A plodding recovery, weak macroeconomic conditions, and dim growth prospects continue to challenge the world’s leading retail banks. In response, these banks are taking action to improve their operational effectiveness and productivity.

The most efficient and profitable among them are going a step further. While continuing to achieve gains in efficiency, they are also becoming more customer-centric than their competitors. Often they are developing digital capabilities to address both challenges. (See “ Customer-Centricity in Financial Services Goes Digital ,” BCG article, August 2013.)

Read more on this topic

Operational Excellence in Retail Banking: The Series

- Creating Digital Banks with a Human Touch

- No Compromise: Advocating for Customers, Insisting on Efficiency

- Committing to Customers in the “New New Normal”

- Raising Performance in Turbulent Times

- How to Become an All-Star

These top-performing banks are rejecting traditional tradeoffs and compromises between boosting efficiency and advocating for customers. At the same time, they are mitigating conduct risk. In short, they are showing that it is possible to achieve excellence on all three dimensions, which they now see as a necessity rather than a choice. In order to achieve this advantage, they are optimizing their operating models in three ways: by boosting organizational and process efficiency, increasing employee productivity, and enhancing the customer experience.

These conclusions, and the report that follows, reflect the latest perspective from The Boston Consulting Group’s client work, supplemented by the findings of BCG’s fourth annual Retail-Banking Operational Excellence benchmarking.

The benefits the top-quartile banks receive by optimizing their operating models emerge clearly in data from the benchmarking, which was conducted in 2013.

- Collectively, these leading performers achieve a cost per customer of approximately half the benchmark median. They do so by developing scalable models of efficient customer service, by migrating most low-value transactions to alternative channels (95 percent compared with the median of 80 percent), by tightly limiting staff in nonclient-facing roles (16 percent compared with the median of 31 percent), and by streamlining management overhead to just 4 percent of total full-time-equivalent (FTE) staff.

- Their income per customer is more than $1,000—nearly 30 percent above the median. They achieve this through more effective lead flow and discussions regarding high-value clients (resulting in 25 new accounts per branch salesperson per week compared with the median of 12) and greater share of wallet (2.9 products per customer compared with the median of 2).

- The most competitive retail banks satisfy customers with responsive, digitally enabled services and products.

- They achieve cost-to-income ratios—a key measure of efficiency and profitability—at or below 40, compared with the median of 54.

Of course, efficient doesn’t mean cheap, just as customer centricity isn’t simply lower fees and cheerful counter staff. The most adroit institutions are developing capabilities to deliver a better customer experience at lower cost, often customized by client segment.

- Leading retail banks provide simple, reliable, and quick paths for customers to switch products held elsewhere to the bank.

- They focus on excellent on-boarding, early tenure management, and fast-cycle development of products that fully function at launch.

- Top performers provide quick, error-free service in the customer’s preferred channel while providing visibility to all channels.

- They rapidly and reliably execute transactions and requests. When mistakes are made, they admit them immediately and correct them proactively and appropriately.

Four Levers Are Crucial in Achieving Operational Excellence

Our 2013 benchmarking, like its predecessors, examined the evolving operational practices of the world’s leading retail banks in the Americas, Europe, and Asia-Pacific—a group of institutions we call the

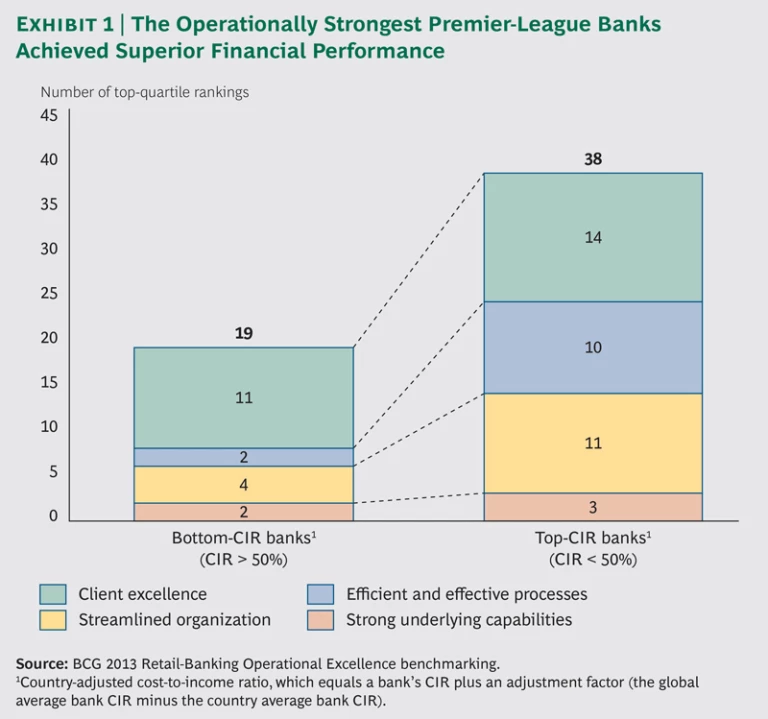

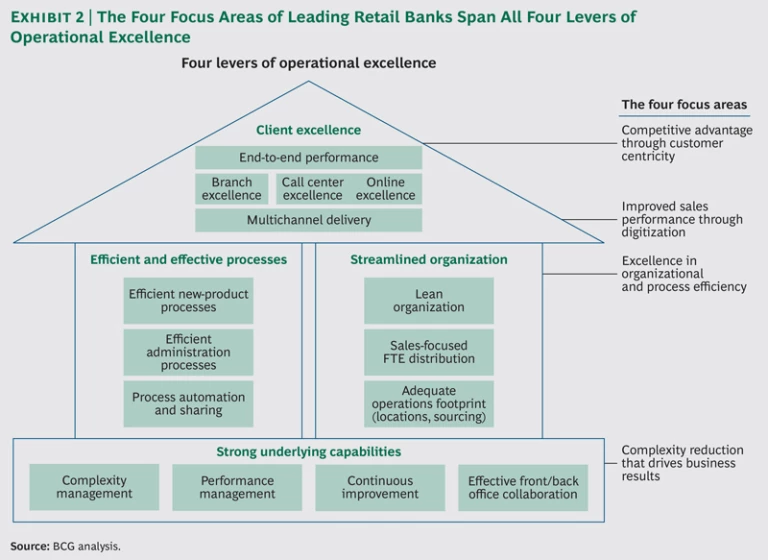

Our previous reports in this series documented that four levers are paramount for banks in delivering operational excellence: client excellence, efficient and effective processes, streamlined organization, and strong underlying capabilities. (See “Exploiting the Four Critical Levers of Operational Excellence.”) In this year’s benchmarking, we again assessed premier-league-bank performance against these four levers. Metrics included FTE staff ratios, processing-center data, cycle times by product line, and customer service by channel. Banks provided additional input during review sessions and at a summit meeting for participants.

EXPLOITING THE FOUR CRITICAL LEVERS OF OPERATIONAL EXCELLENCE

Excelling with the four levers of operational excellence is critical for retail banks that hope to raise their overall performance level. The following are some best practices and success factors.

- Client Excellence. Succeed in “moments of truth” for the customer, providing effective sales and service across channels, contacting and assisting customers proactively, and delivering easy-to-buy, easy-to-sell, easy-to-service products with key features that are instantly functional.

- Efficient and Effective Processes. Design processes that are simple, fast, and, ideally, paper-free and that get things right the first time so customers do not experience delays or errors. When fulfillment cannot be provided at the point of sale, have the ability to hand off the task to operations through data or images, then route it to the right individual for completion.

- Streamlined Organization. Achieve a lean organization with a clear sales-and-service focus, as few layers as possible between the frontline and executives, high single-point accountability, and minimal bureaucracy.

- Strong Underlying Capabilities. Establish robust enabling capabilities that allow the bank to continuously improve its end-to-end operating model and cost performance through complexity reduction, rigorous management of performance, linkages to incentives, and other initiatives.

Even with the heightened focus of recent years on productivity, none of the high-performing banks included in the benchmarking achieved top-quartile results in all dimensions—a reflection of each institution’s starting point and focus. This reality highlights the difficulty of excelling in all areas simultaneously. It also suggests that further gains are possible, even among high performers.

Operationally Strong Banks Outperform Financially and in Customer Advocacy

This year’s benchmarking results amplified an earlier insight: the operationally strongest retail banks deliver superior financial performance. The findings also underscored the fact that there is no single silver bullet; achieving true operational excellence requires a bank to execute at a high level across multiple dimensions, in alignment with its own specific business model.

The strongest overall performance on our four levers of operational excellence was concentrated among the most efficient and profitable set of premier-league banks, that is, those with the lowest

The 9 most profitable banks also demonstrated wide-ranging operational excellence. Six of them achieved top-quartile performance in at least three of the four levers: client excellence, efficient and effective processes, and streamlined organization. The benchmarking found that as banks adapt to the new new normal of weak macroeconomic conditions and dim growth prospects, customer centricity has become an increasingly important competitive differentiator. The most efficient and profitable half of the total field of 18 benchmarked premier-league banks surpassed the premier-league median in client excellence. More crucially, these leading banks have opened a gap with other banks by boosting efficiency and reducing complexity throughout their organizations.

Many of these banks are delivering on customer advocacy and other imperatives by developing their target operating models, as discussed in the final section below.

How Leading Retail Banks Are Achieving Operational Excellence

This year, we identified four specific focus areas that are helping the leading premier-league banks achieve operational excellence while driving efficiency for the customer’s benefit:

- Competitive advantage through customer centricity

- Improved sales performance through digitization

- Excellence in organizational and process efficiency

- Complexity reduction that drives business results

Significantly, these focus areas span all four of the key levers of operational excellence. (See Exhibit 2.) They are also unified by customer centricity, which is now a key part of leading banks’ efforts to drive top-line growth, reduce costs, and attract, serve, and retain clients.

Competitive Advantage Through Customer Centricity

The benchmarking clearly highlighted the business benefits of meeting customers’ financial needs and their rising expectations for fast and responsive service. Customer centricity is more than just good service. It is also about tailoring propositions to customers’ profiles and needs, rationalizing product offerings, and simplifying product features. (See The “New New Normal” in Retail Banking: How Banks Can Get Back on Course , BCG Focus, August 2012.)

Attracting and serving high-income-producing clients and expanding share of wallet have therefore become key differentiators. Increasingly, premier-league banks are turning to big data, sophisticated analytics, and digital capabilities to achieve those goals. (See “Connecting with Customers Through Big Data.”)

CONNECTING WITH CONSUMERS THROUGH BIG DATA

Premier-league banks are adopting big-data tools and approaches—mining massive quantities of previously untapped customer and consumer data—to identify the most attractive customers and serve them better.

The most competitive banks are succeeding in targeting prospects, winning their loyalty, and increasing revenue as they improve lead generation productivity. Some banks are using information about which products a customer already holds—either in-house or with competitors—together with data about lifestyle, income, and recent transactions to suggest better-performing or less expensive alternatives.

One particularly strong bank, for example, is pulling data from multiple sources—internal and external—to tailor services and offerings, progressively, to each customer’s preferences and needs. This also allows the bank to ensure that communication is delivered through the customer’s channel of choice, to highlight offers that match the customer’s situation and risk profile, to alert staff—both physically and virtually—to opportunities in real time, and to enable proactive intervention when needed.

Some best-practice banks mine their databases to identify events in the lives of their customers that might trigger demand for new products and services. One bank with top lead-management capabilities, for example, contacts clients three months before they are scheduled to pay off a mortgage to discuss investment products, and two weeks after a household move to discuss insurance.

The most capable banks are developing data and analytics to accelerate their understanding of sales trends, incorporate more accurate forecasting, and create more powerful marketing platforms and initiatives. Longer term, some banks are combining data-driven insights with customer-centric approaches to plan the evolution of their business models. (See “A New Virtuous Cycle for Banks: Linking Social Media, Big Data, and Signal Advantage,” BCG article, February 2012.)

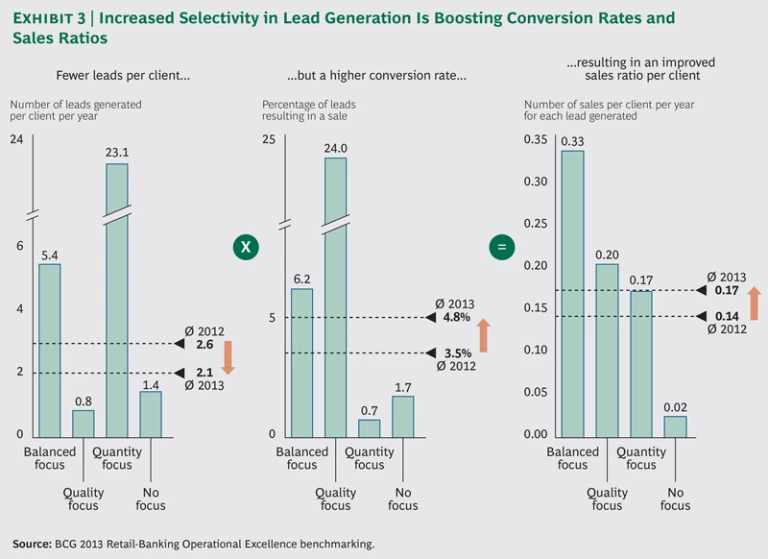

However, we believe that the main challenge for banks, before tackling big data, is to develop “rich data”—that is, customer information that is complete, current, coherent, and consistent. That is far more important than external data feeds in allowing banks to extract key insights. Indeed, our benchmarking revealed that banks achieving a balanced focus on both the quantity and the quality of leads were able to generate nearly twice as many sales per client per year for each lead generated, compared with banks that focus primarily on generating the largest possible number of leads. (See Exhibit 3.)

Another customer-driven differentiator is the ability to improve the speed and responsiveness of sales and service. For example, the top-quartile performers in the benchmarking had a median

The leading banks have also improved the operational excellence of their call centers. For example, the top performer achieved a call wait time of 12 seconds, compared with the top-quartile average of 17 seconds and an overall median wait time of 30 seconds. Some banks are taking the further step of segmenting service by customer type, aligning cost to serve with customer value.

Overall, banks have continued to increase their focus on customer-facing roles, with top-quartile banks now dedicating 82 percent of resources, excluding overhead, to those roles.

For the most customer-centric banks, focusing on clients translates into 30 percent higher income per customer on average, illustrating why advocating for customers is increasingly a competitive differentiator. Some market leaders have made step-change improvements in the customer experience by redefining their operating models around client expectations. As they do so, a number of best practices have emerged:

- Base communications on the needs of individual customers, making explicit service-level commitments.

- Align multichannel distribution with natural customer pathways.

- Tailor customer value propositions, often at the segment level, to match revenue potential and cost to serve.

- Achieve a single view of individual customers and their needs and behaviors, and implement “next best actions” based on that view.

- Incorporate a customer perspective into leadership, culture, KPIs, and employee incentives.

Improved Sales Performance Through Digitization

The digital engagement of clients with their banks is expanding quickly, underscoring both the potential opportunities and the perils of interactive technologies, which have disrupted incumbents in a succession of industries from music and publishing to printing and photographic imaging.

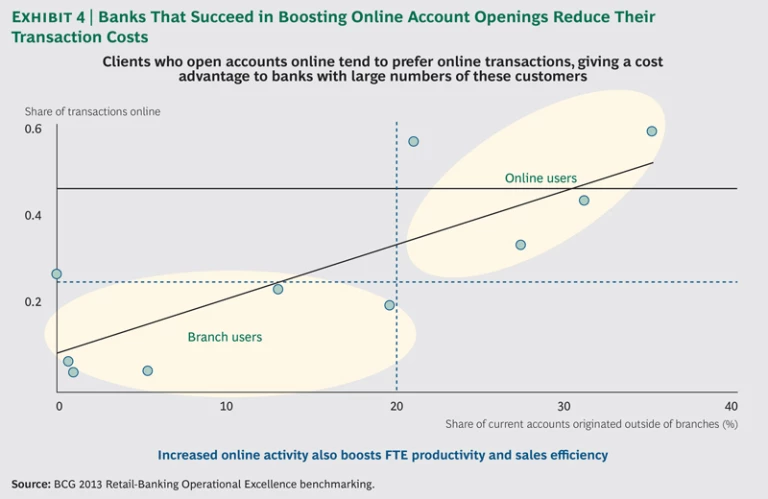

Almost all the benchmarked banks experienced strong growth in online transactions and interactions, as customers increasingly choose interactive, self-service channels, especially for simple tasks. More significantly, mobile interactions and transactions have skyrocketed, quadrupling the previous year’s totals. For top-quartile banks, the online and mobile share of transactions is now equivalent to that of ATMs, at about 43 percent. The largest gap between top-quartile and median performers was in the share of online versus branch transactions.

This expanding digitization is enabling stronger sales performance in two distinct ways. First, multiple interactive channels fulfill the needs of customers—giving them what they want, when and where they want it. Second, digital channels lower operational costs and boost productivity because they require fewer in-person, branch-office interactions and therefore fewer administrative FTEs. Moreover, banks with a high proportion of customers originating online reap a compounding benefit, because those clients tend to prefer transacting online. This allows further reductions in administrative staff and activity, increasing resources for high-value-added client-advisory services. (See Exhibit 4.)

As a consequence of this evolution in channel usage, branches increasingly focus on high-touch transactions. Banks are investing in getting the most out of those branch transactions that are not growing robustly. For example, one bank achieved a 30 percent increase in sales conversion by implementing customer-advisory best practices. It won 80 percent of that increase from scheduled appointments and a focus on the right customers, with the remaining 20 percent achieved through better customer-flow management and a sharper focus on sales.

Excellence in Organizational and Process Efficiency

Banks are making significant strides in improving organizational and process efficiency. Yet new challenges to productivity keep surfacing, many resulting from the rising tide of regulation aimed at reducing risk and enhancing customer protection.

In this environment, banks excelling in process efficiency are widening the productivity gap with average performers. This is particularly true as measured by account openings, as well as the proportion of risk FTEs to new products per account opening, where the performance of top-quartile banks was triple the median.

The benchmarking also found a widening gap in customer management between top-scoring banks and the rest. Top-quartile performers had twice as many customers per operations FTE as the premier-league median, owing to increased operational efficiency, organizational streamlining, and the shifting of FTEs to customer-facing roles. The best performers dedicated an average 82 percent of FTE resources to customer-facing roles. Benchmarked banks achieved a median 3 percent reduction in management FTEs and a 7 percent increase in customers per FTE.

Delayering initiatives have proven to be a very powerful lever for many banks in reducing management staff and simplifying the organization. These initiatives reduce the number of layers in the hierarchy and increase spans of control at appropriate levels. At the same time, delayering brings managers closer to customers and frontline staff. This improves decision making, enhances accountability, speeds communication, and creates a more competitive cost structure.

In order to achieve the desired process and organizational efficiency, every bank in our benchmarking is performing end-to-end process reviews aimed at achieving continuous improvement. The review frequencies vary considerably, however, and only a third of the banks perform annual reviews.

Some banks are excelling in operations productivity, opening a large gap with the average performers. That said, systematic measurement of operations performance and productivity is now the norm. More than 80 percent of the benchmarked banks measure performance and regularly report it.

Process reviews are increasingly used to improve business performance as well. One-third of the benchmarked banks review new products to verify the existence of a sound business case and to eliminate nonrevenue-generating products.

Finally, several of the most competitive financial institutions are doubling down on lean programs both to ensure their own survival and to gain a long-term advantage. (See Lean That Lasts: Transforming Financial Institutions , BCG Focus, September 2012.) The most forward-looking companies are embracing “lean that lasts,” comprehensive and sustainable change based on an operating philosophy of continuous improvement that motivates the entire organization and creates a genuinely lean company. For example, one strong bank that had become frustrated with diminishing returns from process-only changes was able to unblock progress across the organization by improving cooperation between the front office and operations units. The breakthrough was achieved by establishing end-to-end goals, incentives, and feedback loops that focused on customer outcomes.

Complexity Reduction That Drives Business Results

Complexity reduction initiatives are on the rise, with banks expanding rationalization of their product portfolios both to restrain costs and to provide customers with clear, uncomplicated choices. The benchmarking showed a 10 percent median reduction in actively sold products. Half the banks surveyed anticipated further rationalization.

Product rationalization in one silo can have substantial secondary effects by eliminating related products in other portfolios. One bank, for example, undertook a reduction in the complexity of its mortgage products by targeting all product parameters: it slashed mortgage loan types from nine to one, cut down-payment methods from seven to five, and reduced available interest periods from 14 to 6. Ultimately this initiative triggered 10 to 90 percent reductions of related products in securities, loans, current-account packages, and savings accounts as well.

Banks are also starting to turn their attention to the elimination of nonvalue-creating complexity and costs at the intersection of business and IT. (See Simplify IT: Six Ways to Reduce Complexity , BCG Focus, March 2013.) This has led many banks to shelve low-value products that require extensive IT resources. The savings potential is substantial, given that 20 percent of a bank’s products typically generate 80 percent of its revenues. The prerequisite for success in joint business and IT simplification is understanding the true IT costs and revenues generated by each retail-banking product.

Finally, several banks reported initiatives to simplify and clarify internal and external communications throughout the organization. The first objective is to facilitate customer understanding and decision making and allow the bank to address its clients directly and separate from the general public, regulators, and competitors. The second objective is to respond to growing regulatory pressure for straightforward and factual communication that is free of marketing and promotional messages.

For such initiatives to succeed, it is critical to embed the value of simple communications into the company culture, with attention from top executives, and to establish companywide systems that sustain the new standards.

Enabling Customers and Banks with a Target Operating Model

How do the world’s premier retail banks deliver on these and other customer-centric imperatives in a rapidly changing, digitizing world? Our research and client work show that many of the best banks have developed a target operating model—a specific and agreed-upon medium-term operating model that is aligned with the bank’s business model and aimed at creating step-change improvements in the way products and services are delivered to customers.

The necessary first step in developing a target operating model is to achieve clarity on the bank’s business model—that is, its customer-value proposition and strategy based on such fundamental parameters as target customers, customer economics, product lines, and channel mix. Together, these parameters define the business context that determines how the target operating model should be designed and implemented.

With that understanding in place, a target operating model can be created that meets the needs of the business model. In addition to fulfilling functional needs, the model must support a bank’s allowable-cost requirements, which determine both revenue and cost per customer, sometimes measured in FTEs. For example, one bank designed its operating model to provide clarity and accountability on allowable FTEs in separate parts of its business where there was no redundancy or overlap. In this case, the FTE roles, responsibilities, and costs were factored into the design of the target operating model and helped make it a success as a future framework.

While the specific components vary by bank, target operating models are often described in terms of people, processes, and technology. Most models address similar, fundamental questions about how the bank will be structured to deliver products and services and what key changes are required. For example:

- People. What are the major organizational units and how will they be structured? What governance mechanisms—such as decision rights and committees—will guide day-to-day operations and key change programs? What people and talent processes are required?

- Processes. Which processes need reengineering? What shared services and centers of excellence should be created? Which processes will be conducted at the enterprise level and which by the business units? Which processes will be outsourced or offshored?

- Technology. What core platforms will be used for each major product or service? Where are investments in automation or workflow required? What changes are required in data management and infrastructure?

The process of answering these questions and others produces a blueprint of the target operating model. Mapping the path to that goal results in a program of changes that require a clear roadmap, score cards, and quantitative and qualitative targets in order to embed and sustain the changes within the organization. This disciplined and rigorous planning ensures that executives are aligned around a common purpose, that allowable costs are transparent, that initiatives are well defined, that accountable leaders are named, that working-level resources are committed, that milestones and timing are locked in, and that benefits are realized. When structured well, this approach provides greater certainty of execution and ultimately unites the organization around a common goal.

The challenge of designing an operating model is acute in a rapidly digitizing world. Clients have grown accustomed to real-time information access through multiple interactive channels including online, mobile, and even social media. They expect more advice, transparent pricing, tailored solutions, quicker responses, and simplified choices. This increasing sophistication on the part of customers requires banks to keep pace with digital innovation.

The target operating model, as it adapts to this changing environment, must be specific and robust, yet supple enough to accommodate the bank’s priorities and investments. It must also be sufficiently firm to protect the bank against decisions that diverge from the target state. It is no coincidence that the most competitive banks are expending the time and effort required to design a target operating model that establishes the foundation for deep and lasting advantage in the digital era.

Acknowledgments

The authors would like to express their gratitude to the financial institutions that participated in the interviews and benchmarking that served as the foundation for this report. They also thank Michael Leyh and Kai Angermeier for research and other contributions. Special thanks go to Jonathan Gage for his editorial leadership, as well as to other members of the editorial and production team, including Katherine Andrews, Philip Crawford, Gary Callahan, Kim Friedman, Abby Garland, Gina Goldstein, and Sara Strassenreiter.