Over the past five years, the consumer nondurables (also known as fast-moving consumer goods) sector has delivered strong value creation for investors through a combination of top-line growth, higher margins, stronger valuation multiples, and smart financial strategies.

In 2014, as in past years, The Boston Consulting Group conducted an annual study of total shareholder return among 1,620 publicly traded companies in 26 industry sectors, of which 88 were in the nondurables

The top ten nondurables companies returned 39 percent a year to shareholders from 2009 through 2013, an extremely strong performance by historical standards. However, the returns of both the overall sample and the top ten performers lagged those of other consumer sectors during the same period. In part, this may be owing to investors’ perception of nondurables companies as defensive investments. That perception helped buoy the sector during the recession, while companies in more cyclical sectors like durables and travel and tourism fell out of favor among investors. But those other sectors also benefited from much larger changes in valuation multiples over the past five years as they returned to favor.

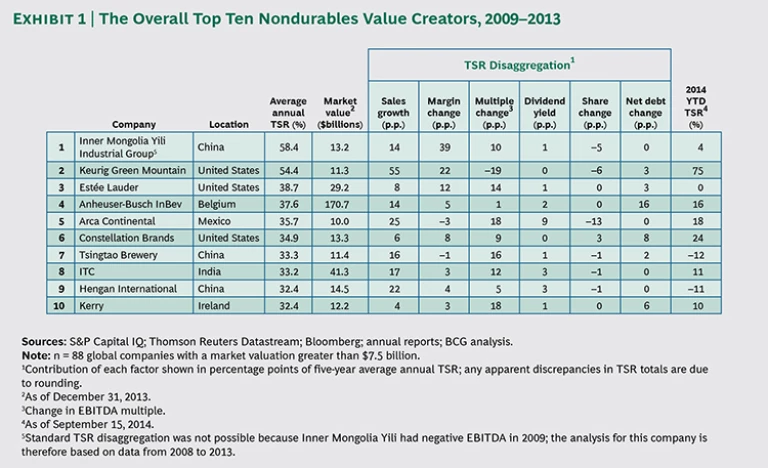

The overall nondurables sector also had a smaller variation in TSR performance from top to bottom compared with the other consumer sectors. The best performer overall (Inner Mongolia Yili Industrial Group, a food manufacturer in China) returned an annual average of 58 percent to shareholders over the five-year period studied. However, the median company in the group (Brown-Forman) returned 21 percent a year, and the return of the company that came in fiftieth (Diageo) was 20 percent a year.

A Geographic Lens

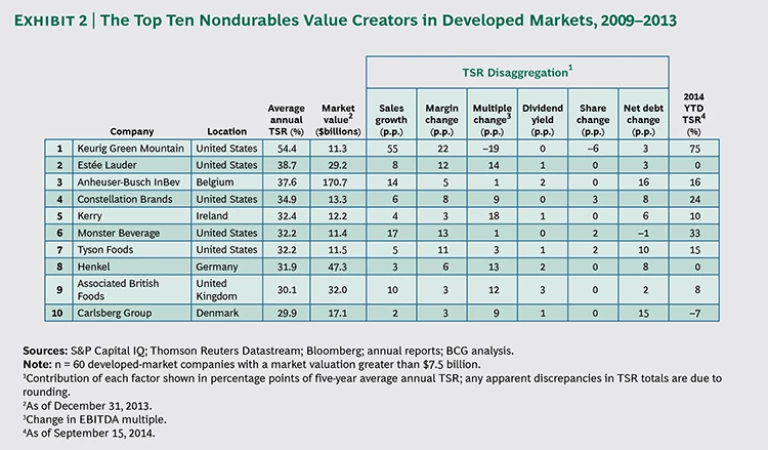

We broke down the top-performing nondurables companies into two groups: the overall global top ten and the top ten in developed markets only. (See Exhibits 1 and 2.) The theme common to both sets of top performers was the importance of growth, which accounted for a significant portion of shareholder value creation for the top ten companies on the global list and only slightly less for the top ten in developed markets. The takeaway is clear: growth—whether from new-product development, breakthrough innovation, leveraging and extending strong brands, exposure to high-growth markets, or selective M&A—is imperative for top-tier value creation among nondurables companies.

Not surprisingly, for emerging-market companies in particular—such as Mexico’s Arca Continental (fifth on the list of the global top ten) and India’s ITC (eighth)—top-line growth was the dominant contributor to value creation. These companies are establishing strong positions in rapidly expanding markets, and they are riding the wave of a rising middle class and its growing demand for nondurable goods. In developed markets, companies that derived much of their returns from top-line growth are leveraging breakthrough innovation to reshape a category, as Keurig Green Mountain (first among the top ten in developed markets and second globally) has done for packaged coffee.

Companies that did not benefit from such advantages paired their more moderate growth with improved margins. For example, every one of the top ten companies in developed markets expanded their margins (by about 9 percentage points in TSR contribution, on average). Of course, this was a more important factor in the total return of some companies than of others. Several developed-market winners used strong cost controls to buy inputs at lower prices and reduce overhead costs. In addition, many are leveraging brands and product innovation to realize higher price points, which also aids in boosting profit margins.

Developed-market winners generated significant cash flow that they were able to return to investors. In previous years, many focused on raising dividends. Now, however, the focus has shifted to repayment of debt, which made a larger contribution to TSR during the five-year period analyzed than changes in either dividend yield or number of shares. Roughly one-third of the total TSR delivered by the top ten companies in developed markets came from changes in capital allocation.

Four Paths to Value Creation

Analysis of the top ten performers both globally and in developed markets suggests four value-creation models for consumer nondurables companies.

- Emerging-Market Superstars. These companies take advantage of rapid growth opportunities in fast-growing markets. They include Tsingtao Brewery in China (seventh on the overall list) and India’s ITC (eighth). These companies have distinctive brands that resonate with local consumers, and they support those brands through powerful, scaled go-to-market systems. Critically, these companies are able to drive growth by generating “pull” for their brands with consumers and “push” through distribution—making their products available for purchase as broadly as possible. Such an approach requires investing ahead of demand, but it ensures that these companies can expand their market share, giving them larger slices of a growing pie.

- Innovators. The second way that nondurables companies create value is through product innovation, often on a foundation of strong brands. For example, Keurig Green Mountain continues to develop its line of coffee devices and technology. Even as its original K-Cup products have lost some of their patent protection, the company has come up with new lines and categories that—along with strong partnerships—have helped it create sustained value despite stiff competition. Keurig Green Mountain has also invested in its brand image to differentiate itself in a crowded market, and it has built a widespread distribution network to give consumers access to its products.

-

Smart Acquirers. The third path is to use M&A to drive growth through additions to the portfolio and then bring efficiencies to bear across the acquired units. For example, Anheuser-Busch InBev (which ranked fourth overall) bought Mexican brewer Grupo Modelo for $20.1 billion in a deal that closed in 2013. The deal gave Anheuser-Busch InBev a strong position in Mexico, the world’s fourth-largest beer market, and has already resulted in more than $450 million in cost savings. AB InBev has committed itself to $1 billion in cost savings by 2016, which would improve margins and spur additional value creation.

As part of an arrangement that AB InBev worked out with the U.S. government’s antitrust regulators, the combined entity had to sell off several assets, including perpetual rights to Grupo Modelo’s brands in the U.S; the company that bought those assets, Constellation Brands, finished sixth on the overall list. Over the five-year period of our analysis, Constellation has adopted a very balanced approach to value creation, with meaningful contributions from five of the six TSR components. The company’s near-term prospects are positive as well; it is currently investing to increase brewery capacity, positioning itself to capitalize on favorable trends in the beer category over the next several years.

- Balanced Winners. The fourth path to value creation is a multifaceted approach. For example, Estée Lauder (which ranked third among the overall top ten) and Tyson Foods and Henkel (seventh and eighth, respectively, on the developed-market list) all use several levers to drive value. They take advantage of the strength of their brands to retain pricing power and thus maintain attractive margins. Tyson also has strong cost controls in place, and Estée Lauder has used its brands as platforms to help the company expand in high-growth markets. As a result, both companies earned nearly a third of their total TSR from margin expansion.

Despite these opportunities, there are some clear pitfalls for companies in the consumer nondurables sector. These include chasing growth that erodes margins, cutting costs in a way that undermines the growth agenda, and pursuing aggressive M&A in which the company buys or overpays for assets that do not fit into its existing portfolio.

Although the global economy is recovering and consumer confidence is rising, the near term is highly uncertain, given tepid growth in the U.S., a slowdown in China, the recession in Japan, and a predeflationary environment in Europe, among other challenges. Nonetheless, there are pockets of opportunity for consumer nondurables companies. Fundamentally, growth remains the primary imperative for driving shareholder value, and the right growth model depends very much on context. Both market opportunity and the ability to differentiate offerings from those of competitors will shape a company’s potential growth trajectory. For many, the path to value creation will also require continued improvement to margins through pricing, cost control, or both. Choosing the right approach for a company’s particular situation, setting expectations clearly with investors, and executing in a disciplined manner will yield handsome returns.