Machinery companies come in forms as varied as the equipment they manufacture. Just as equipment prices range from thousands to millions of dollars, companies vary from large business conglomerates to highly specialized niche companies. What most have in common is that they generate substantial value from after-sales services.

There is no one strategy for machinery companies to generate value from services. The best way to create and maximize value varies according to equipment characteristics, competitive environment, and regulatory conditions. Some companies extract most of their service value from selling spare parts. Others focus on maintenance or diversify into the processes for which their machinery is used. Every day, machinery companies are extending their service portfolios with more innovative and customer-oriented offers.

Services as a Driver of Value Creation

Machinery companies, irrespective of sector, usually have significant service businesses, representing up to 50 percent of their total revenues. Such revenues are a reflection not only of the sector and installed base of the company but also the success of the services strategy.

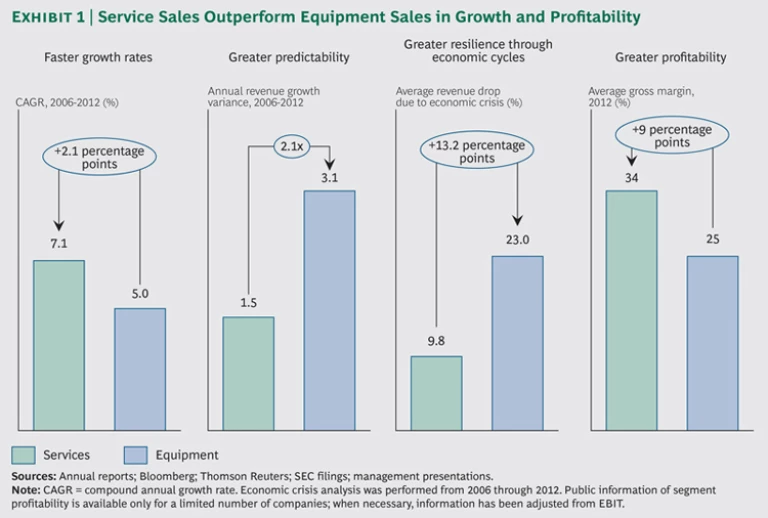

An analysis of performance from leading machinery companies in recent years shows that services have outperformed equipment sales in several dimensions. (See Exhibit 1.)

- Faster Growth Rates. Most machinery companies have managed some positive growth in spite of the global economic crisis, but service sales pulled the most weight—averaging a compound annual growth rate (CAGR) that was more than two points higher than that of equipment sales.

- Greater Predictability. Equipment sales tended to fluctuate widely. They showed twice as much variance in CAGR as did service sales.

- Greater Resilience Through Economic Cycles. The success of machinery companies depends heavily on global economic conditions—and the recent economic crisis provided a significant test. Although equipment sales fell by 23 percent—measured from the last year before the drop in sales to the last year before the recovery—services sales fell by only 10 percent during that same period.

- Greater Profitability. Services are usually more profitable, too. Equipment sales in many industries generate low margins, particularly if the analysis factors in indirect costs such as commercial expenditures and product development. Service sales show higher margins, although there are variations among types of service. Spare-parts services have had, with some notorious exceptions, higher average margins than labor-related work. Analysis of public information shows services as more than 9 percentage points more profitable than equipment sales.

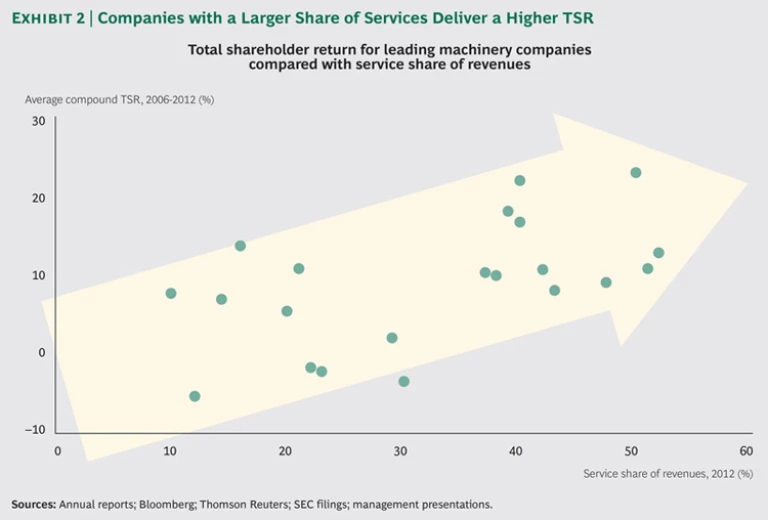

Because of this superior growth and profitability, machinery companies with a greater focus on services will typically outperform their peers. Analysis of leading machinery companies shows that those with a higher share of revenues from services generate a superior total shareholder return (TSR). (See Exhibit 2.)

Designing a Strategy to Maximize Service-Based Value Creation

There is no one-size-fits-all service strategy to suit every machinery company, but there are three broad models that cover how most can make money from services.

- A Strategy Focused on Spare Parts. With this model, companies extract most of their value from spare-parts sales, tailoring services and product offerings to capture the maximum number of spare parts throughout the life cycle of the equipment.

- A Strategy Focused on Maintenance. Industry value is concentrated in service contracts in this model, and companies aim to maximize the penetration rate and loyalty of customer contracts.

- Offering the Complete Process. In this model, suppliers expand beyond machinery servicing to cover whole processes in which their equipment plays a leading role. They can do this by using their specialized expertise to save costs for the customer.

Most machinery companies use a mix of these business models, offering a wide portfolio of services that includes spare parts, maintenance, and complete processes. It is typical, however, for one model to predominate and the others to fill in the missing pieces.

A Strategy Focused on Spare Parts

This strategy is typically used by companies whose products require frequent component replacement due to wear and tear—such as manufacturers of construction, mining, and power generation equipment.

Companies that generate value through spare parts should do more than simply respond to customer demand. With the right strategy, they can also increase the flow and value of spare parts while improving machine performance and efficiency. This increases the value generated for them and for their customers. Here’s how to put that strategy to work.

Turn the wrench. Service-related labor activities can look like an unattractive business. They yield low margins yet require skills and resources well outside an equipment manufacturer’s usual core. But taking on those activities—or “turning the wrench”—can stimulate value generation by enabling companies to prescribe the use of spare parts.

If independent service companies are the ones to make decisions about which parts to use in a service operation, they may have an incentive to refurbish used parts or to use less optimized spares. This will typically increase the labor share of the service bill—which is how independent service companies make a profit—and will likely result in a reduced flow of spare parts from OEMs as well as a lower value for customers.

If OEMs themselves perform this labor element, it links them directly to decisions about part usage. This can unleash large amounts of value, even if the overall sales margin declines.

Establish customer service agreements. In spite of the widely held belief that service operations—in particular those involving spare parts—are hard to plan ahead, much can be handled through OEM-customer contracts such as customer service agreements. Although they come in many shapes and sizes, they usually offer the customer three things:

- Predictable operation costs, since these include the replacement of critical (and expensive) wear parts

- Fewer unexpected operating problems and less downtime for servicing, since major replacements are planned beforehand

- Better service levels, basic field and data services, and replacement of minor worn parts—all complementing the main offering

Machinery companies also do better by selling more parts and benefitting from enhanced service work. They engage in longer, closer relationships with customers, which increase opportunities to understand—and cater to—client needs. In addition, they schedule part replacements before failures occur, which helps the service provider offer simpler, faster, more spare-part-intensive operations—minimizing machine downtime.

These mutual benefits mean service agreements can be introduced as part of the equipment sales process—to both help sell the equipment and create value as early as possible in the relationship.

Prevent spare-part leakage. Spare-parts leakage is synonymous with value leakage. Machinery companies, especially those with long equipment life cycles, should try to keep track of their equipment and components as they are retired from use.

Customers and independent service providers sometimes build a stock of used components recovered from old equipment. This can create two problems: competition that can cut into manufacturers’ spare-part sales and the potential for costly malfunctions or reduced performance and efficiency for the machine owner. This is why a market leader in the engine industry offers the dismantling of used equipment and a discounted price for spare parts in its customer-service agreements. By discouraging the reuse of used spare parts, the company creates value for itself and the customer.

New spare parts can also provide competition. Companies can counter this by preventing arbitrage trades of new parts based on price differences among different regions and clients and ensuring that their own spare parts are competitive in performance and price when compared with parts manufactured by third parties.

Optimize commercial and operational processes. Because of the high costs of machine downtime—particularly for that of critical equipment—some customers build their own stock of new spare parts and develop service capacities. Not all customers and repair operations can be dealt with this way, so customers will still contact service providers to fix their equipment. Speed as well as high-quality commercial and operational processes become a key success factor. Companies should focus on the following:

- Customer requests should be processed and responded to promptly. Machinery companies need to transform their commercial processes and organizations in order to optimize response times, since these are a key determinant in service-purchasing decisions. This can mean assessing the number of commercial and engineering specialists required, training such specialists, providing the tools required to rapidly identify needs and prepare documentation, and creating mechanisms for agile price decision making.

- Responses should ensure the quick delivery of services and spare parts. Customers need to not only get a quick response to a spare-part request but also receive the part as rapidly as possible to get their machine running again. By smartly optimizing logistics and designing inventory levels according to demand, OEMs can both reduce the capital invested in spare parts and speed up delivery. One European power-plant and engine manufacturer redesigned its logistics so that spare parts can now be delivered anywhere in the world faster than before even though they are centralized in a single global warehouse.

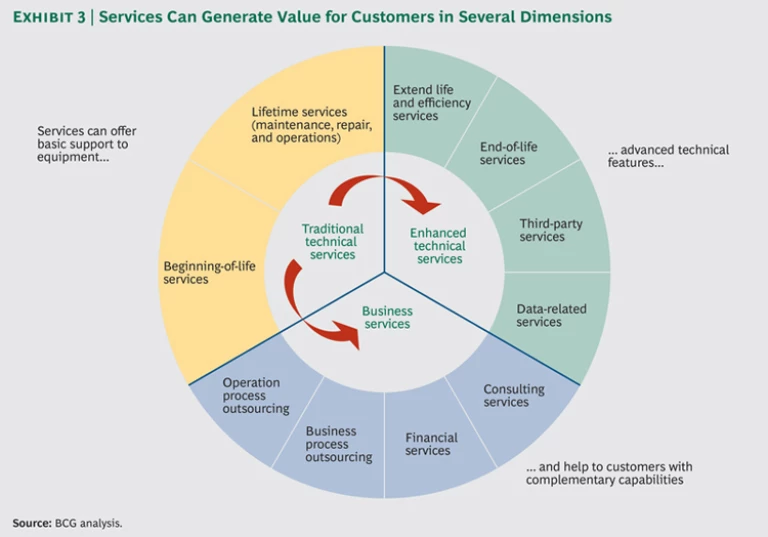

Offer additional services. Services ranging from traditional technical assistance, such as installation and repairs, to more advanced technical operations—even helping clients with tasks closer to their business needs—can generate great value for OEMs and customers alike. (See Exhibit 3.)

Some of these services—such as data analysis, remote monitoring, and predictive maintenance—can greatly improve the performance and reliability of machines; thus, customers are willing to pay for them. In some industries, however, such services offer limited margins and income potential. Even if direct margins are low, offering additional services can drive spare-parts sales. Service design helps manufacturers know the status of their equipment and offer service operations and spare parts accordingly. It prevents costly machine downtime for owners and allows service providers to perform scheduled, spare-part-intensive repair operations. What’s more, additional services can differentiate a manufacturer from competitors, which may increase sales not only of services but of equipment.

Furthermore, a significant share of after-sales revenue in industries such as printing and packaging machinery comes from the consumables used by equipment—including ink and packaging material. Selling such consumables can become a business in itself, competing with other manufacturers and specialized players.

Establish value-based pricing. While the above levers rely on increasing the volume of spare-part sales, profitability can also be driven by ensuring that prices reflect the value provided to customers. Yet many machinery companies still base spare-part prices on an unsophisticated cost-plus methodology.

Value-based price setting optimizes the profitability of spare parts by assigning a margin to each part based on the value generated for the client. This value is determined by analyzing part characteristics according to several objective criteria such as part uniqueness and criticality, OEM competitive advantage, purchasing frequency, and age of machine. Margins are then assigned based on these criteria. Combined with sensible commercial policies, these measures can increase margins per unit sold by 5 to 10 percent.

The same criteria may be used to bundle and sell highly related spare parts that have different competitiveness and unique features. This not only increases spare-part sales but also reduces spare-part complexity by reducing the number of references.

A Strategy Focused on Maintenance

Maintenance can become the main value-generating activity when customers do not want to create their own dedicated maintenance systems but still need to ensure optimal operation because of the potential economic and safety costs of machine failure. Customers may be in this situation because they lack critical mass or, perhaps, because of the complexity of their equipment.

External factors such as regulation can also play a very important role. Many European countries demand a minimum number of maintenance operations for some types of machinery. Even in less regulated countries, insurance companies may charge a premium to equipment owners that do not perform safety maintenance operations. Manufacturers of building-automation equipment and elevators are prime candidates for this strategy.

Adopting a maintenance strategy requires two different mind-set changes from the spare-part model. First, because relationships with customers through maintenance contracts become a key driver of value generation for customer and service provider, they demand careful attention. Second, service cost structures are no longer based mainly on spare parts; they are a labor business requiring specific management.

These two principles are essential to maximizing value for maintenance-focused companies—and fundamental to several initiatives that companies adopting this model should implement.

Pursue service contracts at the time of purchase. Just as the moment of purchase is the best time for retailers to offer extended warranties, it is an outstanding opportunity for proposing service contracts to machinery customers. Machinery companies should develop an attractive service offering for new equipment and consider creating combined offers of equipment and service.

Such simultaneous equipment and service sales are not always possible. For example, even though elevators are sold to construction companies, maintenance contracts are concluded with building owners. When this is the case, commercial processes should identify owners and offer maintenance contracts as soon as possible.

Consider the extension of the service offering to third-party equipment. Extending the service offering to equipment manufactured by competitors increases the potential market size. This approach can work for any of the service strategies (such as spare parts), but it is more common in labor-related activities such as maintenance. Some machinery OEMs following this strategy buy and analyze competitor equipment in order to design services for it—complying with intellectual-property laws by keeping R&D teams for services independent from new-equipment teams.

The attractiveness of providing services for third-party equipment varies according to individual industries. Those with a high volume of profitable maintenance contracts or strong scale effects from regional concentration offer serious promise. So, too, do sectors characterized by limited numbers of brands and models and that have long platform lives. Such conditions offer companies the time needed to acquire and apply competitor equipment know-how over a broad installed base.

At the same time, third-party service may be less attractive if complex competitor-equipment know-how at all levels—information systems, sales force, and field personnel—demands increased investment. This effect can be magnified when there is limited access to the parts and components required to perform third-party operations, whether by a company’s own development or through other suppliers.

Companies can use this analysis to understand whether they will be able to create value for owners of third-party equipment—or if they will incur costs that will burden their competitiveness.

Design equipment and services for sustained competitive advantage. Just as companies can expand their after-sales portfolio by servicing competitor equipment, their own customer base is exposed to service offerings by third parties.

Manufacturers wanting to remain their customers’ service provider of choice need to sustain their competitive advantage over time. Being continuously innovative in product and service design enables machinery companies to offer clients better and more competitive machine features and performance and also to differentiate their service capabilities from other competitors. To do so, companies should invest in equipment and components R&D and protect their innovations with patents. They should also increase technical competences—especially information and communication technology—needed to service their equipment.

Maximize the length and value of client relationships. Machinery companies should actively manage customer and maintenance contracts to maximize the value created for both sides. This means not only increasing services provided in all phases of the client life cycle but also remaining the preferred provider of services for as long as possible—both of which can happen through the following initiatives:

- Contract Design. Contracts can be crafted specifically to benefit customers that remain longer with the service provider—and make it simple for customers to extend contract duration by including predictable price-updating mechanisms.

- Relationship Management. Machinery companies need to learn about customer needs throughout the equipment life cycle, proactively offering timely value-creating services such as retrofits.

- Attrition Monitoring and Customer Retention. Contract cancellation rates should be monitored on an ongoing basis, enabling prompt identification of and reaction to major events such as changes in market conditions. Companies should design commercial responses to customers requesting contract cancellations but also identify patterns that usually lead to cancellation—a customer that has remained for longer than two years but has had technical problems in recent months, for example—and take action before cancellations occur.

Industrialize service sales and operations. Machinery companies usually have efficient processes in manufacturing plants and new-equipment sales forces. By contrast, service processes are less carefully managed and usually offer significant room for improvement. This is particularly true when labor-related activities become a significant—or even the most important—part of services.

Service industrialization starts with a standardized definition of the services offered. Sales teams are armed with clear descriptions and a concrete value proposition for the customer. Industrialization also enables machinery companies to increase the quality, cost efficiency, and scalability of their service delivery. To achieve these goals, companies should act on the following dimensions:

- Process Design. Existing service processes—from sales to operations—should be redesigned with the above goals in mind in order to ensure homogeneity across regions. This will not only help best-practice application but also enable organic and inorganic growth. Introducing new services requires both the definition of supporting processes and action on related existing processes.

- Service Tools. The design and use of support mechanisms such as software, hardware, and work tools can enhance most service-related processes. For example, commercial processes can be streamlined through customer relationship management, and mobility tools such as handhelds can help personnel in the field.

- People and Organization. Process redesign involves changing not only which tasks need to be done but also who will do them and what is expected from them. Roles and responsibilities should be adapted to new processes, and appropriate training should be provided to ensure that cost and quality targets are met.

- Service Metrics. Service industrialization goals should be translated into concrete metrics that can be compared with targets, ensuring the focus of service personnel and management.

A Strategy Focused on the Complete Process

Companies with a model based on a complete process offering must be able to perform maintenance and operations better than the customer can. This requires a deep knowledge of the industry and operations as well as the ability to identify and apply best practices in any environment—often through the adjustment of personnel numbers and skills. Once companies have taken on the processes from the client, they must also sustain the ability to generate better value for customers than any other stakeholder would be able to do.

A machinery company operating in the pulp and paper industry and focusing on this strategy signed a contract at a paper mill plant for maintenance operations—including automation, electrical, and mechanical maintenance. This involved taking responsibility for the plant along with 200 existing employees and introducing tough efficiency and effectiveness KPIs.

Because the service supplier takes on most of the risk that processes may not improve as intended, profitability from this model is not guaranteed. How can a company maximize the value of this strategy? In addition to applying initiatives from the other service business models, machinery companies should work on the following:

- Exhaustively Analyzing Service Costs. Offering to take over the complete process means that companies have to develop deep knowledge of customer processes by identifying cost drivers and potential improvement levers. This analysis should include projected demand for spare parts and consumables as well as labor requirements. These cost analyses cannot be standardized for all customers. Although companies develop a methodology that accounts for every cost factor, they must also insist on careful studies of the individual customer’s processes and plant configuration.

- Aligning Company and Customer Interests. Service providers that take responsibility for operating costs should also have control over the events that generate them. At the same time, customers will inevitably continue to influence the generation or prevention of costs. Contracts should be designed to align incentives for the service provider and customer, forestalling experiences such as that of a mining equipment manufacturer that took on a full maintenance contract for a mine and watched as spare-parts costs skyrocketed. Relieved of repair costs, the customer’s workers had started to treat equipment more carelessly.

Coordination Between Service and New-Equipment Strategies

All of the above initiatives show that interaction between new-equipment and service businesses can be essential to realizing service-based value-creation opportunities. It is usually also better to coordinate equipment decisions with service strategy than to use independent perspectives to maximize value from new equipment and services.

This coordination starts with new-equipment design. Design can have a significant impact on service costs since it is responsible for the type of spare parts needed, the intervals between services, and the time in the field needed by maintenance personnel. Optimizing these costs is vital in any service model, making it important to control future expenses from the beginning. To do so, companies need to minimize the maintenance tasks needed to keep equipment running and reduce the time needed to perform those tasks. They must facilitate failure diagnostics and reduce spare-part needs, costs, and replacement times. And they need to optimize the operating costs of any additional services that are offered as part of the service portfolio, including in the complete process-offering business model.

Companies should also consider the interaction between the new-equipment and service businesses in their commercial strategy. New-equipment prices should reflect not only new-equipment business-unit profitability but also projected service-business profits throughout the life cycle of the equipment. This future service business can be a more relevant determinant of commercial discounts on equipment sales than, for example, the volume of new units being sold.

Companies also need clear guidelines for decisions such as whether a customer should be offered a new machine or a retrofit for its existing equipment. This means not only aligning the strategies of each business unit but also establishing communication between service and new-equipment sales forces.

When None of the Service Strategies Seems to Apply

As already noted, few companies pursue a single service strategy and instead prefer to combine models. There may even be times when none of the models works, and companies may appear unable to extract value from services. This can be true if some of the following conditions are present:

- Equipment characteristics do not foster service value creation. This can happen if the required service adds too little value (because of low complexity and frequency), the equipment life cycle is too short, or the equipment costs too little to warrant significant attention.

- Too many companies are competing on price and offering little differentiation. If barriers to enter the service market are very low, large numbers of companies—typically nonmanufacturers—may reduce business profitability.

- A company cannot deliver the required services. This capability deficit may result from service personnel shortages (in sales and field positions, for example), insufficient financing needed to set up a service organization, or insufficient presence in relevant regions.

- A company prefers to focus on equipment sales. Company history and culture can be an important deterrent to service, and high profitability from some types of equipment might lead to a misplaced perception that services dilute margins.

For some companies, these barriers may be insuperable, but most should be asking themselves whether they can really afford to lose the service opportunity. They should be thinking about how to increase the volume and profitability of services, how to improve competitiveness by differentiating themselves from other companies, whether they can build capabilities to reach service excellence, and how to create a service focus without neglecting their new-equipment business.

Transforming the Service Business

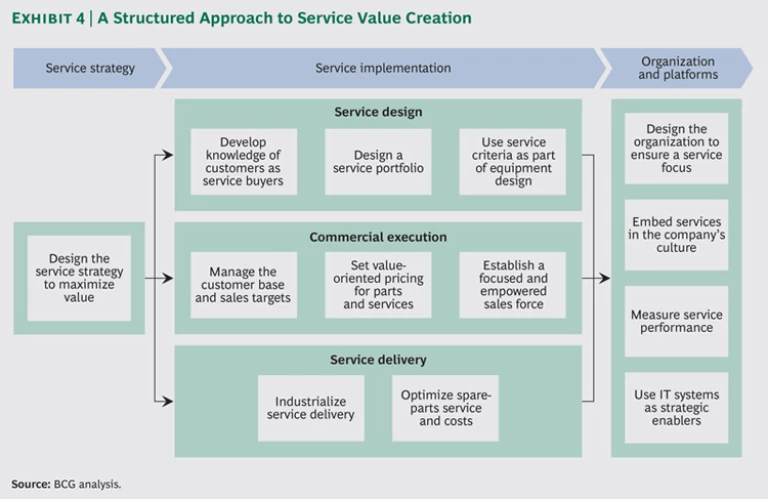

Services offer a significant opportunity to create value. Extracting this value may require relatively simple changes (such as value-based methodology for spare-parts pricing) or a profound transformation (such as establishing services as a separate business unit at the board level). Either way, the changes need a structured approach. Exhibit 4 outlines one possible framework to cover service transformation goals.

Any such transformation starts by defining the right strategy to maximize value creation. This report offers several, along with value-creating initiatives. Detailed analysis of the company’s starting point and the industry in which it operates will help identify the best initiatives to implement or introduce.

Service Implementation. The implementation stage begins once a company has identified the right service strategy and initiatives, and it involves acting on three complementary fronts:

- Service Design. Implementation starts by defining which services to offer. Since most machinery companies focus exclusively on their customers as buyers of new equipment, the first step is to learn more about those customers and their needs as service buyers. The company must design a service portfolio capable not only of generating revenues but also of sustaining the service strategy. Many services are only competitive if they are devised as early as the product design stage, and mechanisms are needed to ensure this happens.

- Commercial Execution. Even the best design will not work without effective commercial execution. Companies need to be proactive rather than reactive. They should offer services according to the evolution of customer needs across the life cycle of their equipment, set challenging sales targets according to customer potential, and ensure commercial efforts are actively pursued. This means that the sales force must have the right numbers, structures, incentives, and commercial tools. Beyond this, it is also essential to set the right price for services and ensure their correct application by customers.

- Service Delivery. Once services are designed and sold, the final step in implementation is delivery. Industrialization of service delivery seeks to define and achieve optimal quality and cost standards for services, while ensuring that these standards are applied to the whole organization. Spare parts require significant attention, including initiatives that range from lean manufacturing to specific inventory and logistics mechanisms.

Organization and Platforms. Any major transformation effort requires companies to align organization and corporate platforms with their goals. Not doing so can lead to limited impact, missed targets, and low morale. BCG experience shows that service transformation requires four main areas of support:

- Design the organization to ensure a service focus. The organizational model helps determine the extent of focus on services and the level of coordination between service and equipment employees. Much depends on whether services report directly as an independent business unit or are subordinated into an industry and equipment unit to which new equipment and services report. There are even examples of hybrid models. Machinery companies seeking service excellence will modify their organization according to service goals.

- Embed services in the company’s culture. Changing the organizational chart of a company will not usually be enough to mobilize the organization. Company culture needs to reflect the service focus both internally to all employees and externally to customers, suppliers, and markets. Companies with a real focus on service will, for instance, devote some of their best resources to after-sales activities rather than retaining such resources for new equipment.

- Measure service performance. The main service goals should be clearly defined and used as strategic KPIs at all levels of the organization. Choosing the right indicators and checking them regularly will ensure a focus on the service strategy and limit deviations from it.

- Use IT systems as strategic enablers. Many of these service initiatives use IT systems to help achieve their value-creation goals. OEMs should include the necessary developments in their technology roadmap—ensuring the initiatives are accomplished on time.

Services offer machinery companies an unmatched opportunity to generate value for stakeholders through a stable and profitable revenue stream. Few machinery companies have yet reaped their full potential and are leaving value on the table.

OEMs that want to improve their performance in services need to define their service strategy and establish a clear vision of how services can create value for themselves and their customers. Machinery companies can achieve this goal by working with the initiatives presented in this report, ranging from service design and commercial execution to service delivery. BCG’s structured approach and experience in service strategy and transformation can help capture this opportunity.

Acknowledgments

The authors are grateful to the following BCG partners and colleagues for their insights and assistance: Amanda Brimmer, Nemesio Fernández-Cuesta, Guillaume Gardy, Thorsten Kahlert, Joerg Matthiessen, Andreas Maurer, Mariya Nacheva, Gaurav Nath, Mikko Nieminen, Alberto Pardo, Ovidiu Petreaca, Lauri Saarela, Xavier Sebastian, Felix Stellmaszek, Peter Ulrich, Manuela Waldner, and Collin Wolfe. The authors would also like to acknowledge Mary Leonard, Ellison Moorehead, and Huw Richards for their help in developing and writing this report.