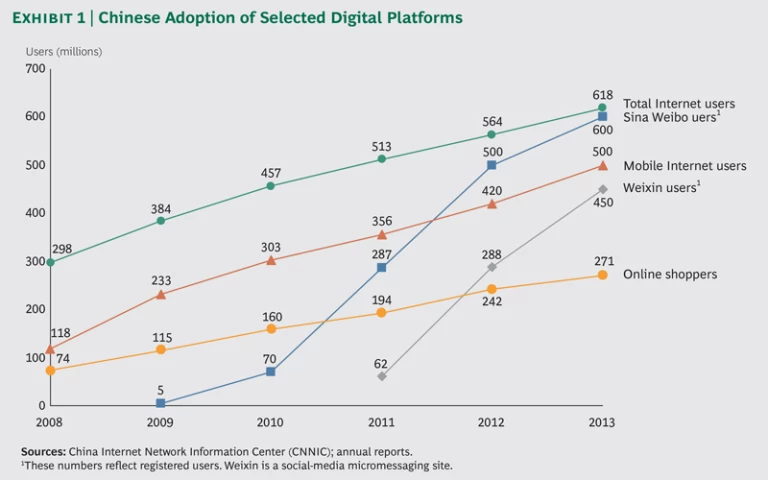

China is going digital very quickly. By 2016, the country will have more than 730 million Internet users and more than 380 million online shoppers, up from 460 million and 145 million, respectively, in 2010. Even China’s lower-tier cities are migrating swiftly to digital technologies. More than 16 million netizens from the country’s tier 3 and 4 cities are using mobile Internet, 80 percent of all Chinese netizens accept mobile payments, and 100 percent have used weibo (Twitter-like microblogs). Finally, as each new digital platform has been added, adoption rates have gained momentum, rising with increasing speed. (See Exhibit 1).

To capitalize on the opportunities being created by these rapid changes in the digital realm, companies must understand the accompanying changes in consumer behavior. This means knowing where and how to interact with consumers, both online and off. BCG’s Center for Consumer and Customer Insight conducted in-depth and innovative digital “shop-alongs” in China—and supplemented them with more traditional face-to-face interviews and surveys—to learn how, why, and when consumers browse and shop online; the ways their behaviors vary across different shopping categories; and the differing roles of offline and online channels. (To conduct the digital shop-alongs, we analyzed PC-based Internet click streams spanning an entire month for a sample of 100 online shoppers in Shanghai and Chengdu.) Our approach yields more nuanced insights than that of traditional digital consumer-research methodologies, which focus on easy-to-capture metrics such as page views per website and minutes spent per page. We share our observations and findings here, as they relate to the purchase funnel that moves consumers from learning about products through purchase to product advocacy.

Online Learning in an Online/Offline World

For approximately 60 percent of regular online shoppers in China, the Internet has become the primary source for learning about products, brands, and prices, according to our research. An additional 30 percent regard online and offline information sources as equally important.

In contrast to other countries, online shoppers in China spend much less time on the official websites of companies or brands: well under 0.5 percent of their online time—or just a few minutes per week on average. (News/portal, video, and e-commerce sites together accounted for around 80 percent of the time Chinese consumers spent online via PC platforms, BCG’s research found. Search engines, forums, weibo (Twitter-like microblogs), blogs, and other social-networking sites accounted for most of the remaining 20 percent.) Furthermore, Chinese consumers typically have less faith in product recommendations from official information sources than do their counterparts around the world.

Meanwhile, most Chinese consumers spend 50 to 80 percent of their time online making repeat visits to a few websites that are their personal favorites. Across all the respondents we analyzed in our research, we found that more than 40 percent of their collective online activities were spent on the following top 5 sites: Youku, a local video-streaming website; Sina.com, a news portal; QQ, an instant messaging service; Taobao, an e-commerce site; and Baidu, a search engine. Consequently, it is critical for brands to identify the most relevant parts of those popular sites for reaching shoppers. In addition, companies should carefully monitor, and sometimes manage, online commentary about their products and brands.

The amount of online time the Chinese devote to product and brand “self-education” is also quite striking. Ninety percent of their product-related online activity—as opposed to general browsing on news or entertainment sites—was conducted for the purpose of product education, and typically did not result in an immediate online purchase. This high percentage held whether we measured online time or page views. Even those few who made a purchase online spent the same amount of time “studying” and buying. Around two-thirds of this online study time was spent browsing e-commerce sites.

In recent years microblogging services such as Sina Weibo have grown in popularity. To date, however, their importance as a source of product or brand information has been mixed. Around 80 percent of our respondents reported that they followed 18 enterprise or company-run weibo on average, but fewer than 20 percent of these consumers said they paid much attention to those blogs. Price- and promotion-related information garnered the most interest; brand- and company-related news received the least.

Weibo run by celebrities, however, are of much greater interest and importance to consumers. Not only do consumers follow more celebrities—on average, consumers followed more than 30 celebrity weibo—but they also seek to learn more information about and read opinions from their favorite celebrities.

While there have been some instances of marketing success on celebrity weibo, most celebrities have been very cautious when it comes to using their microblogs for third-party commercial promotion. Weibo culture is averse to overcommercialization, and consumers are also wary of fraudulent accounts that claim to represent a celebrity and then endorse disreputable products. As a result, well under 5 percent of celebrity weibo post explicit brand-related information, although many feature links to products on Tmall or Taobao.

Nevertheless, weibo can still be leveraged to advance consumer awareness and brand preference without triggering criticisms of overcommercialization. Campaigns launched with grassroots—that is, noncelebrity—weibo users can be both effective and much less costly than signing up established stars. Achieving this successfully and sustainably, however, requires a company to be highly attuned to online trends and agile in execution.

While online information sources are critical, a significant share—40 percent—of our respondents said they regard offline information as equally, or in some cases more, important than online. To that end, most consumers demand a relatively seamless experience across online and offline channels. Therefore, brand interaction should feel consistent whether the consumer’s touch point is a physical store, a brand’s mobile app, or its Tmall site.

Uniqlo, the Japanese “fast fashion” retailer, is one company that has created a relatively seamless experience across channels. Not only does it bridge consumers’ online and offline learning experiences but it also has designed these channels to be mutually enhancing. For example, it presents information and merchandise across online and offline touch points in a highly consistent manner. Another Uniqlo initiative runs joint online and offline activities such as interactive games and other promotions. These all enhance consumers’ engagement and loyalty.

Buying Online in an Online/Offline World

The goal driving the large amount of time that Chinese consumers spend online learning about products and brands is, of course, to make better purchases—whether online or off.

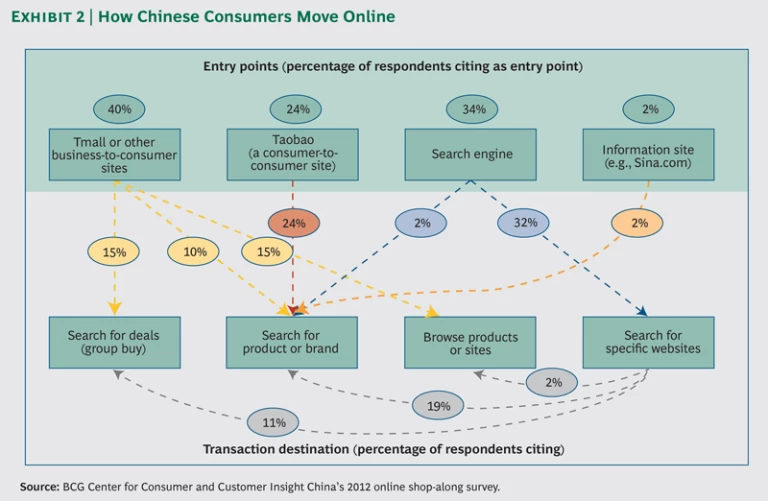

The General Mechanics of Online Transactions. Online shoppers enter their shopping journey either through e-commerce or noncommercial sites. Popular e-commerce sites include the consumer-to-consumer site Taobao as well as Tmall and other business-to-consumer stores. Noncommercial sites include search engines, portals, and information sites such as Sina.com. (See Exhibit 2.)

Two points are worth highlighting: First, while almost two-thirds of the sample transactions we analyzed originated directly from e-commerce sites, a surprisingly low one-quarter began directly on Taobao.com. This is particularly surprising given that, as expected in China, online purchases in our sample were highly concentrated on the Taobao and Tmall sites. Together they accounted for around 70 percent of the online transactions observed.

Second, and more interestingly, only 2 percent of online purchases started with consumers searching for a specific product or brand name. This reflects our finding that official brand sites play only a marginal role in self-education. The low incidence of transactions initiated from product or brand searches partially explains why advertising revenues at Alibaba—the company that owns Taobao and Tmall—are closing in on those of Baidu, the leading search engine in China.

Once consumers decide to buy online, the actual transaction takes just 10 to 20 minutes on average. Prior to making the transaction itself, consumers view about ten Web pages, on average, and review fewer than five products in any detail.

Our research also found that the peak daily online transaction times for Chinese consumers are 10 a.m., 2 p.m., and 9 p.m.

Behaviors Vary by Product Category. While some online shopping categories are more transaction-intensive, others are more browsing-intensive, our research found. In apparel, for example, most consumers searched and purchased in the same, single online session. They are more prone to buy clothing on impulse, especially when there are promotions. By contrast, for categories like small appliances and packaged foods, consumers tend to conduct a fair amount of research online but make most purchases offline. Consumers buy products in these categories in physical stores so that they can try them before buying. Buying products at a physical store also offers consumers immediate satisfaction and a way to avoid the higher risk of purchasing sham products online.

In some categories, integrating online and offline channels is critical. Skin care purchases often require multiple online/offline comparisons, for instance. Consumers may browse both online and offline but purchase online only if the price is lower (and the product genuine), or if the product is unavailable offline. Companies in such categories benefit from providing more seamless online/offline integration.

Integrating Online and Offline Channels in Buying. In today’s environment, online and offline channels are both important for transactions, and very few categories can rely on just one type of channel. Based on our research, 60 to 80 percent of Chinese consumers across a wide range of product and service categories indicated no strong preference for making purchases online or offline. Therefore, it is critical that both types of channels are made available and offer consistent information and experiences. In this way, the different channels can be mutually reinforcing.

Nike China is one company that offers a seamlessly integrated multichannel shopping experience to consumers. Its official site is a comprehensive point of sale. It provides the full range of products, and its online marketing messages, visual merchandising, and promotions are all aligned with their offline counterparts. Companies should consider tailoring their organizational interfaces and digital capabilities to achieve the same kind of alignment.

The Growing Role of Online Advocacy

Online advocacy by consumers is the final important step in the purchase funnel. It is particularly critical in China, given that consumers place low levels of trust in official sources of product information. And it has become popular very quickly, thanks to changes in digital access and technologies. Approximately 60 percent of the online shoppers we interviewed in China post product-related comments online occasionally or often.

Not surprisingly, enthusiasts of social media are more likely to both read and post such comments. About half of the online shoppers who responded to our survey have forwarded or saved product-related information on weibo and on social networking sites such as Renren and Kaixin.

Online advocacy is most important and most evident in apparel, skin care, and cosmetics; around 50 to 60 percent of Chinese consumers read and posted comments online in these categories. By contrast, only 1 to 2 percent of respondents said they did the same for products in the entertainment and home furnishings categories.

To successfully leverage the power of advocacy, brands must build a basic level of online awareness. From there, they must create product- or brand-related content that is engaging and fresh. Then, to broaden online dissemination of their message, brands need to give consumers a reason to advocate for them; one example of advocacy is retweeting brand-related content. In China, offering samples or discounts can often be an effective mechanism for gaining consumer advocates.

The Increasing Importance of Mobility

Finally, all of the behaviors in the purchase funnel—notably learning, purchase, and advocacy—are increasingly conducted via mobile Web. A combination of inexpensive hardware and well-designed ecosystems has led to high mobile penetration in China, particularly on social networking sites. Smartphone sales exceed those of feature phones, and the leading social-networking sites in China are well suited to the “mobile native.” The shoppers analyzed in our research spent an average of 82 minutes online each day via mobile and tablet platforms. Eighty percent had used location-based services, nearly half had scanned shopping-related QR codes, and one-third had made purchases via mobile device. Companies can appeal to would-be shoppers by ensuring payment security and creating easy-to-use interfaces—the two barriers limiting the adoption of mobile commerce cited most frequently by our subjects.

In conclusion, Chinese consumers are increasingly accessing the online world through several devices, from multiple locations and media. They expect to move seamlessly between these options, and to and from offline realms as well. This new multichannel environment has brought with it distinctive consumer behaviors, centered around learning, purchasing, and advocating for brands and products. The need for an integrated experience across the online and offline worlds is rising—yet the experiences themselves vary significantly by product category.

Understanding and leveraging these behaviors is the first step to successfully integrating one’s offerings across many platforms and channels—and gaining a critical competitive advantage.