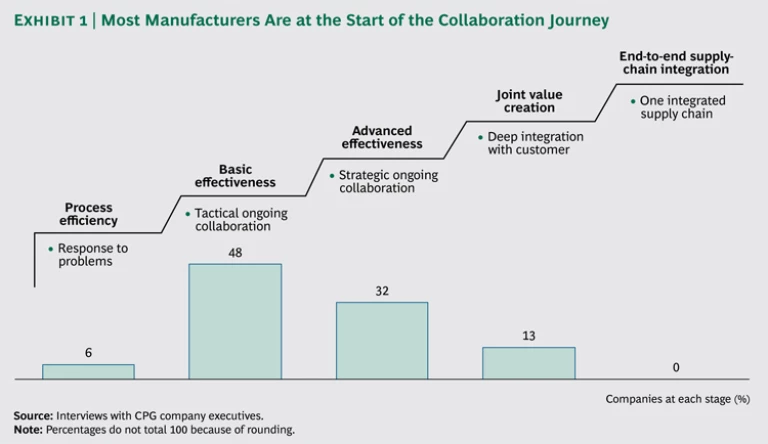

Despite their strategic intent, most manufacturers, even the relatively large, well-resourced manufacturers, remain locked in the basic stages of collaboration. Most executives we interviewed reported that their companies are engaged in either problem solving or basic process-efficiency collaboration, with only a handful of businesses climbing higher up the collaboration chain. (See Exhibit 1.) None has achieved full end-to-end supply-chain integration. Moreover, the more advanced initiatives are usually either small in scale or stuck in pilot mode. “All of our collaboration efforts are in pilot stage,” said one interviewee.

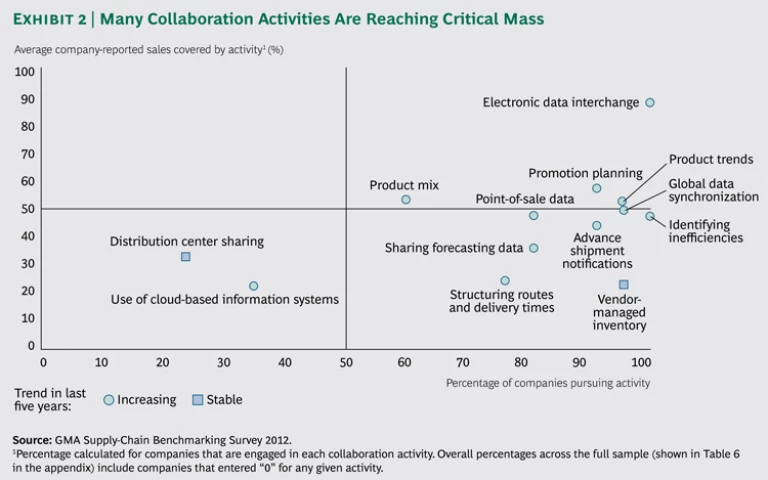

The collaborative projects most mentioned by the interviewees include sharing retailers’ POS data and optimizing order quantities, followed by cooperation among trading partners’ senior supply-chain executives (“top to tops”) and transport optimization. Some of these initiatives are reaching critical mass, measured by the number of companies pursuing particular collaborative activities. (See Exhibit 2.)

Even though many initiatives are in the pilot stage, companies are increasingly introducing advanced solutions, many on the back of technology. For example, one manufacturer provides its customers with an interactive tablet tool that enables them to visualize route options using a graphical “drag, drop, move lanes” representation of the choices. Another manufacturer is leveraging its customer’s POS data to identify “pockets of loss,” and still another is piloting shared supplier-retailer forecasts. Other sophisticated techniques being applied range from value stream mapping to “Gemba walks,” in which supply chain managers from both sides follow a product’s life cycle from production through its sale in the store.

Major Obstacles to Progress: Capabilities, Technology, Trust, and Commitment

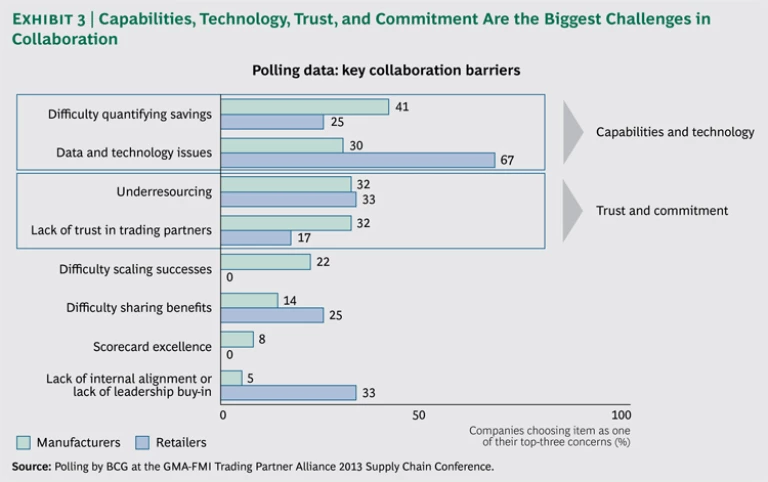

One of the biggest obstacles to scaling up pilots and ensuring deeper, more widespread collaboration is lack of trust between trading partners. (See Exhibit 3.) “Lack of retailer-supplier trust is still an industry issue. It hasn’t evolved too far,” said one interviewee.

One symptom of this problem—and another major barrier to progress—is a reluctance of trading partners to share data. “There needs to be an industry shift around data transparency—the industry holds things close to the vest,” said an executive. Although data and technology issues rank fourth in manufacturers’ list of barriers to collaboration (cited by one-third of the manufacturers we polled at the supply chain conference), they are the top obstacle for retailers by a substantial margin.

There are also fundamental technical issues between the two parties. “It’s hard to standardize and gain alignment to create an interface between disparate systems,” said one interviewee. Another commented, “One retail chain wants to do paperless trading with us, but they can’t get their EDI [electronic data interchange] systems to work—it’s been years.”

Echoing a problem experienced by companies as they grapple with complexity management, companies also struggle to quantify the benefits of collaboration with trading partners. “It’s difficult to calculate the return on investment for each collaboration engagement, which makes it hard to justify the resources and investment required,” said one interviewee.

One consequence of failing to make a measurable business case for collaboration is that the necessary resources and required commitment are not always forthcoming. This can be the case for both manufacturers and retailers. “Collaboration requires significant resources—unless you have a ‘manager of collaboration,’ it ends up on the bottom of the priority list,” noted one interviewee. Another said, “Suppliers have more focused resources to go after issues, but customer resources for collaboration are limited.”

Key Enablers for Deepening Collaboration

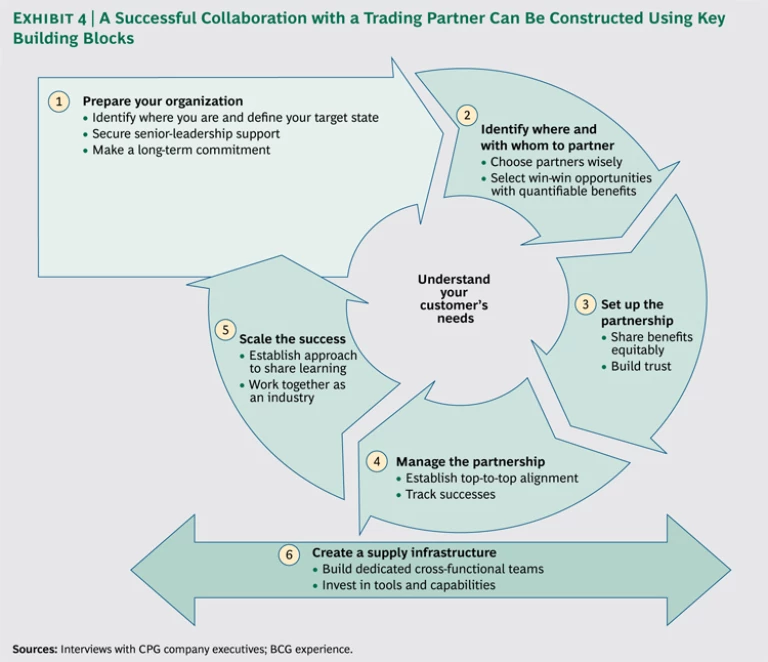

Although nearly all manufacturers have started down the collaboration road, their ability to progress further is often restricted by the lack of a systematic, focused approach, forcing them to act in an ad hoc, opportunistic manner. Interviews with companies that have successfully collaborated at a relatively sophisticated level revealed six key building blocks for mutually beneficial partnerships, always keeping customer needs in mind. (See Exhibit 4.)

Prepare your organization. Collaboration between trading partners often requires sustained investment over a few years to succeed. Before a company starts on that journey, it is important to have an agreement within that company’s leadership regarding where to go and what will be required to get there.

- Identify your current and targeted collaboration position. CPG manufacturers’ size, business strategy, and management structure influence the style and level of relationships with customers, as well as the resources, processes, and tools required. Consider what you can realistically accomplish in your time frame, given your objectives, senior-level commitment, and resources.

- Secure senior leadership buy-in. Executive representatives of retailers who we interviewed said that the top enabler of collaboration is gaining buy-in from senior leaders; nearly two-thirds of the retailers mentioned this factor as the foremost enabler. It was also the second most commonly cited enabler for manufacturers, after mutual benefit sharing. This is understandable. The long-term, strategic nature of collaboration requires senior sponsorship from both sides in order to ensure strategic alignment, define the boundaries of the partnership, provide an escalation route for quickly resolving differences, and maintaining momentum through the inevitable hard times. Top-to-top alignment is a characteristic of all the manufacturers that are successfully collaborating. Indeed, 52 percent of manufacturers and 45 percent of retailers have established top-to-top alignment.

- Make a long-term commitment. It takes time to build the trust required for successful collaboration. Be sure to establish a realistic time horizon for your business, taking into account your long-term strategic objectives, and work to ensure that the necessary resources for investing in the relationship will be available over that period.

Identify where and with whom to partner. To realize the full benefits of collaboration and avoid stretching resources too thin, CPG manufacturers need to prioritize the best projects among the plethora of opportunities that present themselves.

- Select partners wisely. Building trust is an intensive, delicate, and long-term exercise, so it is important to choose targets for collaboration carefully and to ensure fully aligned internal support to avoid any threats to the relationship. Different companies have different selection criteria, in accordance with their strategic priorities. One major manufacturer concentrates on the retailers that account for 50 percent of its volume, enabling it to allocate sufficient resources and time to build the relationships.

- Prioritize win-win opportunities. Understanding prospective partners’ needs and priorities is an important first step. “Instead of going in and selling VMI or order quantities, go in and listen first,” said a PepsiCo executive. To win partners’ confidence, it is also often best to start with small initiatives, such as inventory optimization, that do not necessarily offer big, long-term potential but do deliver quick wins and open the door to larger initiatives. “Everyone is trying to manage inventory, so if you go in with a quick win that’s of interest to them, then that can work well,” said one executive. One CPG supply-chain manager stated, “We have a bias to saying ‘yes,’ but we don’t always do it. It needs to be win-win. Sometimes we will walk away from an initiative if it doesn’t make sense.”

Set up the partnership. When entering into a new collaborative relationship, it is important to agree on a few of its parameters, such as how benefits will be shared and what mechanisms will be used to track the impact over time. During these early stages of the relationship, it is especially important to build the trust that is the foundation of successful collaboration.

-

Agree on mutual benefits. Identifying mutual benefits is considered the top enabler of collaboration among CPG manufacturers (cited by 53 percent of them) and the second-most-important driver for retailers (45 percent), after senior-leadership commitment.

A supply chain executive stressed the importance of transparency in explaining why some projects are chosen over others: “It’s important to be honest about why it won’t create mutual benefit—you can lose trust if you aren’t direct.” Kimberly-Clark is systematic in its approach to benefit sharing. With a large customer, for instance, the company agreed to a joint business plan—including the supply chain—that set objectives for total business growth and margin efficiencies, as well as a three-year cost-reduction target for the supply chain, and equitable sharing of the savings.

- Build and strengthen trust. A transparent and open relationship is the bedrock of trust. For example, Procter & Gamble not only shares its data with its target retailers but also develops joint business plans with its customers. “A joint business plan that encompasses supply chain is very important,” explained P&G’s supply-chain director. “Showing that supply chain drives sales and saves costs is incredibly important to successful collaboration.”

Manage the partnership. Without continued attention, even partnerships that start successfully risk falling by the wayside.

Sustain top-to-top alignment. It is essential that senior support and alignment are sustained beyond the initial collaboration agreement. Several companies do this by holding quarterly top-to-top meetings with their key customers. Kraft has taken senior engagement to a bigger, industrywide scale by holding a supply chain summit with senior executives from multiple retailers to “discuss how to collaborate differently in the new world.” This approach underscores the company’s belief that the way to scale up collaboration is to advance from a one-to-one form of collaboration with individual retailers to a many-to-many quest for joint value creation with the industry as a whole.

- Track successes over time. Although collaboration has to be based on the softer, less quantifiable issue of trust to sustain the relationship, it also has to be approached systematically to deliver tangible results. Tracking and celebrating successes helps maintain the momentum for collaboration both internally and externally, when talking to trade partners. It is also the basis for informed investment decisions as collaboration is scaled up to include more customers and projects.

Scale the success. One of the biggest challenges for CPG manufacturers has been to institutionalize successes achieved with pilot programs by scaling those programs across customers.

- Share best practices across the organization. To move from pilot projects to broader collaborations, it is important that key lessons are shared within the organization. This may require setting up more-structured processes that encompass identifying, quantifying, and prioritizing opportunities, as well as criteria for collaboration.

-

Work together as an industry. True, CPG manufacturers and retailers can push ahead with significant collaboration initiatives individually. But the full value of collaboration will be realized only if the industry works together. Broader alignment is needed on, for example, performance metrics. As one of our interviewees said, “We may have a different notion of what constitutes ‘on time’ than our customers do, which leads to debates about scorecard performance. What’s worse, each customer looks at it slightly differently.”

Differences in policies—for example, regarding product returns and products that can’t be sold—also remain constant topics of debate between CPG manufacturers and retailers and can derail collaborative relationships. Finally, common standards for IT systems and data would open up a new set of collaborative activities and take the industry to the next level.

Create a supply infrastructure. The companies we talked to that have been most successful working with their trading partners systematically invest in resources, tools, and capabilities to advance collaboration.

- Create dedicated, cross-functional teams. P&G employs a cross-functional approach, embedding a variety of team members in retailers’ field operations, not just the supply chain team, so that the company is aligned with the retailers’ business functions that help deliver value, including operations and merchandising. “This makes collaboration more complicated but more lucrative for us,” said a P&G executive. “When we see genuine change, it’s beyond supply.” Another CPG manufacturer has a dedicated collaboration team, including members who are located in the field with customers to provide a “supply chain toolbox” of 20 offerings.

- Invest in tools and capabilities. Invest in developing sophisticated tools—or use third-party equivalents—for integrating and analyzing retailers’ POS and forecasting data, as well as for optimizing order quantities and transport networks. For example, many companies we talked to cooperate with third-party software providers to get better insights from retailers’ POS data that help them identify out-of-stocks and other supply-chain issues.

Key Questions for Supply Chain Executives

To elevate collaboration to the next level, companies should answer the following questions:

- Is your leadership team prepared to invest time and resources into collaboration initiatives?

- How far can you realistically go in your preferred time frame, given your objectives, senior-level commitment, and resources?

- Are there clear priorities for collaboration? Do you have criteria that define which relationships and projects to pursue?

- Do you have a system for sharing lessons from customer teams across the organization?

- How can your company contribute to industrywide efforts to accelerate collaboration?