For marketers around the world, word of mouth matters. For marketers in India, word of mouth matters a lot.

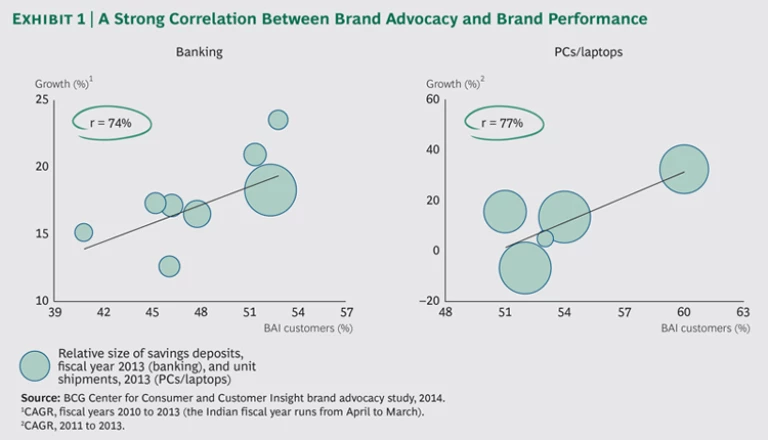

New research by The Boston Consulting Group’s Center for Consumer and Customer Insight shows a strong correlation between BCG’s Brand Advocacy Index (BAI), which measures the drivers of product recommendation, and brand performance across multiple product categories in India. Marketers have long known that word-of-mouth advocacy is important, but they have struggled to show the linkage between advocacy and sales. BAI provides a metric that demonstrates just how critical advocacy can be.

In India as elsewhere, brands with high levels of advocacy significantly outperform those that lack advocates or encounter consumer criticism. (See Exhibit 1.) Marketers that tap into this powerful phenomenon—by determining who recommends a brand and who does not and identifying the most and least successful tactics for improving advocacy—have a formidable tool for driving growth.

Advocacy comes in many forms and takes place among all kinds of people in countless daily situations. A boss asks a junior colleague, a well-known auto buff, for his take on a car that the boss is thinking to buy. Women at “kitty party” get-togethers compare notes on shopping and where to find the best deals. Parents exchange opinions about products for their children. The owner of a new phone shows off its features to a friend or co-worker. For Indian consumers, the opinions of friends and family are by far the most important information resource, far outweighing others. For example, in BCG surveys, 57 percent of auto buyers cited friends and family as a source of information in their purchase decision process, compared with only 35 percent who mentioned dealers. Similarly, for mobile handsets, up to 92 percent of consumers said they consulted with friends and family before making a purchase.

Because of the personal nature of such exchanges, however, companies have struggled to measure brand advocacy in the marketplace, to demonstrate its top-line impact, and to develop tactics that promote word-of-mouth recommendation. To address these gaps, BCG created BAI, a strategic metric that measures advocacy with much greater precision than existing approaches. BAI shows a strong correlation with top-line growth and helps identify concrete actions for improving advocacy. (See Fueling Growth Through Word of Mouth: Introducing the Brand Advocacy Index , BCG Focus, December 2013.)

In 2014, BCG surveyed 13,000 consumers in India to understand their advocacy behavior across more than 100 brands in 16 categories. The results show that Indian consumers are much more active advocates than people in many other countries, including the U.S., the UK, France, Germany, and Spain. For example, Indians are more than three times more likely to recommend a bank than consumers in those other countries. They are more than twice as like-ly to offer an opinion about a mobile operator or where to buy groceries. More important, our research demonstrates how extensive word-of-mouth promotion is in numerous product categories. More than half of Indian consumers make brand and product recommendations in such major categories as food and groceries, computers, several financial services (insurance, savings accounts, credit cards, and home loans), mobile phones, and cars.

Different Categories, Different Advocates, Different Drivers

The nature of advocacy varies across categories and among brands. Part of the power of BAI is that it helps companies in any industry understand the segments, regions, and populations in which their brand is weak or strong—and why. Rather than just leaving brand perception to chance, companies can use these insights to assist them in developing a brand strategy that proactively influences how they are perceived in the marketplace. Ultimately, BCG’s approach to measuring advocacy offers insights that can help companies better deploy their resources. BAI can also help brands pinpoint the identities and motivations of often over-looked advocates, uncovering the relative influence of both customers and noncustomers in driving recommendations, as well as the rational and emotional factors that motivate each group to recommend a brand. Companies can determine who recommends a brand and who does not, helping them identify the most and least successful tactics for improving advocacy.

Identify the advocates. Identifying the right advocates requires rethinking consumer segmentation—on the basis not of consumption but of influence. For example, consumer advocacy is significantly greater among higher-income segments. While Indian consumers on average recommend 30 percent of the brands they are aware of, “affluents” (those with incomes greater than $18,500 a year) on average recommend 40 percent of the brands they are aware of, and “aspirers” (incomes of $7,500 to $18,400 a year) recommend 32

Deeper engagement leads to greater advocacy. Consumers who have been engaged with a brand for a longer period understand the brand better and tend to advocate for it more. At the same time, some categories—mobile phones and televisions are two examples—have a higher “recency effect,” meaning that recent customers are more likely to recommend a brand.

Two questions for marketers to ask are: Who are the people who have the greatest influence on my target consumer segment? And how can I find subsegments among them that constitute a community—a group of people with shared interests or activities? Communities based on shared passions develop strong emotional engagement among their members, making word of mouth fly. BCG and third-party research has found that reaching the right 2 percent of advocates—the organizers of kitty parties, for example—opens the door to 90 percent of a community (the attendees). Following the 2 percent rule keeps companies’ efforts focused on the individuals who matter, making these efforts cost effective.

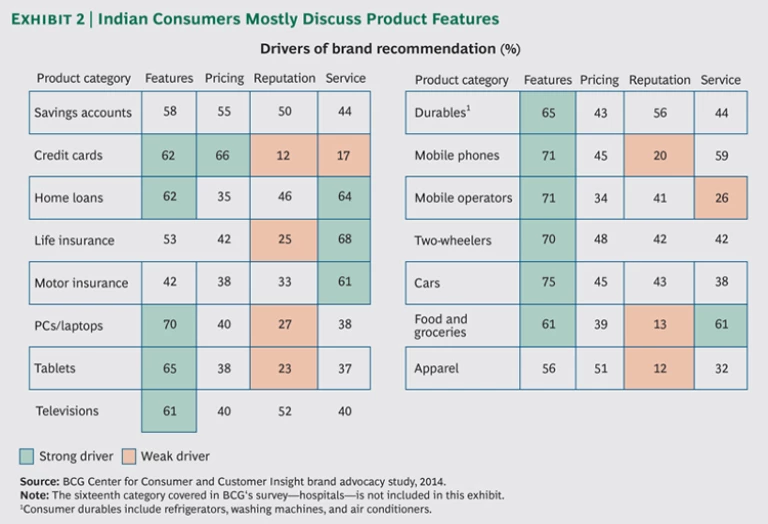

Pinpoint the drivers. BAI reveals what really motivates people to advocate for a brand. The metric uncovers the most relevant factors driving advocacy in a category, as well as the brand’s performance vis-à-vis each of them. In India, the drivers of advocacy can be quite different than elsewhere. For example, while the top two global drivers of bank recommendations are customer service and online experience, in India, trust and reliability and value for money are the most important drivers.

Our assessment of the relative importance of multiple drivers in the 16 product categories addressed in our research uncov-ered some surprising results. While value for money has always been important to Indian consumers, it is not what they talk about with one another. Whether it is the network coverage of mobile operators, the technical features and design of mobile handsets, or the assortment, fit, and quality of apparel, the particular attributes of the product or service are the most impor-tant factors driving advocacy. In financial services, this means attributes such as good customer service and quick application processing. In four categories—home loans, mobile operators, televisions, and consumer durables—brand reputation beats out price in driving advocacy. (See Exhibit 2.)

Uncover overlooked sources of influence. Although customers’ advocacy is critical, in some industries and for some brands, noncustomers’ recommendations or criticisms can also be an important contributor to top-line growth or decline. We have learned that companies may have a blind spot when they measure word-of-mouth recommendations strictly on the basis of what customers say. Noncustomers can be particularly influential in certain industries, such as those in which purchases are infrequent or actual buying customers are small in number. The luxury-automobile industry is one example: even though relatively few people own luxury cars, a large number of people share their opinions about the leading brands. In other industries, such as those with high levels of churn, the noncustomer population may include many former customers, giving their criticisms extra credibility.

Using Brand Advocacy to Drive Growth

In determining how best to employ brand advocacy, marketers can start by asking themselves the following questions about their goals:

- Are we a market leader wanting to keep potential competitors at bay?

- Are we attempting to dislodge the market leader or alter the relative importance of category drivers?

- Are we trying to increase the adoption of a new-to-market product and therefore need to break through prevailing myths about a particular innovation or innovations?

- Are we trying to increase usage of our product by expanding use cases and new occasions for use? Does this require overcoming deep-seated barriers to consumption?

- Are we trying to enter a new market or tap a new consumer segment?

- Are our products suffering from inaccurate brand associations or perceptions? Do we want to reposition our brand with consumers?

- Are we looking for a way to influence consumers that is cost effective and measurable?

If the answer to any of these questions is yes, a systematic plan to activate advocacy is imperative. With increasing media costs and clutter—Nielsen estimates that up to 30 percent of the $5 billion that Indian marketers spend each year is squandered—as well as intense competition at the retail point of sale, consumers are more confused than ever. They are looking to trusted sources for guidance and direction. For a strong brand, advocacy can help keep the competition at bay. For a weak or new brand, advocacy is the most cost-effective way to help a product break out by establishing a reason for consumers to buy.

Activating advocacy is not easy. The levers vary by category, consumer segment, and brand. Identifying the right advocates and defining the right messages are key to an effective advocacy program. People talk about brands when the experience is powerful or when it disrupts their conventional thinking. Sometimes this is a matter of finding the right messages on the basis of deep consumer insights that identify the patterns that the targets expect to see and discovering ways to disrupt that pattern. In other cases, there may be a need for more comprehensive action, including rethinking product design, service delivery, pricing, and the consumer value proposition.

Finding the best way to reach advocates is no simple matter, either. Communities have places where members meet and discuss their interests—in the real world and, more and more, in the digital universe. Being present in these community “temples” enables a three-way dynamic, with the brand listening to what the community is saying, the brand sharing its message with community members, and discussion with-in the community keeping the temple thriving. As in other countries, in India this is increasingly a digital phenomenon. But while many companies are setting up their Facebook pages and ramping up their websites, it pays to remember that the bulk of word of mouth in India still occurs in offline meeting places.

There is immense value in building brand associations and imagery through traditional media, point of sale, and other marketing disciplines. Given the one-to-one nature of advocacy and the need to rely on people’s interactions within the community, it takes time to build critical mass; brand advocacy is rarely a quick fix. That said, advocacy programs engage consumers and drive performance in ways that other initiatives cannot. In India, especially, companies looking to establish momentum for weaker brands or build sustainable competitive advantage for stronger ones need to, determine the advocacy dynamics for their brands and unleash the potential for sales promotion that only word of mouth can provide.