Wholesale transaction banking has been steadily rising in importance since the 2008–2009 financial crisis. Its attractive economics—annuity-stream fee revenues, low risk, low capital requirements, and high returns on equity—have drawn the attention of banks worldwide. Leading banks are now setting aggressive growth goals for this business, with ambitions to double revenues over the next three years. Realizing these goals will require a robust growth strategy, including navigating the new regulatory environment and deepening customer relationships by developing a solutions-based advisory approach.

Global Payments 2014

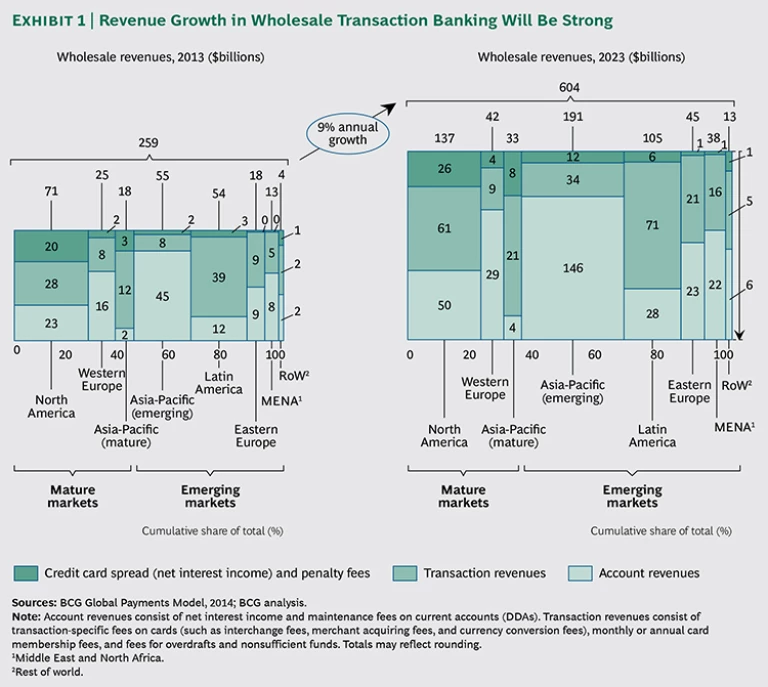

Wholesale transaction banking is expected to outperform retail payments—noncash transactions initiated by consumers—over the next ten years across all markets at 9 percent revenue growth (compared with 7 percent in retail), including small-business credit and debit cards. (See Exhibit 1.) Of the projected $345 billion in revenue growth, emerging markets will account for about 72 percent (a CAGR of 11 percent compared with 6 percent for mature markets). In mature markets, growth will be driven primarily by current-account revenues (thanks to increasing spreads), while transaction revenues are growing in tandem with GDP gains. Fees per transaction are expected to remain stable. In emerging markets, growth will be driven by overall increases in the number of businesses and by the rise of multinational corporations.

Yet despite strong expected revenue growth, excelling in wholesale transaction banking will not be easy over the next ten years. Regulatory burdens continue to hinder banks on both the revenue and cost sides. Corporate treasurers are demanding support—in areas such as e-invoicing, compliance, and the integration of financial and physical supply chains—that go beyond traditional payments and cash-management services. New entrants (such as Tungsten, GT Nexus, and TradeShift) are responding to these demands and threatening to disintermediate banks. Exceptional revenue growth is up for grabs in RDEs.

In order to move forward effectively, wholesale transaction banks need to focus on several areas: achieving sustainable regulatory compliance, seizing the working-capital opportunity, and capturing growth in RDEs.

Achieving Sustainable Regulatory Compliance

Many global transaction banks have doubled the size of their compliance functions since 2011, primarily to address anti-money-laundering and sanctions regulations. These investments have helped solve a number of critical compliance issues and improved organizational awareness of compliance.

But the expansion in regulatory requirements has also led to greater complexity, longer processes, and lower profitability. Conversations with executives of the largest transaction banks have confirmed our view that the desired end state of a sustainable, fully compliant organization has yet to be reached. Indeed, a key finding from the initiatives adopted thus far is that a larger compliance function is not necessarily sufficient, nor does it systematically ensure higher levels of compliance. A second wave of improvements is needed, one that actually embeds compliance into day-to-day business activities—and embraces not just the letter but also the spirit of the regulations.

Achieving such goals involves designing solutions that run end-to-end across the transaction-banking organization—solutions that are not just reactive and focused on the back office, but that go beyond the confines of the compliance function and address behavior where it occurs: the front office. Banks need to adopt the following principles:

- Engage the leaders of revenue-generating business units in designing compliance processes and setting objectives. The ultimate goal is for the business unit to own risk identification, mitigation, and control, while involving the broader compliance function in the process.

- Focus on the front line more than on management. In our experience, the people who really understand the problems are front-line people such as branch managers and call center supervisors.

- Create a risk-conscious culture in which every employee is informed, equipped, and motivated to make the optimal risk-return assessment. This requires fundamentally changing employees’ decision rights and performance metrics. Compensation and recognition systems need to create the right behavior, because top-down value mandates will not be enough.

- Establish conduct and compliance standards end-to-end—from product development to sales and distribution and including ongoing customer management. Product design must consider the impact on the front office of added complexity, and make tradeoffs accordingly.

- Ensure that conduct and compliance standards are effective and practical, not just “check-the-box” exercises. Standards must also be operational rather than conceptual, addressing real risks that are clearly identified. In an example of a bank falling short of these goals, the compliance department designed a customer risk-assessment program that evaluated nearly 200 data points—many more than the front office could gather or than the bank’s systems could capture.

- Measure progress in improving compliance on the basis of outcomes (for example, knowing that your customer standards are all being met)—rather than on the basis of tasks (such as counting the number of employees who have completed compliance training). Staff behavior and beliefs must be accurately gauged.

Banks that follow these principles will have a more accountable and compliant organization that is more proactive and less reliant on after-the-fact controls. Such banks will also be more client-centric by taking a front-to-back approach—bringing regulatory considerations into business decisions about whom to serve and how to serve them. Moreover, these principles will drive better efficiency by removing unnecessary duplication and complexity and enabling cross-organizational coordination.

Seizing the Working-Capital Opportunity

Although banks are being challenged by regulatory requirements, compliance, and price pressure, they are also being presented with a major opportunity to transform their businesses, thanks primarily to evolving digital technologies. Along the financial supply chain, there are numerous pain points (such as dispute resolution, account reconciliation, and trade credit) and vast numbers of manual and paper-based processes that could be automated—thus releasing large amounts of working capital. There is a chance for banks not only to differentiate themselves and win market share but also to generate new revenue streams. Working-capital optimization has thus become a key element of efforts to win cash management business.

Indeed, numerous trends have been changing companies’ payments and cash management needs over the past five years. For example, the financial crisis heightened concerns about counterparty risk. At the same time, the treasurer’s role has become more strategic, with increasing responsibility for working-capital optimization by collaborating more closely with procurement, sales, and accounts receivable. Financing needs have also shifted as buyers’ clout and demand for open-account trade have risen and as suppliers face challenges in accessing credit.

In addition, working-capital constraints caused by the financial crisis—coupled with the dominance of open-account trade—have led many corporations to integrate their cash and trade-finance operations more closely, seeking a comprehensive view of cash and trade activities and expanding their working-capital options to include trade-related services. This trend has led to new opportunities for banks to link trade finance and payment services.

Leading transaction banks have recognized that working-capital solutions and advisory services are differentiators that enable them to diversify away from commoditized services and deepen their client relationships. Several institutions have gone beyond integrating relevant payables and receivables services to include working-capital finance (for example, developing tablet-based interactive tools to demonstrate the power of their solutions).

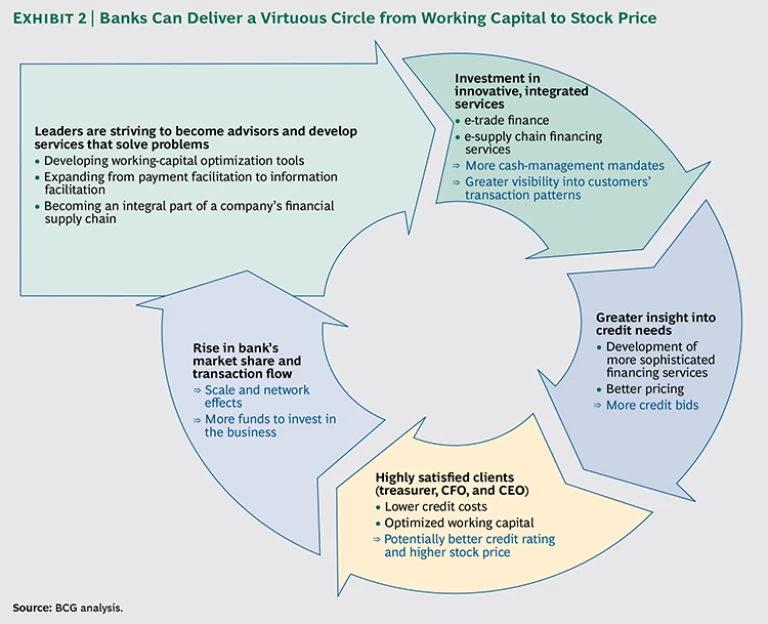

Moreover, banks are in the position of being able to deliver a virtuous circle that nonbank players cannot. (See Exhibit 2.) By investing in services that automate the entire financial supply chain, banks can win a greater share of wallet as well as gain greater visibility into their clients’ cash flows. This visibility, in turn, enables the bank to determine credit needs, offer optimal credit products, and possibly improve pricing. If the bank can improve the client’s working capital, the result could be better analyst ratings and a higher stock price for the client, deepening the bank’s relationship not only with the treasurer but also with the CFO and possibly the CEO.

Of course, the opportunity to build their business by improving financial supply-chain efficiency and optimizing working capital has not gone unnoticed by nonbank players. The procurement-to-payment arena (buyer-centric accounts-payable platforms) is already dominated by third-party players. Nonbank institutions have also had success in forming multibank trade-finance platforms. Therefore, to stay competitive, banks must develop services that integrate working-capital optimization into a holistic offering for their customers. Banks also need to effectively harness digital technologies and successfully work across product silos to address increasingly complex client demands.

Capturing Growth in RDEs

Rapidly developing economies continue to grow significantly faster than mature markets in wholesale transaction banking. By 2023, RDEs will account for 65 percent ($392 billion) of global wholesale transaction-banking revenues, up from 56 percent ($144 billion) in 2013. Emerging Asia-Pacific will be the fastest-growing region and will supply more than half the revenue growth from RDEs. Both trade-finance revenues and wholesale cross-border payments will continue to expand at about 10 percent annually.

As their corporate clients grow and globalize, banks in RDEs are investing to capture this opportunity, and with favorable economics on their side: the returns on risk-weighted assets for transaction-banking relationships are 100 to 200 basis points higher in RDEs than in the typical wholesale relationship in developed markets.

Yet success will not come easily. In order to capture this opportunity, banks that are active in RDEs need to take the five steps outlined below. By excelling at these initiatives, global players can increase their market share, while best-practice local players can demonstrate their ability to challenge global incumbents.

Organize for success. Most banks in RDEs will need to adopt a more integrated model, with transaction banking as a P&L-accountable business that drives both payments and cash management (usually combined) and trade and receivables finance (also usually combined). While product sales-and-implementation teams typically remain localized, centralized teams are indeed necessary for product, channel, and platform management across borders. In Asia in particular, 55 percent of companies with more than $100 million in annual sales maintain regional treasury centers. Understanding the regional treasurer’s agenda and having a cross-market perspective is critical to success.

Focus on sales and service excellence. For many banks in RDEs, sales effectiveness is the main commercial barrier that they face in transaction banking. The levers for improvement are local sales expertise, effective teaming between relationship managers and individual transaction-banking specialists, and shared financial and operational performance metrics. Local players have also started to establish industry-specific transaction-banking sales teams where critical masses of clients exist. For consistent cross-border service, banks need to create teaming and revenue-recognition mechanisms comparable to those of global banks. The most effective players rigorously track transaction-banking penetration and share of wallet across the client portfolio.

Price to capture value. Establishing a disciplined, consistent pricing framework for transaction-banking services can create significant value. (See “Pricing: An Underleveraged Silver Bullet for Boosting Top-Line Growth.”) Indeed, undercharging and poor tracking of fees typically account for revenue leakage of 3 to 5 percent. An Asian bank, realizing that pricing complexity had become a barrier to sales, dramatically simplified its transaction-banking fee schedules. Others have focused on making product teams more effective by providing guidelines for tactical pricing, thus increasing their flexibility and helping them win pitches on high-value accounts.

Pricing: An Underleveraged Silver Bullet for Boosting Top-Line Growth

Although much of the attention in wholesale transaction banking has been on staying ahead of regulatory trends, reducing costs, improving cross-selling, and developing solutions-driven businesses, considerable revenue potential remains untapped in the pricing arena—regardless of region. Two powerful levers are repricing on existing products and price realization on new sales. When well planned and well executed, initiatives in these areas can have a direct profit impact. They can also be implemented in six to nine months with low IT investment and at virtually no marginal cost.

Repricing is focused on existing business and line-item pricing. It involves unilaterally changing the prices and terms of stable, long-running products. Repricing initiatives generate full impact in the first year after implementation.

Price realization on new sales focuses on designing and enforcing a more systematic approach to discounting, thus limiting unwarranted leakage and waivers. Rigorous implementation requires clear guidelines and strict governance. Products are priced by transaction according to the specific bundle of services that the client buys (such as trade finance). Price realization will reach full impact according to the rollover cycle of the specific portfolio.

There are three key success factors in repricing and price realization:

- Focus on the long tail of clients typically constituting 95 percent of clients and 50 percent of revenues, with mostly outdated prices and relatively low price sensitivity.

- Set target prices on the basis of internal as opposed to external benchmarking, which is the best guideline for pricing power given a bank’s specific market and value proposition.

- Exercise disciplined top-down implementation, as this is the only way to minimize discounts and overcome the fear of client attrition.

In order to achieve sustainable results and prevent pricing inconsistencies from creeping back, banks must ensure that related governance, processes, and systems support the goals of these initiatives.

When both types of pricing initiatives are pursued, we have observed increases of up to 7 percent on total transaction-banking revenues (fees and interest) with virtually no attrition, and increases of up to 30 percent on fee revenues for particular segments. Because price increases translate directly into profit increases, margins can rise by up to 25 percent and the return on investment can be up to 200 percent two years after implementation. Furthermore, the bank benefits from a granular understanding of its pricing power and specific product usage.

Such impressive results are possible because of the structural mispricing that is common in wholesale transaction banking today. Prices are often outdated, eroded by unnecessary discounting, and do not reflect changing buying behavior on the part of clients.

Enhance the target operating model for the technology and delivery platforms. RDE players are rapidly developing digital platforms. A majority of corporations envisage an integrated platform that offers both cash and trade finance as a banking requirement. BCG’s corporate-banking benchmarking suggests that portal usage (preferably with a single log-in) is more important than product range as a driver of both total revenues and fee income in wholesale transaction banking. Best-practice local banks already offer a full range of digital services that include cross-border payments, invoice and receivables reconciliation, cash flow forecasting, letter of credit initiation and tracking, and linked FX dealing.

Rethink partnership strategies. Tighter regulations are placing pressure on correspondent-banking networks. Where perceived compliance risks and costs outweigh the benefits, global players are severing relationships with RDE institutions, particularly in Latin America and the Middle East and North Africa region. Many RDE banks are therefore turning to RDE peers with regional networks to access out-of-footprint opportunities—or are building their own presence. As open-architecture and open-account trends continue, they are also increasingly looking to third-party platforms, often from nonbank providers, for client access.