One thing is certain about telcos: they know how to hit a curveball. As the market unloaded on them—with declining revenues, increasing competition, and consumers demanding less expensive products—telcos sized up what they were facing and adjusted their stance. With little money for investment, they focused on cost reduction by aggressively—and successfully—lowering their IT expenses. That took some of the pressure off and helped move the business forward.

The 2013 survey of telco industry participants—conducted annually by BCG and ETIS, a membership-based organization that seeks to help telcos improve their business performance through shared discussion of IT practices—shows that telcos are again adjusting their stance with positive results. The survey of IT performance of European operators finds spending up for the first time in years. But more important, telcos are handling this sudden largesse in a way that wisely accounts for the realities—and risks—of the current market. Although conditions are starting to improve and promising signs are emerging, margins and average revenue per user are still down for many telcos. It makes sense that operators are not simply spending on IT but also focusing that spending on areas most relevant to creating innovative products and enhanced customer relationships.

Indeed, there is good reason for telcos to be prioritizing investments that can drive differentiation. Survey results confirmed that the business environment remains less than ideal—sometimes far less—for many European telecommunications companies. Survey participants in mature markets saw their revenues continue to deteriorate—dropping by 3.8 percent, on average, from the previous year. Also continuing downward were average revenue per user (down 2.8 percent) and EBITDA (down 9.6 percent). Participants in emerging markets fared better: revenues climbed 4.1 percent on average, revenue per user rose 1.6 percent, and EBITDA notched a 4.4 percent gain.

As in earlier surveys, we saw what appeared, on first examination, to be large differences in IT cost levels among participants—ranging from 3.1 percent to 6.1 percent of revenues. But after applying a “normalization” analysis—which accounts for differences in company size, business mix, and value creation—cost levels were found to be more closely aligned.

A related and interesting finding had to do with the relationship between IT spending and business mix. In previous surveys, we saw integrated players reporting a notably higher share of IT spending than mobile- or fixed-only operators. This time, however, the difference was less pronounced—a sign, perhaps, that integrated providers are consolidating their infrastructure into a single platform and seeing a payoff for doing so.

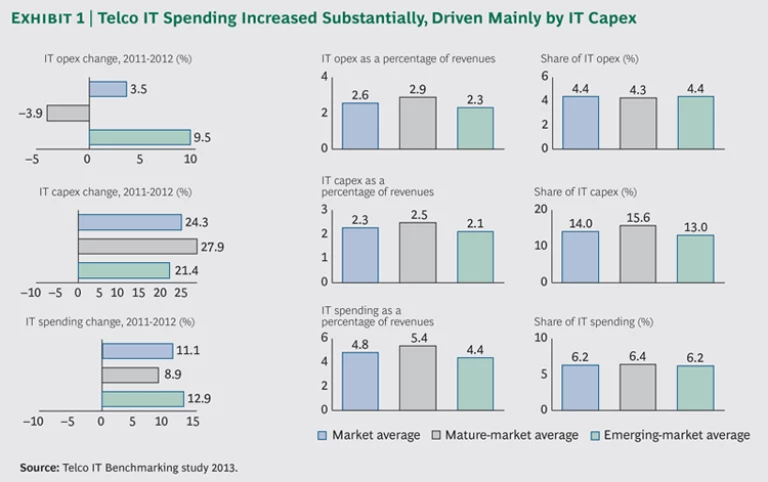

But the most eye-opening revelation of the survey was the size—and structure—of the rise in telco IT spending since the previous year. The increase among participants was substantial: an 11.1 percent jump, on average. It was largely driven, the survey found, by a rise in IT capital expenditure. (See Exhibit 1.) We saw an increase in investments for the majority of participants—something that might be explained, in part, by improvement projects that could no longer be delayed or by cost reduction efforts that were started in previous years but not yet completed.

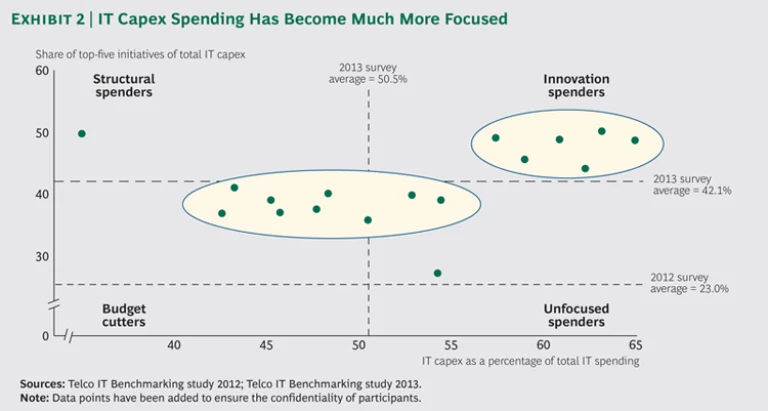

Yet a deeper dive into the IT capex data suggests another reason for the outlays: to support innovative new offerings and enhanced customer service. Each year, the survey looks not just at how much telcos are spending but also where the money is going. The latest survey found that telcos allocated 42 percent, on average, of their IT capex to their top five IT projects. (See Exhibit 2.) While that figure was noteworthy—nearly doubling the previous survey’s result—it was even more remarkable in the context of the actual investments. Areas such as IT digitization, customer relationship management, and automation (such as customer self-service) made up a disproportionate share of top-five projects. In other words, telcos are becoming innovation spenders—focusing on investments that facilitate the development of new products, better experiences, and deeper customer relationships. This is spending that can help set telcos apart—and it stands in stark contrast to other spending models of recent years, in which telcos were structural spenders and, even, budget cutters.

That telcos are focusing their investments in this way is particularly reassuring. An analysis of survey participants’ IT capex and IT operating-expenditure histories reveals that many telcos follow a cycle when it comes to IT spending. In the first phase, IT opex peaks. Next, companies increase IT capex and lower IT opex. Finally, at a later point, IT opex increases again, and the cycle repeats. This pattern suggests that most telcos will be increasing IT capex levels in the near term. As this period begins, telcos seem to be off to a smart, savvy start. Furthermore, the survey pointed to a general correlation between spending and value generation—a trend we noticed in previous surveys. But once again, many participants had difficulty supplying key performance indicators. Better clarity of these metrics is crucial if telcos are to make optimal decisions about how to spend their money.

Overall, we see the shift from emphasizing cost reduction to fostering innovation as a sound move. For one thing, consumers are showing more interest in sophisticated offerings—and more willingness to pay for them. Still, these investments will be risky. New products can assure a company’s future—or seal its fate. Will telcos place winning bets? The survey suggests that their IT departments, at least, are taking the steps in the right direction to improve the odds.

For a copy of “Telcos’ New Business Cycle: Time to Invest Again,” an executive report cowritten by BCG and ETIS that highlights many of the survey’s major findings, please contact one of this article’s authors.