In the biopharmaceutical industry’s ongoing struggle to respond to changing customer expectations, address a slowing of therapeutic innovation, and protect against revenue loss due to patent expirations, many companies now offer not just products but also services and solutions. The goal is to seek higher drug sales and diversified revenue streams, new insights into diseases and customers, and improved reputational standing in a health care community that increasingly demands the delivery of not just drugs and devices but positive health outcomes.

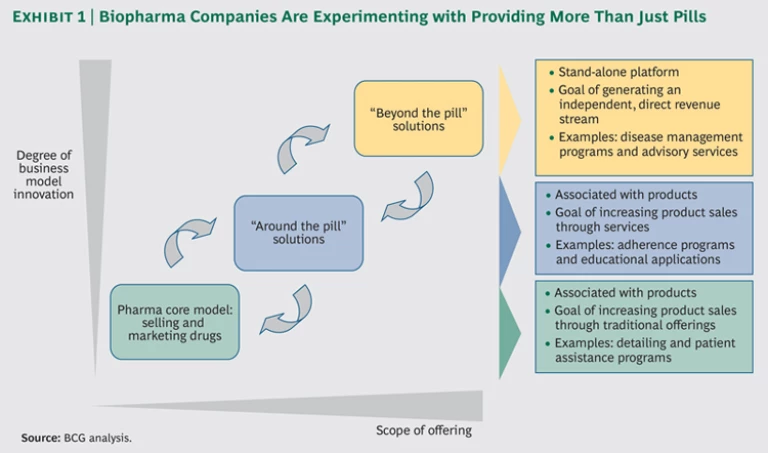

Companies are experimenting with two types of strategies: those designed to support the sales of individual products and those that generate independent sources of revenue. (See Exhibit 1.) The realization of these innovations is facilitated by new technologies—including IT tools that enable data transparency, system interoperability, enhanced mobility, digital capabilities, and rapid analysis of real-world data —and an increased focus among health care stakeholders on delivering improved outcomes at the same or lower cost.

For many companies, however, promising pilots have led to few measurable successes. Instead, enthusiasm is replaced with skepticism, and centers of excellence focused on delivering solutions become early targets of internal cost-cutting efforts. Why are these innovations not bringing the expected results, and how can biopharma manufacturers improve their success rates?

Much Activity, Little Impact

When delivering solutions, biopharma manufacturers bring a number of assets to the table—beyond access to capital. They contribute disease-area knowledge and expert networks that are on par with—and arguably superior to—other industry players, such as providers and payers. They also have high-quality analytics and health-economics talent. And the global footprint of many biopharma manufacturers is a major advantage when introducing solutions.

However, the traditional big-pharma operating model also brings several challenges. Organizational silos inhibit necessary collaboration among commercial, medical-affairs, and R&D organizations. Brand-focused structures limit the ability of solution architects to think like customers when they design and scale strategies across therapeutic areas. Traditional incentive schemes reward the delivery of near-term sales—returns that solution pilots cannot be expected to deliver in a short time. The absence of constructive dialogue between solution architects and legal teams dilutes new ideas and frequently halts innovation before it starts. Finally, the biopharma industry faces external skepticism about nontherapeutic offerings and the motives that may have inspired them.

The result is that biopharma manufacturers risk five common pitfalls when delivering health care solutions:

- Making haphazard investments in a series of subscale solutions with no methodology in place to assess return on investment (ROI) and systematically learn from past successes and failures

- Designing solutions that are informed by superficial market insights—and therefore address the perceived needs of a few stakeholders that will feel the impact of the solution and not the real needs of all relevant customers and stakeholders

- Adopting the wrong role in solution design and delivery by, for example, leading instead of partnering

- Delivering solutions that have been diluted by several rounds of negotiation with legal and compliance teams—reinventing the problem along the way

- Launching pilots with minimal investment and no clear plan to scale up—that is, “failing cheaply” rather than investing to ensure long-term success

Defining the Opportunity

Price increases are among the largest contributors to growth in the biopharma industry. Active measures to curb these increases are in place in Europe, and the U.S. is expected to follow suit. In addition, decision making is becoming increasingly consolidated just as access to real-world data and advanced analytical capabilities are expanding. For biopharma’s most influential customers—payers, providers, and, increasingly, integrated systems—the delivery of therapeutics is only one small part of the equation. The system increasingly demands holistic solutions that enable patients to get to the best outcome at the lowest cost.

There is, therefore, a clear opportunity to deliver solutions that improve the value of care. The critical job of the pharmaceutical company is to identify its optimal role—to build or partner—and to commit sufficient organizational effort and resources to enable large-scale success.

The early successes of some solution pilots are evidence of important opportunities. One example is a disease management pilot that a global biopharmaceutical manufacturer implemented in collaboration with a public payer to improve health outcomes for a subset of mental health patients in Europe. The pilot was an undeniable medical success locally—decreasing rates of hospitalization by 50 percent for enrolled patients. This example supports the specific need for an orchestrator role to coordinate care in an increasingly complex health-care landscape. The value proposition of other solution types—ranging from helping patients with drug-device combinations to providing decision support tools—has also been firmly established. But even in these cases with clearly successful pilots, scale-up and optimal sharing of the upside have been hard to achieve.

Choosing Where to Invest

For investments in innovative solutions to be worthwhile, biopharma companies need to objectively assess whether a proposed solution is aligned closely enough with their core business offering. This proximity is critical because it means companies likely have the relevant capabilities, a greater willingness to invest in bringing the solution to scale, and a stronger credibility with customers and stakeholders.

“Around the Pill.” Solutions designed to augment drug sales—which we call “around the pill” innovations—have at least some connection with the core biopharmaceutical business. However, even in these instances, biopharma manufacturers should ask whether they are best suited to lead or partner.

For example, pharmacies have delivered medication adherence offerings with notable success. CVS Health’s Pharmacy Advisor, for instance, has been extremely effective at helping patients remain adherent to their drug regimens for diabetes—among other chronic diseases. Because pharmacy chains are focused on dispensing drugs, work in close proximity to the patient, and are incentivized to improve adherence across all therapies and disease areas (as opposed to specific brands and diseases), they seem better positioned than a pharmaceutical manufacturer to implement adherence programs and bring them to scale. In such cases, a partnership model may be most appropriate for biopharma manufacturers—although Pharmacy Advisor is not involved in such a partnership.

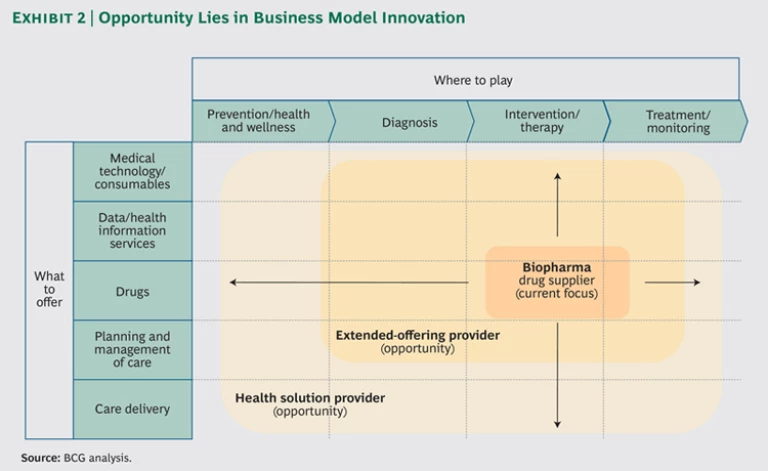

“Beyond the Pill.” When it comes to solutions designed to generate independent revenue streams—“beyond the pill” solutions such as disease management programs and physician advisory services —the investment proposition is less clear. In expanding its role from drug supplier to solution provider, a biopharma manufacturer essentially modifies its business model. (See Exhibit 2.) These opportunities should therefore be treated as corporate strategy—driven by the C-suite, informed by a robust business case, and backed by a commitment to nurture the venture and make it grow. When these solutions are implemented by the marketing and sales organization, they are often abandoned at the pilot stage as opportunities closer to the core business become a higher priority.

Consider the level of rigor that a business case must achieve before it is funded by a venture capital firm. It must go through repeated rounds of fund-raising, returns can be a long way off, and risks are plentiful. A $10 billion pharma giant, thus, may very well lack the inclination to truly commit to beyond-the-pill strategies.

Before investing in such solutions, companies have to answer the tough questions. Is the offering synergistic with the core business? Is another player better positioned to find success with the offering? Is there a commitment to invest in scaling up the solution? Does the organization have the necessary capabilities and mind-set—including agility, risk tolerance, and persistence? Saying no requires discipline—and a willingness to bear accusations of risk aversion—but it is sometimes the prudent move.

Improving the Likelihood of Success

Once a biopharma manufacturer identifies a promising opportunity to deliver an innovative solution, how can it avoid common pitfalls and increase its chances of success? Here are five checkpoints that should be passed prior to investing in any solution.

Are we investing in our priorities and rigorously assessing ROI? When designing solutions, it is critical that biopharma manufacturers invest disproportionately in their most important products, customers, and markets. For example, around-the-pill solutions should be prioritized for products with much higher sales potential and for which breaking ties with competitors is critical. The company must identify its most valuable customers and create solutions that address their specific needs as part of a broader strategic account-management strategy. Solutions should be piloted in high-growth countries with appropriate market conditions—such as piloting disease management programs in locations that have consolidated payer systems. The most promising solution types—such as services to support therapy initiation and maintenance—should be prioritized as company-wide platforms and receive preferential investment. This approach reduces the risk of fragmentation and increases the likelihood of a positive return.

One common issue is that the return generated by an around-the-pill solution cannot be easily disaggregated from other factors that influence product sales. Therefore, a critical part of the initial solution design has to be an approach to measure ROI. This requires first defining the aspiration. For example, is the goal to achieve a certain sales target or to accrue “softer” benefits such as disease insights or stakeholder relationships? For an ROI analysis to be credible, the goal must be codified up front rather than dynamically reinvented on the basis of pilot results. The next step is to identify how the ROI will be assessed and tailor pilot design accordingly. Is sanitized patient data required—and are the necessary partnerships and systems in place to procure it? Will the relevant customers accept this data and analysis? How will data be stratified? The effort required to define the data analysis plan for a solution pilot can rival that of a postmarketing study, yet it is often underestimated. The final step is to ensure that there is a process to systematically capture what is learned and to share that information across the organization—so that the solution can be improved and future efforts can benefit.

Is there a clear value proposition for all stakeholders? For complex solutions to be successful, it is critical to identify all directly and indirectly involved stakeholders and ensure that there is a clear value proposition for each. This includes uncovering any unanticipated incentives. For example, a recent study by the Journal of the American Medical Association found that surgical complications increase profits accrued to hospitals. Any value-based health-care effort designed to lower in-patient costs must address this potential misalignment in goals.

To map stakeholder goals and discover potential leakage points, companies must have access to strong data analysis and the ability to understand stakeholder needs—including those of nontraditional stakeholder groups. Without the tools to define a watertight value proposition, the investment in a solution will not be worthwhile.

Have we identified the right role for biopharma? As discussed, the most appropriate role for a biopharma manufacturer in delivering a solution depends on several factors: alignment of the solution to the core business, availability of required capabilities, ability to navigate potential compliance restrictions, and public perception of a good fit. Usually the most effective way to deliver a solution is through a partnership.

One medical-affairs group, for example, designed a partnership model to deliver a technology solution in a specialty disease area. The goal was to enable more informed treatment decisions by facilitating use and analysis of a sophisticated diagnostic measure. The team discovered that a medical-technology vendor—with the capabilities, incentives, and market position to embed the use of the new diagnostic measure—would be best able to drive the solution. Opinion leaders and physician societies would also help design the underlying algorithm. And by narrowing the role of the biopharma manufacturer, compliance hurdles were significantly reduced.

Do legal and compliance hurdles dilute the solution? Some solutions may be nonviable out of the gate because of legal and compliance constraints, but biopharma companies must also watch out for viable solutions that will lose effectiveness after suc-cessive rounds of review with a legal team.

To avoid this, companies need to define the absolute legal and compliance boundaries for priority solution platforms. In addition, legal and compliance teams must be engaged early in the design of a specific solution—after the concept and potential alternatives are defined but before substantial investment is allocated. Finally, the legal and compliance teams have to be on board with the solution. This requires hiring advisors who take a “how,” not “if,” approach, as well as rewarding collaboration on business problems.

It is often possible to revise concepts in a way that drives compliance and still achieve intended goals. For example, one company designed the concept for an expert consultation service to improve detection rates for an adverse event associated with a drug. Although the company could not legally offer second-opinion services, redefining the concept as a peer-to-peer educational platform provided a favorable alternative that still met stakeholder needs.

Is there a plan to bring the solution to scale? For most solution concepts, implementation plans take a phased approach—beginning with a small, local pilot and then expanding once the concept is proved. While this can be a sound approach, it is critical to ensure that the pilot is designed in a way that enables a successful return, with a real organizational commitment to expansion.

As an example, one biopharma company defined a disease management program on the basis of fees per patient. From the early pilot stages, the health insurance partner sought to expand the scope to additional related diseases—better aligning the solution to its internal systems and business objectives. Even after the pilot showed early signs of success, however, the biopharma company was reluctant to expand the pilot—in part because the uptake of the solution was considered too slow in the first disease area.

The existence of multiple subscale “pet projects” is the most visible symptom of an organization that lacks a systematic approach to appropriately managing its health-care solutions. Companies need to build expansion plans into pilot design—identifying potential partners, customers, and markets that can support scaling up the program. They must also decide on clear “go-no go” thresholds up front and set realistic timing expectations for returns.

Biopharma manufacturers face challenges today that will compel them to invest in innovative health-care solutions in order to develop a true competitive advantage in the future. This requires a serious commitment from leadership. Defining a single corporate investment approach—one that includes priority solution platforms, the involvement of strategic customers, and an allocated investment pool to bring a small number of promising solutions to scale—is a good place to start.