When India’s Tata Motors acquired Jaguar Land Rover from Ford Motor in June 2008 for $2.3 billion, many feared that another storied icon of the UK’s industrial past would be shipped off to Asia—and thousands of good-paying jobs along with it.

Cost Competitiveness: A Country View

- An Interactive View

- Australia: Losing Ground

- United Kingdom: A Rising Regional Star

- India: Holding Steady

- Mexico: A Rising Global Star

Yet the company’s three UK production facilities have enjoyed a remarkable turnaround. Jaguar Land Rover is now investing heavily to expand production. In March, it will fill the first of 1,400 jobs that will be created at the new, state-of-the-art, $840 million plant being built in Wolverhampton. That facility will make a new family of high-technology, low-emission engines. The company says it will create an additional 1,700 jobs by 2015 at its Solihull facility to make Jaguar XE premium sedans based off of its new, advanced aluminum architecture.

Other global automakers are also taking advantage of the UK’s new position as one of Western Europe’s cheapest manufacturing locations. Since 2010, car companies have announced £10 billion ($16.8 billion) in investments, according to the Financial Times, including expansions by Nissan, Honda, and the BMW Group’s MINI. UK auto output has already increased by around 50 percent since 2009, and the Financial Times projects that it will grow by another one-third by 2017, to 2 million vehicles. More than 80 percent of cars built in the UK are exported, with most sent elsewhere in Europe.

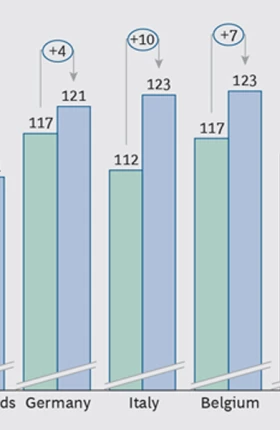

Because of moderate wage increases over the past decade that were almost entirely offset by productivity gains, the UK’s direct-manufacturing cost structure improved by up to 10 percentage points relative to other leading Western European manufacturing export economies, according to the BCG Global Manufacturing Cost-Competitiveness Index . The UK has also improved its competitive position compared with Eastern European nations such as Poland and the Czech Republic, as well as with Asian economies such as China.

As a result, manufacturers of everything from toy trains to fashion garments are reshoring production. In a recent Manufacturing Advisory Service survey, 11 percent of small and midsize manufacturers in the UK said they had brought production back from overseas in the previous 12 months—twice as many as said they were shipping work abroad.

The UK’s advantages go beyond labor costs. Corporate taxes in the UK are the lowest in Europe, and by 2015 they will drop further, from 28 percent to 20 percent—nearly half the level of the U.S. Strong advanced manufacturing ecosystems that include engineering and components suppliers have emerged in Midlands and Oxfordshire for automobiles, Bristol for aerospace, and East London and Warwickshire for high-tech manufacturing.

But it is labor flexibility that gives the UK a distinct edge. The country scores highest among both Western and Eastern European economies in terms of overall labor-market regulation by the Fraser Institute, a Canadian policy research organization. This allows manufacturers in the UK to restructure much more quickly than those in other European economies. It also makes the UK an attractive place to build factories and create jobs once the investment cycle turns back toward growth.