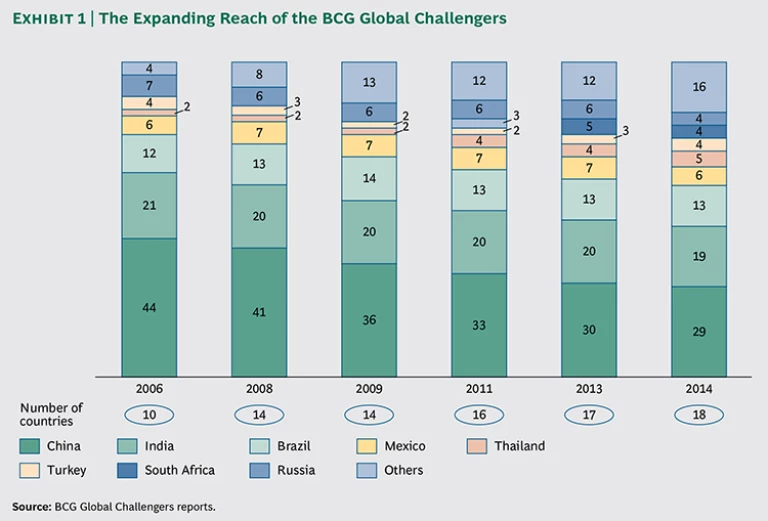

Each list of global challengers is more diverse than the prior one. With the addition of the Philippines this year, headquarters for the 2014 BCG global challengers can be found in 18 countries, nearly double the ten countries represented in the inaugural 2006 list. (See Exhibit 1 and Exhibit 2.)

2014 BCG Global Challengers

In that first list, China and India supplied nearly two-thirds of the challengers. In 2014, the number of Chinese and Indian challengers has fallen below 50 percent for the first time. Smaller countries are picking up the slack. Thailand (five challengers), Turkey (four), and Chile (three) are at all-time highs. (See “Methodology for Selecting the 2014 BCG Global Challengers.”)

Methodology for Selecting the 2014 BCG Global Challengers

We began our analysis by compiling a list of potential global challengers based in emerging markets, focusing on companies located in developing Africa, Asia, Central and Eastern Europe, the Commonwealth of Independent States, Latin America, and the Middle East.

Our initial master list of potential global challengers was drawn from local rankings of the top companies in the markets listed above. As in previous years, we excluded joint ventures and companies with significant overseas equity holders but included state-owned companies that compete internationally. A few of the global challengers and graduates are headquartered in global financial or commercial centers, but their operations take place primarily in rapidly developing economies. We have listed these companies in the markets that house most of their operations.

Next, we applied a set of quantitative and qualitative criteria. Companies needed to have annual revenues of at least $1 billion—a threshold that ensures they have the resources to go global. We sought companies in which overseas revenues totaled either 10 percent of total revenue or $500 million. In export-oriented industries, such as mining, oil, and gas, we also required that companies possess overseas assets of at least 10 percent of total assets or $500 million. We made a few exceptions when we strongly believed that companies would meet these thresholds in the next two years. A final set of quantitative measures were related to growth and performance.

We sought companies with credible aspirations to build truly global footprints, excluding those that could pursue only export-driven models. Accordingly, we analyzed each company’s international presence, the number and size of its international investments, M&A activity over the past five years, and the strength of its business model. We also compared the size of each company with the size of other challengers and multinational competitors in its industry.

We based our final selection on these criteria as well as feedback from industry experts around the world.

In identifying graduates, we looked for top global competitors in an industry that reported foreign sales of at least 60 percent of total revenue. Graduates also needed to demonstrate a commitment to maintaining a global footprint.

Global challengers are growing more quickly than are comparable companies. From 2000 through 2013, the revenues of global challengers grew by an annual rate of 18 percent, on average, compared with 7 percent for global peers and 6 percent for the nonfinancial S&P 500.

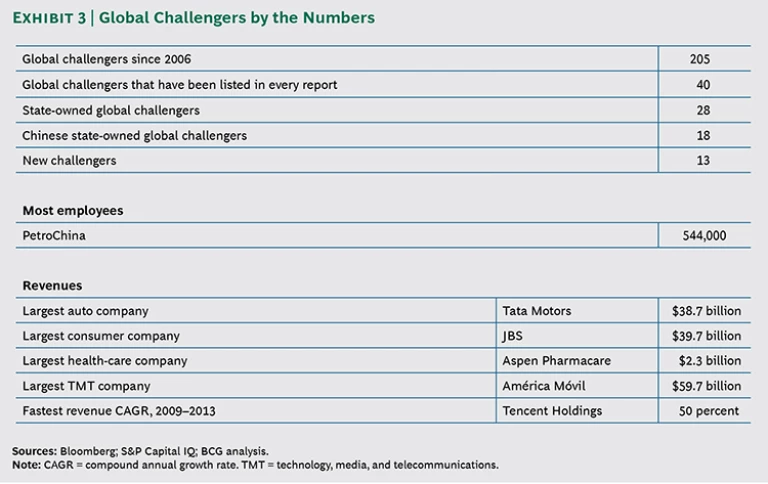

Job growth has been equally impressive. From 2008 through 2013, the 2014 BCG global challengers increased their employment by 32 percent, compared with 11 percent for the nonfinancial S&P 500. Even more striking, the average revenue per employee of the global challengers exceeds that of the nonfinancial S&P 500 companies—$479,000 compared with $440,000. (For other statistics about the global challengers, see Exhibit 3.)

The Newest Members

Each global challenger report provides an opportunity to welcome new members and applaud the graduates. The 13 newcomers in 2014 are grouped by three themes that help describe the reasons for their entry to the list. A fourth theme—growing through acquisitions—cuts across the groupings and applies to several companies from several industries.

Capturing Middle-Class Consumers. As the world becomes increasingly middle class, global challengers are emerging to serve these new consumers. From 2009 to 2020, the size of the global middle class will expand from 1.8 billion to 3.2 billion, and nearly all of the new members will live in emerging markets. By 2020, the number of middle-class people will exceed the number of poor people. The following are the new global challengers that are best serving this massive middle class:

- Concha y Toro (Chile). The first luxury-goods company to become a global challenger, Concha y Toro is the largest Latin American wine producer and the seventh largest in the world. The company, with $950 million in sales, has vineyards in Argentina, Chile, and the U.S. It is one of the few winemakers trying to create a global brand, as evidenced by its sponsorship of the Manchester United Football Club. Despite flat wine consumption globally, Concha y Toro increased revenues by 5 percent annually from 2011 through 2013. Exports, which account for 68 percent of revenue, are growing even faster. Global wine consumption is increasing in the U.S., where Concha y Toro bought Fetzer Vineyards in 2011, and in China.

- Jollibee Foods (Philippines). Jollibee is the first restaurant chain to qualify as a global challenger. The company, which started in 1975 as an ice-cream stand, moved into burgers and Filipino fast foods a few years later. Jollibee has since expanded to more than 2,000 locations through internal growth and domestic and foreign acquisitions, such as Mang Inasal, a U.S. barbecue chicken chain. Jollibee also has operations in Brunei, China, Indonesia, and Taiwan. In 2013, its 500 overseas restaurants generated nearly one-quarter of the company’s $1.8 billion in revenues, which have increased by 12 percent annually from 2011 through 2013.

- Thai Beverage (Thailand). With $4.8 billion in sales in 2013, Thai Beverage is Thailand’s largest beverage producer. Known for its rum, whiskey, and beer, the company has six overseas distilleries. Although international sales make up only about 3 percent of revenues, the company expects one-half of future growth to come from overseas. Charoen Sirivadhanabhakdi, Thai Beverage’s chairman and one of the wealthiest Thais, acquired control of Fraser and Neave, a Singapore beverage and real estate conglomerate, in a 2013 deal that valued the expanded company at $11 billion. The acquisition creates a new beverage leader in Southeast Asia, with a strong platform to expand further.

- Yildiz Holding (Turkey). As Turkey’s largest packaged-food company, Yildiz Holding has long been well known in Africa, Central and Eastern Europe, and the Middle East. It broke onto the global stage in 2007 when it acquired Godiva, a premium chocolatier with 600 outlets in Asia, Canada, Europe, and the U.S. Within Turkey, its Ülker subsidiary controls nearly half of the nation’s biscuit and chocolate markets. Yildiz sold a 20 percent stake in Ülker in late 2013 for $431 million—one of the nation’s largest recent stock offerings. In 2013, the company generated revenues of $8.2 billion. International sales accounted for about 20 percent of total revenue.

Meeting Digital Needs. Many companies in emerging markets have been rapidly developing innovative and advanced digital services, helping consumers improve their lives and companies strengthen their capabilities. Two new challengers are taking advantage of these trends:

- Etisalat (United Arab Emirates). The largest telecommunications operator in the Middle East returns as a global challenger after sluggish revenue growth kept it off the last list. The company operates in 19 countries in the Middle East, Asia, and Africa, including Nigeria, that continent’s largest economy. Etisalat expanded its African footprint in May when it acquired a controlling stake in Maroc Telecom from Vivendi. The acquisition helped boost second-quarter profits by 27 percent.

- Tencent Holdings (China). Tencent, one of the three most valuable Internet companies in the world ranked by market capitalization, is the first global challenger whose roots are wholly online. Tencent recently began expanding overseas and is already generating 7 percent of its revenues outside of China. Of the 600 million users of its WeChat social-messaging service, 100 million are located outside China. The company is investing heavily overseas in gaming, a business that now generates more than half its revenues. For example, Tencent now owns Riot Games, the studio that created the popular League of Legends video game. The company generated $9.8 billion in revenues in 2013 and recorded 46 percent annual revenue growth from 2011 through 2013.

Building and Supplying the World. Seven of the newcomers belong to the industrial-goods and resources sectors from which global challengers have traditionally come. But their success is increasingly driven by innovation rather than low costs.

- Apollo Tyres (India). India’s largest tire manufacturer has been growing rapidly overseas, especially in Europe. Apollo Tyres opened a global R&D center in the Netherlands in 2013 and is adding plant capacity to produce 6.2 million car and truck tires in addition to the 6.5 million tires it currently produces in Europe. In 2014, the company generated $2.7 billion in revenues—37 percent of which came from overseas. Revenues grew by 12 percent annually from fiscal 2010 through 2014.

- China Railway Construction Corporation (China). China’s largest engineering contractor has ambitions to generate 30 percent of revenues overseas by 2020, compared with 4 percent in 2013. In addition to rail construction, the company also works on highways, airports, ports, industrial plants, and municipal projects. It has completed or is working on major projects in Italy, Libya, and Saudi Arabia. The company generated $95 billion in revenues in 2013 and grew by 16 percent annually from 2011 through 2013. China Railway Construction Corporation has nearly 250,000 employees.

- Emirates Global Aluminium (United Arab Emirates). The fifth-largest aluminum company is the product of a merger completed earlier this year between Dubai Aluminium and Emirates Aluminium, two state-owned enterprises. In 2012, the last year for which data is available, the companies collectively generated $4.3 billion in revenues. The new company expects to generate $6.6 billion in 2015 by taking advantage of the Middle East’s strategic location for serving global markets. It will also benefit from operating at full capacity, since demand is high for its value-added specialty products. The company has customers in nearly 70 countries.

- EuroChem Mineral and Chemical (Russia). A top-ten fertilizer producer today, EuroChem aims to break into the top five and go public in the next few years. Its business model is built around vertical integration, pulling raw materials out of the ground and producing and distributing final products. EuroChem announced plans in 2013 to build a $1.5 billion fertilizer plant in the U.S. and form a joint venture with Migao, a specialty fertilizer producer based in China. Foreign sales accounted for more than 80 percent of EuroChem’s $5.5 billion in revenues in 2013, and revenues grew by 24 percent from 2011 through 2013.

- Fuyao Glass Industry Group (China). Fuyao, the largest maker of auto glass in China and the fourth largest globally, is opening a plant in Russia this year and recently bought part of a former General Motors plant in the U.S. In 2013, one-third of Fuyao’s $1.8 billion in revenues came from overseas. From 2011 through 2013, revenues grew by 21 percent annually.

- China Shenhua Energy (China). The world’s largest coal producer is rapidly expanding its overseas presence. In 2013, it entered into a $2 billion agreement with Russian coal operator En+ Group and the China Development Bank to build coal mines and transportation infrastructure in Siberia and the Far East. It has also entered into a joint venture with Energy Corporation of America to develop shale gas. China Shenhua Energy earned $46 billion in revenues in 2013 and grew by 19 percent annually from 2011 through 2013.

- UPL (India). UPL, which sells seeds and a full range of insecticides and other crop-protection products, is the third-largest agrochemical company in the world. Most of its 23 manufacturing plants are located outside of India, and 81 percent of its $1.5 billion in 2013 revenues were generated overseas. From 2011 through 2013, revenues grew by 19 percent annually. UPL is seeking to transition from selling generic products to selling branded products by investing in R&D.

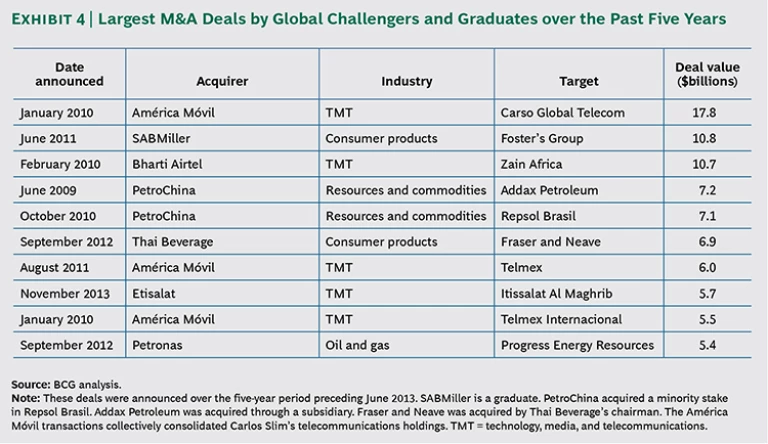

Growing Through Acquisitions. Many of the new challengers have achieved growth, market share, and momentum through acquisitions. (See Exhibit 4.) Jollibee is a strong example. In 2004, the company bought Yonghe King, a noodle, rice, and dim sum chain that has about 80 outlets. Today, Yonghe King has 314 restaurants in China. Jollibee followed up by buying Hong Zhuang Yuan, which serves congee, in 2008, and San Ping Wang, a noodle restaurant, in 2012. Today, China is Jollibee’s largest foreign market.

Other new challengers have also been busy. Tencent has made more than 100 overseas acquisitions in the past two years as part of its globalization push. UPL has acquired 14 companies in the past ten years, primarily in the U.S. and Europe. Yildiz has expanded into new markets and new categories.

The Graduates

Five former global challengers graduated from the list because they became leaders in their respective industries. Before this report, a total of seven challengers had graduated, so 2014 represents a big coming out on the world stage for emerging markets. When selecting graduates, we followed broad guidelines about financial performance and overseas footprint. But we also looked qualitatively at companies that have successfully developed talent, innovation, and other initiatives that are core to our C2L program. This year’s graduates include the following companies:

- Lenovo Group (China). Lenovo has done a particularly impressive job of achieving global leadership. Through organic growth and acquisitions in Brazil, Germany, and Japan, Lenovo has become the world’s largest PC maker. Its corporate brand and product brands, such as ThinkPad, are recognized globally. It has operated dual headquarters in the U.S. and China for nearly a decade. And in early 2014, Lenovo embarked upon another major diversification effort, acquiring a portion of IBM’s server business and acquiring Motorola Mobility from Google—a move that will give it stronger access to the global smartphone market.

- Grupo Bimbo (Mexico). In May 2014, Grupo Bimbo, the largest baker in the world, completed its acquisition of Canada Bread for $1.8 billion. Before the acquisition, Grupo Bimbo employed 123,000 people, operated 144 plants, and had 52,000 routes. In 2013, 60 percent of Grupo Bimbo’s $14 billion in revenues originated outside of Mexico. The U.S. is now a larger market for the company than Mexico is, thanks to the company’s acquisition of Weston Foods and Sara Lee’s bakery operations in 2009 and 2011, respectively. The company also owns such well-known U.S. brands as Entenmann’s and Thomas’. In July, it agreed to acquire Ecuadorian baker Supán.

- Huawei Technologies (China). The largest telecom-equipment maker in the world, Huawei reported nearly $40 billion in revenues in 2013 and 16 percent annual growth since 2009. Two-thirds of revenues come from overseas, with plants in Africa, Europe, and Russia. Huawei is also the third-largest maker of smartphones, after Apple and Samsung Group.

- Li & Fung (China). This $20 billion trading company manages supply chains for buyers of clothes, toys, and other merchandise sourced globally. Despite rising competition and rapidly changing market conditions, Li & Fung grew at an annual rate of 12 percent from 2009 through 2013. The company operates in more than 60 countries and works with more than 15,000 suppliers. An early adopter of the Internet and digital technologies, it is able to rapidly shift sourcing and supply resources to meet demand and lower costs. It has also integrated several acquisitions in recent years, including suppliers to JC Penney, Macy’s, Sears, and Target.

- Tata Steel (India). Tata Steel is a top-ten global steel producer with operations in more countries than all but one other competitor. More than 70 percent of Tata Steel’s revenues come from outside of India. The company generated more than $27 billion in sales in fiscal 2014 and employed about 80,000 people in 26 countries. Over the past decade, Tata Steel has integrated several acquisitions, including the UK’s Corus in 2007, Thailand’s Millennium Steel in 2006, and Singapore’s NatSteel Asia in 2005.