The outlook for retail payments—noncash transactions initiated by consumers—differs widely by region. In Europe, regulation and the need to sharpen pricing and operating models are shaping the landscape. In North America, digital technologies and innovative card strategies are driving growth. And in RDEs, a host of forces—including young populations, favorable macroeconomics, and low banking penetration—are providing both challenges and opportunities for payments players.

Global Payments 2014

Europe: Dealing with Disruption

Retail payments in Europe are in a state of flux, with transformational forces disrupting economic models. European payments players need to have a full understanding of these forces in order to plan their future strategies. Above all, they need to take action, especially regarding pricing initiatives and operating models.

Four Transformational Forces

The four principal forces (apart from regulation) that are affecting the European payments landscape are heterogeneous growth patterns, digital innovation, evolving merchant payments needs, and widespread M&A activity.

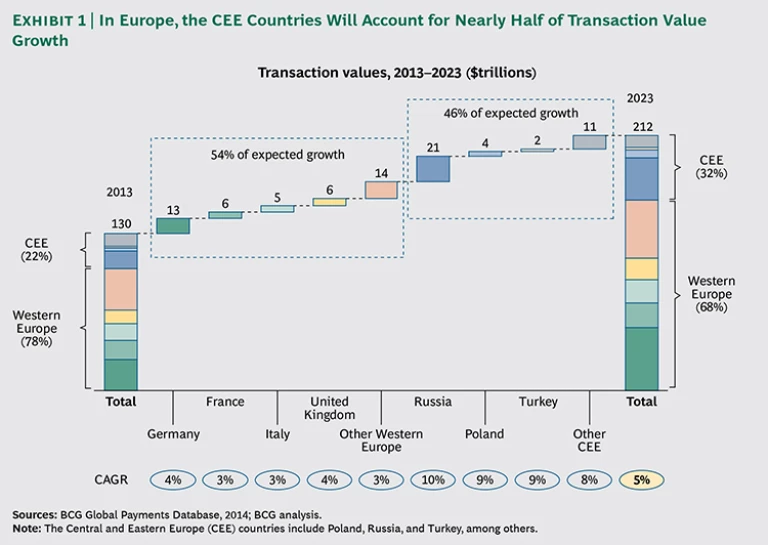

Heterogeneous Growth Patterns. There is a clear difference between the Central and Eastern European (CEE) markets and the Western European markets. While the former accounted for just 22 percent of total European transaction volume in 2013, they represent nearly half of transaction value growth through 2023. (See Exhibit 1.) Transaction value in the CEE markets is expected to grow at roughly 9 percent per year through 2023, with Western European markets expanding at less than half that rate (about 4 percent per year). Global players that want to enter the CEE markets will face considerable barriers to entry, including significant innovation by local and sometimes nonbank players.

Varied growth patterns, moreover, will occur not only regionally but also by type of transaction. Across Europe, the growth rate of online transactions through 2023 is projected to outpace that of other forms of payments by 10 percentage points, with cards dominating online payment methods. Indeed, in 2013, cards had a 50 percent greater share of total payment values in online spending (compared with offline), with e-wallets representing about 25 percent of online transaction values. Here again, traditional payments players seeking entry will face competition stemming from local payment habits. For example, there is still a relatively high use of cash-on-delivery transactions in some CEE countries, and instruments for online commerce are highly local in some Western European markets.

Digital Innovation. Although it can be argued that European countries initially lagged behind the U.S. in digital payments innovation, there has been a flurry of activity recently. Not all apps have reached widespread adoption, and most innovations remain country-specific, but some initiatives in Europe have succeeded in truly addressing customer needs. For example, in-app payment wallets—such as the Starbucks loyalty app and mobile taxi-booking apps such as mytaxi and Uber, each with embedded payment functionality—have gained traction by offering a clear benefit to clients while not requiring coordination with the broader payments ecosystem, as do general-purpose wallets. In the U.K., new apps have fully leveraged the real-time nature of the Faster Payments scheme with person-to-person (P2P) payments, such as Paym, and mobile or point-of-sale (POS) payments, such as Pingit and Zapp. Sweden, Poland, and Switzerland have also developed a real-time payments infrastructure, while other countries, such as Finland, are planning to build one. Some innovative payment solutions such as MobilePay in Denmark have managed to gain traction locally.

Evolving Merchant-Payments Needs. The traditional acquiring landscape is shifting at multiple levels as the needs of merchants continue to evolve. First, physical merchants are increasingly seeking to provide customers with an omnichannel shopping experience in response to the growth of e- and m-commerce. To this end, they are trying to establish links with multichannel providers in order to offer one-stop shopping. Acquirers, for their part, are also building up multichannel capabilities, through both greenfield initiatives and acquisitions. Moreover, as innovation continues to accelerate, the complexity of merchant needs will increase. This trend will favor payment service providers (PSPs) and require traditional acquirers to develop or acquire PSP-like capabilities.

Further, microacquirers are competing with traditional acquirers on both pricing transparency and onboarding time. They are still largely limited, however, to underserved client segments. Meanwhile, Square’s U.S. rollout of its mPOS solution has been copied in several European countries. The integration of payments with core merchant-business processes, including accounting systems and merchant-funded rewards, is rapidly gaining traction by leveraging transaction data analytics.

Widespread M&A Activity. With the EU landscape still relatively fragmented compared with that of the U.S., we have witnessed a fair number of mergers and acquisitions, mostly among acquirers and PSPs. In addition, traditional bank-tied acquirers are increasingly outsourcing their acquiring activities.

Regulation: Weaker Revenues and Stronger Competition

Renewed legislation on payments, promoted by the European Commission, is now entering the final stages of a multiyear implementation process. Some of the specifics are still in flux, but the main pillars are in place. These include the following:

- Interchange rates will be significantly lower, with caps most likely at 30 basis points for credit transactions and either 20 basis points or €0.07—whichever is lower—for debit transactions.

- Third-party payment providers will have greater access to information about the availability of funds in consumers’ bank accounts.

- Schemes and processing will be separated in some form that is still to be determined.

- Remaining restrictions on cross-border acquiring will be eased.

The cap on interchange rates will have a significant negative impact on issuer economics in Europe, with issuers standing to lose roughly €8 billion per year (beginning in 2015) out of a pool of €60 billion in card revenues. The loss will be roughly evenly split between credit cards (€4.3 billion) and debit cards (€3.7 billion). Issuers in markets where interchange accounts for a larger proportion of overall card revenues will obviously suffer more—and some credit-customer segments will become unprofitable. Regulation will also accelerate existing trends in European retail payments such as tighter competition in the acquiring market and the rise of alternative payments solutions.

Benefits for Acquirers, but Only Temporarily. While issuers are incurring the bulk of revenue losses, we expect new legislation to have a temporary positive effect on the economics of acquirers—after which the impact of increased competition is likely to outweigh the short-term windfall. As interchange decreases, merchant service charges will adapt only gradually, and acquirers thus will benefit. The rate at which this rebalancing occurs will depend on two factors: whether the merchant service charge is pegged to interchange, and whether the merchant is proactive in negotiating the charge downward. Acquirers whose customer portfolios are geared more toward small or unsophisticated merchants will benefit more. The temporary windfall will therefore vary greatly by acquirer and by country.

Overall, the new regulations will increase the level of pricing transparency to merchants, strengthening their negotiating power. As a result, we may increasingly see merchants trying to pit different acquirers against each other, leading to margin erosion for acquirers.

The Rise of Alternative Payments Solutions. Overall, we expect legislation to accelerate innovation in alternative payments solutions in the following ways:

- The general economics of e-wallets will be improved in the short term by the reduction of interchange, which will then gradually be passed on to retailers.

- The reduction in interchange will shift rewards for card users from issuer-funded programs to merchant-funded programs, which will further accelerate the trend toward more deals and offers, as well as toward in-app payment wallets.

- Greater access to the balances in consumers’ bank accounts by third-party providers will foster the development of alternative payment solutions by reducing risk.

Given the expansion in alternative payment solutions, banks will need to clearly define their strategies concerning local and global wallets, especially with regard to how they plan to compete (or cooperate) with other local banks and alternative payment providers. Finally, it is important to note that some banks are still short of reaching their Basel III capital requirements. Asset-quality reviews by the European Central Bank (ECB) are still in progress. The ECB could require banks either to raise capital or to further deleverage. In parallel, payments assets have been highly valued. Banks could therefore use the underlying value of their payments infrastructures to strengthen their capital bases without having to deleverage excessively.

Sharper Pricing and Operating Models

The revenue challenges facing issuing banks will require them to sharpen their pricing models on both current accounts and payments transactions as part of a broader effort to reshape their strategic priorities. They will also need to review their operating models.

The Pricing Model. Although revenue streams from what is sometimes referred to as daily banking—current (or checking) accounts, transaction fees, and financing charges on revolving credit-card balances—vary by market, such areas represent roughly 25 percent of all retail-banking revenues. Indeed, the differences in retail-banking profitability among countries and client segments are due largely to pricing models, which are generally more favorable to banks in southern Europe than in northern Europe.

Moreover, although it remains clear that customers’ current accounts and payments products are the keys to deepening the relationship and positioning the bank to meet other financial needs as they arise, daily-banking economics are increasingly under duress, especially for mass-market clients. This pressure is coming not only from lower transaction revenues owing to regulation but also from higher transparency, lower margins on deposits, the need to invest in innovation, and the ease with which customers can switch institutions.

Banks will increasingly need to counter these forces through three key pricing levers:

- Formulate segmented pricing offers based on each customer segment’s value and price sensitivity. Adjust the cost-to-serve for less-profitable clients.

- Devise smart incentives for non-daily-banking products to increase cross-selling. Offer appropriate rebates and discounts to high-value segments.

- Create targeted pricing campaigns to improve both the volume and quality of customer acquisition. Provide direct financial incentives but exercise caution in order to avoid excessive price reductions.

To capture these opportunities fully, it is critical for banks to develop a well-defined, comprehensive pricing initiative that includes a holistic view of all aspects of the business portfolio. Such programs should start by defining clear goals in terms of customer acquisition, cross-selling, up-selling, and new revenue generation for each client segment. On the basis of our client experience, we estimate that European banks could potentially increase their daily banking revenues by up to 25 percent over two years with a successful pricing program.

The Operating Model. Multiple types of deals among banks have occurred in the European card space in recent years, from collaboration on bank utilities to the forging of strategic partnerships. We expect the trend toward deals and partnerships to accelerate in the coming years. As European banks review their card-payments operating models, they must first consider the current landscape, which can be roughly divided into three types of markets:

- Outsourcing markets , in which payments are typically outsourced to a single processing utility, such as in Belgium (Atos Worldline), Switzerland (SIX), Spain (Redsys), and Ireland (TSYS)

- Hybrid markets , in which some banks have outsourced their payments processing to third-party providers, such in as the U.K., Germany, and Poland, while other banks have kept processing in-house

- Insourcing markets , in which payments processing remains largely insourced, such as in France and Turkey

In noncard payments, banks have made significant investments to comply with SEPA rules on credit transfers and direct debits. Further, in certain countries, banks have reviewed their IT and operations in order to fully leverage the real-time nature of new market infrastructures (such as Faster Payments in the U.K. and Express Elixir in Poland).

Banks should use current market disruptions as an opportunity to upgrade their payments operating model, assessing their current position through multiple lenses: operational efficiency and scale, pure economics (including the overall value of payments to the bank), competitiveness against rivals, and innovation capability. Initiatives for true change should start with a clear statement on overall objectives, as this will drive both the type of potential deals to pursue and the most appropriate type of partners or buyers.

North America: Deepening Relationships

After several years of being battered by regulatory measures, retail payments revenues in North America (the United States and Canada) rebounded to $222 billion in 2013, up 4 percent from 2012, representing 30 percent of global retail-payments revenues. Transaction revenues accounted for $104 billion, credit-card net interest income and penalty fees accounted for $93 billion, and demand-deposit products represented $25 billion. Retail payments revenues in North America are expected to reach $323 billion in 2023, with account revenues showing the strongest growth (6 percent), followed by transaction revenues (5 percent). Retail payments businesses accounted for 76 percent of total payments revenues in North America in 2013.

In a region characterized by an active investment and acquisition landscape, with numerous new entrants—such as technology companies—disrupting the status quo, banks need to develop a holistic strategy. If they do not, they will likely fall short in seizing growth opportunities, increasing market share, preserving margins, fending off disintermediation threats, and capturing new revenue streams.

The principal opportunities lie in two areas:

- Leveraging new digital technologies to deepen customer relationships by way of the checking or demand deposit account (DDA)

- Forging new and innovative strategies in credit cards

Taking the Demand Deposit Account Digital

Leveraging the DDA to build and deepen customer relationships has become more powerful with the development of digital technologies. Digital banking, which spans remote channels and includes remote deposit capture and mobile payments, provides an excellent platform to increase customer contact, deliver value-added services, and ultimately increase customer satisfaction. New capabilities such as preorders from retailers, highly targeted offers, and alerts sent to mobile devices will be every bit as game-changing as the advent of online banking and electronic bill payment (e-bill pay) more than a decade ago. Indeed, while the 24/7 functionality of online banking increased the role of banks in consumers’ daily lives, and e-bill pay allowed banks to capture a greater share of wallet, today’s digital technology enables banks to be more proactive in helping customers in multiple ways throughout the day.

Yet there are tall challenges to overcome. Although banks are well positioned—they possess key assets such as security and risk-management skills, as well as reliable, scalable infrastructure—technology companies and retailers are matching some of these assets and excelling at others (such as one-click purchases). Moreover, mobile-banking penetration is only about 30 percent for leading banks. Clearly, at this relatively early stage, institutions still have everything to win or lose. The initiatives that they launch today will go a long way toward determining their market positions and performance levels over the next ten years.

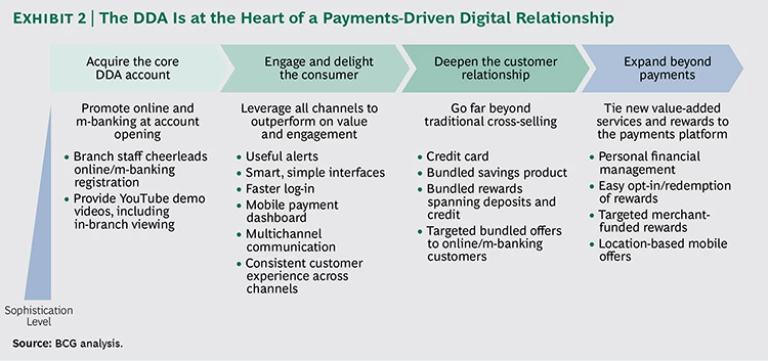

The road to building a powerful payments-driven customer relationship begins the moment the customer opens a DDA. (See Exhibit 2.) This is when the promotion of digital banking should start. Next, a bank must observe usage patterns and solicit customer input to continually enhance its applications. As the bank increases customer engagement and satisfaction, it should systematically seek out ways to improve the relationship.

Of course, deepening customer relationships goes far beyond simple cross-selling. It means creating product bundles targeted at specific segments (such as students, newlyweds, or retirees), offering relevant products based on “trigger” events (such as the birth of a child or the first purchase of a home), and ultimately linking products, rewards, and offers together in an all-encompassing value proposition that adds up to more than the sum of its parts.

A bank must be visionary. It must not stop with customer input but figure out new sources of value that the customer may not think of. With technology companies driving innovation every day, digital banking and payment services will become table stakes—absolutely necessary but certainly not sufficient for differentiation. Payments providers need to distinguish themselves from the pack by offering digital services that go beyond payments and banking. Prime examples are delivering targeted deals, location-specific promotions, point-of-sale redemptions, and convenience-oriented services (such as being able to preorder and pay prior to pick-up at a quick-service restaurant or coffee shop).

Innovating in Credit Cards

There are significant opportunities for payments players to broaden their credit-card businesses and gain market share by targeting “transvolvers”—cardholders who execute a high number of transactions and revolve their credit balances every month—as well as by exploring cobranding arrangements that can bring substantial benefits.

In addition, there are growth opportunities for banks that successfully provide a bundled DDA and credit-card product. The bundle could include a single statement (preferably paperless), a spending analysis tool that includes payments made through both the credit card and the DDA, and the option to have minimum card payments automatically deducted from the DDA in order to avoid late-payment fees.

Finally, it is important to note that the U.S. and Canadian card markets differ in four key dimensions:

- The average number of credit cards per consumer is more than three in the U.S., compared with just two in Canada, where cardholders typically have one Visa card and one MasterCard.

- Cross-selling between DDAs and card accounts is higher in Canada, where there is a strong branch-distribution model.

- Canada has just one dominant cobrand, Aeroplan.

- Canadians’ credit-card debt is half that in the U.S., resulting in lower transvolver revenues.

Excelling in the Transvolver Value Proposition. The transvolver segment, which typically represents 25 to 30 percent of a bank’s card customers, can generate up to 90 percent of a credit card portfolio’s profit and three times the risk-adjusted margin of other segments. Although this segment already consists of heavy card users, there is ample room for improvement in both customer satisfaction and retention. Hence, the opportunity to gain market share exists not only for national issuers but for regional issuers as well.

The value propositions that resonate with transvolvers vary during the customer life cycle. Winning in the customer acquisition stage requires offering the right interest rate (particularly the promotional rate), providing a sign-on reward, and effectively leveraging multiple channels. Issuers that are excelling with transvolvers are successfully originating credit-card customers both in branches and online.

The next hurdle with transvolvers is to achieve “first in wallet” status, which typically depends on the robustness of the reward offering. Indeed, although these customers tend to apply for a card primarily on the basis of the interest rate, the decision on how often to use the card depends on the rewards. So-called headline rewards (such as 5 percent cash rebates on fuel purchases) have proved to be more powerful than complex, staggered rewards, and tend to influence card use across merchant categories.

Yet despite the importance of customer retention to portfolio profitability, many issuers underperform, creating significant opportunity for differentiation. Retention, moreover, generally requires simply treating the customer fairly. This translates into, for example, forgiving the first late payment or offering cardholders a free FICO credit score. Best-practice issuers have implemented so-called win-back programs to reduce attrition.

Pursuing Cobranding Deals. For issuers seeking to diversify their portfolios and boost growth, cobranding and partnership deals can be a profitable strategy. At least five significant deals among major players in North America will be up for renegotiation in the next two years. In addition, there are an increasing number of examples of dual- and triple-issuance portfolios. But competition is stiff, and issuers must be increasingly innovative in their partnership structures by focusing on select segments, investing in key capabilities, and excelling in execution. Overall, they must thoroughly understand their partners’ economics and objectives and undertake rigorous due diligence during the request-for-proposal process.

At the same time, it is worth noting that partnership structures and capability requirements are changing, owing to several factors. First, economic terms are starting to hit the limits of the interchange ceiling. As a result, issuers and partners are beginning to explore more innovative accords (such as the issuer being compensated on a profit-sharing model). Second, partners are expecting more from issuers in terms of driving market-share shifts and generating value. Some issuers are integrating other service offerings into the partnership and leveraging their own data to identify revenue generation ideas and opportunities. Lastly, some issuers are pitching advanced operating capabilities such as new forms of customer servicing and innovative methods of fulfillment.

In our experience, issuers that excel in cobranding arrangements outperform in six dimensions: organization, people and culture, process management, technology, regulatory compliance, and the ability to focus on a specific industry vertical. Leaders in cobranding firmly believe that a vertical focus builds a track record, expertise, and, ultimately, scale. They recognize that the partnership skill set is different from that of their own branded business, requiring a particularly strong retailing and operational mindset. Moreover, they understand that the partnership business deserves as important a seat at the table as their own branded business, and they dedicate sufficient functional resources, especially IT. The person responsible for partnerships is empowered to negotiate with partners in real time and to marshal the necessary enterprise resources to get things done.

Partnership deals also need to include frequent peer-to-peer interactions, cross-functional teams, and quarterly (or more frequent) sessions among senior leaders at both entities to review strategy and performance, ensure alignment on objectives, assess regulatory compliance, and agree on the best path forward.

Ultimately, with $100 billion in retail-payments revenue growth to capture over the next ten years in North America, banks need to act strategically and decisively. Yet competition will be increasingly intense. Differentiation is paramount, with regard not only to other banks but also to technology companies.

RDEs: Thriving in a High-Speed World

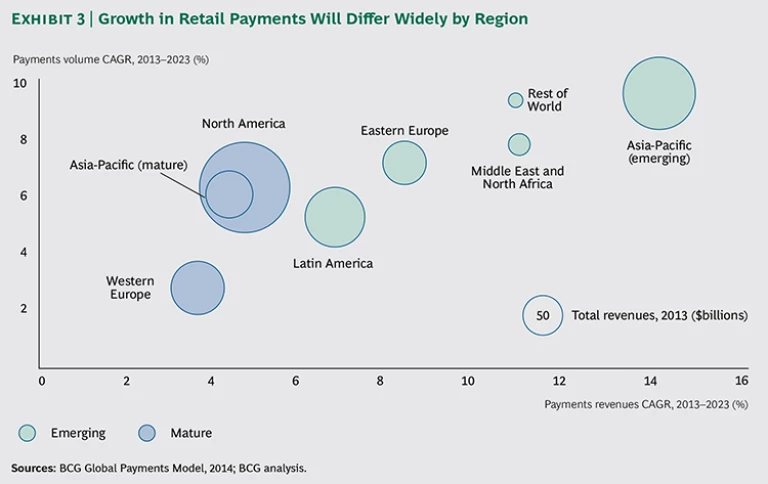

The payments industry in RDEs continues to be characterized by strong growth. The primary drivers are relatively young populations, generally favorable macroeconomic conditions, and low banking penetration—in stark contrast to the developed payments markets with their low macroeconomic growth and near-universal banking penetration. Indeed, a two-speed payments world is emerging, as evidenced by divergent growth in volume and revenues. (See Exhibit 3.)

Yet despite the high-growth environment and the fact that the payments business is still very profitable in most RDEs—featuring substantial margins for acquirers, issuers, and card schemes—the outlook is not all blue skies. Prospects for incumbent players are clouded by falling interest rates, declining merchant discount rates and interchange (in response to regulatory pressure), and the emergence of new competitors. Banks must also find ways to motivate customers to use their noncash payments products and digital banking services. (See “Taking Action on Customer Engagement.”)

Taking Action on Customer Engagement

Despite the overall positive outlook in RDEs, banks are facing profitability pressures. Tighter regulation, rising customer expectations, and intensifying competition levels are narrowing margins significantly. At the same time, large portions of private assets are still held in cash, with a high volume of transactions executed outside formal banking systems.

One way that banks and other payment institutions can fight back is by redoubling their efforts to increase customer engagement, achieved by motivating customers to direct-deposit their paychecks and to routinely use the bank’s noncash payments products, especially cards. In so doing, a bank can become firmly established as the customer’s primary bank. Statistics from many RDEs show that engaged customers generate two to three times the revenue of “nonengaged” ones, and are also more loyal.

In our experience, a thorough approach to increasing customer engagement involves four elements: segmentation, value proposition, channels, and stimulation.

Segmentation. Banks must first make an effort to fully understand customers’ concerns about noncash transactions. They must then segment and prioritize the customer base in order to approach those with the highest engagement potential. A leading bank in Turkey, for example, realized that many customers did not apply for loans for fear of an in-person rejection. The bank introduced a way to request a loan through a text message, and responded only if the loan was approved (with rejections not actively communicated). The bank received 300,000 loan requests in the days following the launch.

Value Proposition. Banks need to establish more robust value propositions. Features should include increased conveniences—such as 24/7 transaction capability and remote functionality—as well as lower fees, loyalty programs, and cash-back offers.

Channels. Banks must also ensure that the required channel infrastructure (such as ATMs, transaction and acceptance terminals, Internet access, and mobile networks) is widely available and sufficiently functional to execute the most common transactions. For example, a South American bank developed a network focused on low-income regions in order to enable financial inclusion of these customer segments. Terminals for essential services such as withdrawals, deposits, and transfers were installed at partner institutions such as grocery stores and other merchants. The growth of the network was so rapid that within a few years the number of terminals surpassed the total number of ATMs in the bank’s home country. The bank ultimately acquired 30 percent of the country’s population as customers.

Stimulation. Banks need to foster customer awareness of the advantages of their services and create a sense of trust and comfort in using them. A Malaysian bank introduced an all-in-one product bundle aimed at mass-market clients. The bundle is easy to sell and consists of basic transaction functionality (an account, a card, and remote banking), along with easy-to-activate optional product components (including several types of preapproved loans and goal-based savings and insurance products). Since all products are available immediately after the account is opened, the bank has doubled customer engagement and has been able to serve its mass-market customers more profitably.

Ultimately, there are ample growth opportunities for payments players of all varieties in RDEs. In order to thrive, however, these players must successfully navigate a landscape characterized by significant change. Two major themes are shaping the future of retail payments in RDEs: the battle against cash, and growing digitization.

The Battle Against Cash

Unlike developed markets, cash payments still dominate in RDEs. And although there is a clear correlation between a country’s level of economic development and its level of card penetration, some RDEs stand out for their high penetration rates. In general, penetration rates can be explained mainly by the roles of governments, issuers, and acquirers, but also by the roles of nonbank payments providers and local card schemes.

Governments. By promoting the development of a sturdy payments infrastructure and generating proper incentives, some governments have been supporting the advancement of electronic payment methods. Examples include the following:

- Turkey has introduced regulatory changes to promote credit-card payments, including establishing a credit bureau, restructuring credit-card debt to make terms easier for cardholders, and enabling remote sales of credit cards outside bank branches through alternative channels. Oversight legislation introduced in 2005 has provided a solid regulatory base, and the switch to cards equipped with microchips has fostered trust in the system.

- The United Arab Emirates has implemented a program aimed at achieving a cashless economy. Its features include the mandatory use of payroll cards for wages, the establishment of an electronic payment gateway for government payments, a national automated clearinghouse, and higher levels of card acceptance by taxis and fuel merchants.

- Mexico has passed legislation that promotes the development of correspondent banks, eases requirements for opening new bank accounts, and increases tax benefits both for banks that support point-of-sale installations and for consumers that make electronic payments.

- India, in a document published by its central bank, has stated its vision of proactively encouraging electronic-payment systems. In its regulatory policies, India intends to drive financial inclusion among the unbanked, cut debit-card merchant discount rates, and narrow the window of check validity from six months to three months. ACH (Automated Clearing House) and GIRO (General Interbank Recurring Order) initiatives have already been put in place, as well as 24/7 IMPS (Immediate Payment Service) capability, which has been extended to multiple channels. India is also urging nonbank players to participate in the payments network.

Issuers and Acquirers. Issuers and acquirers naturally play a key role in promoting the penetration of noncash payments. Some incumbent players are taking forceful action in the battle against cash by leveraging new technologies to increase card acceptance, introducing low-cost debit cards or alternative local schemes, developing correspondent-banking models, or simply educating their customers. In Russia, for example, a leading bank has made a significant investment in hiring branch-based greeters whose principal function is to educate customers on how to make noncash payments.

As for prepaid cards, their usage is still small. But these cards have the potential to play a larger role in the growth of electronic payments in the future. Prepaid cards are appealing both for unbanked consumers and for banked consumers who prefer not to have to worry about paying a credit card bill or possibly incurring card debt. Moreover, cobranded prepaid cards enjoy virtually universal acceptance, are safer and more convenient than cash, and are easily obtainable. Prepaid cards currently account for less than 1 percent of total payments in RDEs, but they are expected to grow by 16 percent per year through 2023. They are increasingly being used to make benefits payments to unbanked individuals, such as in Turkey where citizens now receive their welfare funds on a prepaid MasterCard.

Of course, increasing card penetration requires attractive economics for issuers, acquirers, and merchants. We have witnessed penetration growth in some countries (such as Argentina and Brazil) in which the economics provide incentives both for acquirers to underwrite merchants and for issuers to promote card usage through rewards and other benefits.

Nonbank Payments Providers. Nonbank institutions such as retailers and telecommunications concerns are playing a leading role in promoting financial inclusion. A well-known example is M-Pesa, a mobile-phone-based service launched in Kenya in 2007 that enables money remittances to be sent with a couple of taps on a handset. People can also make digital payments in shops that have M-Pesa representatives—a growing force that rose by 40 percent in 2013 to more than 65,000 agents. More than two-thirds of Kenya’s adult population currently subscribe, and a quarter of the country’s payments flow through this mobile-money service.

The Evolution of Local Card Schemes. National card schemes have continued to grow and evolve. Their lighter cost structures have also helped promote card penetration among lower-income consumers. For example, China UnionPay, the first large-scale national scheme, is dominant in China and accounts for 11 percent of domestic payments. Other countries have followed suit, including India with RuPay and Brazil with Elo. Elo, launched by a consortium of financial institutions, is aimed largely at increasing card penetration in underbanked segments of the population and thereby driving card usage. With roughly 50 million cards in circulation, Elo is growing rapidly and targeting a 15 percent market share by 2016.

The key challenges to success for local schemes are securing broad acceptance both locally and internationally, particularly among merchants and in ATMs, and generating incentives among banks to issue their cards.

Growing Digitization

RDEs are characterized by rapidly increasing mobile and 3G phone penetration, as well as by ever-expanding Internet access. These trends are fueling strong online growth. Indeed, China has already replaced the United States as the world’s largest

These dynamics and the higher volume of transactions that they promise are creating attractive new opportunities for the payments industry. But there are also challenges for incumbent institutions, particularly in terms of intensified competition from emerging players that are pursuing a share of new revenue pools. In China, Alipay, which processes payments on the huge Alibaba e-commerce platform, provides value-added offers to online merchants, a service it can use as a strategic perch to expand beyond e-commerce into other areas of financial services.

Some incumbent banks and acquirers in RDEs are still in a relatively early stage of building their digital capabilities, although others are already among the most innovative. Those that have advanced have been able to afford investing in digital capabilities or have developed partnership models. Finally, bank utilities that enable a group of institutions to share platforms and resources can play a role in capturing the digital opportunity by lowering entry costs for all participants and generating network effects.

Acknowledgments

The authors would particularly like to thank Mohammed Badi, Alexander Drummond, Jennifer Glaspie, Simon Lindenmann, Max Hauser, Maarten Peeters, Achim Seyr, and Michael Urban, whose contributions were invaluable to the conception and development of this report. In addition, the authors are extremely grateful to Alex Behaeghe, Jürgen Eckel, Christoph Militzer, and Jan Speelman, who were vital members of the team that developed the BCG Global Payments Model. Grateful thanks also go to the following BCG colleagues: Ashwin Adarkar, Andrés Anavi, Lionel Aré, Brent Beardsley, Jorge Becerra, Jeanne Bickford, David Bronstein, Tijsbert Creemers, Laurent Desmangles, John Garabedian, Deepak Goyal, Brad Henderson, Monish Kumar, Flavio Magalhaes, Hans Montgomery, Cagri Ogan, Rebecca Ott-Wadhawan, Neil Pardasani, Pedro Pereira, Bharat Poddar, Max Pulido, Sukand Ramachandran, Aymen Saleh, Niclas Storz, Burak Tansan, Steve Thogmartin, Andrew Toma, Jody Visser, Rahul Wadhawan, Ian Walsh, and André Xavier.

The authors are also deeply thankful to Javier Pérez-Tasso, Luc Meurant, Wim Raymaekers, and Laurent Mertens from SWIFT.

Finally, we thank Philip Crawford for his editorial direction, as well as other members of the editorial and production teams, including Katherine Andrews, Gary Callahan, Angela DiBattista, Kim Friedman, Abby Garland, Sara Strassenreiter, and Janice Willett.