Six years after the global financial crisis, the reshaped contours of the market for the life insurance industry are coming into focus. As with any other turn of events, threats and opportunities abound.

The threats—notably low interest rates, regulatory scrutiny, customer concerns, and rising competition from banks, mutual funds, and other asset managers—should not obscure the sizable and growing opportunities.

Demographics and technology are all friendly forces for the industry. Insurers are well poised to help older people manage their assets in mature markets, especially as the government’s role in providing retirement income shrinks. In emerging markets, insurers can cater to the desire of the expanding middle class to save and plan for the future. Digital and mobile technologies are opening new, low-cost channels to consumers in all markets. (See Exhibit 1.)

This new environment will produce winners and losers. To understand what will separate the winners from the pack, we recently concluded a comprehensive global study of the life insurance industry. As part of our research, we interviewed senior executives in the 16 markets that generate 80 percent of global life-insurance premiums.

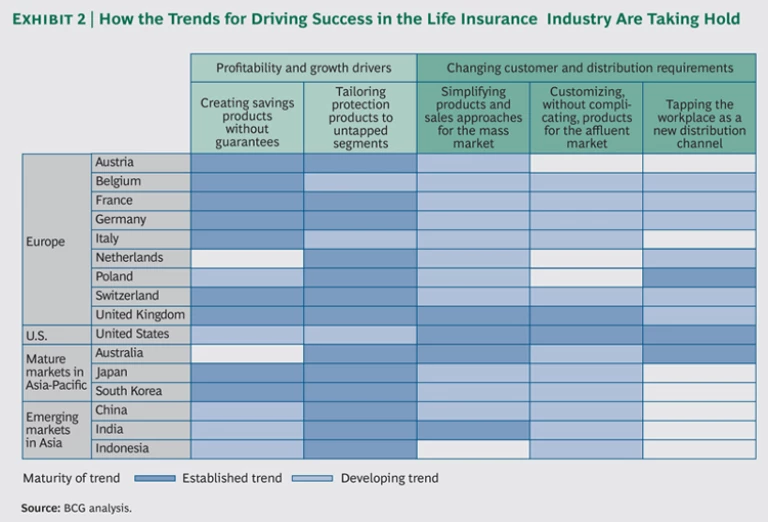

We detected five trends that will drive success in the future. Two of them describe how the design of products can improve profitability:

- Creating savings products without guarantees

- Tailoring protection products to untapped segments

Three trends respond to shifting consumer needs and behavior and changing distribution capabilities:

- Simplifying products and sales approaches for the mass market

- Customizing, without complicating, products for the affluent market

- Tapping the workplace as a new distribution channel

These global trends have not taken hold equally in the 16 markets we studied, but they will blossom throughout most of the global insurance marketplace in the coming years. (See Exhibit 2.) The insurers that understand these trends and act quickly to develop products that respond to them will be able to overcome the well-publicized threats facing their industry and surf on the waves of opportunities that demographics and technology provide.

Creating Savings Products Without Guarantees

For decades, insurers relied on guaranteed savings products that offered high, stable returns, which appealed to customers looking for good yields and security upon retirement. Those days are dwindling. Falling interest rates and rising capital requirements prevent insurers from offering generous guarantees and are forcing them to rethink the savings proposition.

Asset management remains one of the most important strengths of insurers, but they now need to engineer financial solutions that provide assurances—rather than guarantees—of solid, steady, long-term performance. In this new environment, insurers still have two strong advantages over traditional asset managers and banks: their reputation and their distribution networks, both of which they can use to promote new offers to retail customers.

The Standard Life Investments Global Absolute Return Strategies Fund is an example of this type of solution. From 2008 through 2013, the UK fund exceeded its target return of 5 percentage points over the six-month London Interbank Offered Rate by 3.6 percent annually. This performance, coupled with low volatility, has attracted investors. Assets have increased from £1 billion in 2008 to £20 billion in 2013, despite annual fees exceeding 1.5 percent for retail investors and no guarantee of returns. The fund takes both long and short positions globally and invests judiciously in derivatives to generate returns and minimize risk.

Swiss Life Premium Immo, another successful product without explicit guarantees, invests in commercial real estate in Switzerland and expects to earn around 4 percent annual returns after fees. Investors view the fund as an attractive alternative to purely financial products. Founded in 1857, Swiss Life, the nation’s largest and oldest life insurer, is able to draw on the strength of its brand to introduce new product lines.

Moving into a world without guarantees has challenges. The new products will be similar to those offered by mutual funds and banks, and insurers will have to learn how to compete against these institutions. In addition to drawing on their brand and distribution capabilities, insurers will need to deploy sophisticated asset-management tools, such as dynamic portfolio rebalancing and hedging. Explaining these techniques to their sales forces, independent financial advisors, and customers may be challenging. Communication, marketing, and clear product descriptions will become more important than ever.

Tailoring Protection Products to Untapped Segments

As margins deteriorate for traditional savings products, protection products—such as term life insurance, disability insurance, and annuities—are becoming relatively more attractive to insurers. They provide new sources of income, generate steady margins, and diversify risks. Under new capital standards, such as the European Union’s Solvency II directive, this diversification can help minimize capital requirements.

These products appeal to two large sources of relatively untapped demand: emerging markets and the low-income segments of mature markets. In emerging markets, the middle class has a growing appetite for protection products, while the low end in mature markets has historically been underserved. In all markets with an aging population, consumers are recognizing the value of products that offer steady retirement income and other services in old age. To broaden their offerings and increase margins, insurers increasingly embed additional services in protection products.

In China, for example, Taikang Life has created an innovative annuity that provides retirees with an apartment for life and optional medical care and other features. The product is aimed at older affluent consumers who are able to pay a large, single-contribution premium. The company plans to sell about 50,000 policies over ten years; 2,000 were sold in the first six months.

This new product enables Taikang Life to build a new revenue source and compete against banks. Other insurers are preparing to offer similar products. The winners will successfully pull together marketing, sales force training, and real estate expertise into an attractive package.

In South Korea, Hyundai Life responded to many consumers’ perceptions that life insurance products are too expensive and confusing by offering an à la carte health-protection policy called Hyundai Life Zero. Customers can pick the particular risks, such as cancer, that they want to cover at a fraction of the cost of comprehensive, long-term health-care policies. And the benefits of the plan are so simple to understand that it is offered online and by phone in addition to traditional channels. The insurer sold 15,000 policies in the product’s first six months.

Despite their appeal, however, such products take insurers out of their comfort zone. Insurers do not have deep experience in many of these segments, so risk assessment and pricing—as well as developing low-cost sales channels—will be crucial. Since many of these products will offer coverage that is less than comprehensive, insurers must make sure that communications about coverage are clear and be prepared to manage risk and litigation.

Simplifying Products and Sales Approaches for the Mass Market

Several forces are combining to encourage product simplification and streamlining. First, regulatory moves, such as the European Union’s Insurance Mediation Directive, will impose greater expense, liability, and oversight on traditional products. Those products sold without the need for advice from an agent or sales executive will escape these burdens.

Second, declining returns have reduced insurers’ ability to finance expensive channels with high management fees, especially for savings products.

Finally, consumers’ buying preferences have changed, too, shifting toward online and direct channels. While such routes are less costly and widen the access of insurers to consumers, new products offered through these channels must be sufficiently simple to be sold without advice.

Insurers need to do more than simply strip away features from existing products. They need to build products that appeal to specific customer segments and that can be sold through direct sales channels. Online marketing material will also need to be simple, transparent, and interactive and be designed to appeal to specific segments.

The online channel will explode with innovation over the next several years. One likely avenue of experimentation will be automated and algorithmic advice that directs potential customers to specific products depending on those individuals’ answers to questions.

Scottish Friendly, for example, has created a suite of tax-advantaged individual savings accounts that appeal to specific consumer segments. Each account offers varying levels of choice and financial risk tailored to the sophistication of the customer.

Online marketing material for each account is based on simple graphics, checklists, and descriptions. Telephone support is also available. These accounts helped to double Scottish Friendly’s sales in 2013, the first year that they were offered.

Metropolitan Life, the largest U.S. insurer, is pursuing the mass market by offering term life insurance in a box through Wal-Mart stores. Snoopy, the lovable dog in the Peanuts comic strip, is featured prominently in the in-store marketing material. The policies are available with coverage as low as $10,000, opening the low-income market to insurance products. Customers activate the policies by calling a toll-free phone number and answering simple eligibility and health questions.

For an industry known for complex products, the trend toward simplification presents several challenges. Insurers will need to sharpen their skills in consumer insight to identify the most attractive features and benefits for specific segments. The new products will also need to be successfully integrated into insurers’ distribution networks without alienating the existing sales forces.

Insurers must address the hybrid needs of more savvy consumers, who often seek streamlined, simple products and services for a specific need—such as life or accident insurance or savings—but still require some support during sales and service. Such a multichannel approach could combine the best of worlds by leveraging simplicity and personalization.

Customizing, Without Complicating, Products for the Affluent Market

Simplification is a smart strategy for new and low-end insurance customers, but it is generally unsuitable for the affluent segment. These customers have the means and the desire to pay for advice, customization, and more advanced financial-savings products. Despite changes in the industry, the best financial advisors still have a role to play and can actually increase their earnings by focusing on affluent customers and sophisticated products.

Italy’s Assicurazioni Generali designed a three-phase product for German consumers in their fifties who want to maintain flexibility at the start of their policy and receive protection and benefits as they enter retirement. During the first two years, the policies are fully liquid. In the second phase through retirement, withdrawals are still allowed. In the third phase, the product converts to an annuity. Long-term care and critical-illness riders are available. The product was so successful at launch, taking in €1.5 billion in premiums in 2011 and 2012, that Generali had to impose sales and production measures to manage capital.

Insurers should not go crazy with customization, or they will land in an economic trap. Instead, they should rely on stringent economic calculation and rigorous customer segmentation to provide varying levels of customization. For example, the mind-set and expectations of a customer whose net worth is $500,000 may be similar to those of a customer whose net worth is $10 million—but they have very different financial needs. Insurers will also need to allow agents to customize without creating unnecessary complexity—or risk overwhelming both agents and customers.

Tapping the Workplace as a New Distribution Channel

In many markets, consumers have grown frustrated with the increasing complexity of life insurance products and the lack of transparency and questionable sales practices of insurers themselves. These consumers have gravitated toward other savings products, such as bank accounts, mutual funds, and employers’ savings plans. Meanwhile, regulators have encouraged employees to save for retirement by supporting auto enrollment in their companies’ plans and providing tax benefits that promote participation.

These trends have helped raise the importance of using the workplace as a sales channel. Insurers may now integrate several insurance and savings offers into one customer-friendly package that carries the employer’s stamp of approval. Insurers have offered basic life and disability insurance through the workplace for a long time already. But they now offer a much wider range of products and services and developing an integrated workplace-marketing machine that combines industry-specific expertise with scale and technology.

Insurers are able to leverage their expertise in relevant industries and product areas, such as income protection; provide products aimed at specific occupational groups; and offer other services. In the UK, Unum, a specialist in financial protection products, offers a suite of products through the workplace. These include income protection insurance, which provides a rehabilitation program to help employees return to work, and a program called Unum LifeWorks, which provides legal, lifestyle, and fitness assistance for employees.

Insurers can also leverage their long-term relationships with employers to position themselves in the role of orchestrator, providing employees with a range of products and services from several insurers. Aon Hewitt, a benefits advisor, has created an insurance marketplace for employees at large U.S. corporations, allowing them to shop from a range of products offered by several insurers. Life insurers are also well positioned to organize private marketplaces in the workplace.

Conventional wisdom is wrong. There is growth potential in the life insurance business. So long as people are averse to risk, demand for insurance will remain. However, insurers will not be able to grow in the same way they have in the past, positioning themselves as pure financial organizations and relying on asset returns to solve all their problems. They will have to challenge both their business models and the way they operate in order to ride the waves created by these five trends.