Manufacturing cost competitiveness around the world has changed dramatically over the past decade—so dramatically that many old perceptions of low-cost and high-cost nations no longer hold.

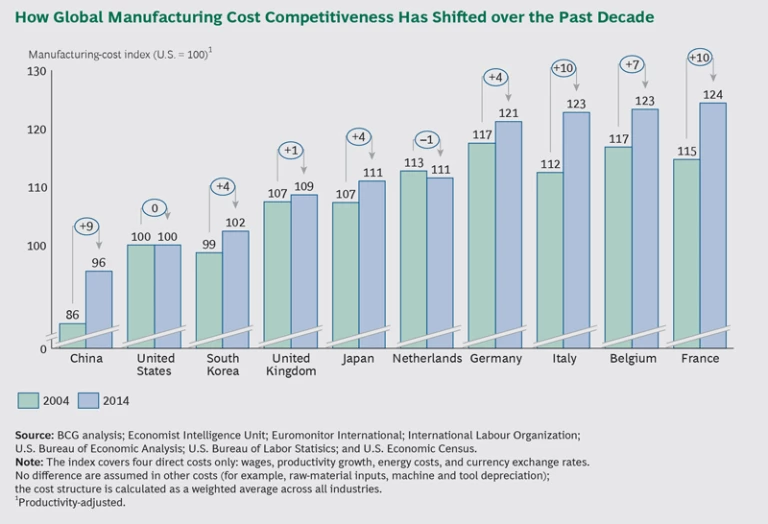

The new BCG Global Manufacturing Cost-Competitiveness Index shows how the production costs in the world’s ten largest goods-exporting nations changed from 2004 to 2014 relative to the U.S. The index covers four primary drivers of manufacturing competitiveness: wages, productivity growth, energy costs, and currency exchange rates. The U.S. score of 100 serves as the benchmark.

Some of the shifts in cost competitiveness have been both surprising and dramatic. China’s direct cost advantage has narrowed considerably relative to most other major goods exporters, and its advantage over the U.S. has shrunk from 14 percentage points to only 4 over the past decade. The U.S. now is the second-cheapest manufacturing location in the top ten. The UK and the Netherlands have essentially held their ground since 2004 and are now the lowest-cost manufacturing nations of western Europe. France, Italy, and Belgium, which already had relatively high direct costs in 2004, have lost even more ground since then.

These findings suggest that some nations must act urgently to shore up their manufacturing competitiveness. It also suggests that companies should reassess their global production and sourcing footprints in light of today’s cost structures and trends.