Little more than a decade ago, Mexico’s manufacturing takeoff was in peril. After industrial zones along the U.S. border had filled up with thousands of maquiladora assembly factories in the 1980s and 1990s, the entry of China into the World Trade Organization fundamentally altered the economics of global manufacturing. Investment and employment growth in maquiladoras fell as makers of everything from garments to auto parts flocked to China, where workers were more plentiful and wages were dramatically lower.

Cost Competitiveness: A Country View

- An Interactive View

- Australia: Losing Ground

- United Kingdom: A Rising Regional Star

- India: Holding Steady

- Mexico: A Rising Global Star

Now the pendulum appears to be swinging back. Foreign investment in factories in Mexico is taking off again, even in industries in which China has been dominant. For instance, Mexican exports of electronics more than tripled, to $78 billion, from 2006 to 2013. Asian companies such as Sharp, Sony, and Samsung account for around one-third of investment in Mexican electronics manufacturing—compared with only around 8 percent a decade ago. In fact, Taiwanese electronics-manufacturing giant Foxconn Technology Group—the single largest investor in China—lags only General Motors as Mexico’s leading exporter, according to the trade consulting firm IQOM. Foxconn says its 5,500-worker facility in San Jerónimo in Chihuahua state exports 8 million PCs a year, and a major expansion is in the works.

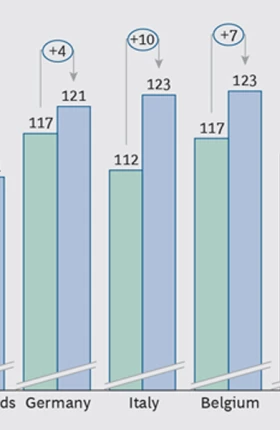

A significant shift in cost competitiveness is behind Mexico’s manufacturing revival. A decade ago, average direct manufacturing costs in China were estimated to be 6 percentage points cheaper than Mexico’s, according to the BCG Global Manufacturing Cost-Competitiveness Index . Now, Mexico is estimated to be 4 percentage points cheaper. In fact, Mexico’s manufacturing cost structure improved the most of any of the 25 economies in our index.

The primary reason is that in China, labor costs soared and productivity wasn’t able to keep up. In Mexico, the 67 percent rise in average Mexican manufacturing wages from 2004 to 2014 was almost entirely offset by productivity gains in the modern industrial sector and an 11 percent depreciation of the peso against the U.S. dollar. Mexico also is benefiting from the shale gas revolution in the U.S. Natural-gas prices for industrial users have dropped by 37 percent since 2004, giving Mexico a significant energy-cost advantage over most other exporting economies.

Beyond cost, several other factors also favor Mexico. The country has free-trade agreements with 44 nations—more than any other nation—including the North American Free Trade Agreement, which allows its goods to enter the U.S. duty free.

The country also has a strong work ethic: the average Mexican works more hours per year than people in any other OECD country, and there are relatively few labor conflicts. Most manufacturers have learned to mitigate the security risks posed by drug-related violence, although they must remain vigilant.

Mexico is experiencing strong growth in a range of industrial clusters, including transportation equipment, home appliances, and computer hardware. Eighty-nine of the world’s top auto-parts manufacturers produce in Mexico, as do 70 companies that assemble appliances or build related components.

An ambitious agenda of reforms under the new government of president Enrique Peña Nieto could bolster Mexico’s competitiveness further by spurring infrastructure development, improving the investment climate, and lowering energy costs. Moves to open the energy sector to private developers of shale gas and offshore oil, for example, are expected to build on the country’s energy-cost advantage. Such moves could strengthen Mexico’s position as a rising star of global manufacturing.